Solana won almost 6% on Friday, gathering alongside Bitcoin, while the largest cryptocurrency finds $ 80,000 as a support. However, the total value of the assets locked in the Solana chain is down $ 5.26 billion compared to its peak, a drop of almost 50%. TVL represents demand and relevance for a chain, which means that Solana is affected negatively by changing market dynamics.

The parts even based in Solana considered the driving gains of the catalyst in soil (soil) this market cycle, is struggling to recover while traders become frightened.

Solana state

The total value of locked assets is a key measure used in DEFI to follow the confidence of investors, the relevance of a chain and demand among crypto traders. TVL followed Defillama’s emissions that Solana slowly loses the relevance in the cycle of the current cryptography market.

TVL SOL is down from its summit of $ 12.191 billion to $ 6.939 billion when writing the editorial’s time. This marks a drop of almost 50% TVL in the chain. One of the main catalysts behind the decline is the crash of coins on the floor chain.

During the last month, the 10 main protocols of the Solana blockchain erased up to 40% in TVL. The three main catalysts influencing this change are the Bitcoin Flash crash, the controversies of the Mèle play surrounding the Melania token (Melania) and the Same Coin (balance), the prices decline in the official trump token (Trump) and the cryptographic traders which have a response to risk in response to American macroeconomic developments.

The three market movers contributed to the capital outings of the 10 main Solana protocols and to the main parts of memes on the ground chain. Defillama shows the change of 1 day, 7 days and 1 month in TVL through Jito, Jupiter, Kamino, Marinade, Raydium, Sanctum, among other channels.

Part market analysis even Solana

On Coingecko, the metrics in the category of Jeme Solana even show a slight recovery. The market capitalization of all tokens in the category increased to $ 8.949 billion. Two the five best -memerics based in Solana has produced negative yields in the past 24 hours, Trump and Bonk (Bonk).

The other three, Dogwifhat (WIF), Grassouiers (Pongu) and AI16Z (AI16Z) penguins began their recovery during the last day. More than half of the solana -based parts have been corrected two -digit in the last seven days.

Statistics suggest that there is a change in market dynamics and that the capital and attention of traders go from the “same corner” sector to other categories of cryptographic tokens.

Bitfinex analysts have evaluated recent market events and observed that the launch of a part of memes associated with the American president, although which has led to significant loss and a drain of liquidity through other memes parts on the Solana network, is a negative catalyst for the category.

Market Movers and Solana Catalyst

The largest exchange in the world, the CME group has announced the launch of Solana Futures, a bullish development for the competitor Ethereum. The news comes after the Metamask roadmap released where the cryptocurrency portfolio-based on the browser discusses the addition of the native support of Solana in May 2025.

Solana is the first non -EVM channel supported by the browser portfolio and adds the functionality to buy, sell, exchange and interact with the DAPPs on the entire floor ecosystem. All existing users of the chain will have access to the same Metamask features that Ethereum users appreciate alongside other channels supported by the portfolio.

Bitcoin recovery and BTC find a support of $ 80,000 after a flash accident on Friday is one of the main engines on the cryptography market. Solana and Bitcoin benefit from a correlation of 0.83 within three months. Bitcoin price changes therefore influence the Solana price trend.

The new Bitcoin support test at $ 95,000 and a rally to the $ 100,000 milestone are the two developments that could have a positive impact on the Solana price trend in the coming weeks, while the tokens are strongly correlated.

