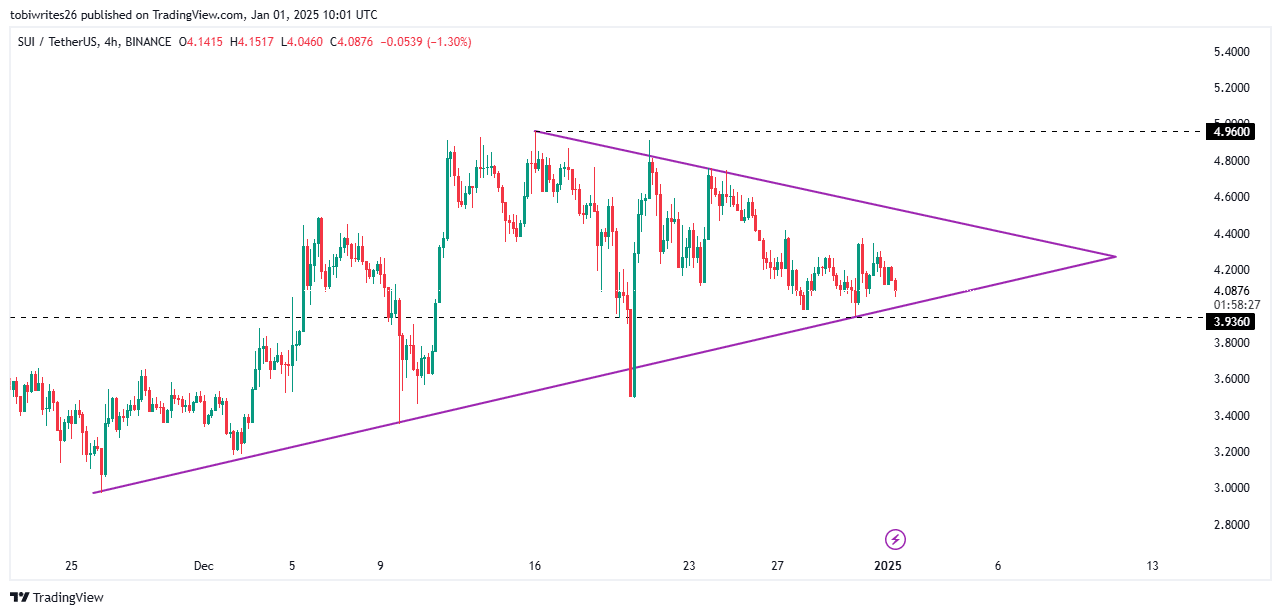

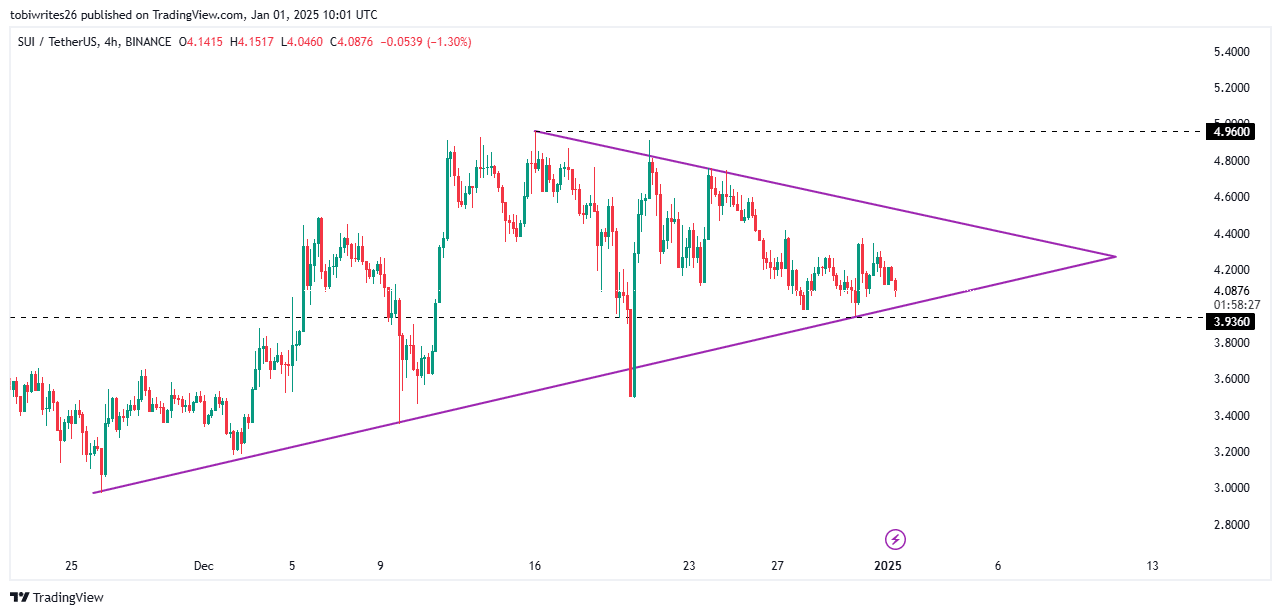

- SUI was trading in a symmetrical triangle pattern, with a key support level to provide a potential basis for bullish momentum.

