- After the hard fork was released, the SHIB burn rate increased sharply

- Although SHIB’s price action has been bearish, one metric suggested it might be undervalued

Shiba Inu (SHIB) Shibarium recently underwent a hard fork that aimed to improve the overall ecosystem. In fact, the latest upgrade also aimed to further strengthen the deflationary characteristics of the ecosystem.

Let’s take a closer look at the hard fork and its possible impact on SHIB price on the charts.

Shiba Inu’s new hard fork

Shiba Inu Official Nickname X revealed that they launched a hard fork with the new version of Bor. The upgrade took place on August 9th and introduced a burn mechanism to improve the Shiba Inu ecosystem. The burn mechanism is directly linked to transaction fees.

With this update, 70% of all base transaction fees collected on the network will be automatically converted into SHIB tokens and permanently removed from circulation via burning.

The remaining 30% will be dedicated to platform maintenance, development, and ecosystem growth initiatives. By gradually reducing the overall supply of SHIB, this deflationary strategy aims to eventually increase the value of the token.

Notably, at press time, data from SHIBBURN revealed that the token’s burn rate had already increased by over 4,430% in the past 24 hours.

Source: SHIBBURN

Here it is also worth taking a look at Shibarium’s statistics after the hard fork.

According to Shibariumscan.ioTotal L2 transactions reached 418 million, with a total of over 1.8 million wallets.

How is SHIB?

Although the upgrade was successfully launched, SHIB’s price action remained bearish as it dropped by over 5% in the last seven days. At the time of writing, Shiba Inu was trade at $0.00001407 with a market cap of over $8.2 billion, making it the 13th largest crypto.

