- ECB officials claimed that the BTC rally would make non-holders and laggards poor.

- The crypto community criticized the report calling for policy against BTC.

Over the weekend, the European Central Bank (ECB) made headlines following the anti-Bitcoin (BTC) report from its senior officials and calls for its “demise”.

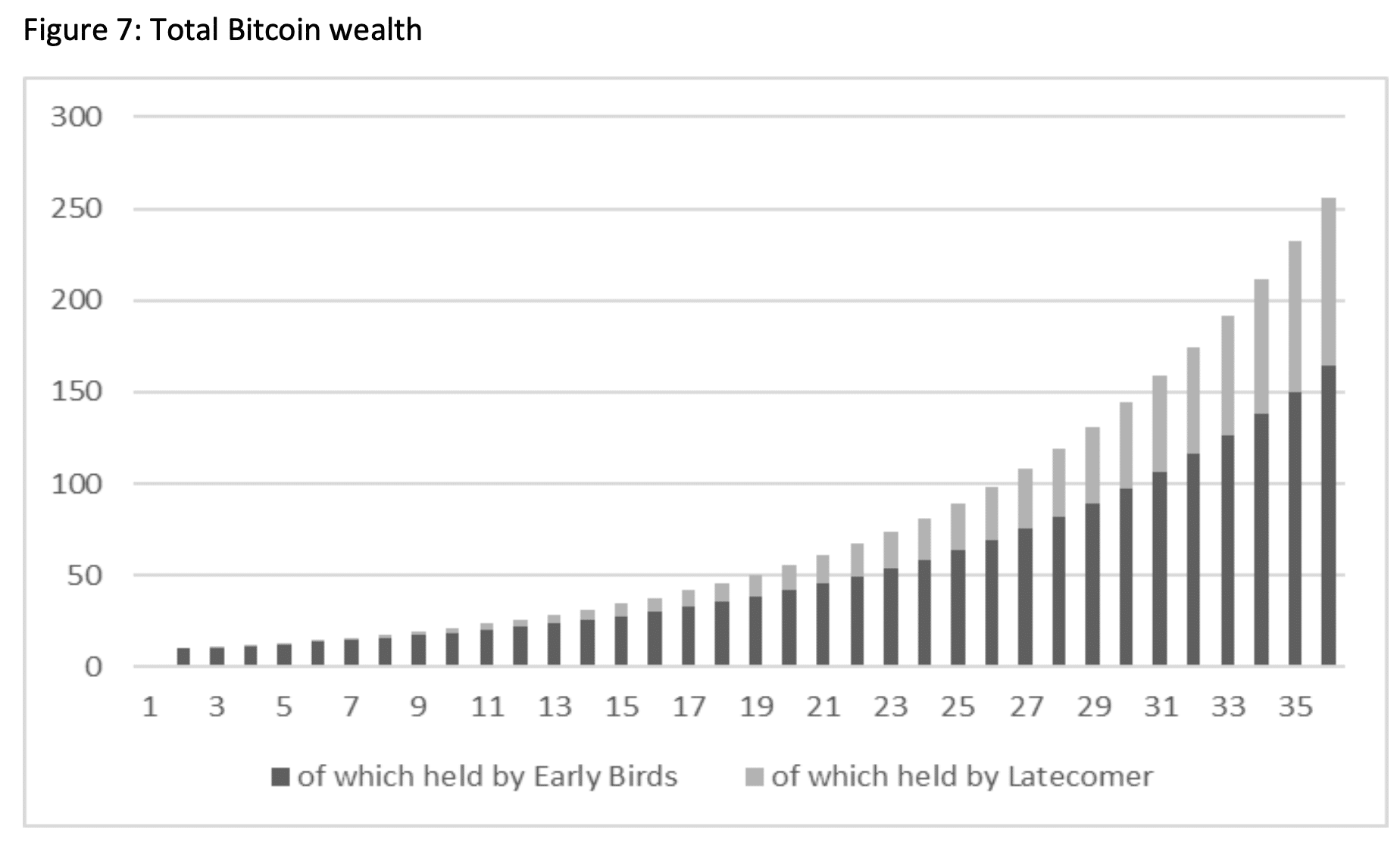

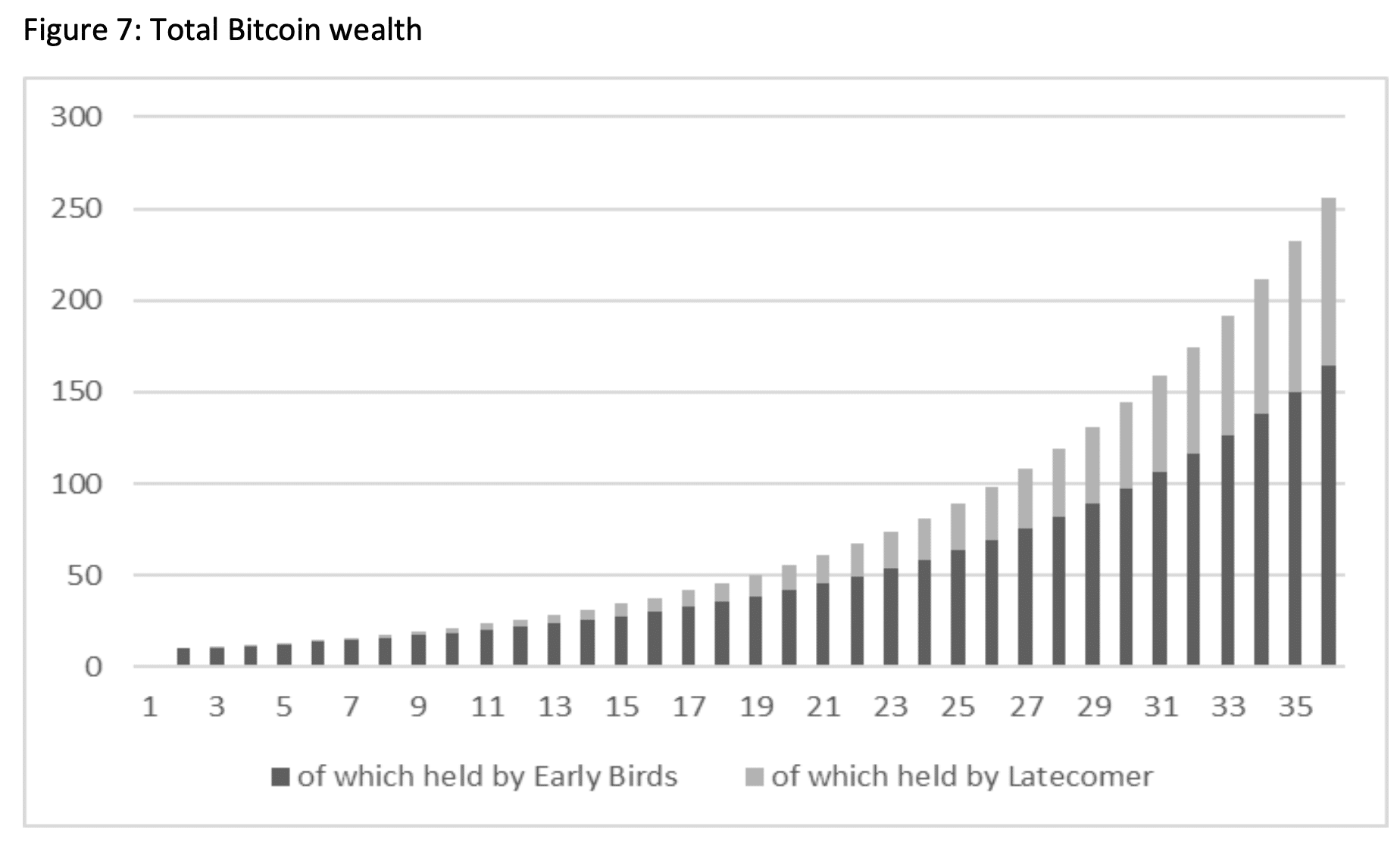

They claimed that the BTC price surge would lead to a redistribution of wealth from laggards and non-holders to early adopters.

According to the report, this would impoverish laggards and holders, as early adopters would dominate holdings and wealth.