- A slight decline remains possible as the coin sought stronger support before resuming its upward trajectory.

Over the past 24 hours, SUI is down 4.89%, suggesting further downside risk in the near term. Despite this, the asset’s 24.75% monthly gain highlights its broader uptrend.

Based on technical indicators and on-chain data, SUI may soon break out of its current range and bounce towards a higher price zone, possibly reaching $4.96 in the near term.

SUI trades within a symmetric channel

On the 4-hour chart, SUI appears to have entered an accumulation phase and is forming a symmetrical triangle. This trend suggests that market participants are buying at lower levels, which could lead the market higher.

This phase is characterized by two converging trend lines: the upper line as resistance and the lower line as support. For a rally, SUI may need to fall to establish sufficient support at two key levels.

First, SUI could test support at the lower trendline. Alternatively, it could fall further to an all-time high of 3.926, which could trigger a move towards the $4.96 level. Beyond that, the price will likely tend to increase.

Source: TradingView

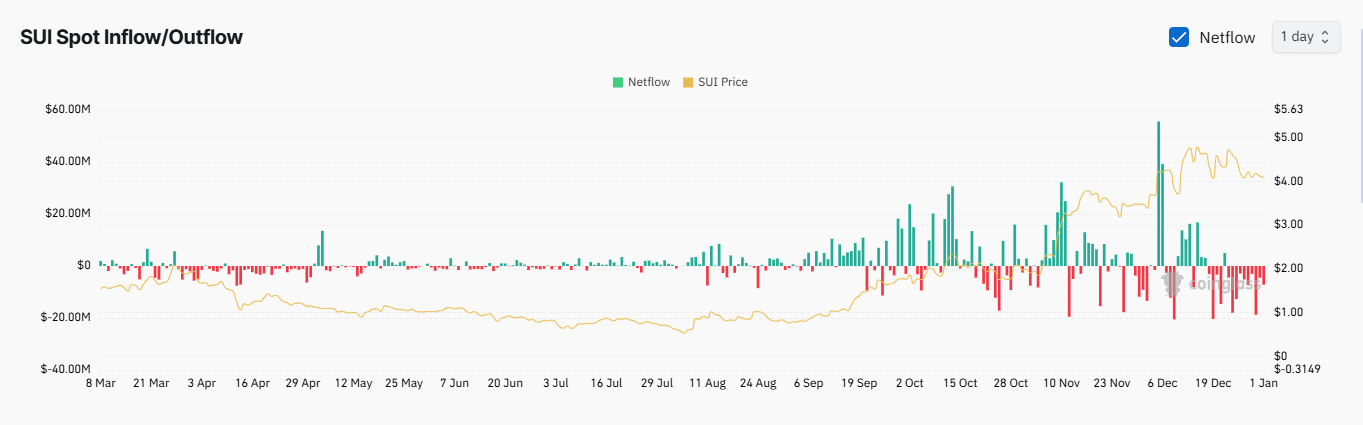

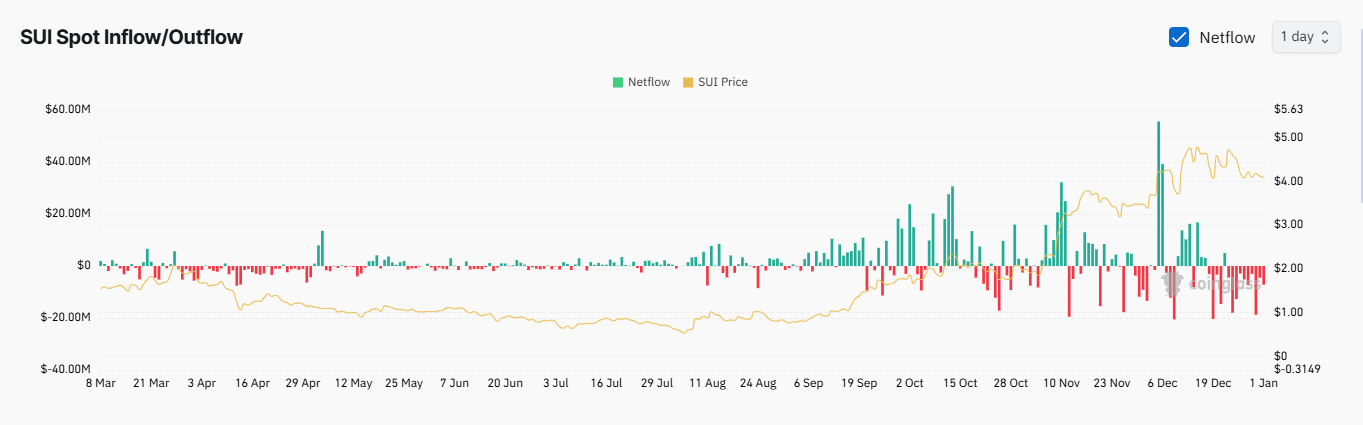

Currently, the bullish momentum is supported by continued negative net outflow, as recorded by the Exchange Netflow metric on Coinglass. A negative net flow, in which more assets leave exchanges than enter them, often has a positive impact on price.

