Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The prediction of the prices of the batteries shows that STX shows signs of consolidation and the potential optimistic momentum, if the price succeeds upwards, it could trigger a solid bullish rally.

STACKS Prediction Data:

- Battery prices now – $ 1.33

- Capagne of Emblaire – 2.05 billion dollars

- Stacks Circulating Supply – 1.51 billion

- Stacks Total Supply – 1.51 billion

- Stacks CoinmarketCap ranking – # 55

Going to the start of cryptographic projects can change the situation, because history has been shown with many tokens that increase the value over time. Take batteries (STX) as an example – since its lower $ 0,0,4501 on March 13, 2020, it skyrocketed by an narcotic + 2929.4%, proving the power of long -term maintenance in good projects. Although its $ 3.84 summit in April 2024 is a distant memory, STX remains a strong artist in cryptographic space. Keeping an eye on these tokens and their historical growth can help you identify the promising opportunities early.

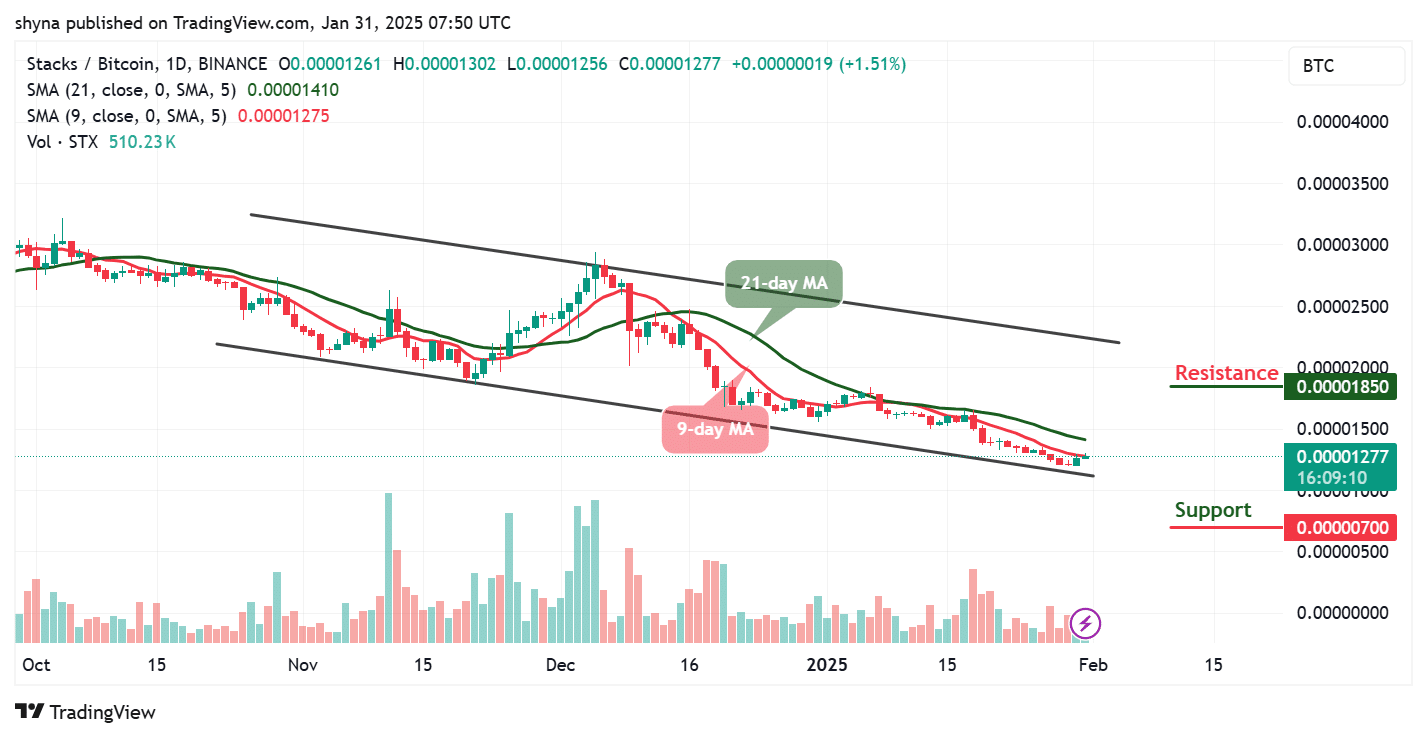

STX / USD market

Key levels:

Resistance levels: $ 2.10, $ 2.20, $ 2.40

Support levels: $ 0.60, $ 0.40, $ 0.20

STX / USD currently shows a continuation of its downward trend in a downhill channel. The price is negotiated at $ 1.33, slightly above the lower limit of the canal, indicating that the market is testing a level of crucial support. However, the 9 -day MA (red line) remains below the 21 -day MA (green line), confirming a continuous bearish momentum. Consequently, if the price does not exceed the 9 -day MA, sellers can push the price lower towards the key support at $ 1.00, which aligns the lower tendency of the canal. A strong downward closure below this level could trigger more downward movement, extending losses in deeper price areas.

Price prediction of batteries: STX / USD can be consolidated below the mobile average

The price of batteries (STX) is on the way to the medium of moving of 9 days and 21 days to $ 1.33. On the bullish side, there is a chance for a short -term rebound because the price is close to a historic support area. If buyers are gaining momentum and the price ends above the 9-day MA, the following target would be the 21-day MA, currently about $ 1.43. A successful escape beyond this mobile average would signal a change in potential trend, leading to a retaining of the major resistance level at $ 2.0. However, any other bullish movement could reach the resistance levels of $ 2.10, $ 2.20 and $ 2.40.

Nevertheless, the prospects for the market for STX / USD remain lowered unless an escape above the 21-day MA and the descending trend line occurs. If the price remains below these resistance levels, the probability of testing the supports at $ 0.60, $ 0.40 and $ 0.20 increases. Meanwhile, merchants should monitor pricing near the current support area and monitor if the 9 -day MA acts as resistance or is raped upwards. A decisive movement in both directions will determine if Stx continues its downward trend or begins to form a bullish recovery model.

