As the pre-election crypto bull market kicks off, Solana network stats shine once again, a testament to resilience and expansion.

2024 has become the year crypto traders doubt Ethereum, and for good reason.

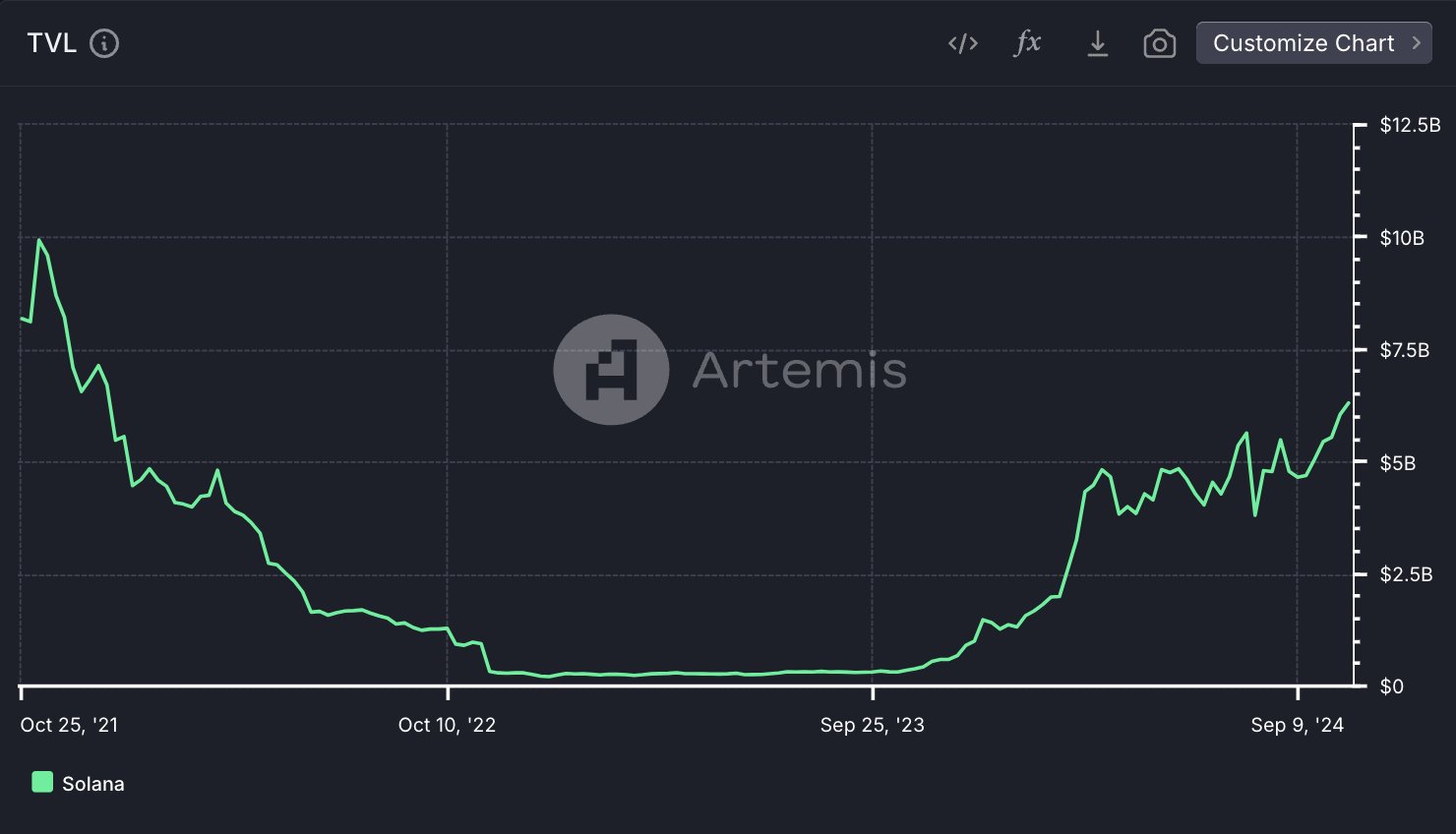

Rebounding from the tumult of late 2022, the Solana blockchain now boasts remarkable statistics in terms of revenue, transaction volume, and total value locked. This resurgence confirms Solana’s heavyweight status in the crypto ring, alongside Ethereum and BNB Chain.

Solana: increase in revenue and TVL

Solana’s return to prominence is marked by a steady increase in revenue, now approaching $12.5 million. This growth, mainly fueled by gas fees linked to transactions and smart contract deployments, has seen a significant increase since September 2023.

The network’s TVL, a crucial indicator of its usage and appeal, surpassed $6 billion. Although this figure is below the peak of $10 billion recorded in October 2021, it represents a robust recovery.

Solana exceeds or reaches the ATHs for:

–TVL

– income

– volume

– real economic activity

– developer activity

– taxes

– net collection

– deduplicated stable transfer volumenot bad for a channel that will never be of any use according to this app

faster pic.twitter.com/QwGrTfoTQW

—mert | helius.dev (@0xMert_) October 27, 2024

Platforms such as Jito, a leading liquid staking service, dominate the ecosystem with over $2.4 billion in assets under management.

Additionally, Raydium, one of Solana’s largest decentralized exchanges (DEXs), grew its assets by 28% over the past month, surpassing $1.4 billion. These platforms highlight the growing interest and investments in Solana’s DeFi sector.

READ MORE: 16 Best Crypto ICOs in 2024 for 50x Returns

DEX trading volume exceeds that of competitors

SOL also outperforms its competitors in the crypto landscape. DEX to SOL trading volume has recently skyrocketed, surpassing $15 billion per week, outpacing competitors such as Ethereum, Aptos, and Cardano.

This 150% increase over Ethereum’s numbers highlights Solana’s vibrant trading scene and its undeniable appeal to traders.

The increase in trading activity is partly attributed to the rise of coin projects, notably triggered by the launch of Pump.fun in January 2024. This has boosted engagement and trading volumes in decentralized applications from Solana, contributing to its impressive growth indicators.

NEW:@JupiterExchange Exchange TVL hits new all-time high, surpassing $1.55 billion pic.twitter.com/HCSNiQVsnE

– SolanaFloor (@SolanaFloor) October 28, 2024

Daily transaction metrics indicate sustained engagement across Solana’s various services, supported by a healthy balance between usage and profitability. This dynamic continues to attract developers and users, positioning Solana as a preferred network for innovative blockchain solutions.

Future outlook for the SOL ecosystem

Recent developments in Solana’s DeFi sector show a promising trend in the integration of Solana-based protocols with traditional financial applications. This integration contributes to increased TVL and transaction volumes, suggesting a solid foundation for future growth.

SOL’s blockchain journey is a saga of courage and calculated moves. With pioneers like Jito and Raydium steering the ship and the coin buzz electrifying the scene, Solana is poised for more triumphs in the ever-changing crypto world. By riding this wave of growth, Solana is becoming the benchmark for innovation and agility in blockchain.

EXPLORE: Hong Kong police foil romance scam that stole $46 million from victims

Join the 99Bitcoins News Discord here for the latest market updates

The article Solana New High as Platform Records $2.4B in Liquid Staking as Network Activity Increases appeared first on .

NEW:

NEW: