- Polygonal whales have accumulated 140 million tokens worth $56 million.

- POL has surged 17.45% over the past month.

Over the course of the fortnight, Polygon (POL) saw a sharp rise. Since hitting a low of $0.28, the altcoin has surged to a high of $0.47.

In fact, at the time of writing, POL was trading at $0.4348. This represents an increase of 2.89% on the daily charts, with the altcoin gaining 17.45% on the monthly charts.

However, POL saw a decline on the weekly charts, falling by 0.92%. Even though POL saw a price rally, it remained 66.07% below its ATH of $1.29.

Therefore, these market conditions raise questions about the sustainability of the uptrend. As far as, popular crypto analyst Ali Martinez posited that POL can reach higher levels, citing key support levels.

Polygon Market Sentiment

In his analysis, Martinez cited Polygon supports at $0.375 and $0.386, saying POL must hold these levels for a sustainable rally.

Source: In the block

According to him, these are the most important ranges and if they hold, POL will reach higher highs since the resistance at these levels is insignificant.

In context, when we say that resistance appears insignificant, it means that at these levels prices are unlikely to encounter strong selling pressure.

Above these support levels, resistance is weak and sellers cannot dominate. Without selling pressure, POL could see a sharp rise until it reaches a point where it encounters strong resistance.

What the POL chart suggests

Given that POL was trading above these levels at press time, this implied that the altcoin was safe from short-term selling pressure.

Source: TradingView

When we looked at Polygon’s Advanced Decline Rate (ADR), it rose above 1 to 1.47 after a sharp decline. With an ADR above 1, it reflects growing optimism among investors, leading to widespread buying activity.

This increased buying pressure was evident in the fact that Polygon’s Relative Strength Index (RSI) rose from 49 to 60. When the RSI increases, it shows that buyers are entering the market, thereby increasing buying pressure. ‘purchase.

Source:

Moreover, the increase in buying pressure was further supported by the increasing accumulation of whales. Polygon whales purchased approximately 140 million POL tokens over the past four days, worth $56 million.

Whale activity coincided with increasing buying activity, suggesting that large holders were very bullish and actively accumulating.

