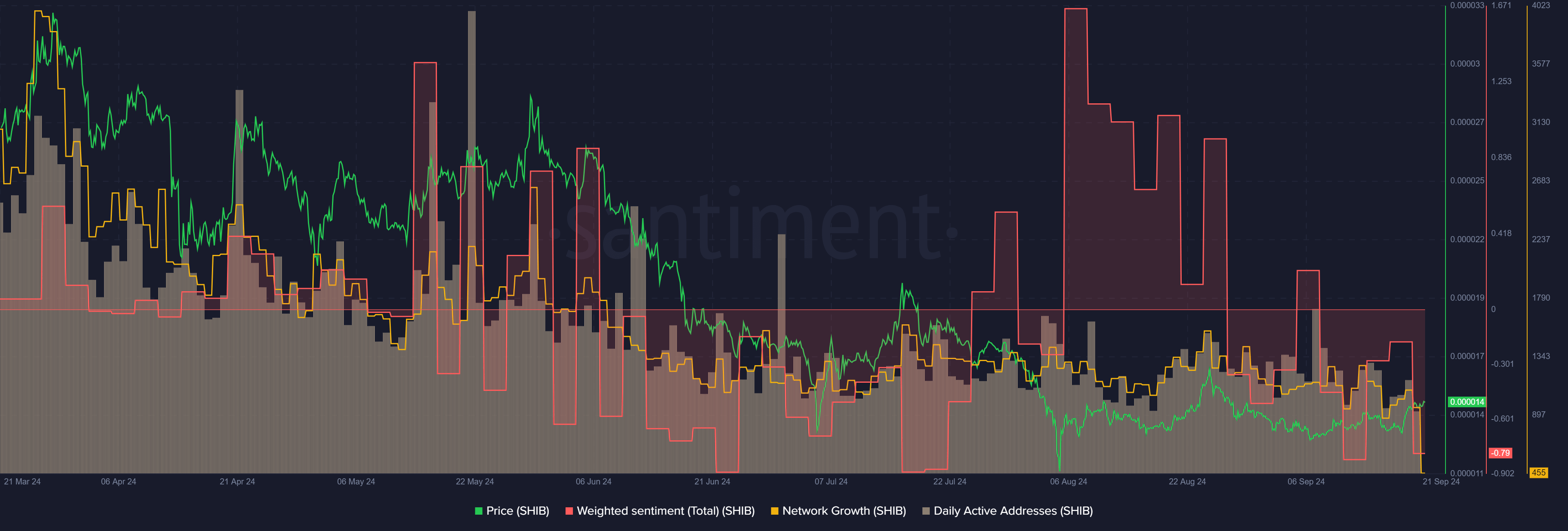

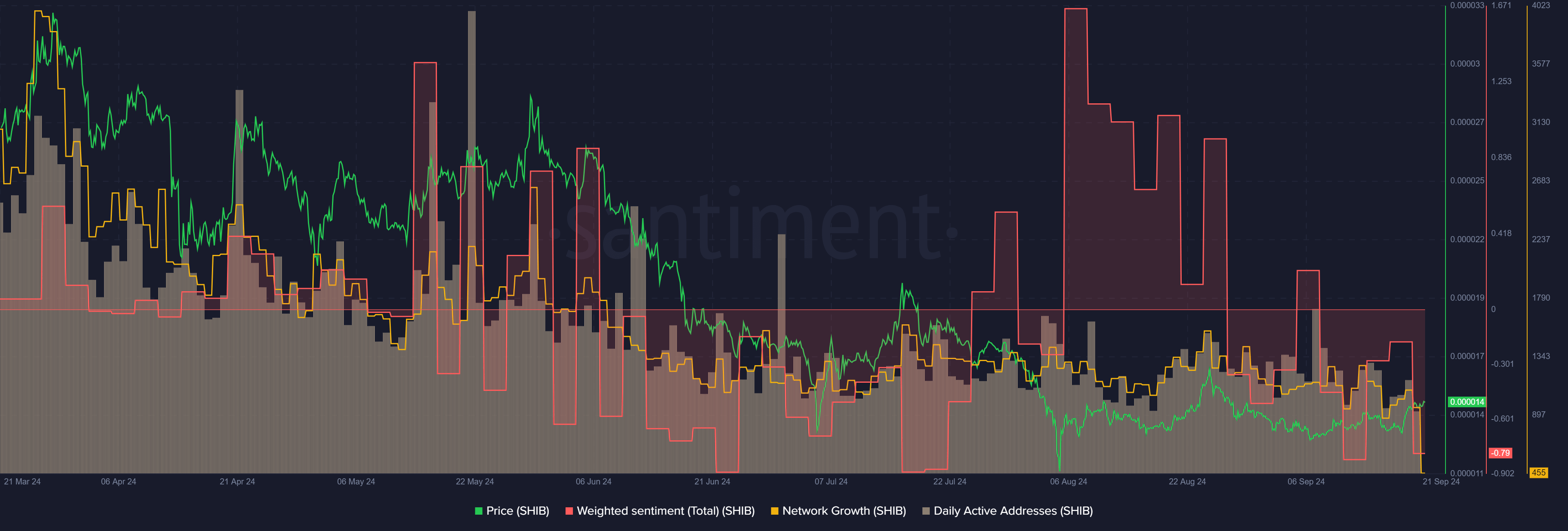

- Network activity was down in September.