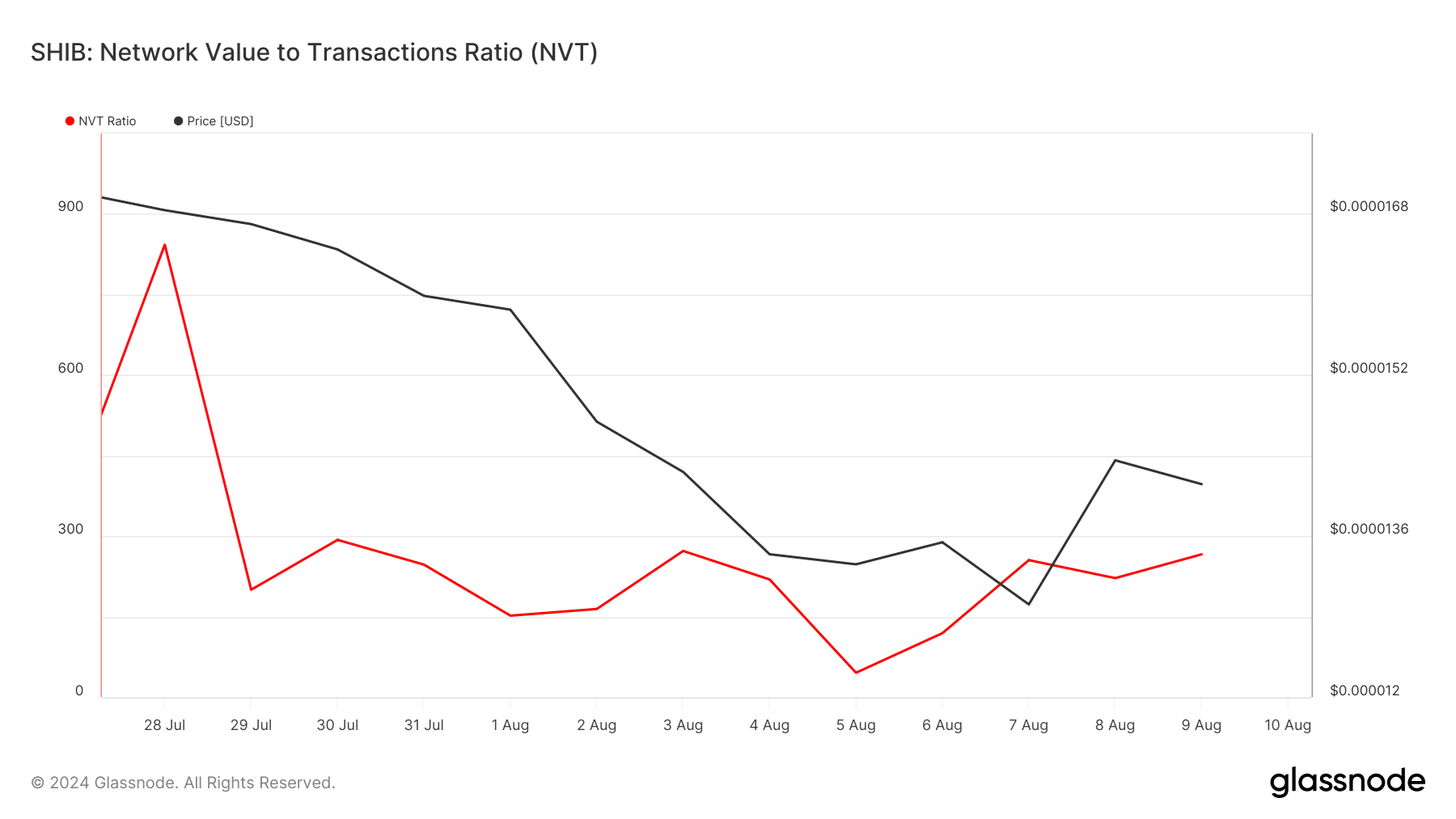

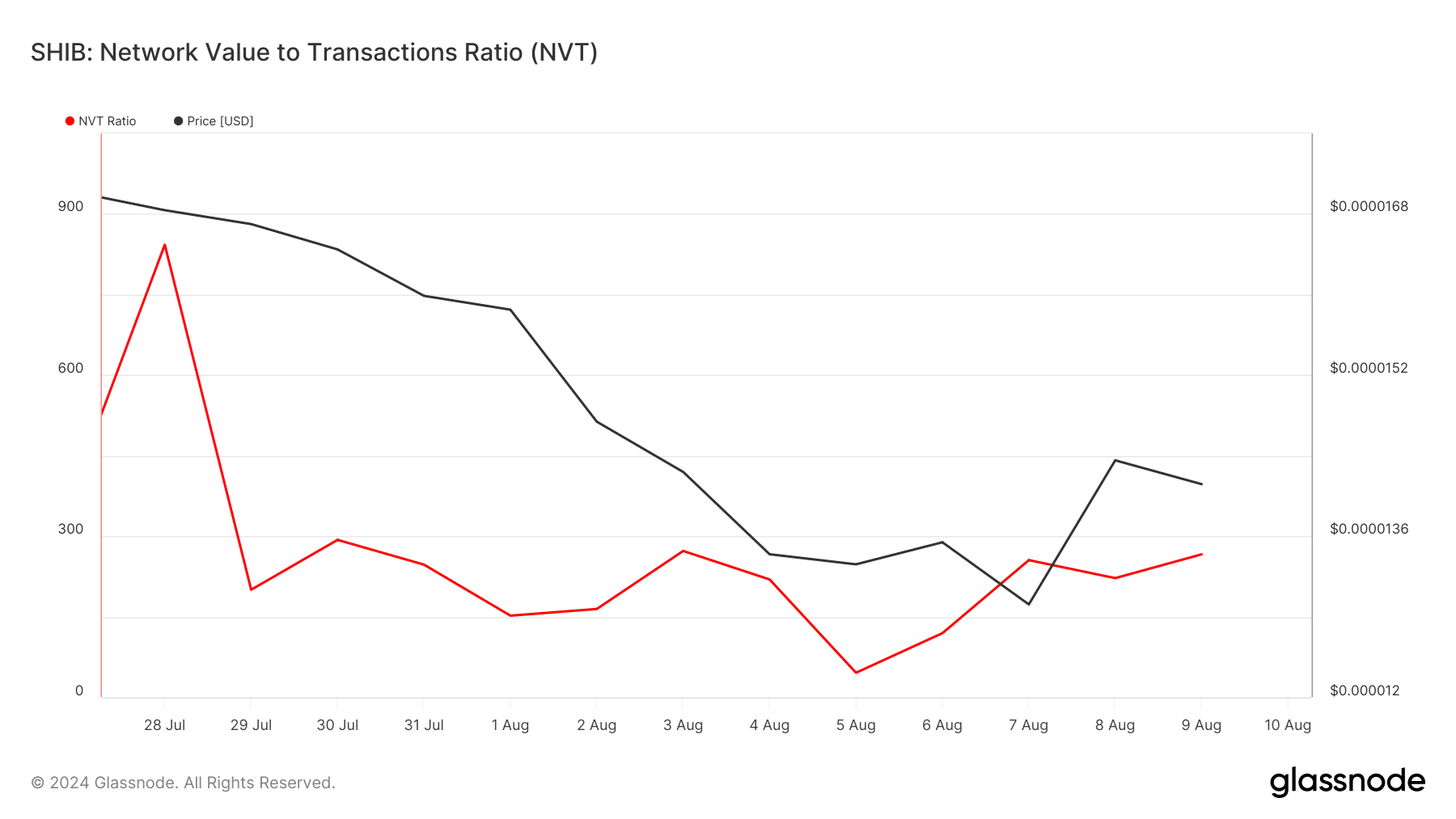

AMBCrypto’s assessment of Glassnode data revealed that SHIB’s NVT ratio has fallen sharply over the past two weeks. A decline in the metric means that an asset is undervalued, indicating a possible upcoming price hike.

