- BTC generated up to $70,000 in positive inverse network fundamentals.

- Is this a bullish signal despite the short-term correction and likely consolidation?

Bitcoin (BTC) the fundamentals of the network have been transformed positive for the first time in October, on what one analyst considers a positive signal for the asset in the medium term.

According to CryptoQuant, the network’s positive metrics were a familiar trend during bullish periods and suggested a likely positive outcome for the asset despite a likely correction or consolidation.

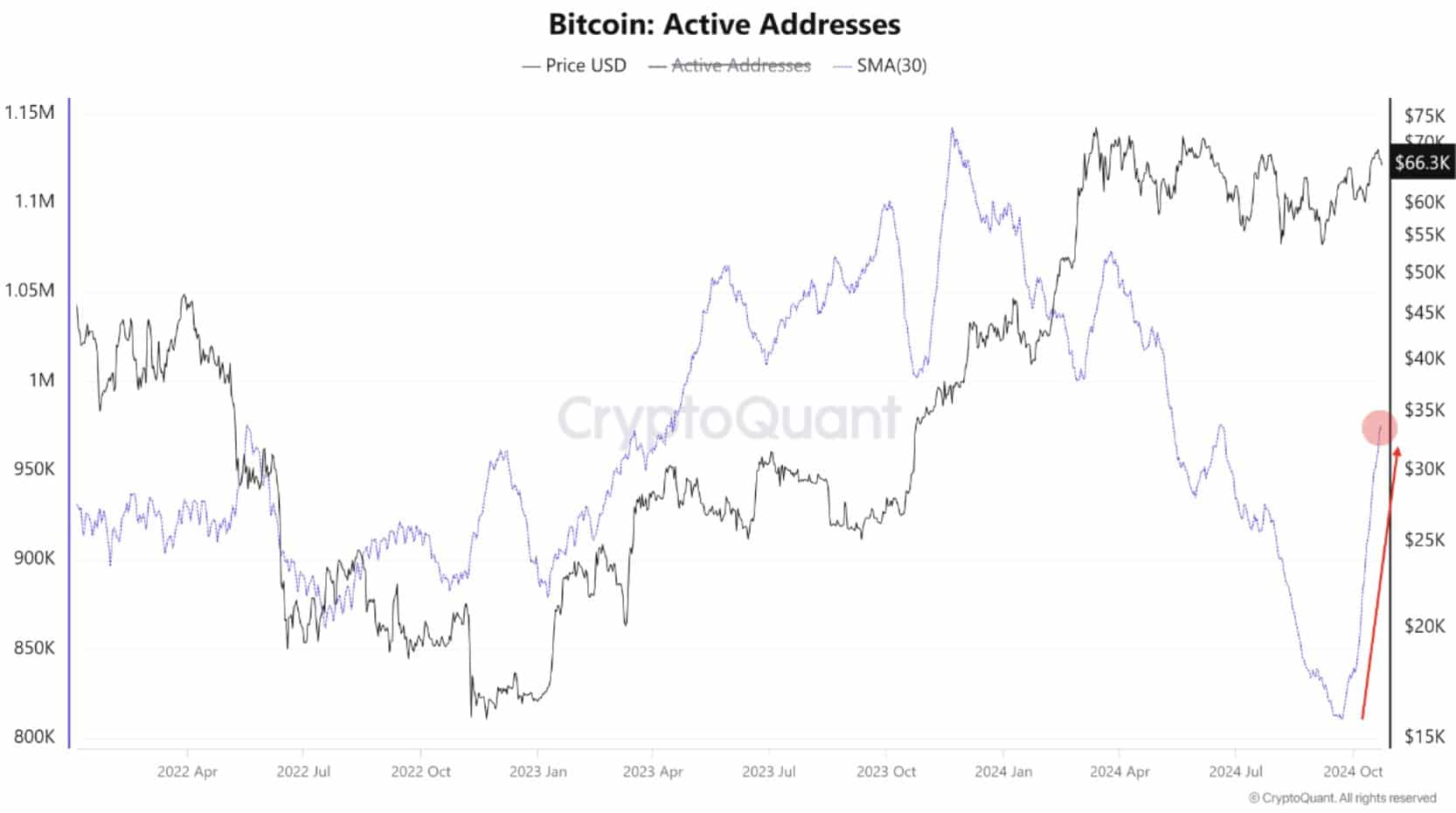

