- QNT has gained 28% in seven days, with the price now approaching a three-month high.

- Net trade flow data showed that fewer traders were interested in selling despite the rally.

The cryptocurrency market moved lower on Friday, Bitcoin (BTC) struggled to hold levels above $58,000. Despite the downtrend, Quant (QNT) posted gains of over 5% to trade at $75 at press time.

This is its highest price in almost three months.

Quant has also been one of the market’s best performing stocks over the past week, with seven-day gains of 28% at press time.

However, given the uncertainty in the broader market, will QNT’s rally continue?

On-chain data is positive

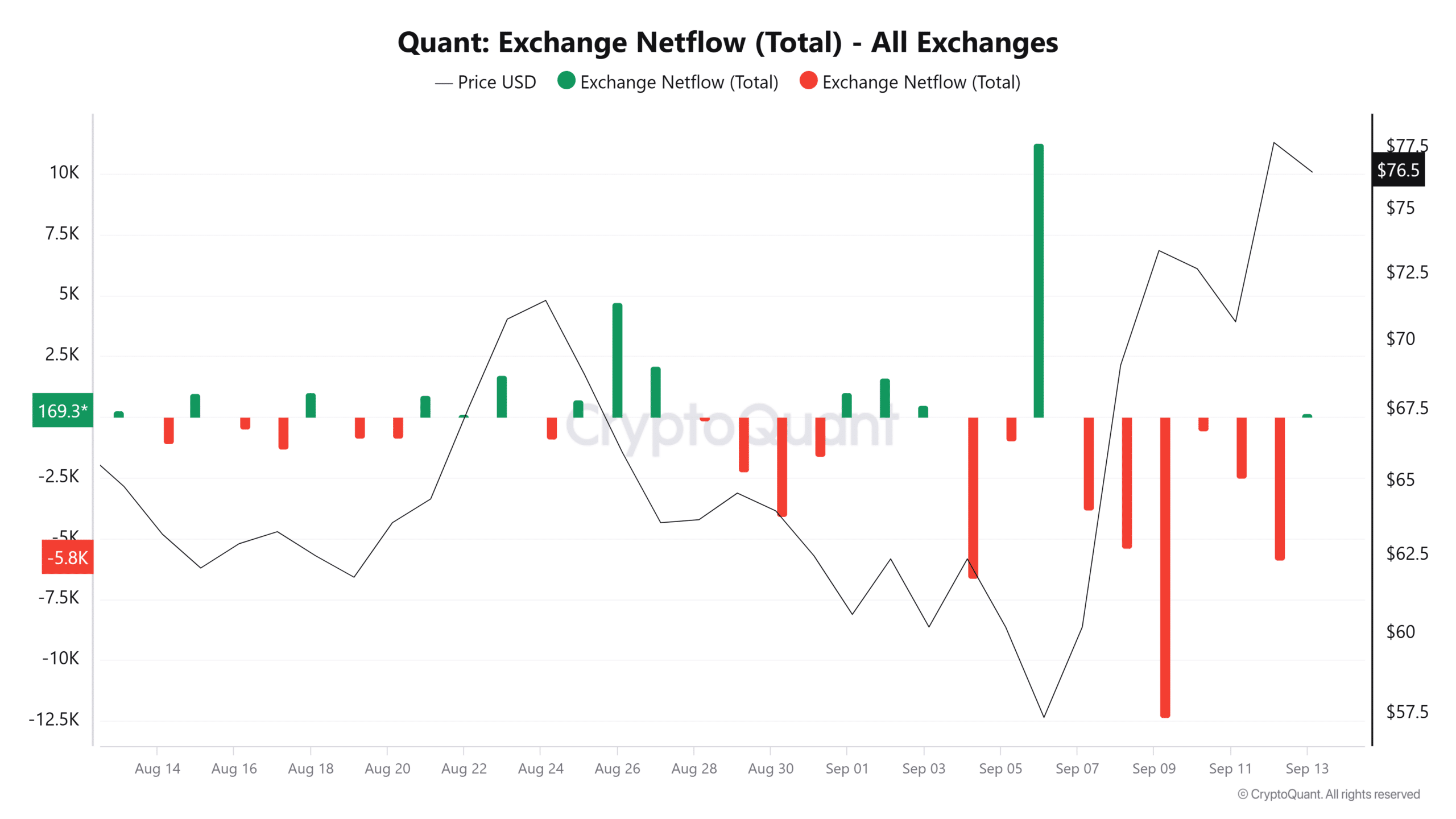

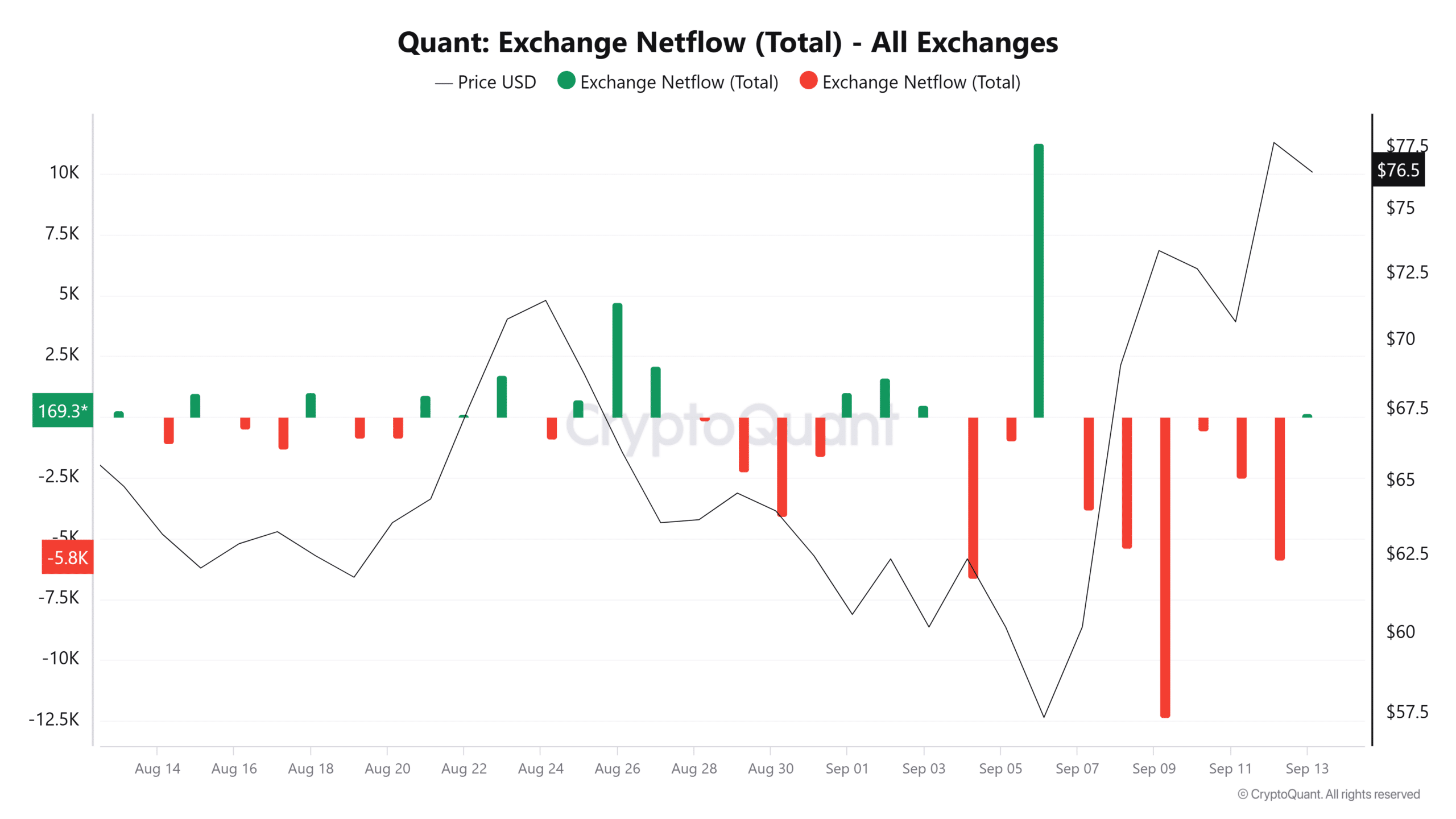

On-chain data suggests further tailwinds for Quant price. Traders have been withdrawing QNT from exchanges at a higher rate than they have been depositing, as seen on CryptoQuant.