Around $26 million worth of SUI has been withdrawn from exchanges, including $7.11 million in the last 24 hours.

Source: Coinglass

Although the altcoin is trading in a generally bullish environment, AMBCrypto has identified other confluences that suggest the price may face downward pressure in the near term.

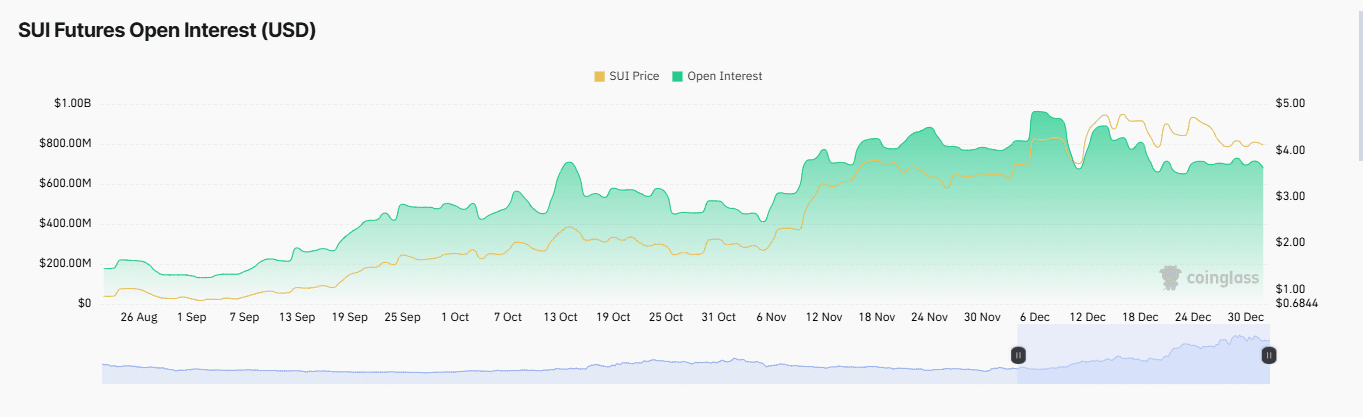

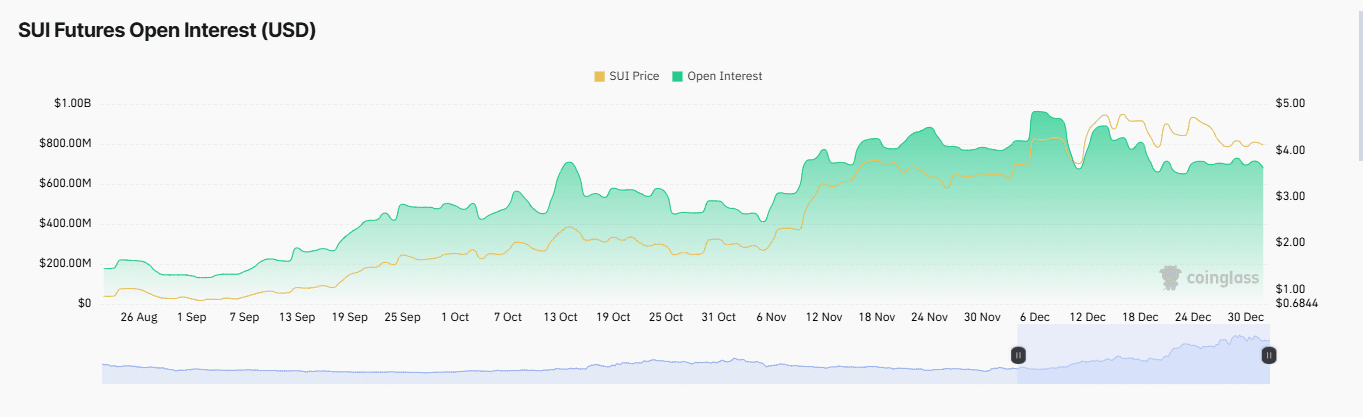

Open interest decreases

SUI’s open interest (OI) in the market fell by 5.68% over the past 24 hours, falling to $677.82 million.

A decline in OI often indicates a decrease in market participant participation, as the number of unsettled derivative contracts decreases.

This trend is further supported by a significant decline in trading volume, which fell by 48.84% during the same period, reaching $1.15 billion.

Source: Coinglass

The reduction in trading activity and selling pressure suggests that SUI price may decline further, potentially testing support at the $3.96 level based on current chart patterns.

SUI surpasses SHIB in terms of market capitalization

SUI has become more valuable than SHIB in terms of market capitalization. At press time, SUI’s market capitalization stood at $12.54 billion, compared to SHIB’s $12.45 billion.

Read Shiba Inu (SHIB) Price Forecast 2025-2026

With an expected rally for SUI, the margin between the two assets is expected to widen further, potentially pushing SUI’s market cap even higher.