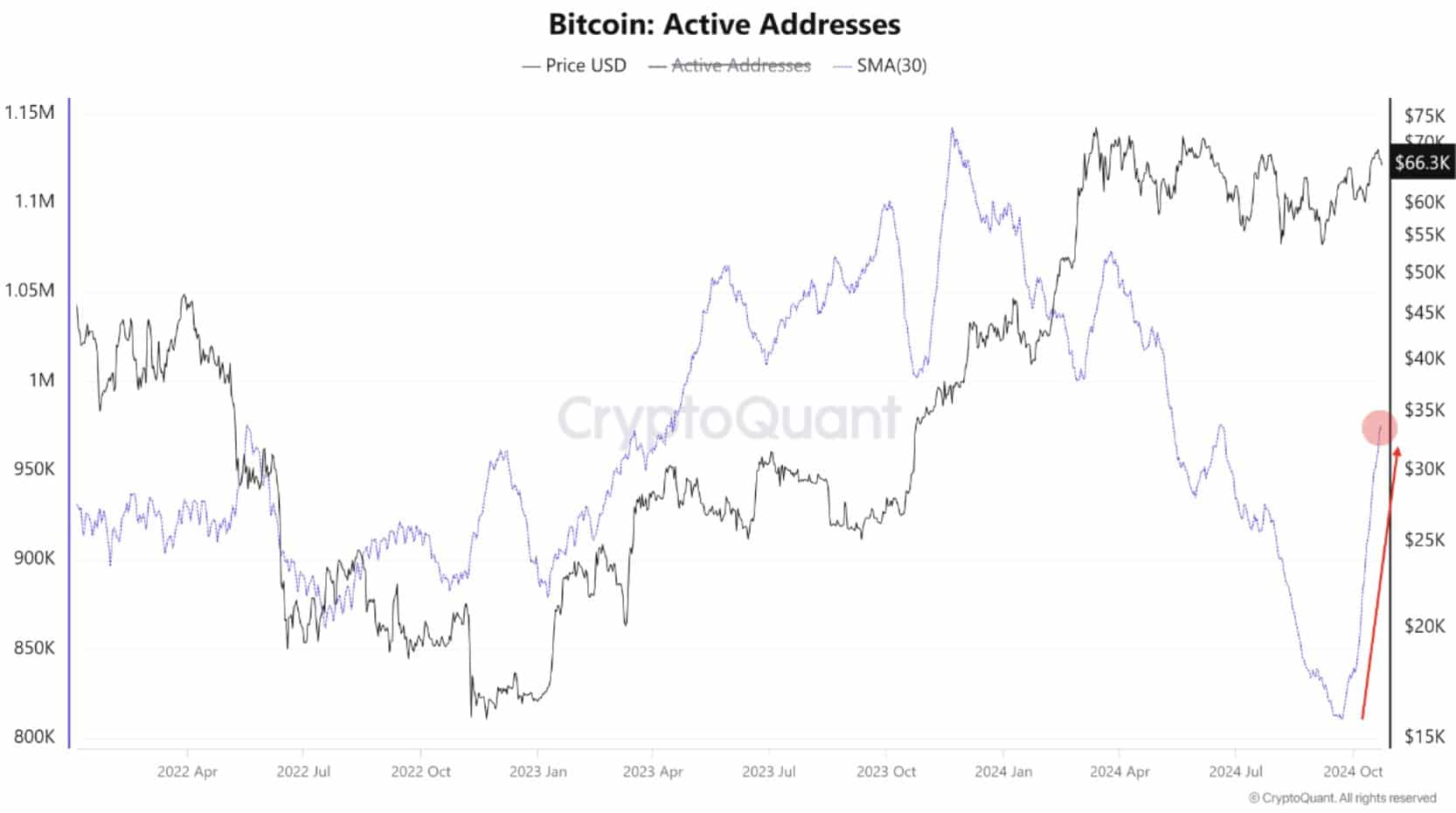

After a recent run towards $70,000, the 30-day average number of active BTC addresses has climbed to the one million mark. It reached levels last seen in June, indicating massive interest in the asset amid last week’s rally.

Source: CryptoQuant

An upcoming increase in BTC?

A similar positive trend was recorded in the mining and network fees segment. In particular, the mining difficulty reached an all-time high, indicating intense competition for rewards among BTC miners, a positive catalyst for BTC’s intrinsic value.

