Key notes

- The price of Shiba Inu tripped to $ 0.000011 on Friday June 20, down 19% compared to the monthly peak of the deadline recorded on June 11.

- Global exchange order book data show that purchases exceeding the sales orders of 3.1 Billions of Shib, signaling an influx of back -to -school tenders.

- The scheme of the sand fall indicates a potential race to $ 0.000017 if the downward momentum turns.

Shiba Inu Price found a support greater than $ 0.0000111 on Friday June 20, after decreasing 19% compared to its monthly calendar peak. With

Salogner

$ 0.000011

24h volatility:

3.3%

COURTIC CAPESSION:

$ 6.62 B

Flight. 24 hours:

$ 124.61

Prices action is now compressed in a formation of a corner and purchases accumulate, the traders are watching closely for the price of potential shib price rebounds.

Shiba Inu holds $ 0.000011 as a flood exchange

Shiba Inu has undergone a sharp drop of 19% since June 11, from $ 0.000014 to a minimum of nine days of $ 0.0000111 on June 20. The withdrawal reflects the wider market volatility by increasing geopolitical tensions.

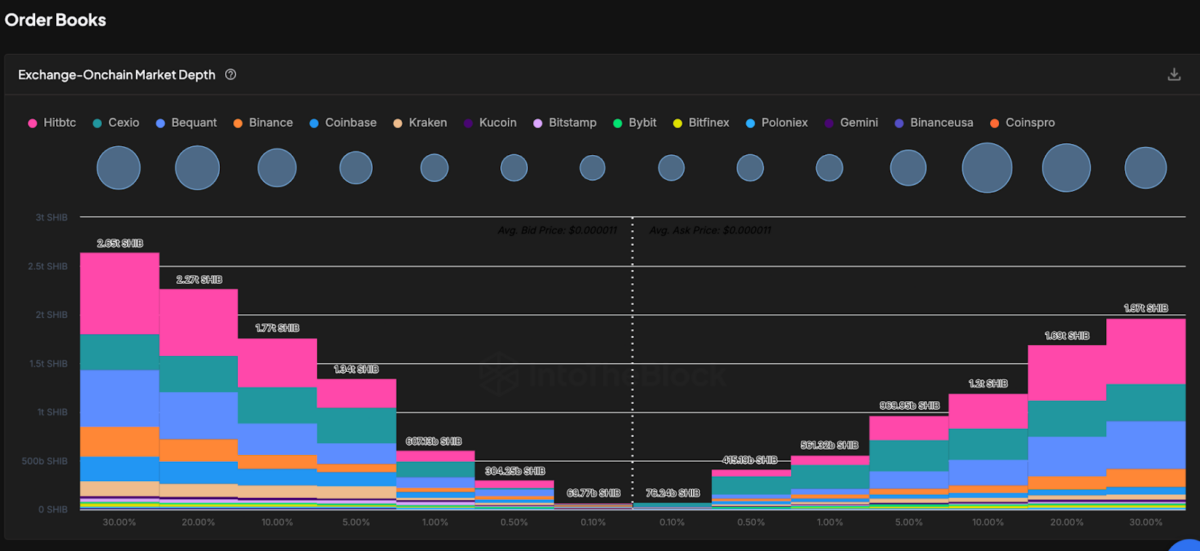

However, chain metrics suggest that bullish merchants are positioning themselves for a reversal. According to the graphic of intotheblock exchange books, total purchase orders for SHIB are currently 9.46 billion tokens, considerably exceeding 6.28 billion total sales orders. This results in a net depth of 3.18 billion sinks, signaling has intensified accumulation at current price levels.

Shiba Inu Change Data Books Orders Data | Source: intotheblock

This Bid-Ask imbalance suggests that a major demand wall is just under the current levels. This accumulation zone has already triggered brief intraday inversions and could serve as a launch for a break, if the bulls manage to recover the resistance of $ 0.000012.

Can SHIB price forecasts: Can the structure of the Falling Coin Fall trigger an escape of $ 0,0000,17?

Shib Price Action finished the complete structure of a downward corner model, a configuration which generally signals a reversal when associated with a high volume price medium. The current corner extends from the peak of June 11, almost $ 0.0000149 to a base at $ 0.000011, where the bulls intervened several times.

Shiba Inu Prix forecasts | Tradingview

The above graph also shows that Shib has now touched the lower corner limit three times, each rebound growing in force. An escape above the resistance line of $ 0.000012 would end the upward configuration and open the door to a measured movement around $ 0.000017, an increase of 50% compared to the current levels.

The addition of force to this perspective is an optimistic divergence visible on the MacD. While the prices have dropped off, the MacD histogram started turning up and the MacD line curls up to the signal line. This shift in the momentum, associated with high volume hollows, often precedes an escape phase.

However, Shib must decisively close to $ 0.000012 to confirm the break. Otherwise, ventilation less than 0.00000011 could extend the losses to the psychological level of 0.000010, where historical demand triggered a 40% rebound in May.

While the shib stabilizes, snorter boot ($ snort) pre-sale is gaining ground

While Shiba Inu holds more than $ 0.000011 in wider cooling on the same market, traders focus on Solana tokens at an early stage like Snorter Bot ($ Snort).

Snorter Bot is a native Solana trading assistant designed to rationalize the hunt for chain coins. Powered by the $ Snort token, it offers ultra-basic costs, early access to trendy tokens and rapid execution, throughout a simple telegram interface.

Now in presale, $ SNORT is positioned as an essential utility token for merchants looking for alpha before the parts were major lists.

To join the presale, visit the official Snorter Bot website or the telegram channel and connect a supported wallet.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Abijade on Linkedin