The cross-pollination between traditional finance (TradFi) and decentralized finance (DeFI) is only just beginning, as digital asset investment products see record inflows in 2024.

Research provider Coalition Greenwich said in its Key Market Structure Trends to Watch in 2025 that traditional companies introduce access to TradFi assets via DeFi mechanisms. Traditional investors can trade cryptocurrencies through exchange-traded funds, futures, and options to access the asset class through their existing accounts. In the other direction, DeFi investors can earn yield through on-chain stablecoins backed by a massive asset manager holding US government debt.

*New Report* In what is shaping up to be an unpredictable year for financial markets, there are a few things everyone can count on: trading will continue to be electronic, workflows will continue to automate, Markets will continue to become more transparent…

– Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) January 6, 2025

For example, Frax Finance, a decentralized stablecoin cryptocurrency protocol, launched a stablecoin backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) this year. BlackRock’s tokenized fund invests in cash, US Treasuries and repos.

“It is too difficult to predict whether all of finance will shift to DeFi in the coming decade or whether these two worlds will ultimately coexist with more transparent ties,” the Greenwich Coalition added. “But the TradFi-DeFi love affair is certainly just beginning.”

Digital Asset Investment Flow

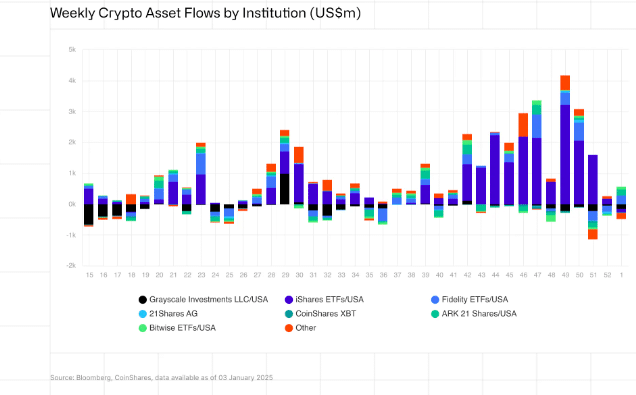

In 2024, there was a record $44.2 billion inflows into digital asset funds globally, almost four times the previous record set in 2021 according to research provider CoinShares.

James Butterfill, head of research at CoinShares, said in a report that Bitcoin dominates inflows in 2024 with Inflows of $38 billion represented 29% of assets under management, while Ethereum saw a resurgence late in the year, bringing inflows for the full year to $4.8 billion.

“Although other countries saw capital inflows, such as Switzerland, to the tune of $630 million, this was offset by large outflows from Canada and Sweden, of $707 million and $682 million, respectively. million dollars, as investors shifted to U.S.-based products and in some cases took profits,” he said.

Source: CoinShares

In the first three days of this year, digital asset investment products generated $585 million in inflows according to Coinshares.

The Greenwich Coalition predicted that more crypto-related ETFs would lead to an increase in the volume of crypto-ETF options. Additionally, the Greenwich Coalition expects the US crypto markets to see lighter regulation under the new administration and gain regulatory clarity;