Federal prosecutors charged a man for having stolen $ 65 million in cryptocurrency by exploiting vulnerabilities in two decentralized financial platforms, then in laundering the product and trying to extort the swarming investors.

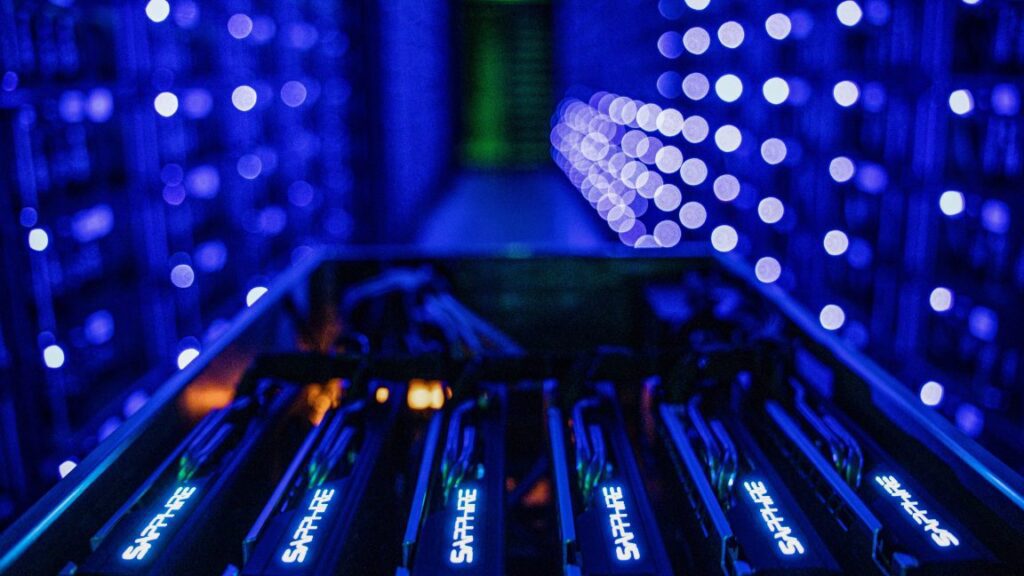

The program, allegedly allegedly in an unclosed indictment on Monday, took place in 2021 and 2023 against the DEFI Kyberswap platforms and indexed finances. The two platforms provide automated services called “liquidity pools” which allow users to move cryptocurrencies from one to the other. The pools are funded by a user-controlled cryptocurrency and are managed by intelligent contracts applied by platform software.

“Formidable mathematical prowess”

Prosecutors said Medjedovic, which is now 22 years old, has exploited vulnerabilities in Kyberswap and indexed financial contracts using “manipulative negotiation practices”. In November 2023, he would have used hundreds of millions of dollars in cryptocurrency borrowed to cause artificial prices in Kyberswap liquidity pools. According to the prosecutors, he then calculated precise combinations of trades which would induce the intelligent contract system Kyberswap – known as AMM, or automated market manufacturers – for “Glitch”, as he wrote later.

The regime would have enabled Medjedovic to steal approximately $ 48.8 million of 77 Kyberswap liquidity pools on six public blockchains. He would also have tried to extract developers from the Kyberswap protocol, investors and members of the decentralized autonomous organization (DAO). The prosecutors said that the defendant had proposed to return 50% of the stolen cryptocurrency in exchange for him receiving control of the Kyberswap protocol.

In a product laundering attempt later, prosecutors said, MedoDovic also used “bridge” protocols to transfer the cryptocurrency from one blockchain to another via a “mixer” cryptocurrency designed to hide the source of digital assets. After a bridge protocol froze several of his transactions, MedoDovic agreed to pay more than $ 80,000 to someone who, according to him, had control of the bridge to get around the restrictions and release about $ 500,000 in crypto -Slated. This transaction, as will be explained shortly, finally led to its loss.