Source: SSRN

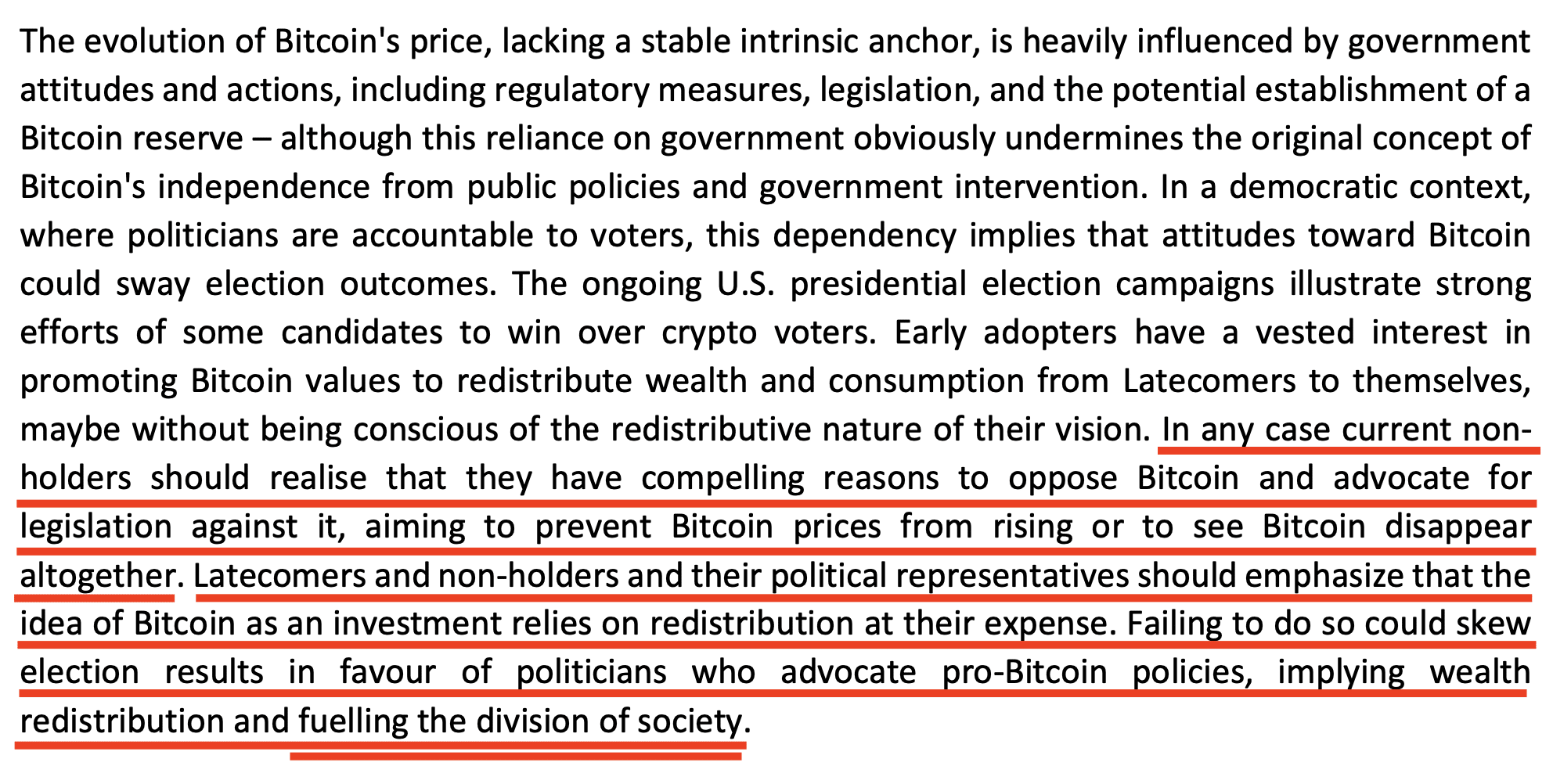

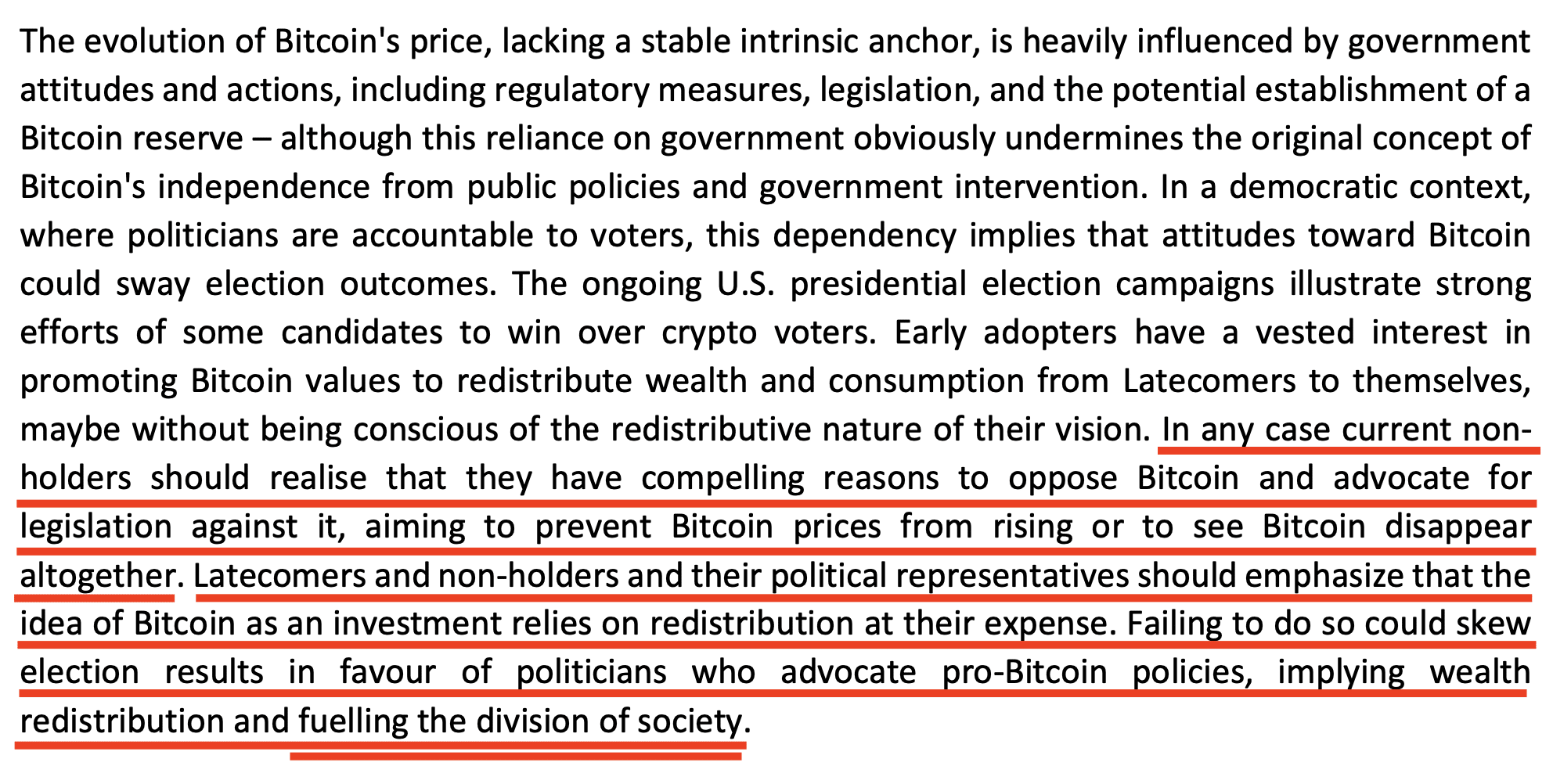

According to ECB officials Jurgen Schaff and Ulrich Bindseil, non-holders should advocate for anti-BTC policies or campaign for its “disappearance” altogether. Part of their research read,

“In any case, current non-holders should understand that they have compelling reasons to oppose Bitcoin and to advocate for legislation against it, aimed at preventing Bitcoin prices from rising or to see Bitcoin disappear completely.”

Is the ECB declaring war on BTC?

The crypto community criticized the report, while some warned that it could signal the ECB’s war on BTC.

Tuur Demeester, a BTC analyst, claimed the research constituted a declaration of war by the ECB against the digital asset. He declared,

“This new document is a real declaration of war: the ECB claims that the early adopters of #bitcoin are stealing economic value from the latecomers. I firmly believe that the authorities will use this ridiculous argument to enact harsh taxes or bans.

Demeester cited the authors’ push for legislation as one of the compelling reasons for its projection.

“Then they brazenly advocate for legislation… “to prevent bitcoin prices from rising or to see bitcoin disappear altogether” in order to prevent “the division of society.”

Source: SSRN

For his part, Max Keizer, BTC maximalist and senior advisor to Salvadoran President Nayib Bukele on all matters related to Bitcoin, referred to the report as a “failure of the IQ test” of the ECB on the digital asset.

“Bitcoin is an IQ test. The ECB has failed.

Well, this was not the first time the regulator criticized BTC. In February 2024, it declared that the asset had no intrinsic value and constituted a bubble that would eventually burst and cause enormous social damage.

Later in June, Fabio Panetta, a former ECB executive and current governor of the Bank of Italy, called for other banks to block crypto because it was doomed to failure.

In fact, the regulator itself critical the US decision to approve spot BTC ETFs in the first quarter of 2024.

That said, some saw the regulator’s anti-BTC thesis as an acknowledgment of the asset’s future boom.

According to Plan CAccording to , a market analyst, BTC was the solution to the regulator’s money printing (inflation) as a global easing cycle begins.

“This new ECB document also contains a hidden signal: the ECB knows full well that “Bitcoin is going to go up for good” because the ECB knows full well that central banks will soon have to start printing ungodly amounts of money, and forever.