- SUI trading volume soared to $28 billion, tripling APT figures

- SUI and APT downtrends were super bullish at press time

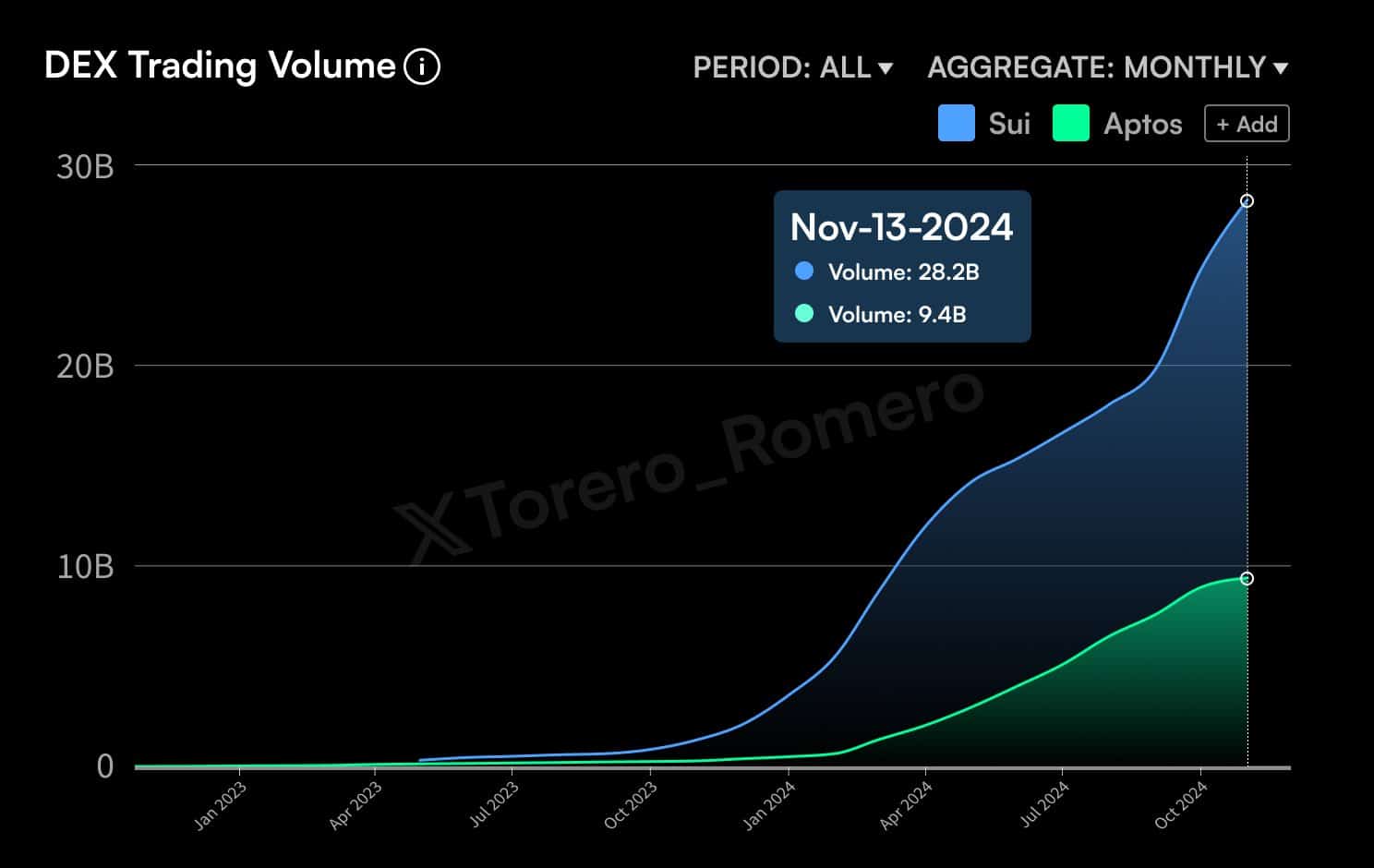

The recent surge in crypto markets has contributed to a significant increase in DEX trading volume for Sui Network (SUI), compared to Aptos (APT).

SUI’s trading volume soared to $28 billion, tripling that of APT’s $9.4 billion. The SUI line’s steep upward trajectory suggests rapid growth and increased activity on its DEXs. This difference in volume is a sign of strong market preference and liquidity on Sui Network, perhaps reflecting higher technology adoption or investor confidence in Aptos.

