Floor is held at a key technical stage with three powerful catalysts that potentially converge the token around $ 200, as institutional adoption accelerates, the ETF approval ratings reached 91% and that the highly anticipated “Solana Summer” officially launches tomorrow.

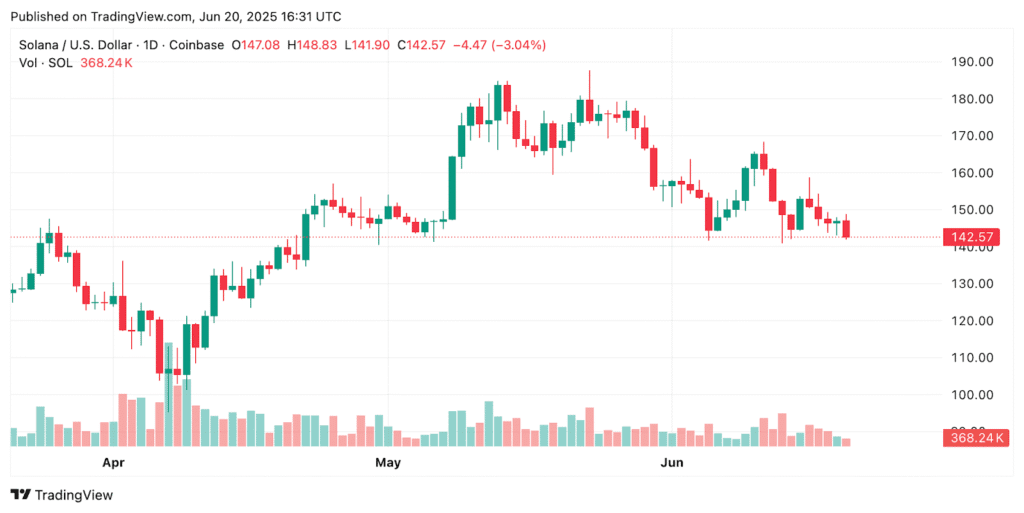

At the time of writing the editorial staff, Sol is negotiated at $ 142 and has entered what technical analysts identify as a “makeup artist” area, where the convergence of fundamental developments could trigger the next major price movement.

The institutional impulse has reached a fever field, several public companies passing by traditional Bitcoin reserves to cash strategies focused on Solana.

Business cash change leads to institutional accumulation

The most convincing fundamental engine for Solana’s potential break is focused on the radical change in business treasure allocation strategies, where public enterprises choose more and more soil rather than Bitcoin for their digital asset reserves.

This transition reflects the growing institutional recognition of Solana’s superior technological infrastructure, the implementation of performance opportunities and positioning in DFI and NFT ecosystems in rapid expansion.

Sol strategies has become the child of the poster for this movement, depositing a basic prospectus of $ 1 billion and guaranteeing a convertible ticket installation of $ 500 million specifically for soil accumulation, while exploring the tokenized equity emission on the Solana blockchain.

Memmettegy has become the first company listed in Hong Kong to add Solana to its corporate treasure with a purchase of $ 370,000, while class holdings obtained up to $ 500 million in funding specifically for soil accumulation, sending its shares from almost 40%.

The wave of institutional adoption extends beyond the simple allowance of the Treasury to strategic operational integration, companies like the Memmettegy providing to participate in the validation of the network to gain stimulation awards while contributing to the security of the network.

Solana ETF’s approval ratings reached 91% as seven file companies

The regulatory appetite has evolved considerably in favor of Solana. On June 13, seven main asset managers, including Fidelity, Vaneck and Grayscale, deposited or modified Solana ETF Solana applications.

The dry would have asked for updated deposits by June and seems open to the authorization of staging features, a key differentiator who could make Solana ETF more attractive than traditional bitcoin offers.

Bloomberg analysts believe that 90% approval ratings for 2025, with potential launches expected in the fourth quarter. This creates a powerful anticipation premium which could cause substantial capital inputs before real approval.

Participants in Polymarket granted even higher confidence in approval perspectives, 91% of users predicting the approval of the Solana ETF in 2025.

The wave of deposit includes heavy goods vehicles such as Coinshares, which submitted plans for an ETF Solara classified Nasdaq according to the reference rate CF CF CF Solana – Dadro.

In fact, the analyst of Bloomberg ETF Senior James Seyffart noted that although delays are expected, the SEC considers that Solana as a commodity rather than a security, offering a clearer regulatory way than other altcoins confronted with the uncertainty of classification.

Solana’s summer launch promises the expansion of the ecosystem

The official launch of “Solana SummerTomorrow adds to the bullish indicators. This initiative is a coordinated effort to stimulate the development of ecosystems, the adoption of users and the activity of the network which is historically correlated with a strong assessment of prices.

Previous campaigns focused on Solana have demonstrated the network’s ability to take advantage of community engagement and developers’ activity in a sustained dynamic which benefits both technical fundamentals and tokens assessing.

The moment perfectly coincides with the improvement of technical conditions and increasing institutional interest, creating a potential catalyst for convergence.

Solana’s summer initiatives generally include hackathons, developer subsidies, partnership announcements and community strengthening activities designed to present network capacities through DEFI, NFTS, games and emerging use cases such as the integration of AI.

The launch of the campaign during a period of technical consolidation and institutional accumulation suggests a strategic moment designed to maximize the impact when market conditions are started for an ascending movement.

Historical analysis shows that the coordinated campaigns on Solana’s ecosystems often precede the 30 to 90 days of outperformance compared to other major cryptocurrencies.

Technical analysis reveals the configuration of the rupture to a key support

From a technical point of view, the structure of Solana’s graphic suggests that the asset completes a complex corrective model which could peak in a powerful escape around $ 200 and beyond.

Daily analysis reveals soil trading in a key phase of “retrace” at $ 143.68, positioned between key demand zones of $ 126.00 at $ 135.00 and resistance clusters between $ 164.00 and $ 175.00.

The technical framework shows a downward pressure of expanding mobile averages in expansion, although it is a healthy consolidation in the broader positive trend rather than a fundamental rupture.

Analysis of the 2 -hour period reinforces the consolidation thesis, with an extended side range which built substantial energy between the support area from 130 to $ 140 and the resistance zone of $ 200 +.

This prolonged basic formation generally precedes major directional movements, the current structure suggesting that Solana wores for an upward resolution.

The technical configuration indicates that a shortage supported above the resistance strip from 160 to $ 170 would probably trigger algorithmic purchases and potentially trigger a movement to the upper limit of around 200 to $ 220.

In addition, the daily perpetual contract analysis provides the most convincing technical account thanks to the theory of Elliott waves, suggesting that Solana develops a classic ABC corrective model after its peak around $ 310.

The structure of the waves indicates the potential completion of wave C around the level of retirement of 0.618 FIBONACCI at $ 130.00, representing a key support zone which aligns with historical demand zones.

The projection of the Elliott waves suggests that at the end of this corrective phase, Solana could undergo a strong reversal, initially targeting $ 220-250 before extending to previous peaks around $ 310.

Overall, the key surveillance level remains the support area of $ 130.00, where a solid rebound would confirm the completion of the corrective model and potentially trigger the next major advance phase.

Given the next Solana summer launch, FNB approval expectations and the acceleration of institutional adoption, the technical configuration seems to be initiated for the type of coordinated break that could result in resistance of $ 200 and to the summits of the new cycle in the coming months.

The post soil for an $ 200 escape because the ETF ratings reached 91% and “Solana Summer” begins first on Cryptonews.

Just in: the wave of public enterprises accumulating

Just in: the wave of public enterprises accumulating