Source: CryptoQuant

Since September 7, QNT net outflows from exchanges have exceeded 30,000 tokens, which has eased short-term selling pressure. This has also supported the continuation of the bullish trend.

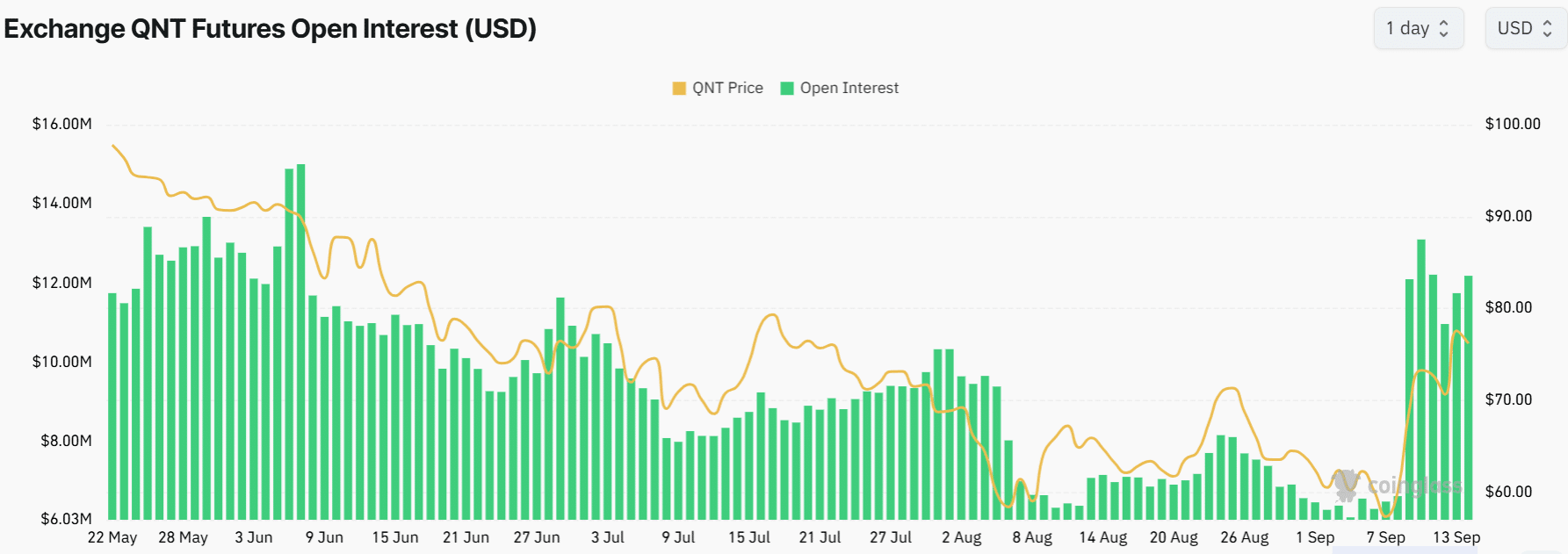

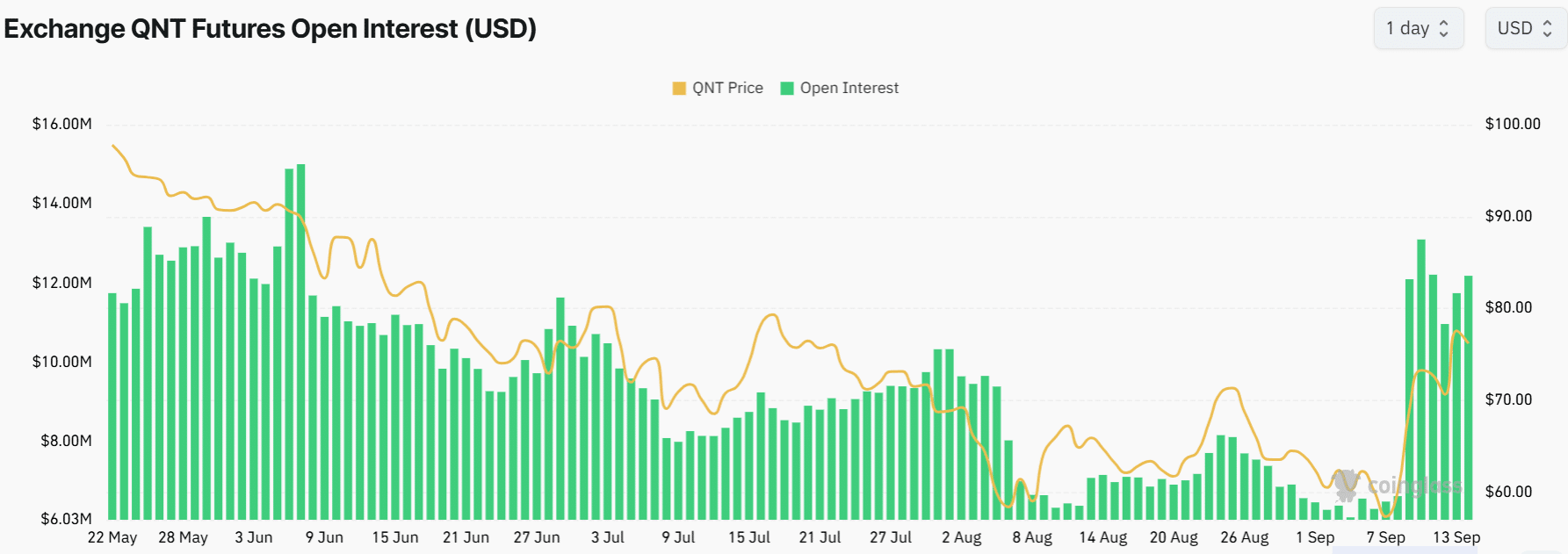

The derivatives market also indicated that traders were holding on to their positions in QNT. At press time, open interest had increased by 12% to $12 million.

The OI was trading at its highest level since June. Given that funding rates had turned positive at the time of writing, this shows that a majority of futures traders have opened long positions on QNT.

Source: Coinglass

Are Traders Still Investing in the Rally?

