Key notes

- 60% of pumping portfolios are at a loss, with more than 1,700 wallets losing more than $ 100,000.

- Commercial robots inflate the pump. Assembly volume, which raises manipulation problems.

- The launch of the pump token aims to collect $ 1 billion thanks to a community -oriented model.

Like Solana

GROUND

$ 149.5

24h volatility:

5.0%

COURTIC CAPESSION:

$ 78.37 B

Flight. 24 hours:

$ 3.70 B

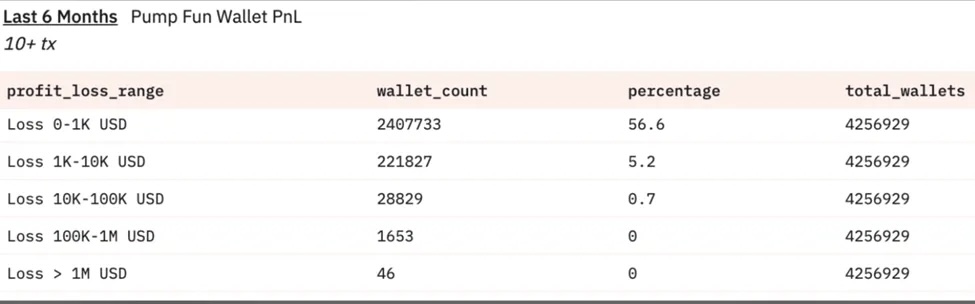

Token Launchpad Pump.fun is preparing for the next launch of pump tokens, chain data shows that around 60% of wallet addresses on the platform currently operates at a loss, with more than 1,700 wallets each more than $ 100,000.

Duneanalytics data show that out of 4.257 million addresses that have exchanged more than 10 pumping tokens in the last six months, around 2.4 million (56.6%) have recorded cumulative losses ranging from $ 0 to $ 1,000.

Nearly 1,700 addresses were faced with losses over $ 100,000, while 46 portfolios said losses of more than a million dollars.

PUMP.Fun portfolio addresses lose – Source: Dune Analytics

On the other hand, only 5,000 addresses managed to invite a profit of more than $ 100,000, with only 311 portfolios recording more than a million dollars.

In accordance with the analysis data, the average profits range is between $ 0 and $ 1,000, observed in 916,500 portfolios, which represent 21.5% of all addresses. This shows a strong disparity in the distribution of wealth among users of the Pump.Fun platform. While retail players are Fomo’Ed, it is Pump.fun who took the most.

Analyst Miles Deutscher has highlighted the distribution of profit and loss (NLP) in a graph shared on X (Twitter) in May 2025. The data revealed that 51.06% of the portfolios, which is equivalent to 166,590 addresses, said loss exceeding $ 500, while only 0.0015% (only five portfolios) $ and $ 100,000.

The pleasure of pumping is good for the crypto pic.twitter.com/gfypx05xpd

– Miles Deutscher (@milesdeutscher) June 5, 2025

Did the commercial bots dominate Pump.fun?

The data also reveals that commercial robots artificially inflate the volume on the pump.

Similarly, a report referring to the research of Solidus Labs revealed that 98% of the tokens on pump. Fun were reported as scams or involved in a fraudulent negotiation activity, with only 1.4% demonstrating real liquidity.

Despite generalized losses among users, Pump.Fun still managed to generate impressive fees of $ 300 million so far in 2025, even exceeding Ethereum

Ethn

$ 2,566

24h volatility:

3.4%

COURTIC CAPESSION:

$ 309.93 B

Flight. 24 hours:

$ 17.64 B

in this regard.

Meanwhile, the platform is preparing for the launch of its pump token, aimed at lifting $ 1 billion thanks to a community model. This ambitious objective sparked an additional debate on the long -term vision and sustainability of Pump.

Analysts warn that the next launch of a pump token could trigger a sales pressure on Solana, driven by an aggressive capital rotation. In a recent article on X, analyst Miles Deutscher stressed that Solana could face a short -term drop while investors are concentrating and funds to the new token.

Some unmistakable thoughts / opinions on the fun pump token:

Pump himself:

– Launch of the OMI too late, affects the optics / feeling because the costs now stop

– They made $ 738 million in fees. If part of this is not distributed to the incentives for the ecosystem, Idk what to say (feels like …– Miles Deutscher (@milesdeutscher) June 4, 2025

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Bhushan is a fintech enthusiast and has a good flair in understanding the financial markets. Its interest in the economy and finance draws its attention to the new technology of emerging blockchain and the markets of cryptocurrencies. He is permanently in a learning process and motivates himself to share his acquired knowledge. In free time, he reads fiction novels to thriller and sometimes explores his culinary skills.