The RWA sector has doubled by over 20% in the past week and now appears to be one of the fastest growing areas of the crypto market.

The real market capitalization of the assets sector is $40.41 billion, with a 24-hour trading volume of $3.22 billion. RWAs gain stability as the next step in the innovation process by providing a bridge for blockchain technology that connects real assets to art, commodities and real estate.

The two sector leaders were Avalanche (AVAX), up 14.97% over the past week, and Chainlink (LINK), up 14.39%. Even more impressive, MANTRA (OM) is up 128.51% in the past week. In comparison, Maker (MKR) rose 15.89%, reflecting the immense interest currently building within communities for decentralized finance protocols.

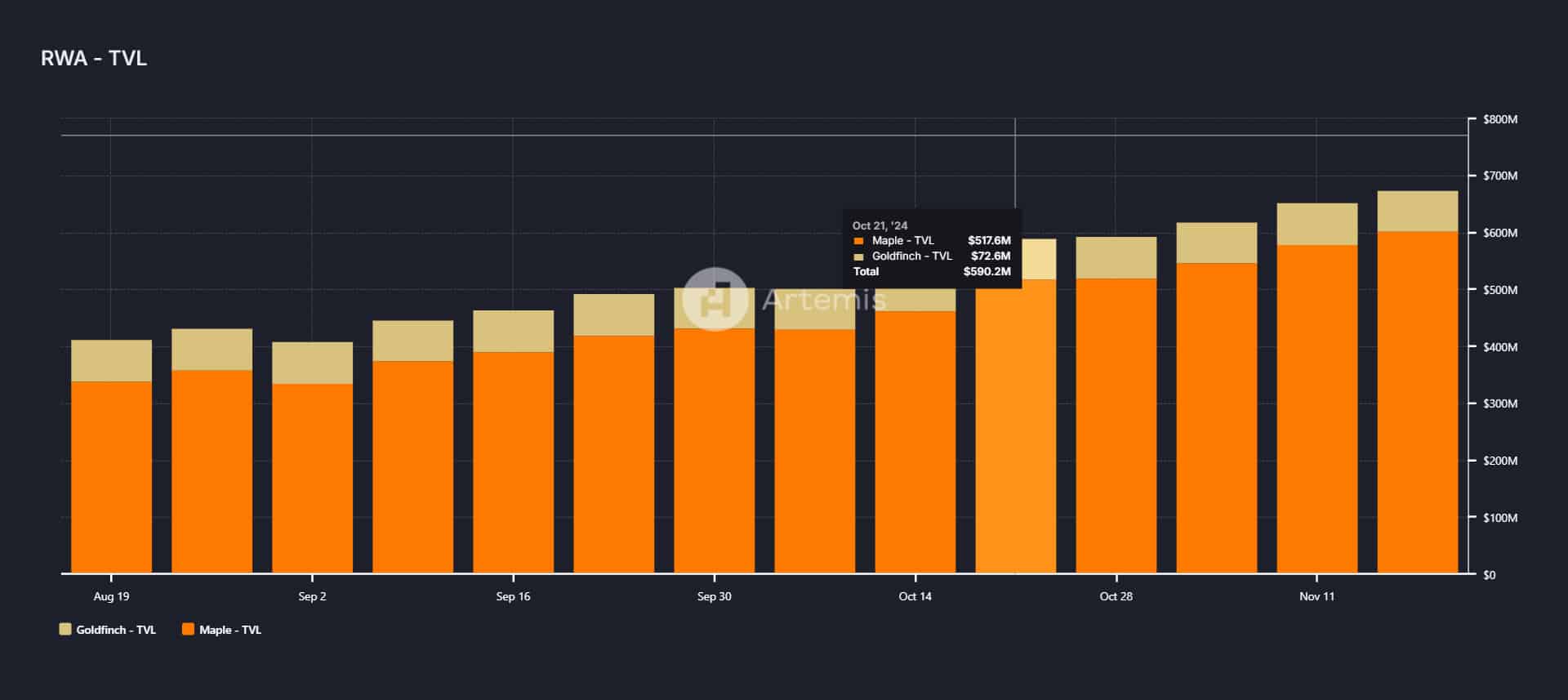

As of October 21, the total value locked for the RWA sector had increased by $517.6 million on Maple Finance and $72.6 million on Goldfinch, two DeFi protocols attempting to fund decentralized lending with RWA in emerging markets . The overall value blocked is approximately $590.2 million. This further indicates increased investment value and adoption of decentralized lending and borrowing protocols.

This increase in TVL reflects the growing use of RWA to provide liquidity to traditionally illiquid assets. Players such as Maple and Goldfinch have emerged as key entities in this process, in which blockchain solutions have translated institutional-grade capital.

Companies like ADDX, Vertalo and Polymesh are also participating in the innovative areas of this domain. Vertalo is an SEC-registered transfer agent focused on shareholder record modernization and tokenization.

Growing demand for liquidity in illiquid asset classes

The United States Securities and Exchange Commission takes a cautious approach to RWAs. Unlike many cryptocurrencies, which the SEC often reviews for possible securities offerings, RWAs are generally structured to comply with security law regulations.

In a recent interview, David Hendricks, CEO of Vertalo, a company that provides software to more than 100 entities involved in the RWA sector, including Warhols and tokenized racehorses, said that the future of the industry lies in settlement technology. “The SEC and FINRA will see this as a way to create investment products using technology. This is not a typical crypto space with rug pulls: this is a database technology aimed at creating investment products and increasing efficiency.

With a greater focus on RWA sectors, this sector merges with decentralized finance, and new avenues of financial inclusion and innovation will be opened. Observers of this space, including investors and developers, are looking to the potential space, which must redefine ownership of assets and ultimately make them accessible to the market.