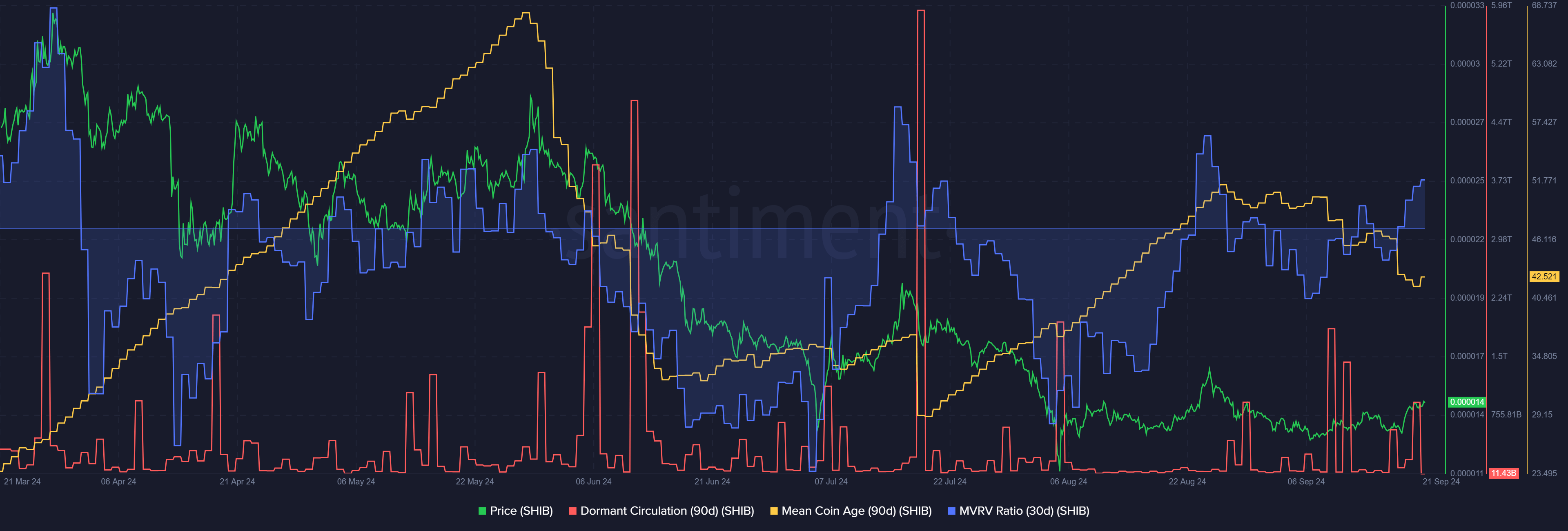

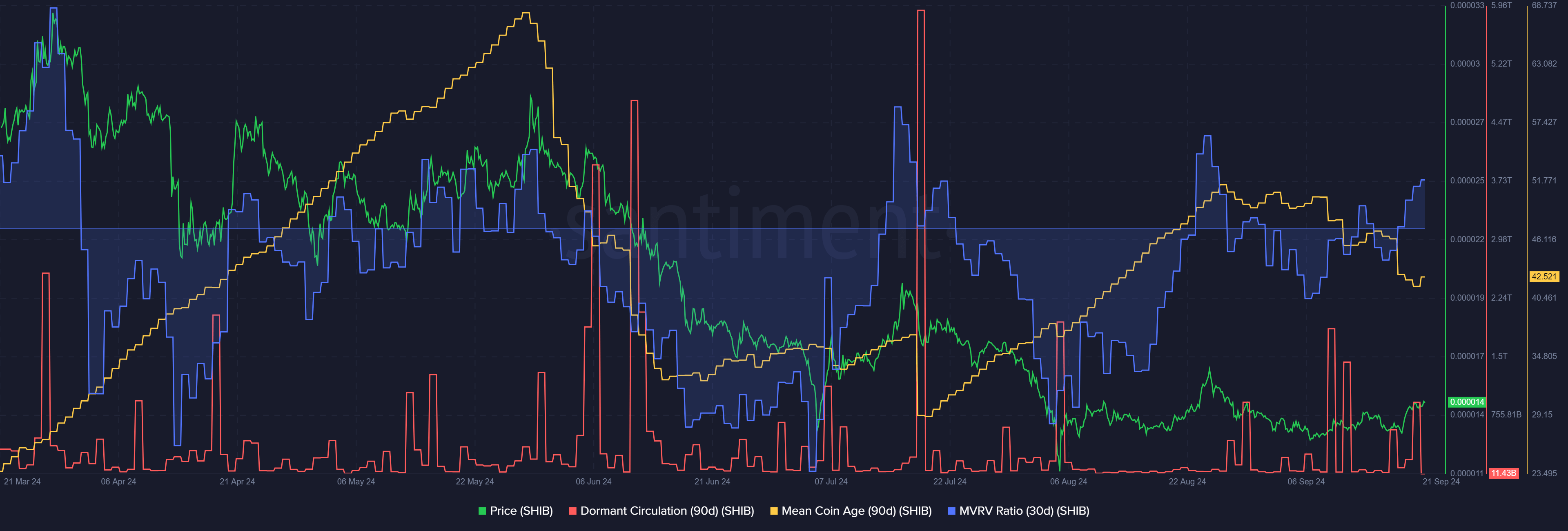

- Average coin age and MVRV have shown a short-term downward trend.

Shiba Inu (SHIB) has been trading in a triangle for the past 75 days. The cryptocurrency promises to perform well in the coming months after breaking out of the triangle last week.

Since Monday, September 16, the entire cryptocurrency market has been moving upwards, with gains of around 7%. Shiba Inu has made an 8% gain and the break of the local resistance at $0.000014 has signaled a further 7-8% increase.

Network activity is declining

Source: Santiment

Daily active addresses trended downward from May to July, but began to level off through late August. There was a spike in activity in early September, but since then the metric has been falling again.

The latest decline means daily activity has reached its lowest levels since the first week of February earlier this year. Network growth has also declined since the last week of August.

Weighted sentiment was strongly positive in August, but like active addresses and network growth, it also took a hit in September. Overall, Shiba Inu does not seem likely to see a surge in demand due to the increase in users in the short term.

Short-term bearish sentiment for SHIB

Source: Santiment

The 30-day MVRV was positive. The last time a notable positive spike was seen was on August 24 and was followed by a sharp 12% price correction over the next three days.

Dormant circulation saw a notable spike on September 20, another sign of short-term bearish pressure. At the same time, the average coin age has also been trending downward over the past month, showing a distribution across the network.