Chain floor analysis

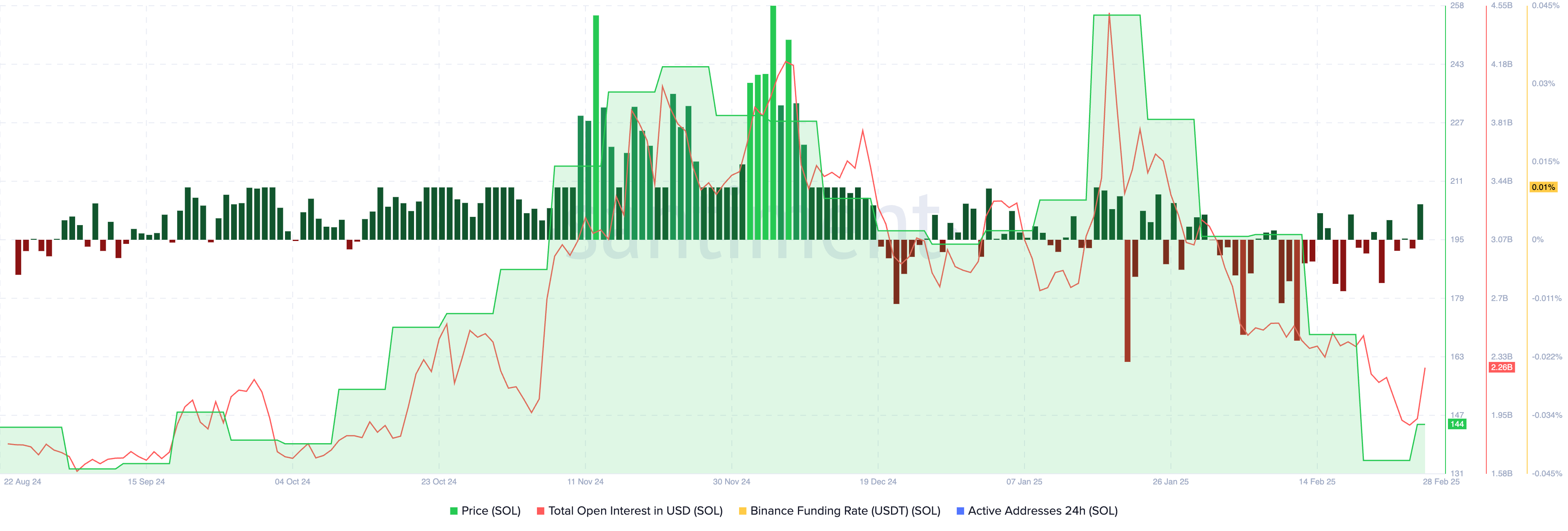

Solana’s chain metrics show signs of recovery in the token in the coming weeks. After several days of negative financing rate on Binance, Solana observes positive funding or biases bias among the merchants of derivatives on Friday.

The total open interest, a metric which follows the value of all the derivative contracts open in Solana, increases, climbs to more than 2.26 billion dollars on February 28. The price of the soil recovered after weeks of downward trend, up almost 6% during the day.

The increase in open interests and the rate of positive financing support a bullish thesis for the resumption of Solana in the short and short -term.

Solana price forecasts

Solana could break its downward trend of several months with daily closure in the resistance area between $ 147.09 and $ 166.42. These two levels mark the upper and lower limit of a difference of fair value, an ineffectiveness on the market. Once Sol undertakes the resistance area, the next key level for merchants is resistance to $ 180.

The level of $ 180 acted as a support for almost three months, making it a key level for soil. A daily candlestick close to this level could prepare Solana for a level of $ 200 level, a key step for ground.

Technical indicators on the daily delay, RSI and MacD support the thesis. RSI bed 32 and is sloping upwards, above Solana’s “occurrence” area. MacD shows an underlying negative impulse underlying the trend in soil prices.

Ryan Lee, Bitget Research chief analyst, commented the recent Solana prize action, recent events like Bybit Hack and Bitcoin Etf Outflows. Ryan Lee shared the following comments with Crypto.News in an exclusive interview:

“Trump’s new prices on China, Canada and Mexico have shaken the cryptography market, resulting in the drop in TVL to 40% Solana, aggravated by the harassment of statement and more than 2 billion dollars in Bitcoin ETF outings, reflecting a weakening of the confidence of investors and the liquidity strain.

A downward perspective suggests that Solana faces stagnation if commercial tensions intensify, inflation increases or risk aversion is intensifying. The trajectory depends on the tendency of bitcoin prices, the response of China, the actions of the federal reserve and the question of whether Trump’s regulatory support counterbalances the macroeconomic winds. Critical developments are expected in the next 30 days, which makes this pivot period for market clarity. »»

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.