- Sui has a bullish daily market structure and notable buying pressure.

- Fibonacci levels and bearish divergence contributed to the rejection.

Sui (SUI) was on a strong uptrend, but recent market-wide volatility spoiled it. Since September 1, the token has gained 131%. It maintained a firmly bullish bias on the daily chart.

Trading volume was above average and the structure suggested that further upside was likely. There was an obstacle to achieving bullish targets at $2 and above.

Stable purchasing volume and firm accumulation trends

Source: SUI/USDT on TradingView

The daily market structure has been bullish since September 15. This happened after a brief price drop to $0.8 followed by a strong recovery. Trading volume in September was high compared to July and the second half of August. This highlights a bullish belief.

Buyers were able to maintain this belief and push prices higher. They reached the $2 level, but were stuck by selling pressure that evolved after Bitcoin (BTC) saw a correction to $66.5k.

The CMF was at +0.06 while the A/D indicator surpassed the March and April highs. Together, they showed that recent buying pressure was strong and September accumulation trends were favorable for the bulls.

Fibonacci retracement levels stall SUI bulls

The daily RSI had formed a bearish divergence on October 2. This happened when the token price reached the resistance level of $1.81, the 78.6% retracement level based on the downtrend observed by Sui from April.

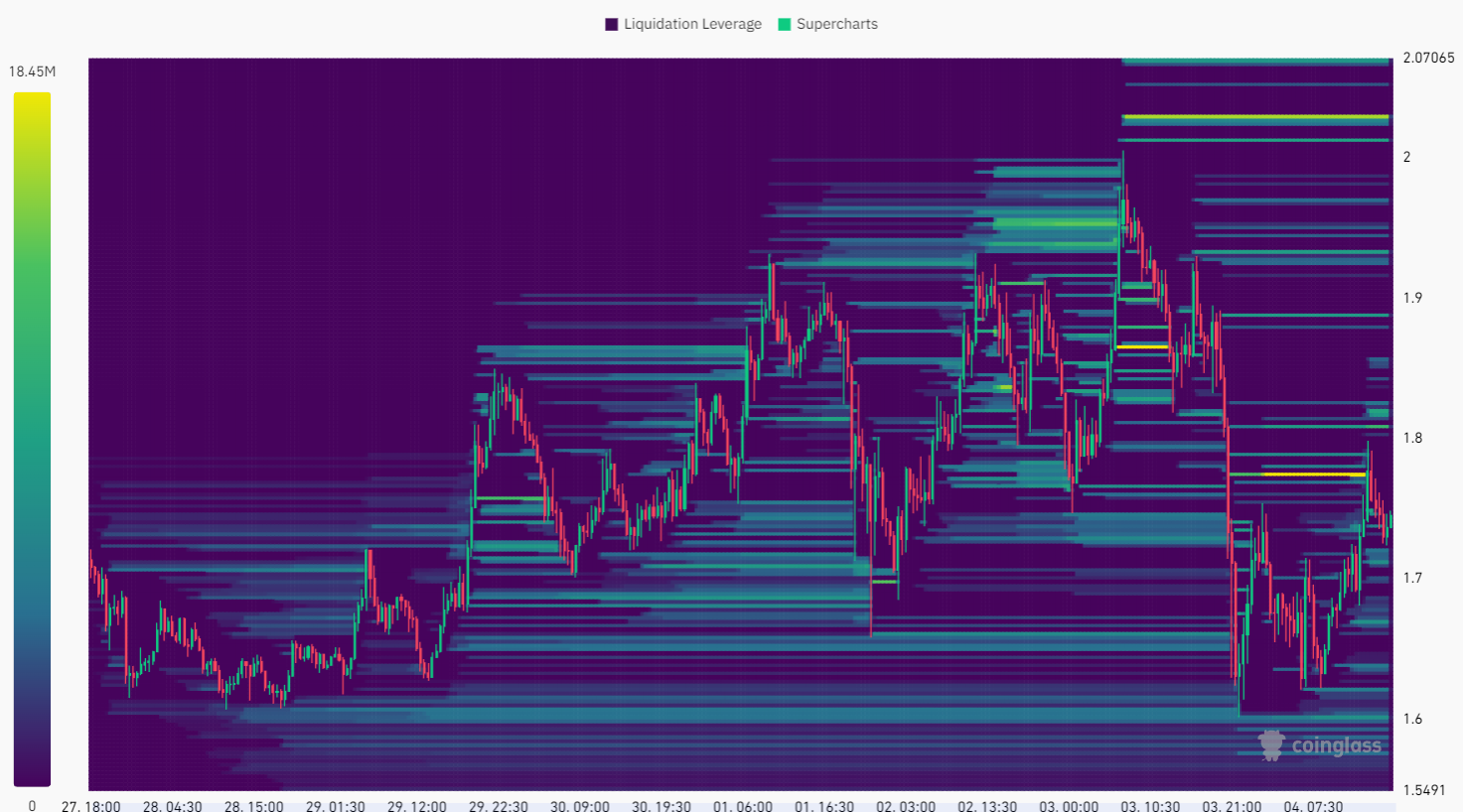

Source: Coinglass

Short-term liquidation heatmap data depicts the $1.77 area as a region of high liquidity. The recent upward move has wiped out this liquidity, reached the psychological resistance of $2 and is once again below the Fib level.

Is your wallet green? Check the Sui Profit Calculator

The token has a strongly bullish structure on the daily chart, but the resistance at $1.81 is crucial. If the bears continue to defend this level, it could wipe out the bullish conviction and force prices lower.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.