- WLD lost some of its gains from previous trading sessions

- Alameda still holds over 24 million WLD tokens

Worldcoin has been trending downward on the charts recently. However, that’s not all, as Alameda’s recent actions could potentially make things worse for this AI-related token.

Alameda Moves Part of Worldcoin Reserves

Recent developments involving Alameda, the trading arm of now-defunct FTX, have brought attention to the movement of Worldcoin (WLD) tokens. According to data from Lookonchain, Alameda recently transferred 205,387 WLD tokens worth approximately $352,000.

It’s worth noting here that this transaction coincided with a significant legal development: a New York judge ordered Alameda to pay $12.7 billion as part of a resolution in a lawsuit brought by the Commodity Futures Trading Commission (CFTC).

The outcome of the lawsuit requires FTX and Alameda to pay $8.7 billion in restitution to individuals affected by their violations of the Commodity Exchange Act. In addition, an additional $4 billion will be paid in restitution for the profits made from those violations.

At the time of writing, data revealed that Alameda still held 24.795 million WLD tokens worth over $43 million. In the coming days, we could see more of these tokens being moved.

Worldcoin Stuck in a Downtrend

Worldcoin (WLD) price trend has been down over the past few weeks. Despite this overall trend and recent developments involving Alameda, WLD saw a notable increase on August 8.

Furthermore, this rise is part of a broader market recovery, seen across various cryptocurrencies.According to AMBCrypto analysis, WLD appreciated by 20.22%, its price rising from around $1.5 to $1.8.

