Main to remember

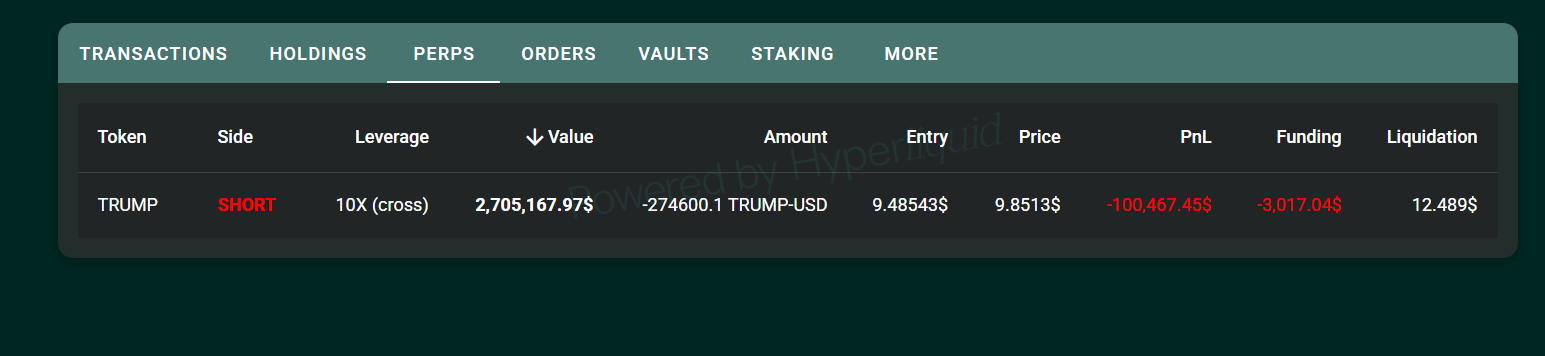

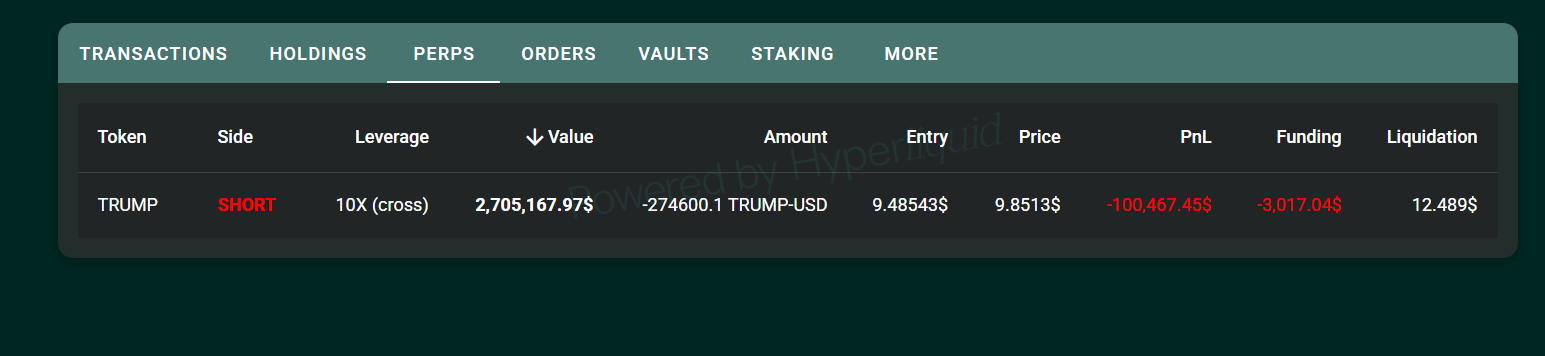

- World Liberty advisor lost more than $ 100,000 by interrupting $ Trump.

- The advisor used a 10x lever effect with 1 million USDC on the hyperliquid.

Share this article

A portfolio that belongs to Ogle, the pseudonym cryptographic influencer and warld Liberty Financial advisor, posted unrealized losses exceeding $ 100,000 after betting against the EME Trump token, according to data followed by Lookonchain.

Looks like the freedom of Trump’s world (@Worldlibertyfi) is an airy dropout $ Wlfi sale. pic.twitter.com/yt8y7ipfpu

– Lookonchain (@lookonchain) June 4, 2025

Ogle would have opened a 10x short film on $ Trump at the entry price of $ 9.4, with a liquidation level set at $ 12.49. Although the meme’s play briefly dropped under the entrance point, it has since bounced above this level.

$ Trump is currently negotiated at around $ 9.8, down approximately 10% in the last 24 hours, according to Coingecko data.

President Trump’s official play fell below $ 10.5 Thursday afternoon after a new legal drama and political warmth.

World Liberty, strongly supported by the Trump family, notably Donald Trump Jr. and Eric Trump, has published a letter to stop and “to fight Fight Fight, the team behind Trump’s official play, and to Magic Eden, on their development of an unat-affiliated cryptographic portfolio, according to Bloomberg.

After the existence of the portfolio has surfaced, Eric Trump threatened legal action, clearly indicating that the Trump family had no connection with the initiative.

Although previous interactions have blurred the boundaries between cryptographic projects on Trump’s theme, the family now insists that they have no involvement in the Crypto project and have been teasing that their official wallet is coming soon.

The lowering momentum intended to be intensified later in the day after President Trump publicly postponed the criticism of Elon Musk on the “One Big Beautiful Bill”, a legislation that Trump defended.

Musk responded quickly, contesting Trump’s statements and triggering what many call the most prominent quarrel between two of the most influential personalities of technology and politics.

Tensions between Trump and Musk spread on the markets on Thursday, resulting in traditional and cryptographic assets. Tesla’s shares have plunged more than 15%, marking their worst day since September 2020, according to Yahoo Finance.

It was not just $ Trump and $ TSLA feeling the heat. The wider market of cryptography took a hit, with Bitcoin below $ 101,000.

Ethereum fell by about 7%, Solana fell by 5% and XRP and BNB slipped by around 4% as the feeling of risk spreads.

One day when most of the things collapsed, Fartcoin (Fartcoin) was an unexpected winner. The token climbed more than 10% after Coinbase put it on its registration radar.

Share this article