The FNB Bitcoin SPOT US have been one of the main bruises of the current market cycle, announcing an influx of institutional investors in the BTC ecosystem. In 18 months of negotiation, these FNBs acquired 6.25% of the Bitcoin capitalization cement their status of force majeure on the market.

Interestingly, the eminent market analyst Axel Adler Jr. underlined a recent positive trend in the Bitcoin ETF space, suggesting an additional potential and an optimistic perspective for the coming months.

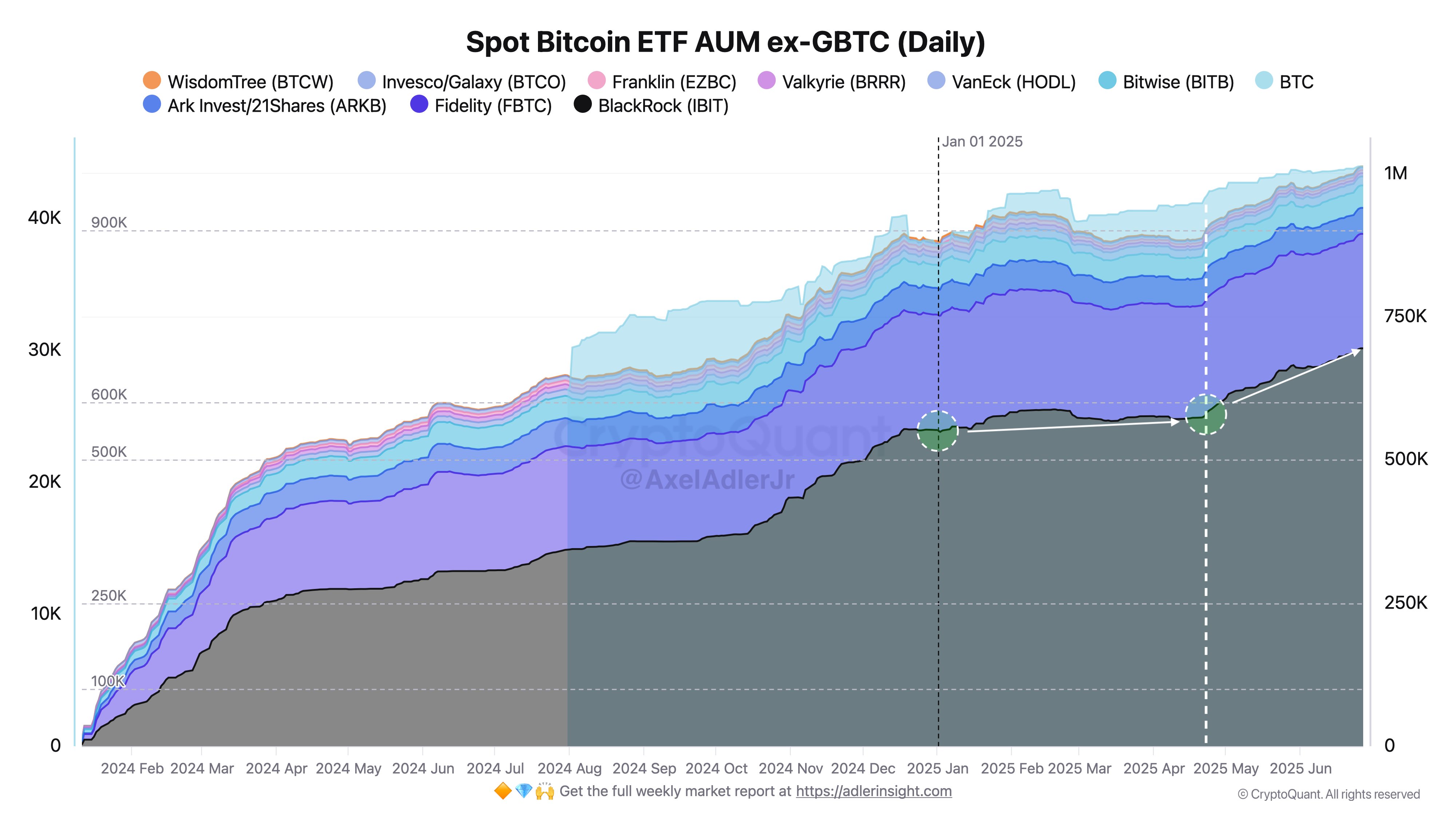

Bitcoin Spot ETF to have 1.2 million BTC by September – Analyst

In a post X on June 28, the analyst of the Axel Adler Jr. market has highlighted a convincing trend in the model of accumulation of FNB Bitcoin Spot in the last three months.

The renowned analyst explains that the assets under management (AUM), that is to say that the net assets of these FNB to the exclusion of GBTC in gray levels increased significantly from 932,000 BTC in April 2025 to 1,056,000 BTC today. This development represents a net gain of 124,000 BTC over 87 days, with an impressive average intrigue of 1,430 BTC per day.

As an undisputed market leader, the BlackRock Ibit represents the majority of this growth, attracting 118,000 BTC, or 1,360 BTC per day in deposits. On the other hand, the remaining ETFs contributed a combined total of 6,000 BTC, or 70 BTC per day, indicating a clear concentration of interest of investors around the BlackRock product.

According to Adler Jr., if institutional investors maintain the current accumulation rate of 1,430 BTC per day, these Bitcoin ETF are on the right track to reach an alms of 1840,000 BTC by September, representing 9.25% of circulating BTC tokens. In this total, BlackRock Ibit should have around 817,000 BTC.

When combined with current GBTC AUM of $ 19.79 billion, Adler Jr.’s predictions mean that FNB Bitcoin Bitcoin would hold net assets of a value much greater than $ 197.54 billion.

Bitcoin price preview

At the time of writing this document, Bitcoin is negotiated at $ 107,339 reflecting minor growth growth of 0.28% in the last 24 hours. Meanwhile, the daily trading volume of the assets is down 33.88% and valued at $ 30 billion.

On the larger deadlines, the first cryptocurrency also maintains a positive performance with gains of 5.61% and 1.06% on the weekly and monthly graph respectively, indicating a shift in potential bullish momentum after weeks of movement linked to the beach.

Since the creation of a new summit of $ 111,970 at the end of May, Bitcoin has struggled to explore a new price territory, installing rather in a channel descending between $ 100,000 and $ 110,000.

Image in Libertex star, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.