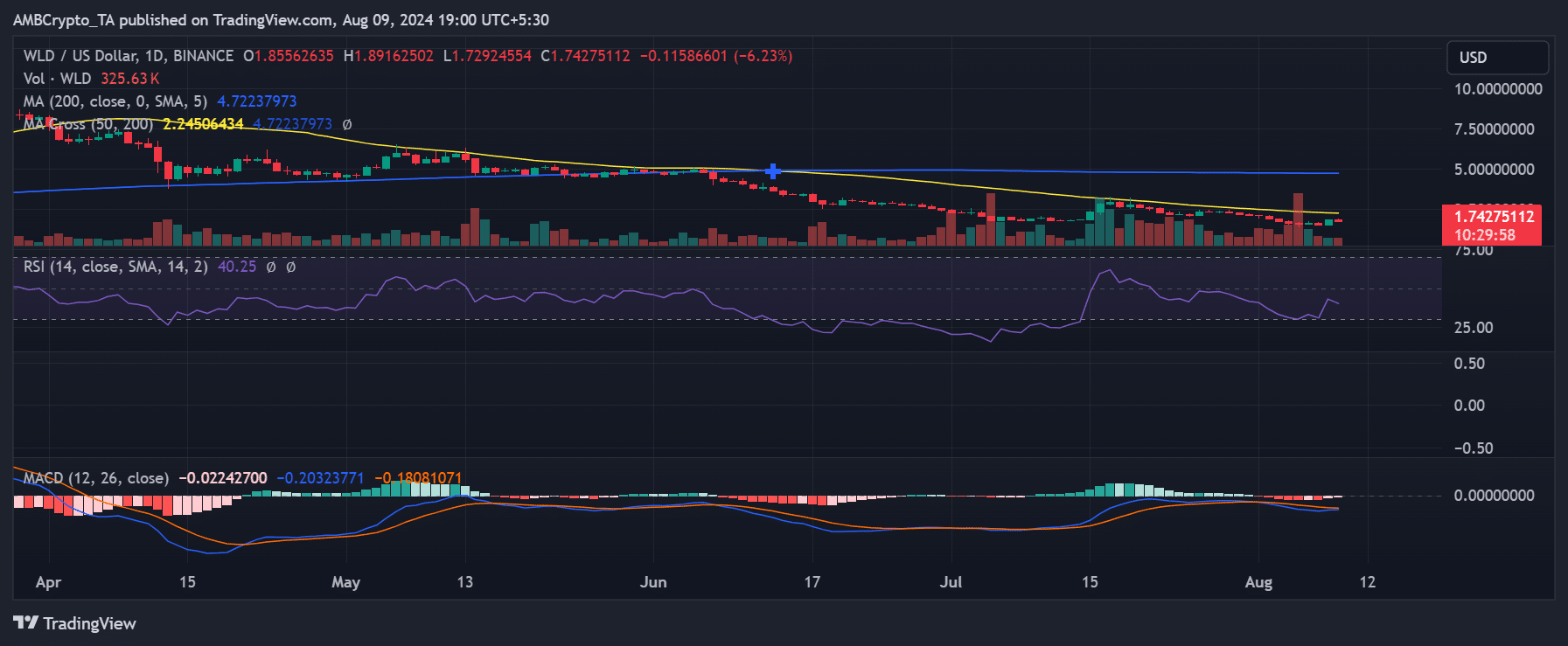

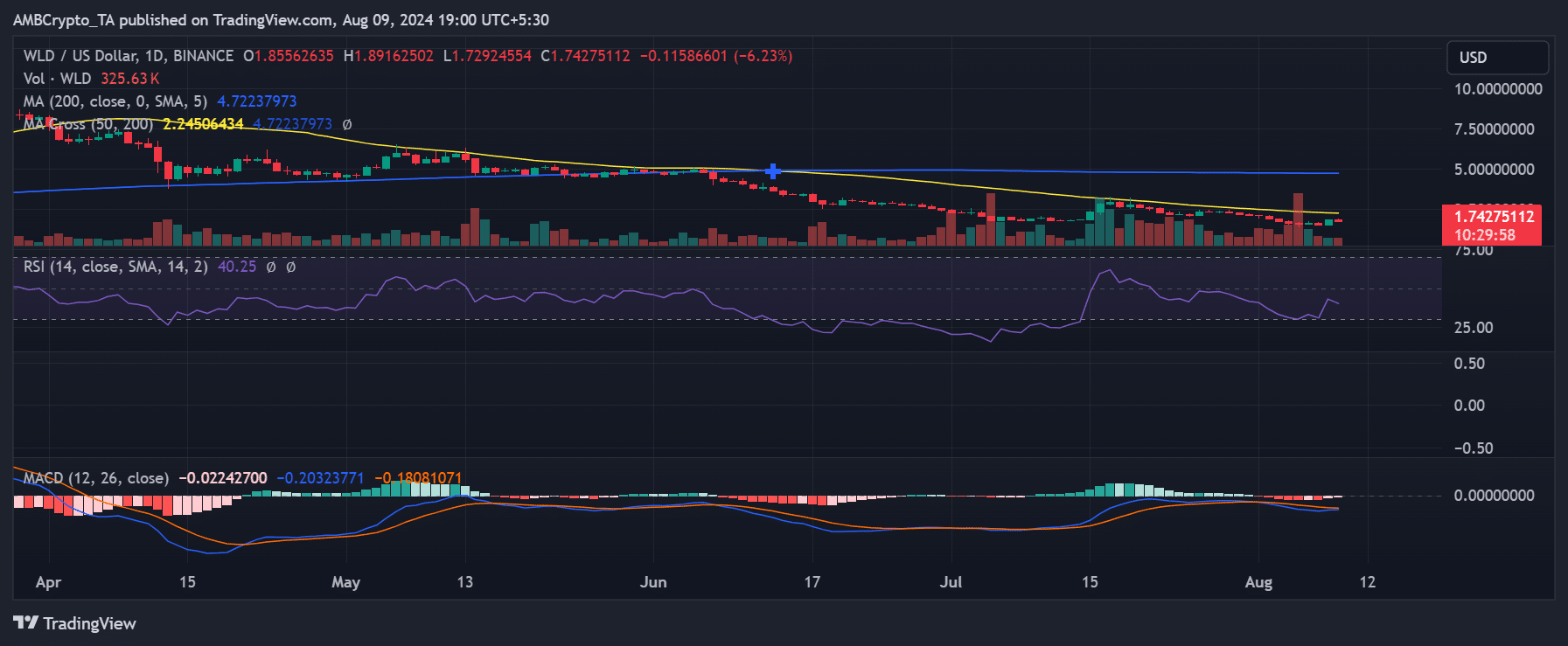

Source: TradingView

These gains were short-lived, however. Especially since Worldcoin has since retraced some of its gains. At press time, it was trading at around $1.7, reflecting a 6.52% drop from its recent peak.

Furthermore, a closer analysis revealed that WLD was still under bearish pressure as indicated by its position below the neutral 50 mark on the Relative Strength Index (RSI).

WLD is dominated by shorts

Recent derivatives data has further complemented the negative trends affecting Worldcoin (WLD), particularly regarding funding rates.