Source: Torero Romero/X

If this trend continues, SUI could strengthen its position as a leading platform, attracting more investors interested in taking advantage of its higher liquidity and active trading environment.

Comparison of performance and price action

SUI’s slight 8% rise in the past 24 hours has propelled its price to $3.18, while Aptos’ 1% rise has propelled it to $12.24 at the time of writing.

Both saw rising prices during the latest crypto bull run that began late last week, thanks to Bitcoin’s strong performance. However, Sui’s trading volume fell 22%, while Aptos saw a decline of almost 60%.

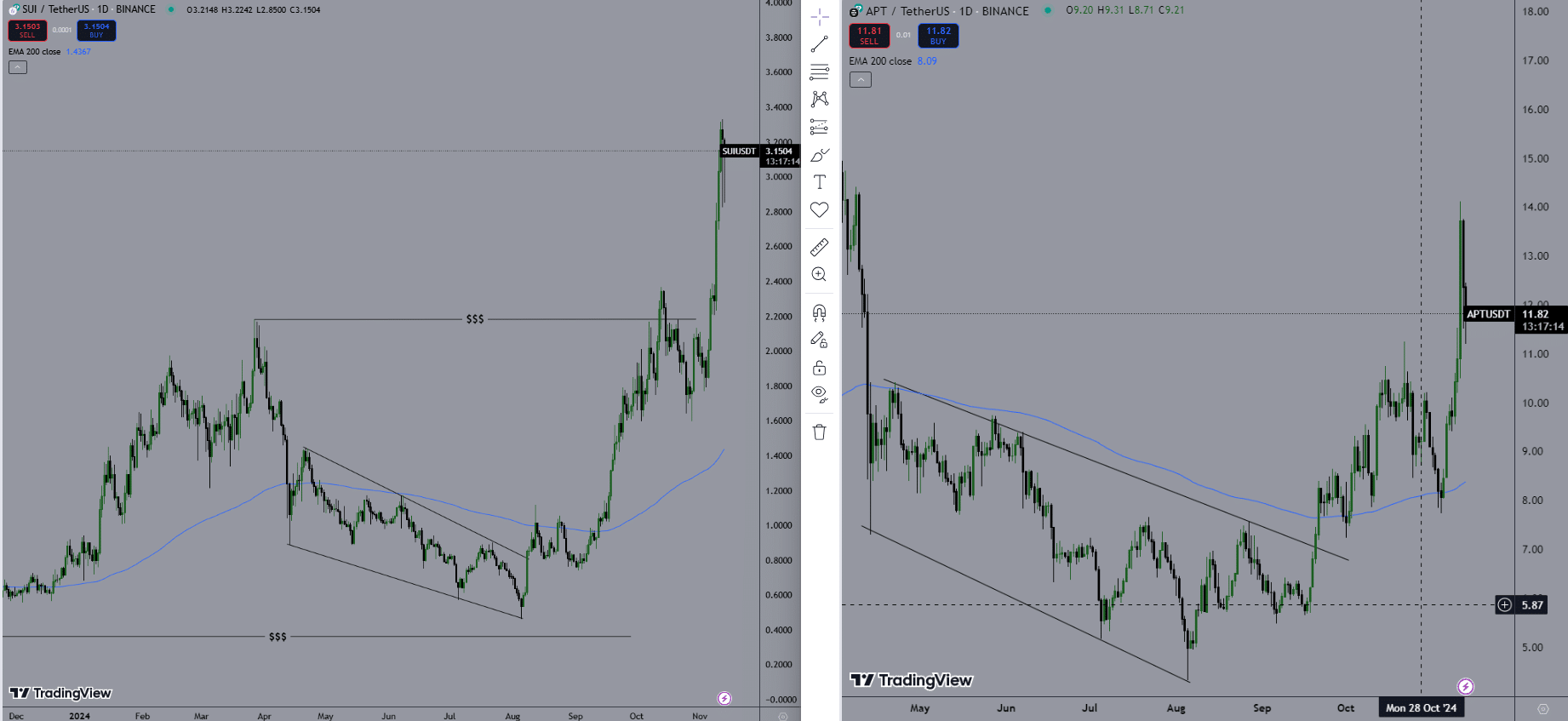

SUI price action has been trending upward, breaking out of a downtrend channel in late August and maintaining a strong rise since then. This breakout, followed by sustained gains, indicated strong buying interest and bullish sentiment.