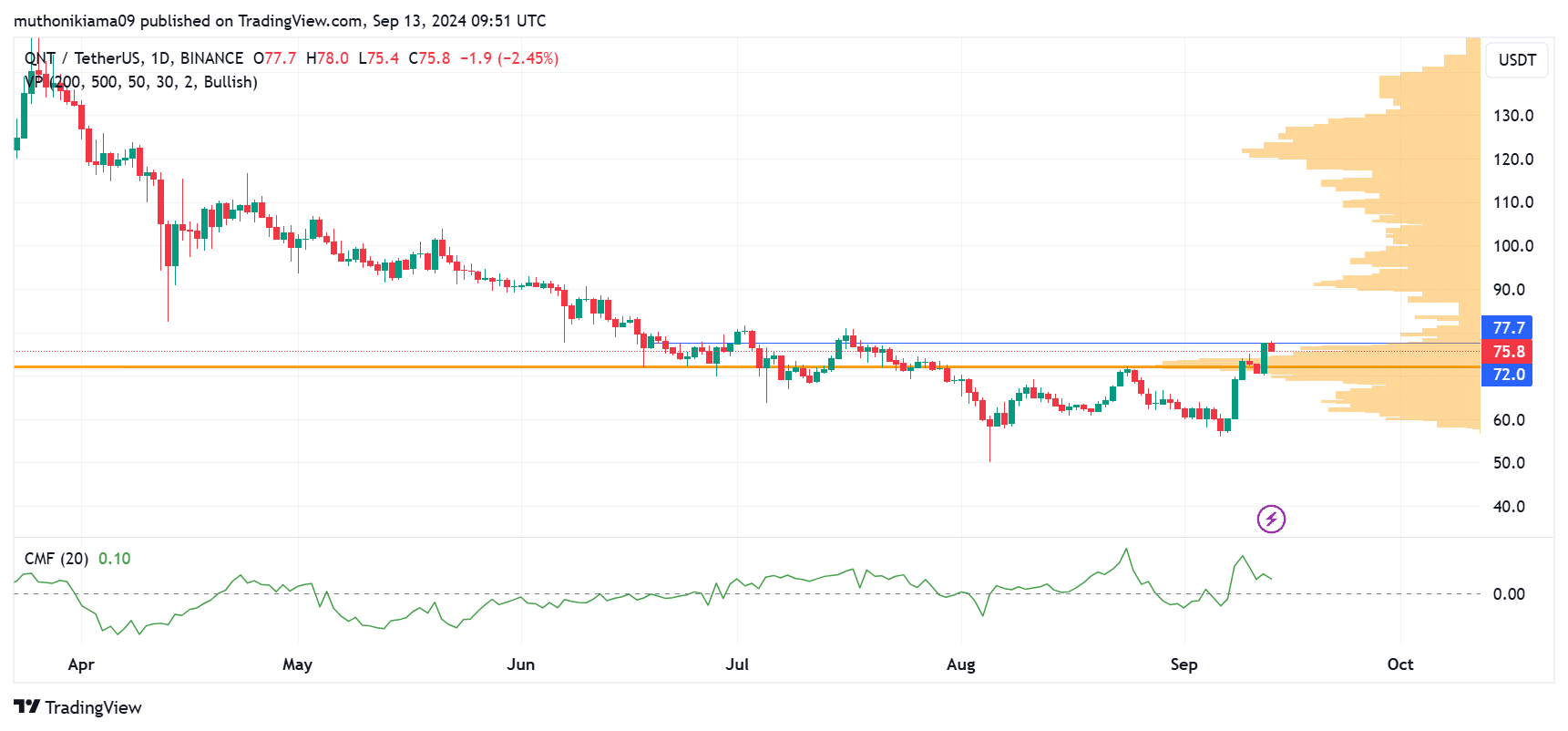

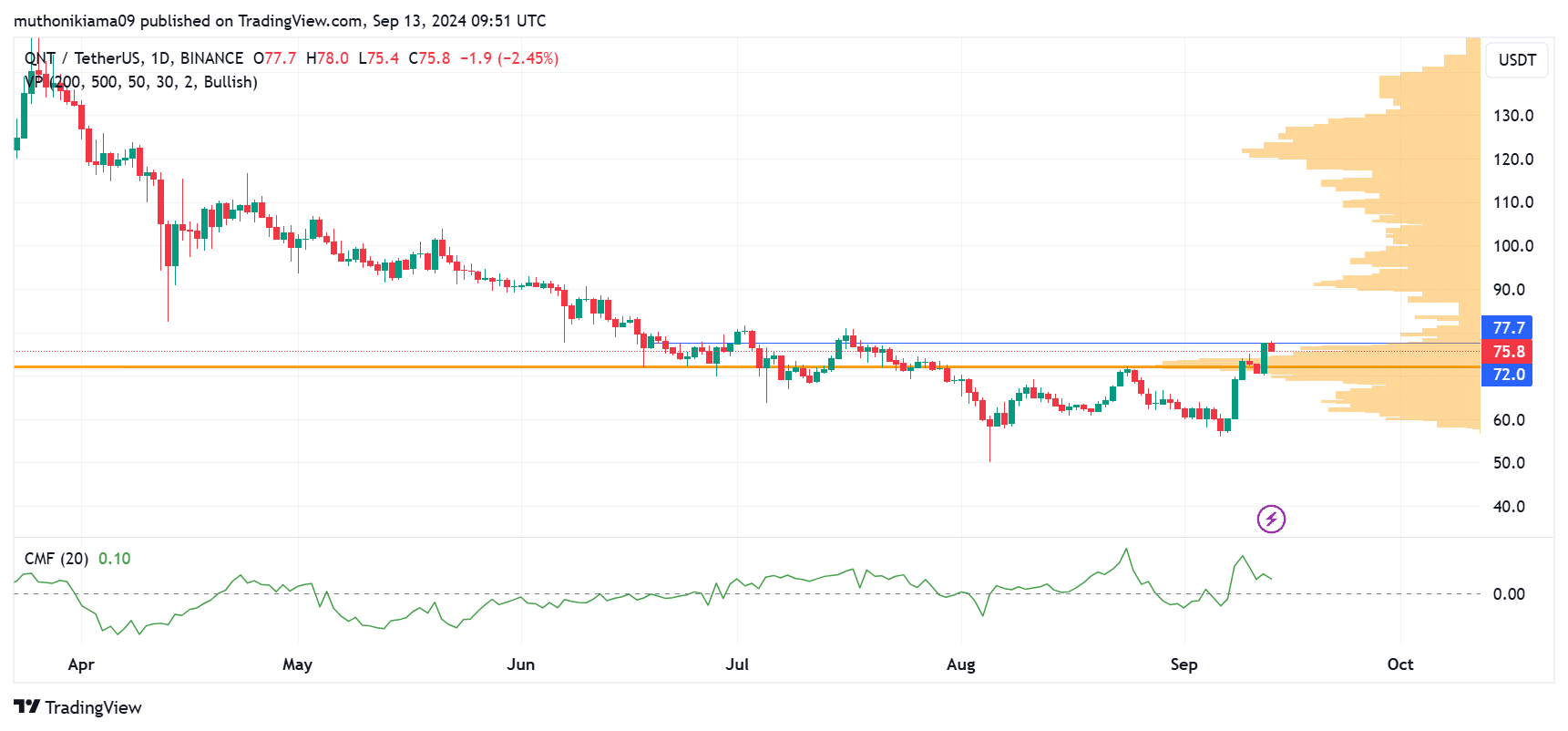

The current trend shows that the bullish momentum may be running out of steam. The Chaikin Money Flow was positive, indicating that buyers are still dominating the market.

However, the movement of the CMF line showed a possible change in momentum. The line was tilting towards the south, suggesting that buyers were leaving the market.

Source: TradingView

The QNT rally was dependent on buying activity, given the bearish sentiment prevailing in the broader market. Therefore, if buying pressure wanes, the uptrend could weaken.

Volume profile data also proved the slowdown in the recovery. Buyers were saturated in the $71-73 price range, which explains the recent price increase.

However, QNT broke above $75, and fewer traders were willing to buy. Volumes were also very low at $77, which was a critical resistance level.

Read Quant (QNT) Price Prediction for 2024-2025

A strong uptrend will likely resume if QNT breaks above $90, given that this price has already attracted buying volumes.