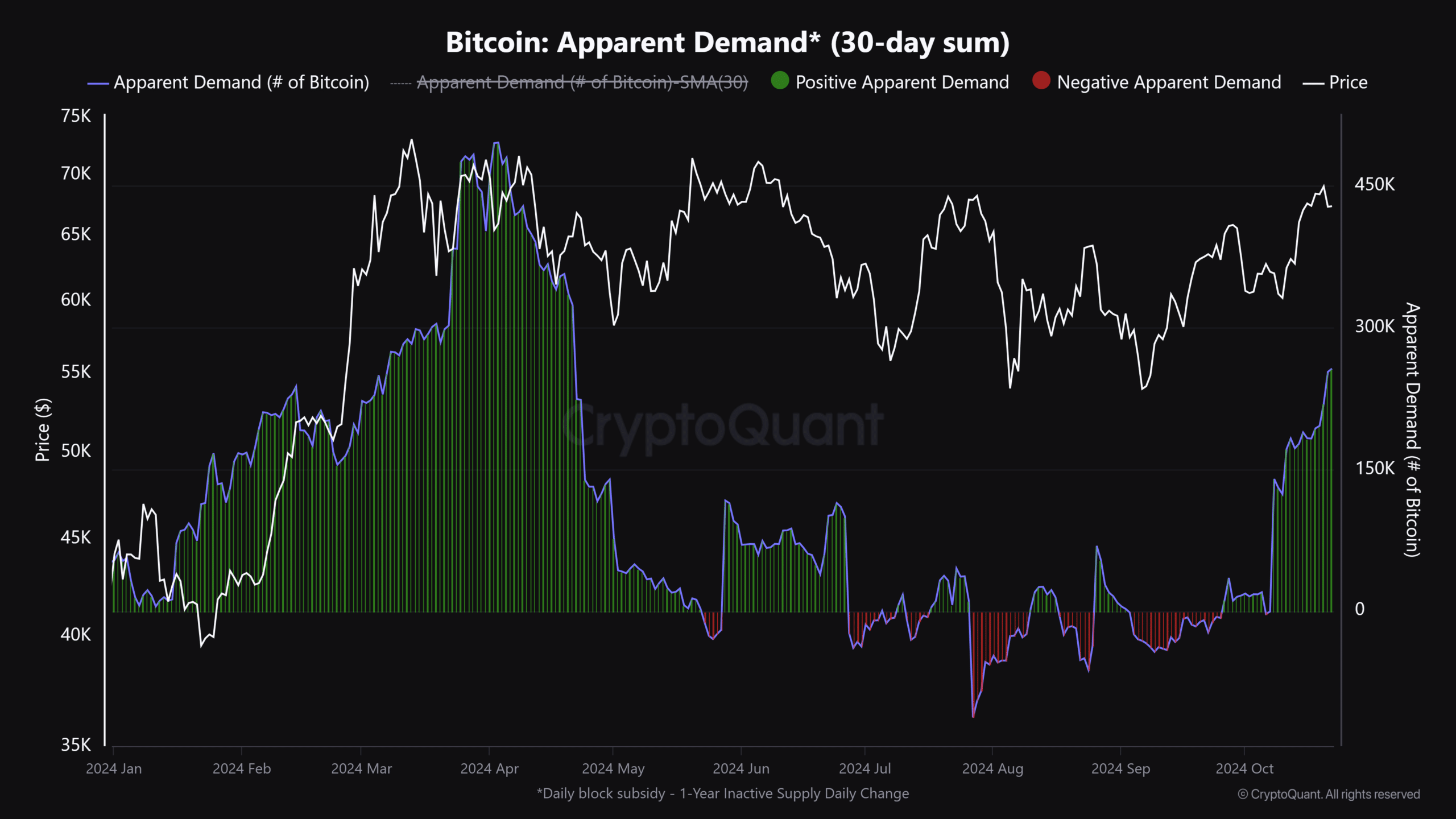

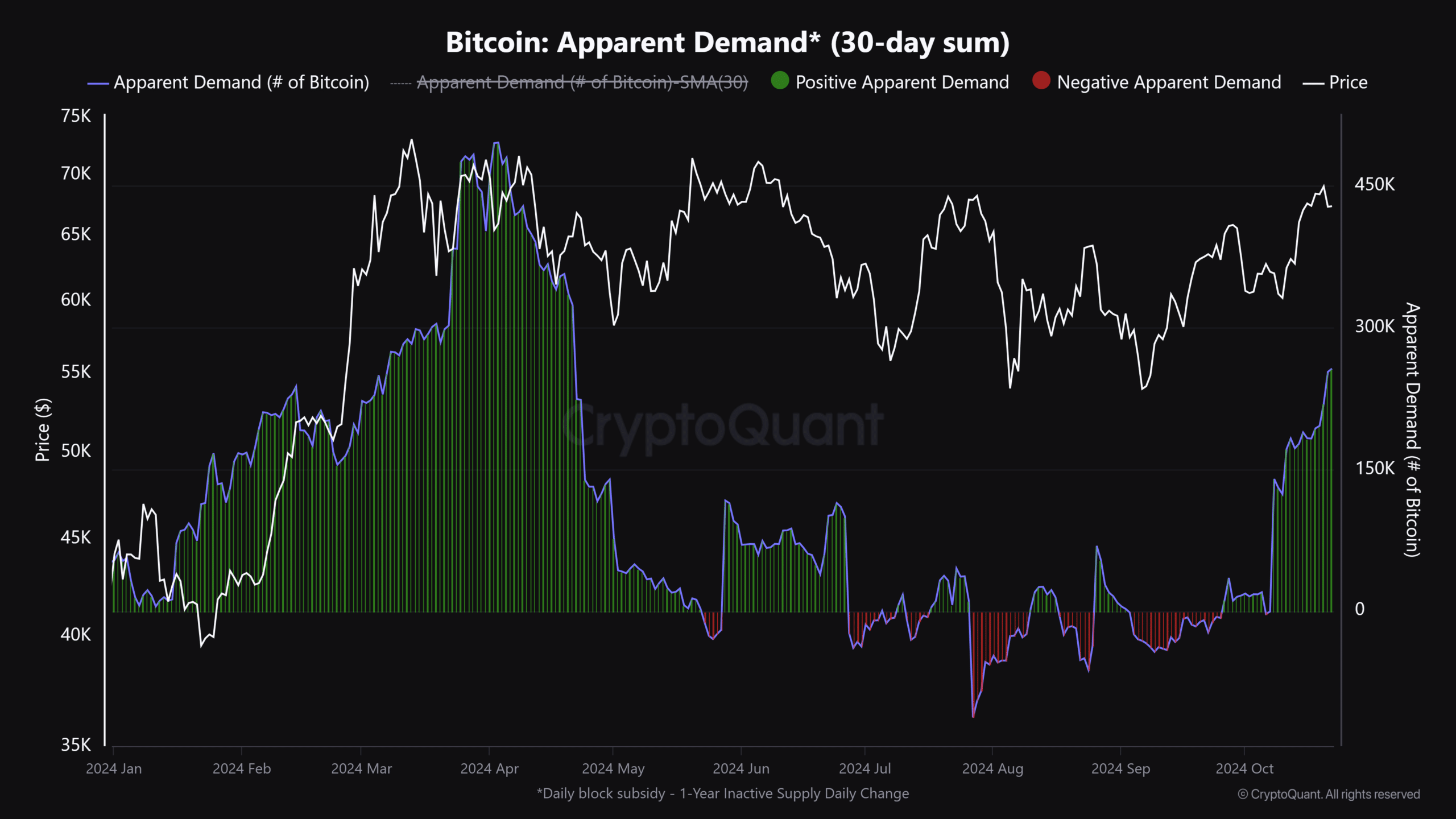

Additionally, apparent BTC demand, or the difference between production timing and inventory timing, reached a 6-month high of 256,000 BTC at press time. In most cases, the rise in demand is always preceded by a rise in BTC prices.

Source: CryptoQuant

Despite the positive catalysts above, analysts had mixed projections for BTC prices heading into the US elections.

Félix Jauvin, analyst at Blockworks warned that BTC could be limited until after the election.

