- Solana’s new proposal could reduce inflation by 80%.

- Option traders looked at $ 120 as part of increased down pressure.

A section of Solana (soil) The initiates struck the support of the new proposal (SIMD-0228), declaring that this would considerably reduce inflation.

In fact, according to Ryan Watkins Crypto vc partner of Syncracy Capital, this decision slash 80%inflation.

“The potential reduction in inflation of 80% is coming soon.”

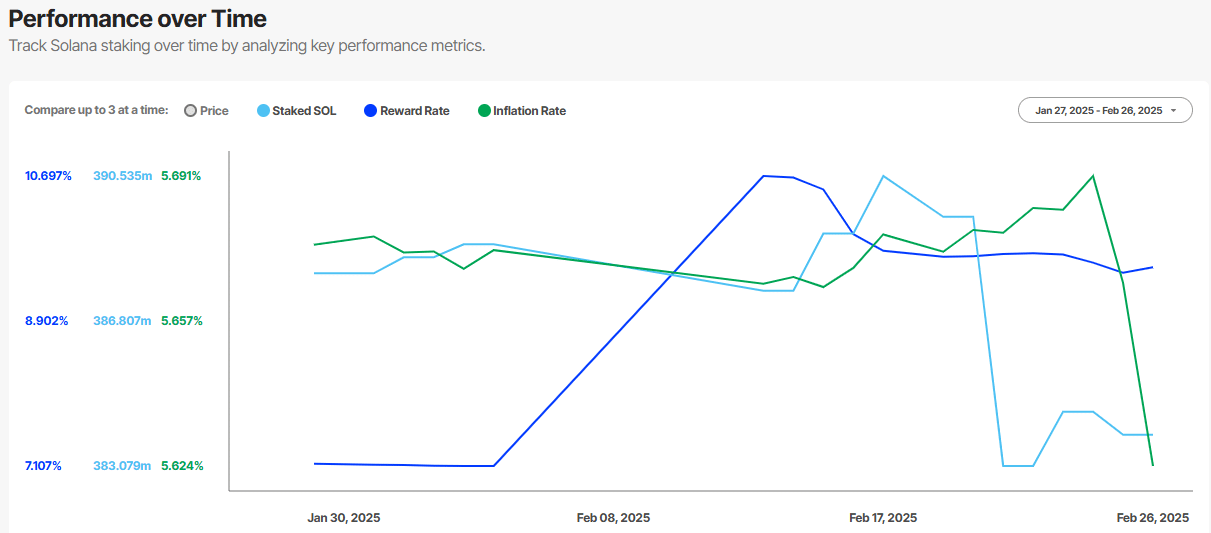

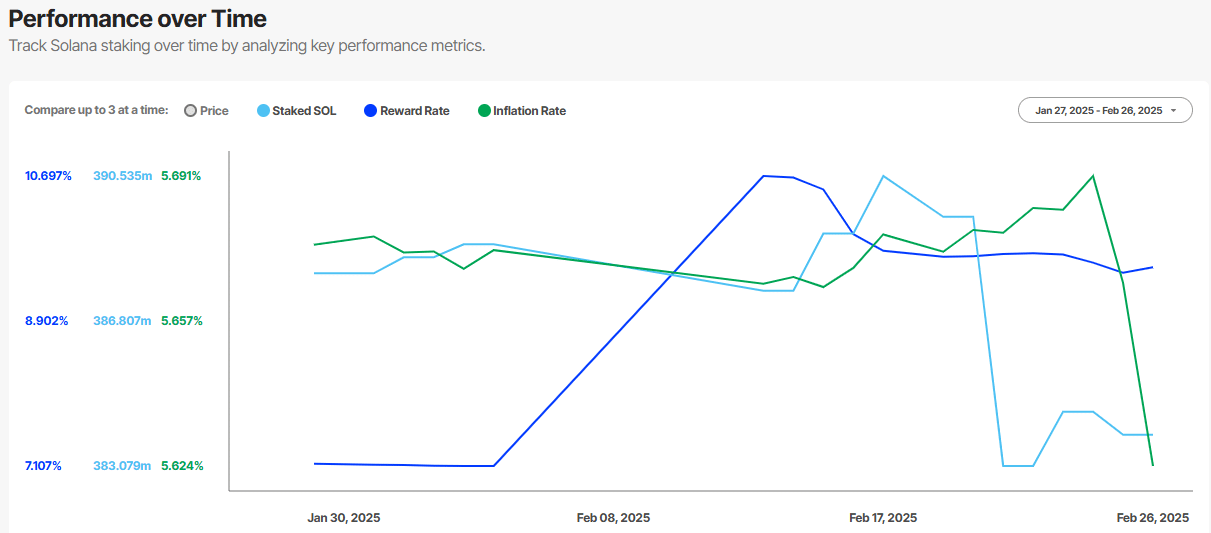

Souce: Solana inflation

Is Solana too paid for security?

SIMD (Solana improvement document) -0228 proposal aims to prick the solana emission rate in the participation of stake.