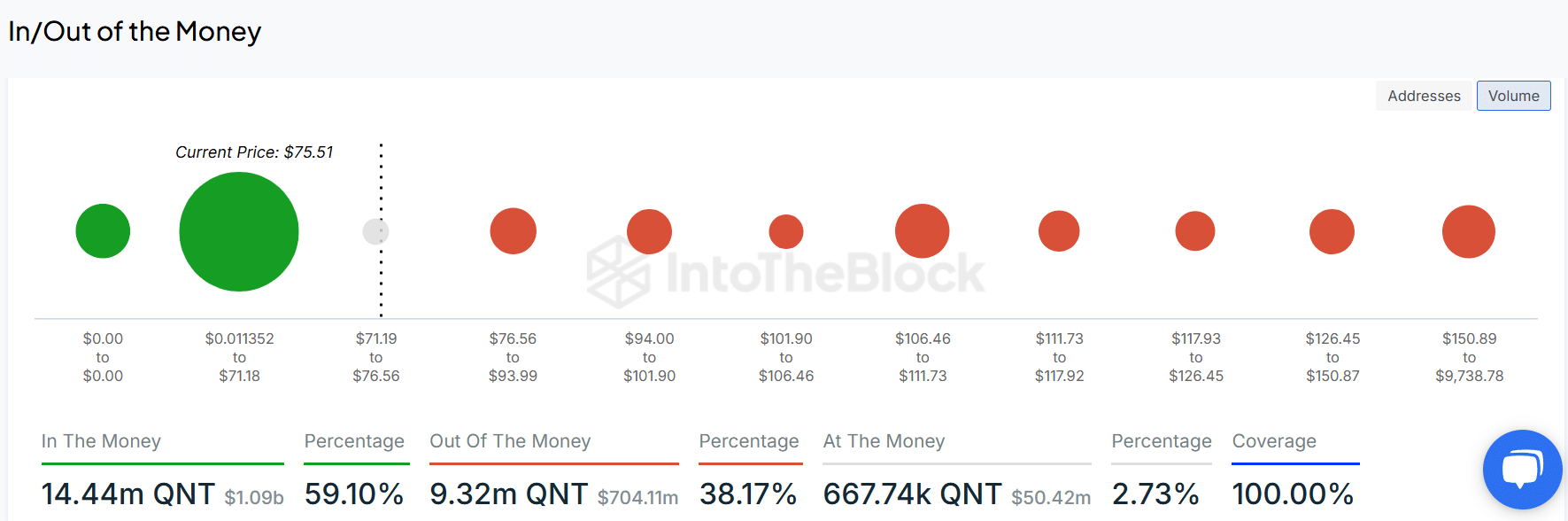

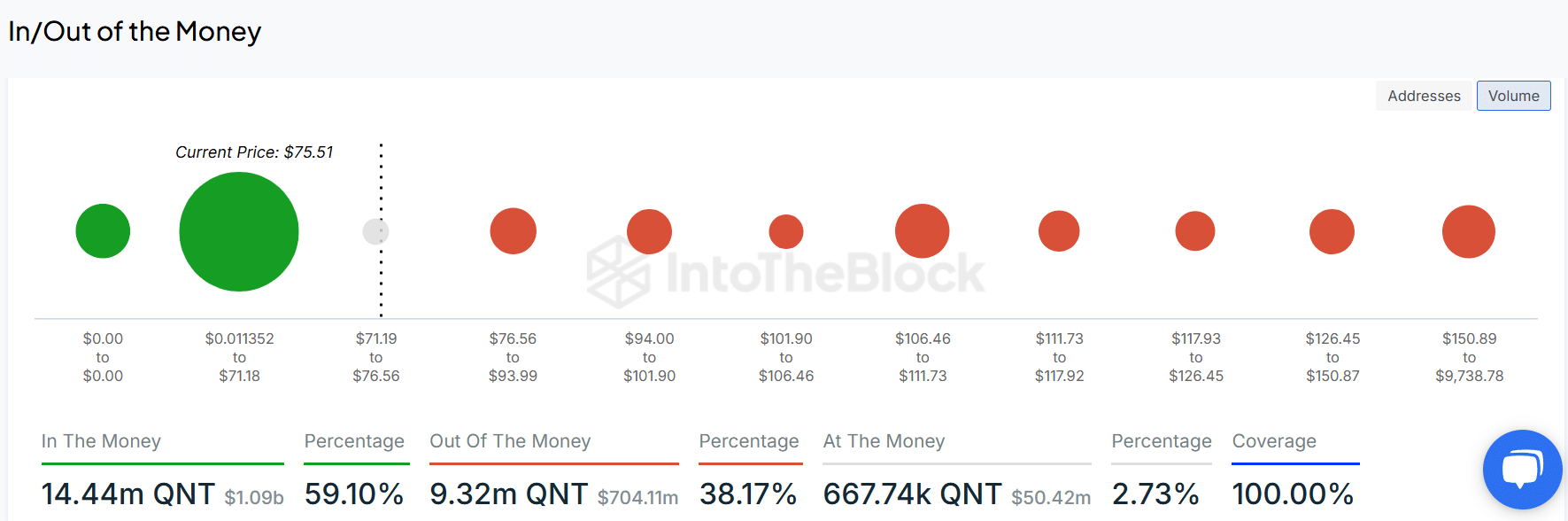

Data from IntoTheBlock showed that a majority of QNT traders were in losses at press time. These traders could choose to sell to minimize risk. This would further weaken the uptrend and trigger a bearish reversal.

Source: IntotheBlock