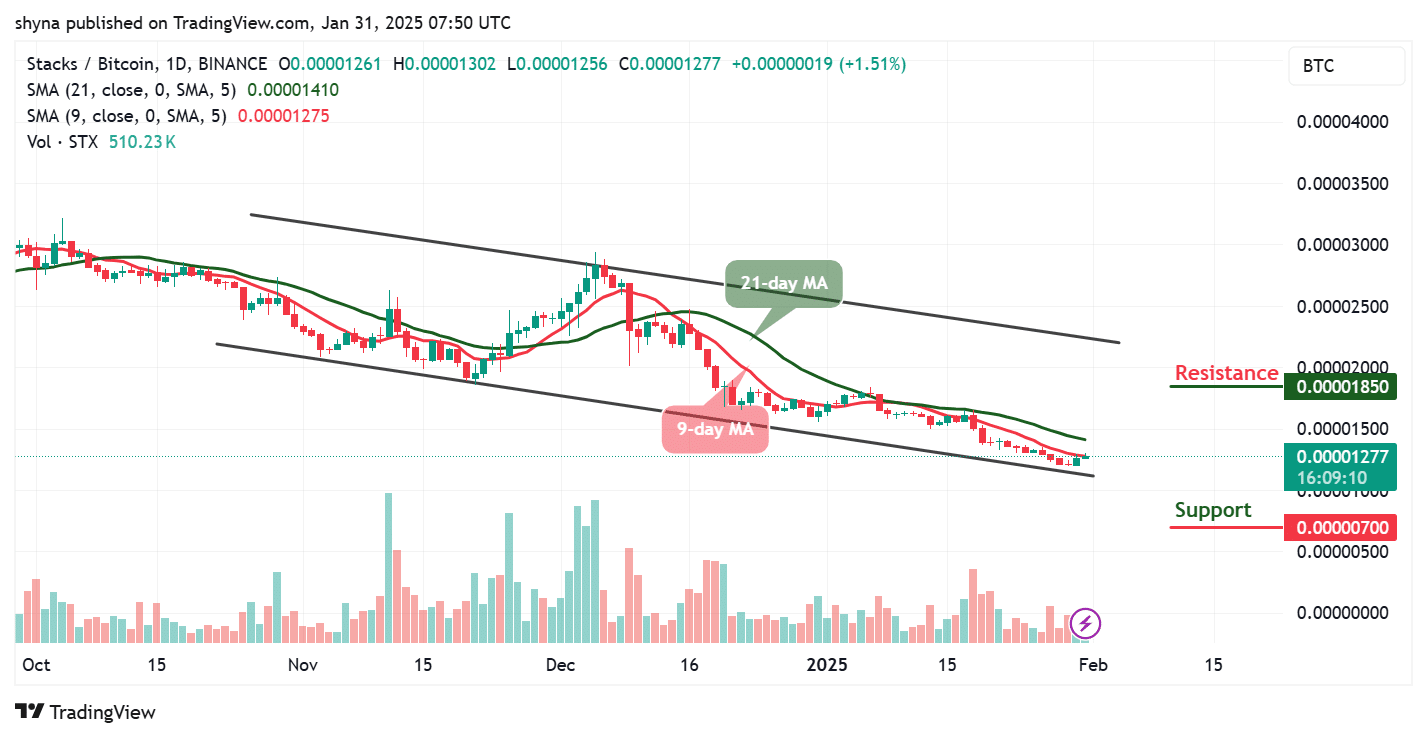

STX / BTC can cross below the trend line

The daily STX / BTC graphic continues to be negotiated in a descending channel, with the current price at 1277 SAT. The market remains lower because the 9 -day MA (1275 SAT) is lower than the 21 -day MA (1410 SAT), confirming the downward pressure. However, the price is close to the lower limit of the canal, suggesting a potential support test at 700 SAT. If this level has remained, a short -term rebound towards control of 9 days or even the 21 -day MA could be expected. Not maintaining this support could however accelerate the bearish momentum and push prices.

On the side of the increase, so that STX / BTC reveals its current trend, the price must deviate from the 21 -day MA and target the next resistance to 1850 SAT. However, a bull escape from the downhill canal could point out a change in trend, but current volume levels remain low, which suggests a low purchase interest. If the bulls fail to support the momentum, the downward trend can continue. Meanwhile, merchants should monitor how the price reacts near the support area and if it can recover MA from 9 days as initial resistance.

In addition, @inMortalcryptto shared on X (formerly Twitter) that $ Stx drew their attention as the first cryptographic project qualified from the dry, stressing that with America leading cryptographic space, rooms based on states -Unis as well as batteries are likely to surpass.

One of the main reasons $ Stx Catching my attention is because it was the very first dry crypto project.

America will be at the forefront of crypto, and pieces like batteries, literally an American room, will most likely surpass.$ Stx pic.twitter.com/g0uat8q3p8

– Inmortal (@inMortalcrypto) January 21, 2025

Stack

Recent market developments indicate that the price of STX is in a hurry in a corner drop, which could soon resolve an escape. If the price decreases above the upper resistance of this corner, the technical objective would be around $ 3.50, which aligns the previous rupture targets. In other words, Wall Street Pepe has gained traction on the cryptography market, rising more than $ 65 million in presale with a hard ceiling of $ 73 million. Compared to the USD, $ Wepe’s momentum suggests high early demand, but the action of post-launch prices will depend on the behavior of investors.

It will not last – Wall Street Pepe is likely to sell early

With daily entries of more than a million dollars, demand soar and the first investors are positioned for potential exponential gains. The project has already aroused the major interest in previously successful token holders, showing solid community support and confidence. While the cryptography market heats up, $ Wepe stands out with its unique brand image, its growing ecosystem and its bullish feeling. Do not miss – secure your position now before the sale of the presale and $ Wepe takes off in major exchanges.

Visit Wall Street Pepe

Related News

New same corner ICO – Wall Street Pepe

- AUTIDENCE by COINSULT

- Early access presale round

- Alpha Tradie Privé for the army $ Wepe

- High dynamic pool – Apy Dynamic

Join our Telegram Channel to stay up to date on the coverage of information on the breakup