“No one wants to be a marginal risk buyer in the run-up to the election. Probably just a bunch of chops until it’s over….:

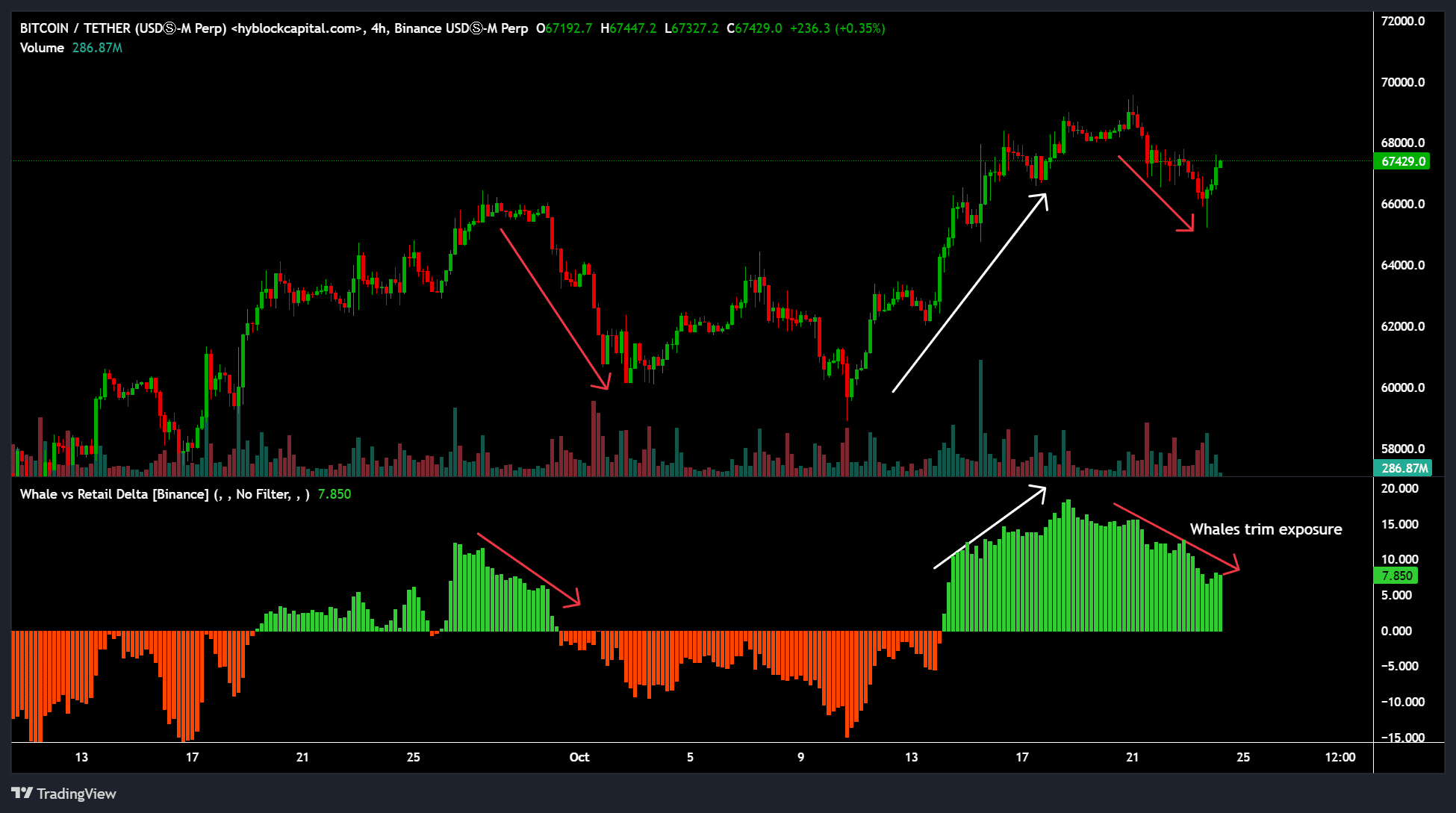

Another expert, Justin Bennettechoed his cautious sentiment, citing whales’ lack of interest in taking advantage of the recent midweek decline.

Since October 17, Whale vs. Retail Delta, which tracks the positioning of whales relative to retail traders, has declined, suggesting that whales have reduced their exposure to BTC.

Source: Hyblock

Interestingly, options traders remained optimistic, as evidenced by their increased buying of call options (betting that the price of BTC will rise) on Election Day.

In the daily update of October 22, the trading company QCP Capital note,

“Short-term implied volatility peaks at Election Day expiration, with a 10 vol gap from the previous expiration and biases favoring calls over puts, although BTC is ~8% in below its historic highs.