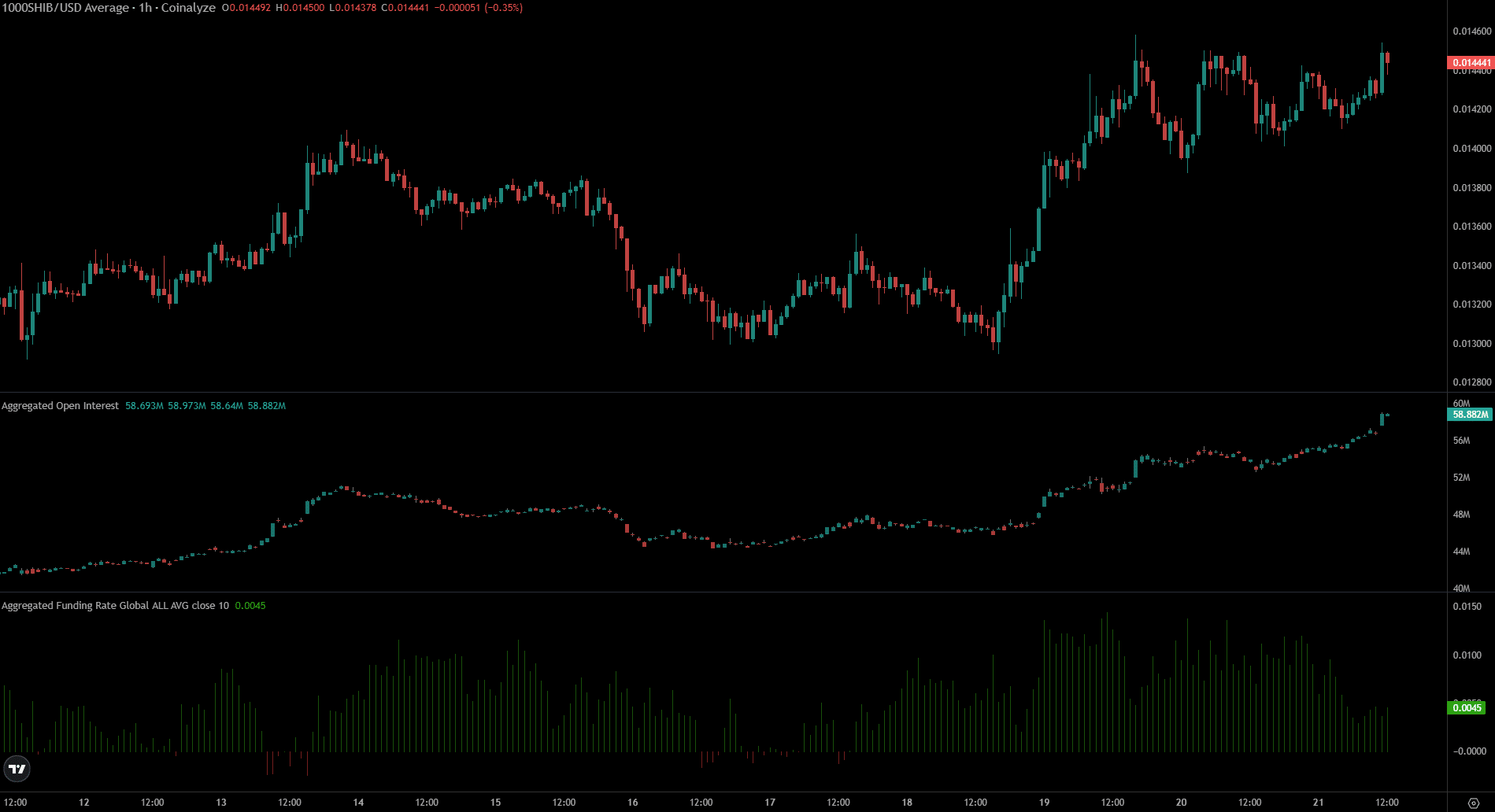

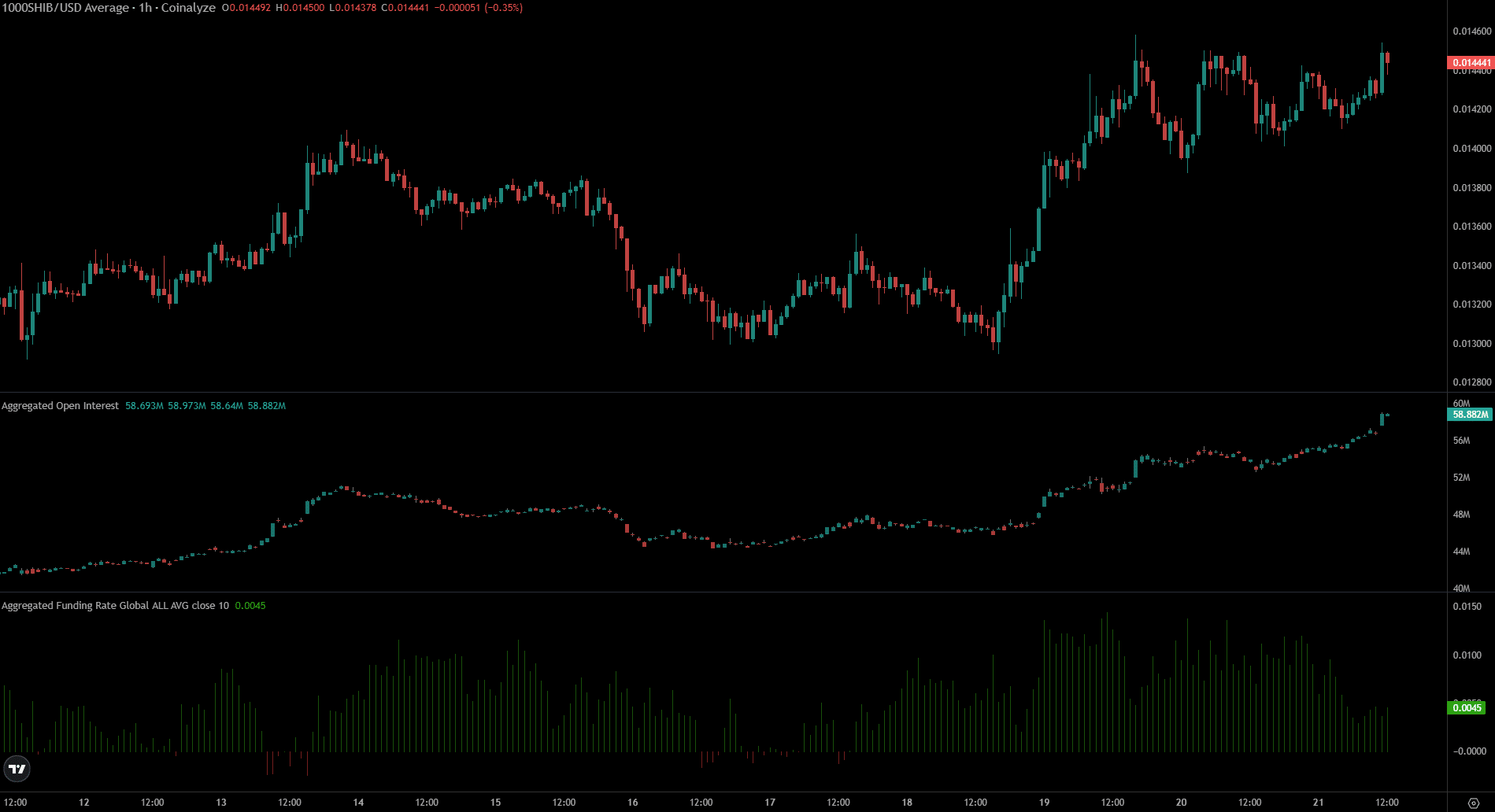

Source: Coinalyze

Open Interest has been rising alongside prices over the past week, showing strong bullish sentiment. The Funding Rate was also very positive but has fallen over the past 24 hours.

Realistic or not, here is the market capitalization of SHIB in terms of BTC

This drop in the funding rate suggests that the long/short imbalance is narrowing, but long positions are still favored. Overall, on-chain metrics indicate that some short-term selling pressure is to be expected.