Source: Glassnode

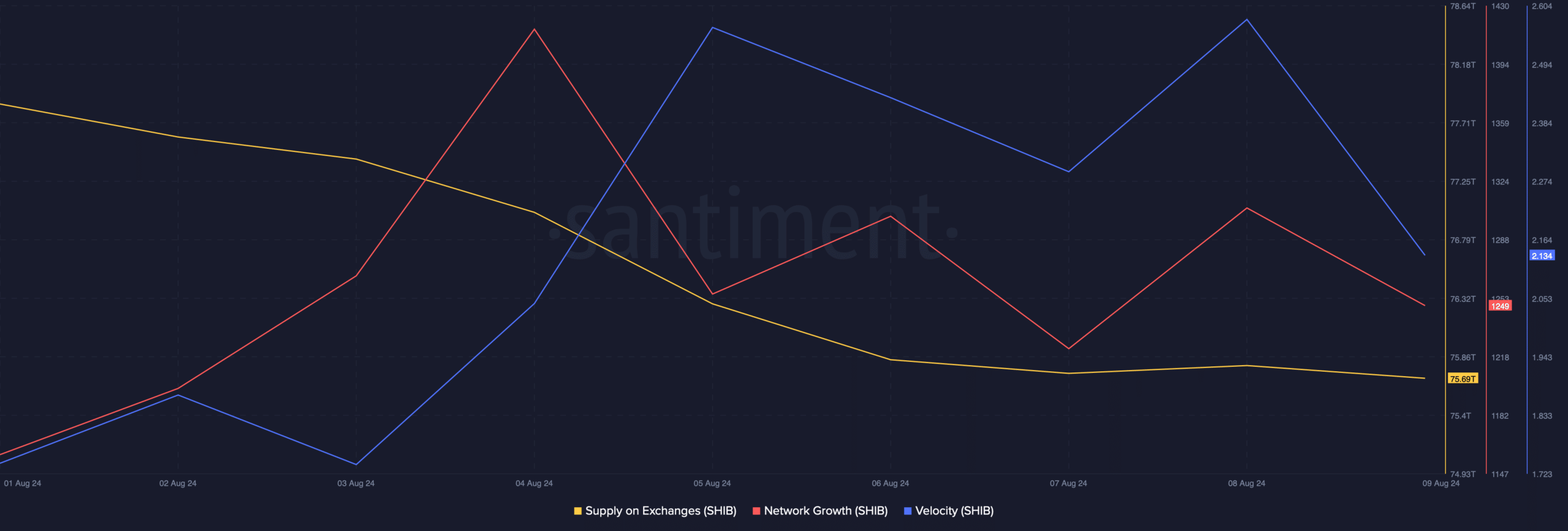

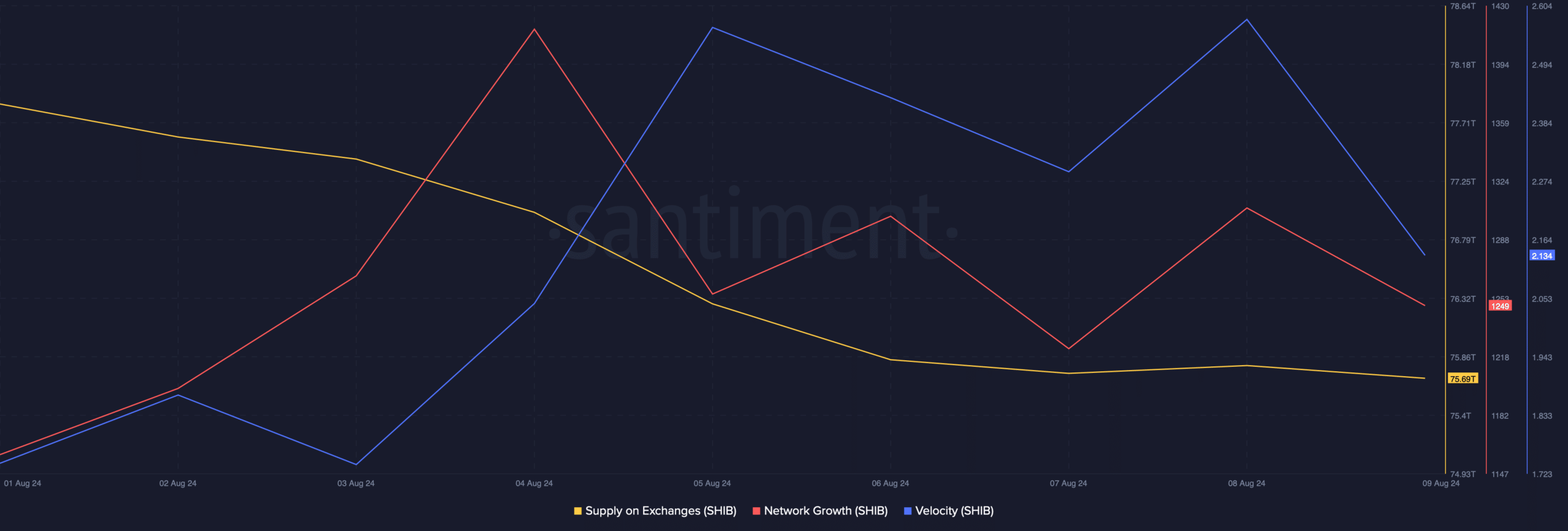

The supply on exchanges has dropped along with its price. This means that buying pressure on the memecoin has increased.

Additionally, its speed has also increased in the past week, suggesting that SHIB has been used more often in transactions over a given period. However, its network growth has dropped, which can be interpreted as a bearish signal.