According to Vishal Kankani, Partner of Multicoin Capital, Solana “ Too paying for network safety ” with its fixed emission rate compared to Ethereum. He said,

“Currently, Solana releases approximately 4.5% of new tokens each year, reducing 15% each year. For comparison, Ethereum, with less than 30% milestone, emits less than 1%. »»

Kankani added that the current model also limits the growth of defi.

“Solana’s high emissions not only lower prices by increasing tax sales, but also on unnecessarily stimulation yields, discouraging participation in its growing DEFI sector.”

However, the awards of jealking would also be reduced by almost 80%, a decision of which certain members of the community were dissatisfied.

Stakers earn about 10% in awards, but that would considerably reduce if the proposal was adopted.

Source: Press the awards

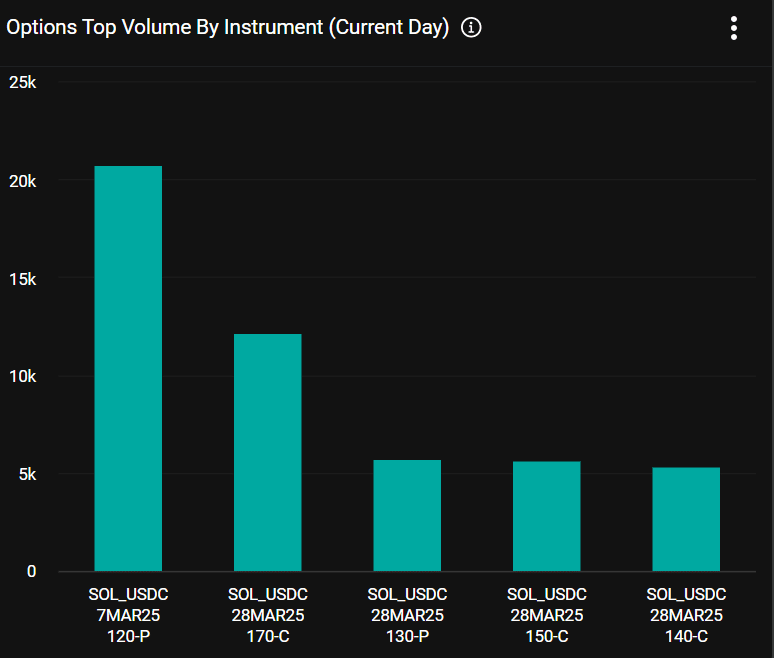

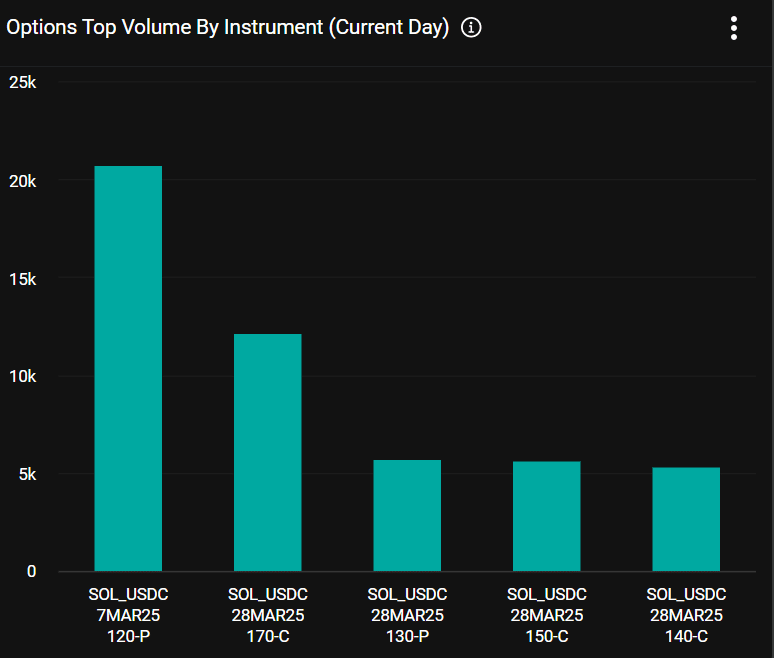

Will Sol go to $ 120?

Interestingly, the voting calendar occurs immediately after the March release of 11.2 million soil from the FTX succession.

Planned for March 1, the massive unlocking added a downward pressure on the token after the peel of the same scale.

Sol has since lost 53% compared to its record summit of $ 295, below $ 140.

However, Greg Magadini of Amberdata said that unlocking was already at the price and that a wider market rebound would increase soil.

In a recent newsletter, Magadini said,,

“There is an argument to argue that a rescue rally in the soil prices could bring a positive correlation on site / flight, because the market is potentially too congested.”

The prolonged BTC plunges $ 86,000 in sharp market feelings. Put (Paris Leases) options for $ 120 target were the most purchased on the drunken in the last 24 hours.

It suggested that Traders expected more and more risks downwards at this level during the first week of March.

Source: Enchanting