Source: Santiment

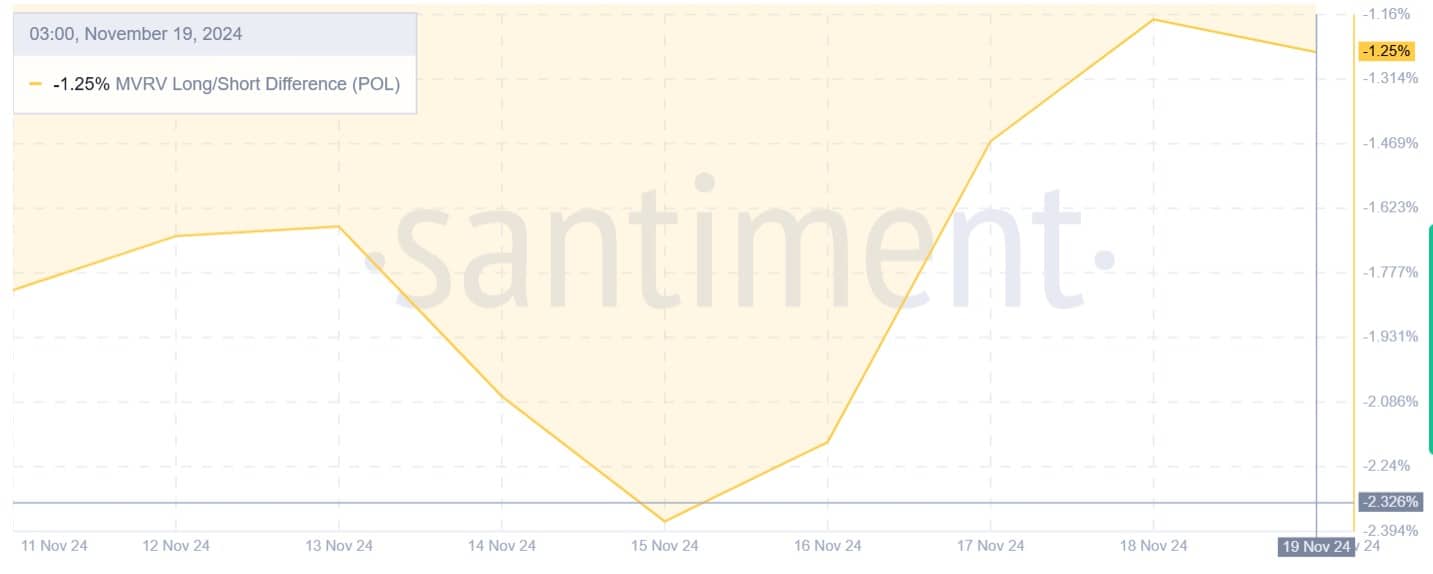

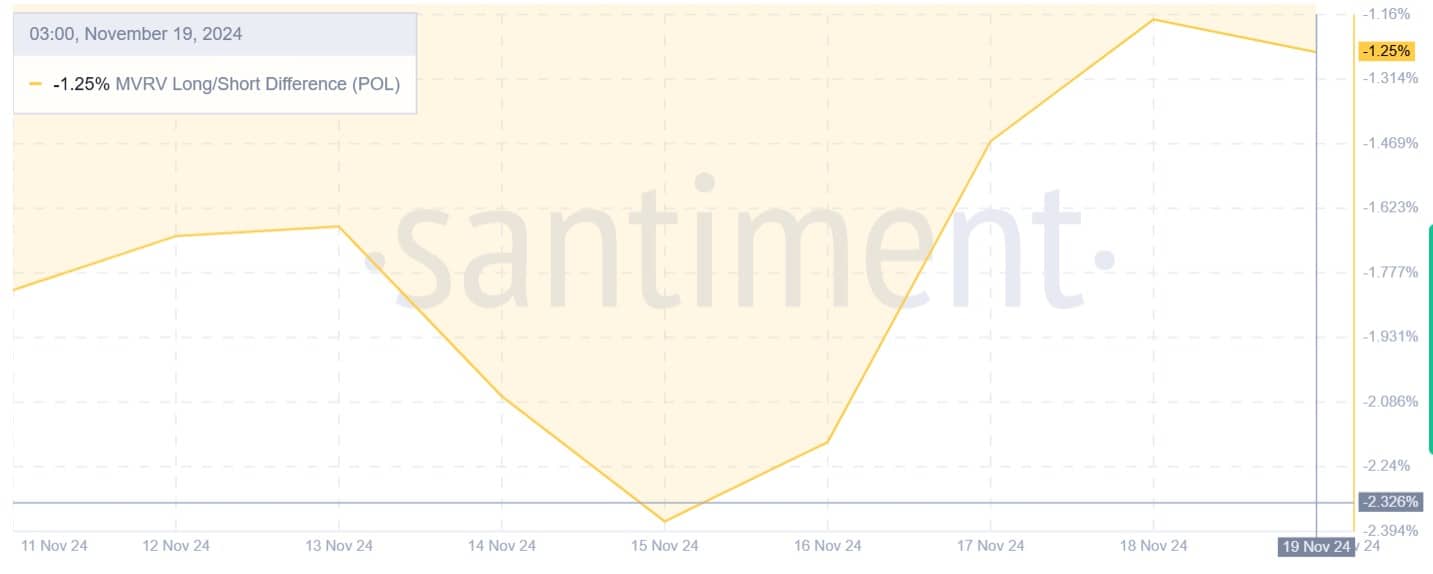

The confidence of large holders in POL is also reflected in the increase in the long/short MVRV spread. This goes from -2.37 to -1.25.

When the ratio increases, it suggests that long-term holders are making profits and are confident in the future value of the altcoin.

Is your wallet green? Check out the POL profit calculator

Simply put, POL is currently experiencing strong buying activity, especially among large holders. Such market conditions tend to drive up prices due to supply compression.

Therefore, these conditions portend further gains on the POL price charts. So, if the positive market sentiment continues, POL will regain the $0.47 levels and find the next significant resistance around $0.57.