The price recently broke above its long-term moving average (200 EMA), suggesting potential for further bullish momentum. In fact, SUI could target higher resistance levels, while potentially approaching the $4 mark on the charts.

Source: Commercial View

On the contrary, the APT chart revealed a dramatic price rise after a prolonged downtrend within a downtrend channel. The recent rise, surpassing its previous resistance levels, indicated a strong reversal and greater investor confidence.

Aptos, attracting over 8 million monthly users, has launched the world’s first staking ETP on the SIX Swiss Exchange, with the aim of driving institutional adoption. It is plausible to predict a test of higher prices for APT, potentially at the $15 level.

Can SUI reverse the price of APT?

In conclusion, both demonstrated strong rallies, indicating bullish sentiment that could influence their future prices. If the momentum from press time continues, both could continue their upward trend, while also affecting the broader altcoin sector.

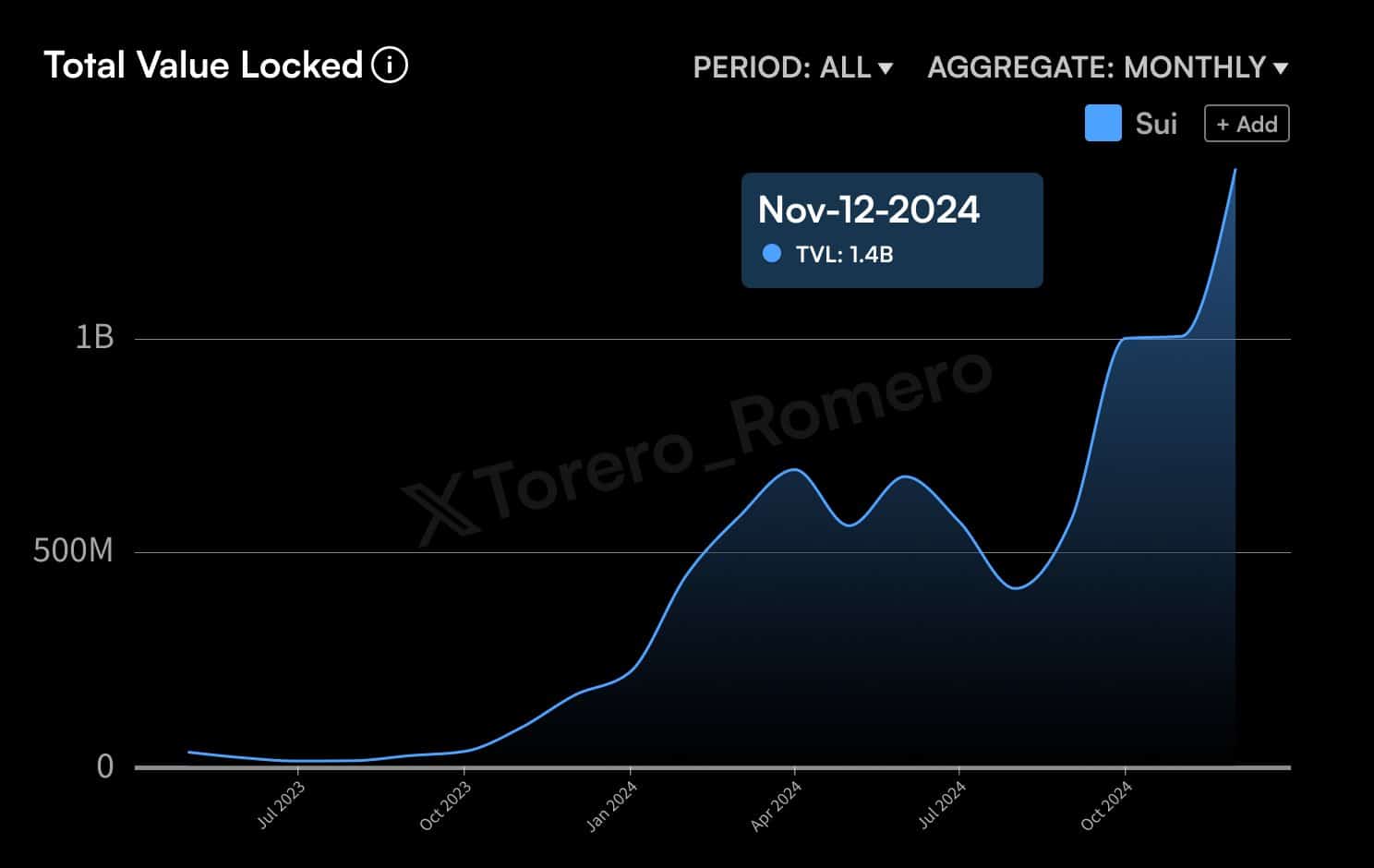

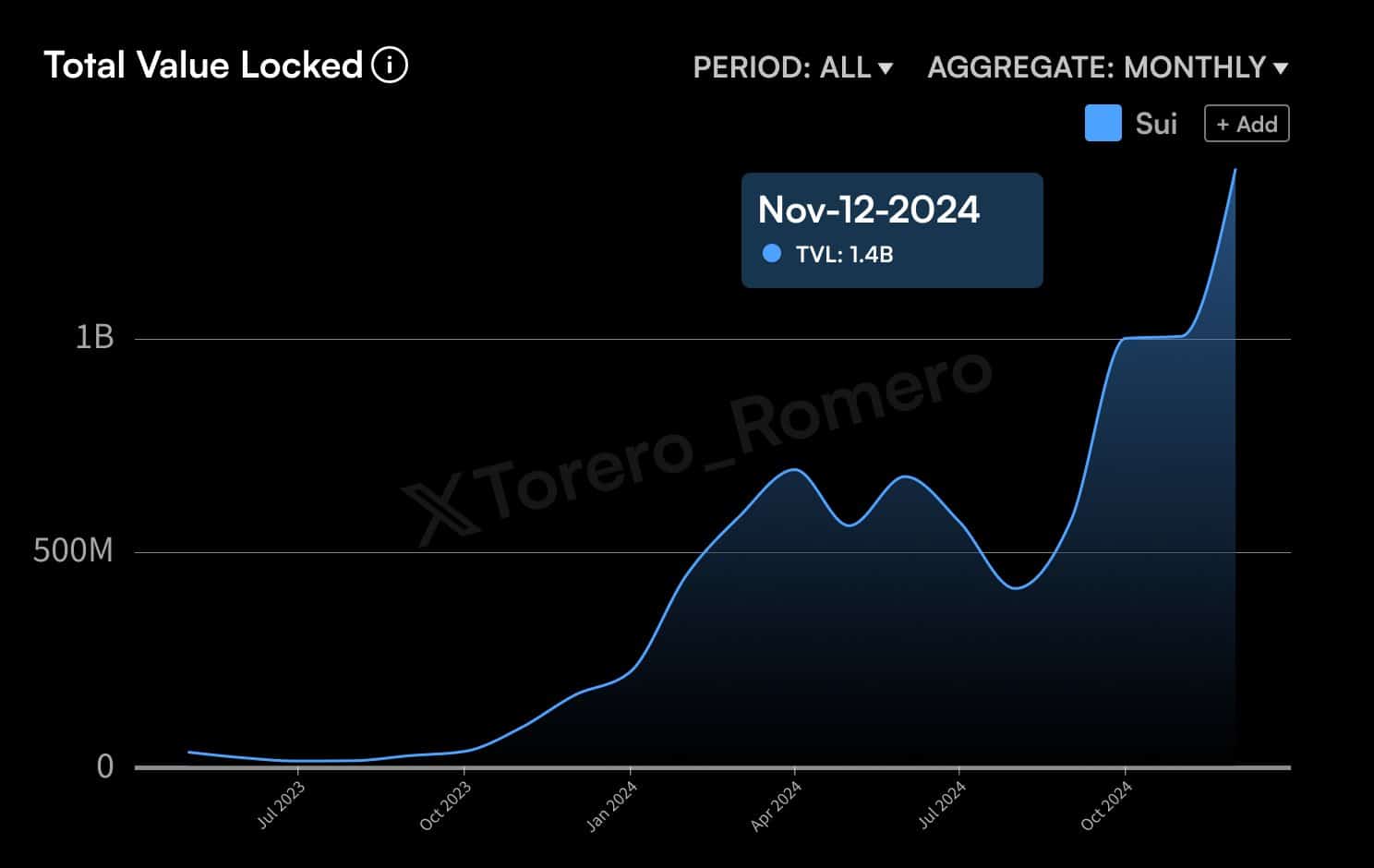

However, surpassing the APT price will be difficult when considering the total supply of both tokens. This, while other metrics such as market cap and TVL, which reached a new ATH of $1.4 billion, and volume, might be easier to reverse and surpass.

Source: Torero Romero/X

Going forward, SUI could be poised to overtake Aptos in terms of price gains. Especially if it can replicate Solana’s success in the memecoin space.