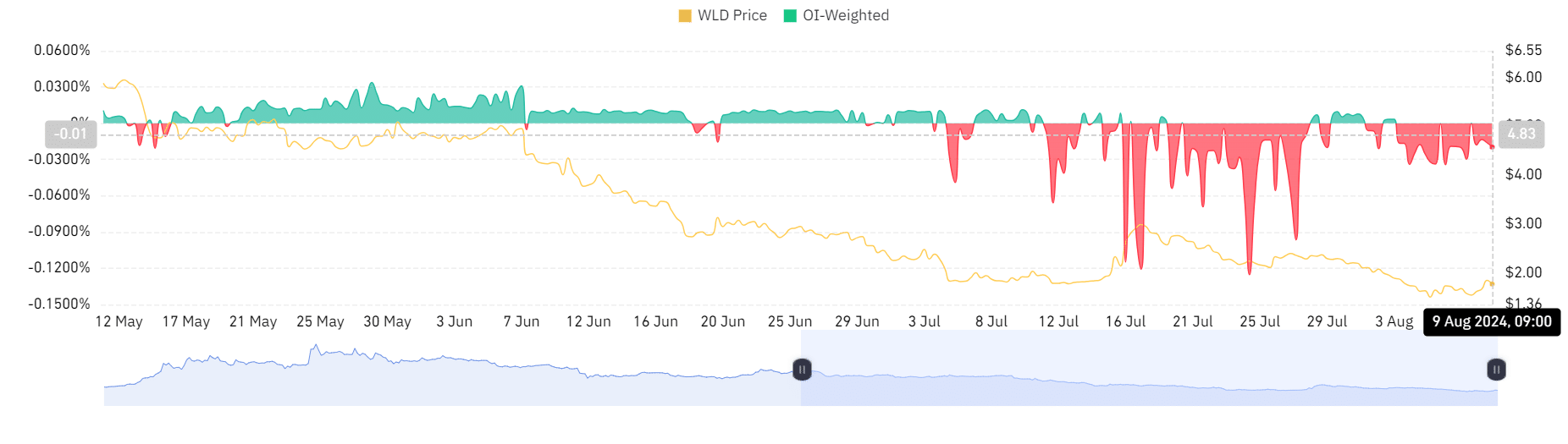

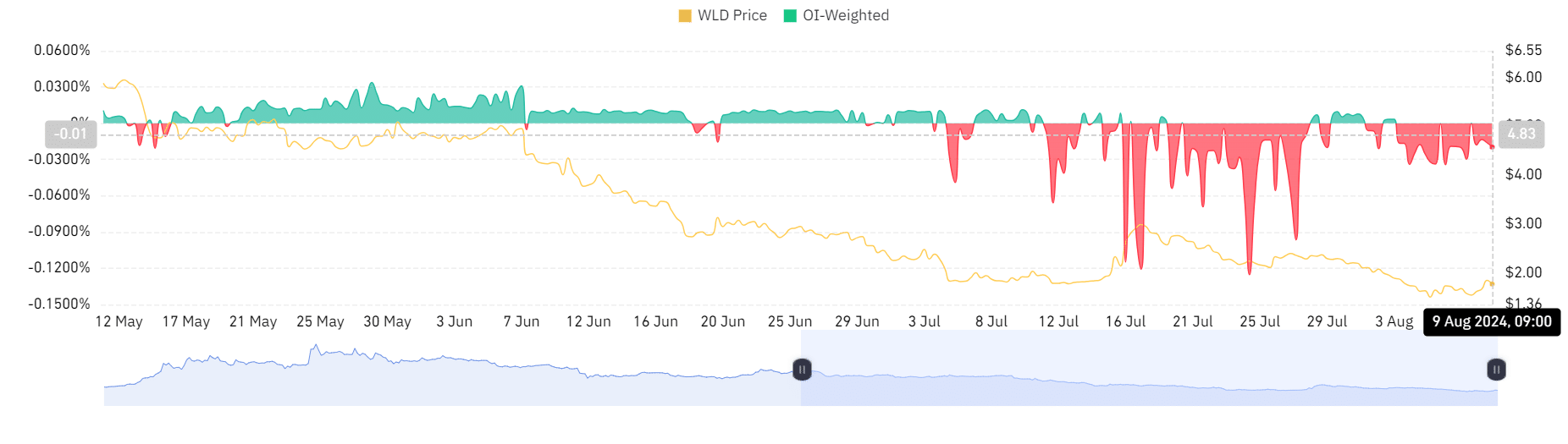

Source: Coinglass

– Is your wallet green? Check out Worldcoin’s profit calculator

In fact, an analysis of this data by Coinglass indicated that WLD’s funding rate has been negative over the past few days. At the time of writing, the funding rate was around -0.0197.

This suggests that short sellers dominate the market because they are paid to hold their positions open. In this case, a negative funding rate usually means that the cost of holding long positions is higher than holding short positions.