Source: Santiment

Read Shiba Inu (SHIB) Price Prediction 2024-25

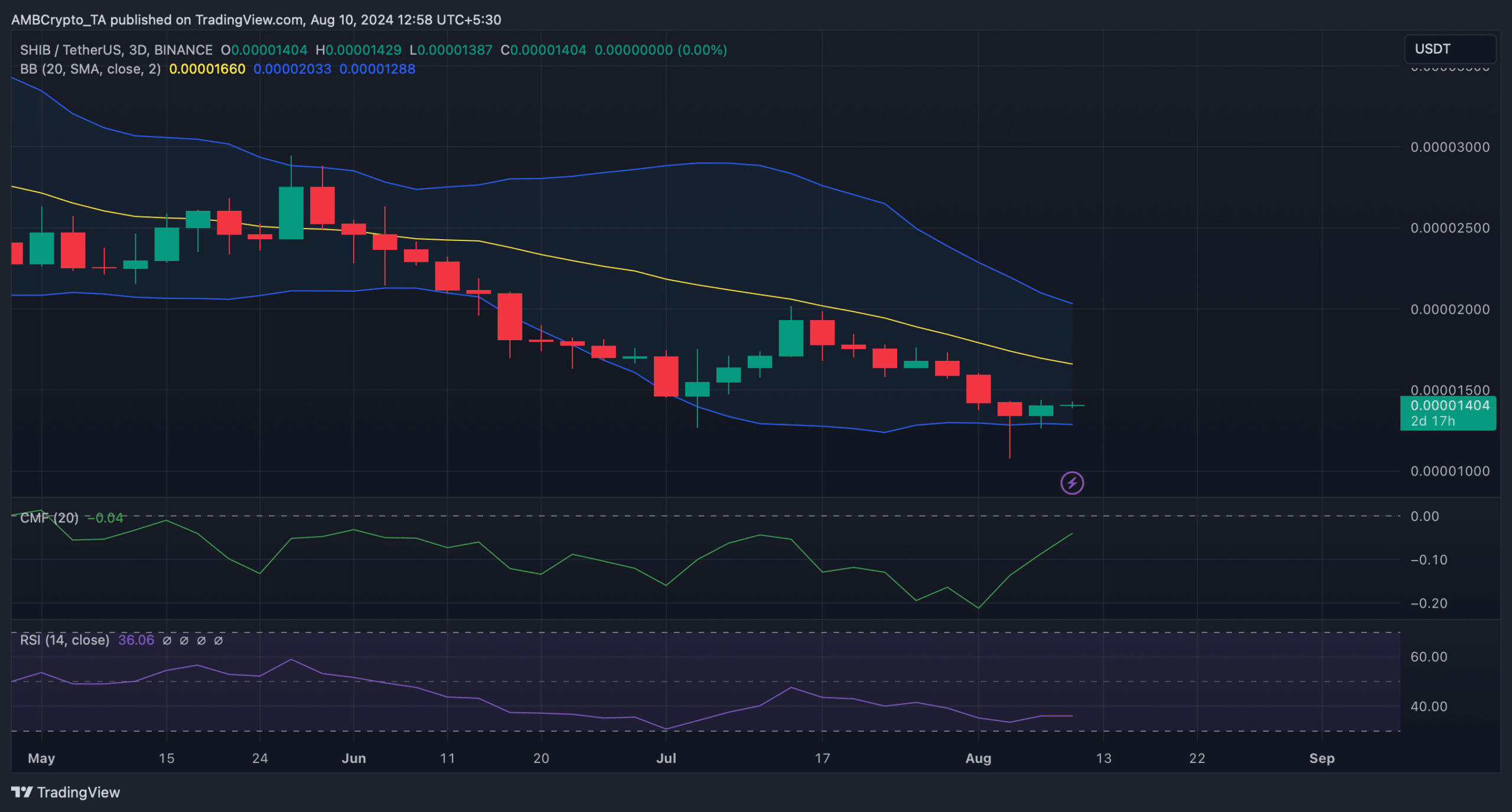

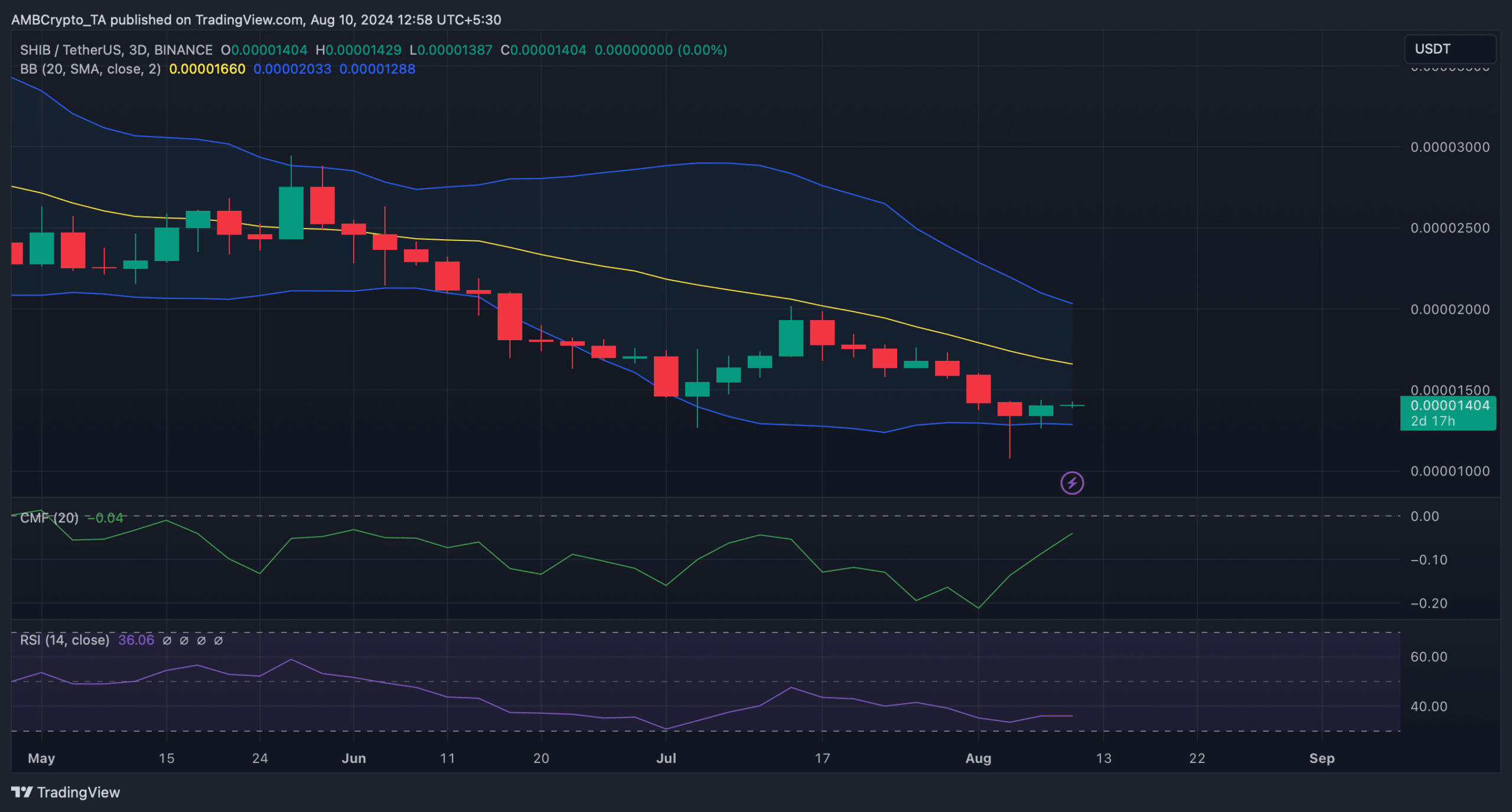

Finally, we checked the daily chart of Shiba Inu to see what signals the market indicators were showing.

The memecoin’s Chaikin Money Flow (CMF) saw a sharp increase. Additionally, SHIB price touched the lower boundary of the Bollinger Bands, which often leads to price increases. However, the Relative Strength Index (RSI) looked bearish as it had a value of 36.

Source: TradingView