- Airdrops are popular with DeFi users.

- 0xngmi from DefiLlama explores how they benefit the projects that led them.

0xngmi is a developer for DefiLlama. The opinions are his own.

Airdrops have become one of the biggest draws for DeFi users.

Hopeful hunters crowd into new blockchains in hopes of becoming eligible for future rewards in the form of valuable tokens.

For the chains themselves, airdrop token launches are seen as powerful marketing tools, growing user numbers and galvanizing their communities.

This year, several channels rewarded users with symbolic airdrops. But how effective were the launches in attracting users? Let’s look at the data.

Activity maintained

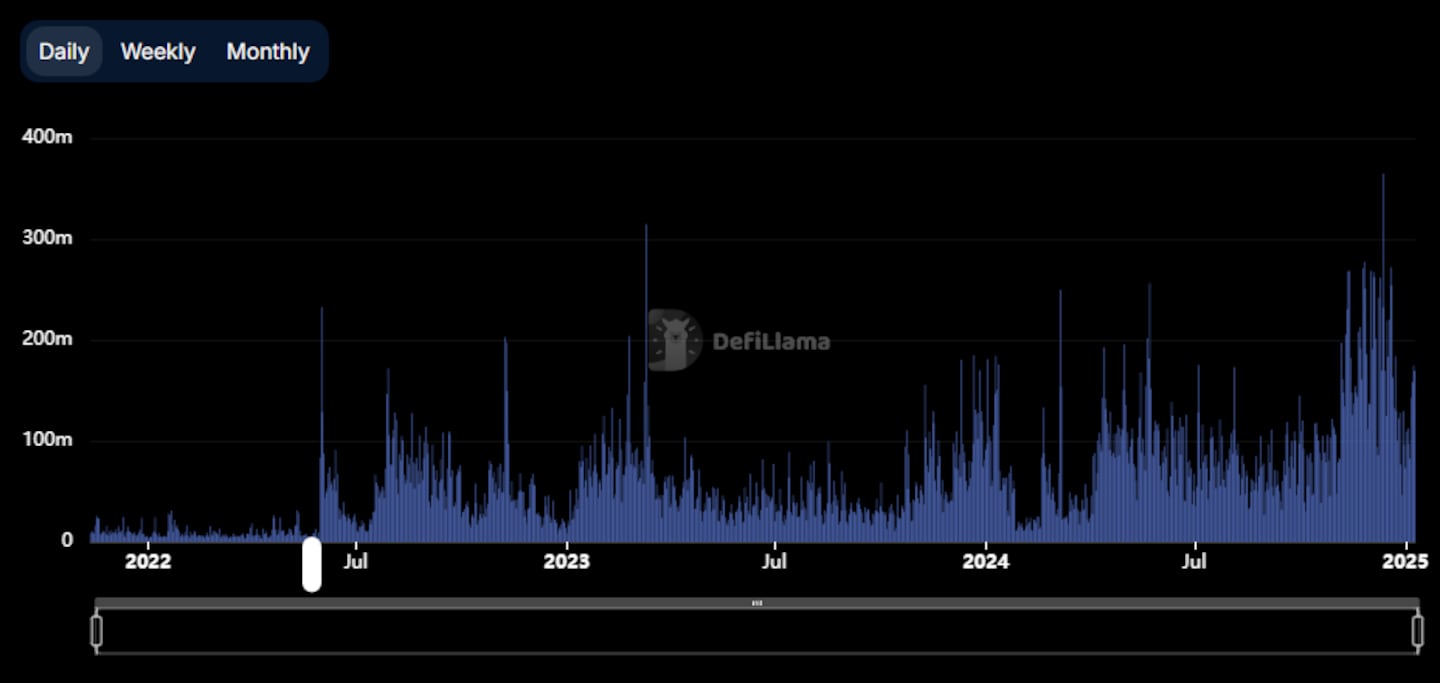

Blockchains launching their own tokens often trigger sustained spikes in activity and create lasting engagement. Optimism is an example where activity increased and remained high following the launch of its OP token in 2022.

Many attribute this effect to token post-launch incentive programs, which promise rewards to users who contribute funds.

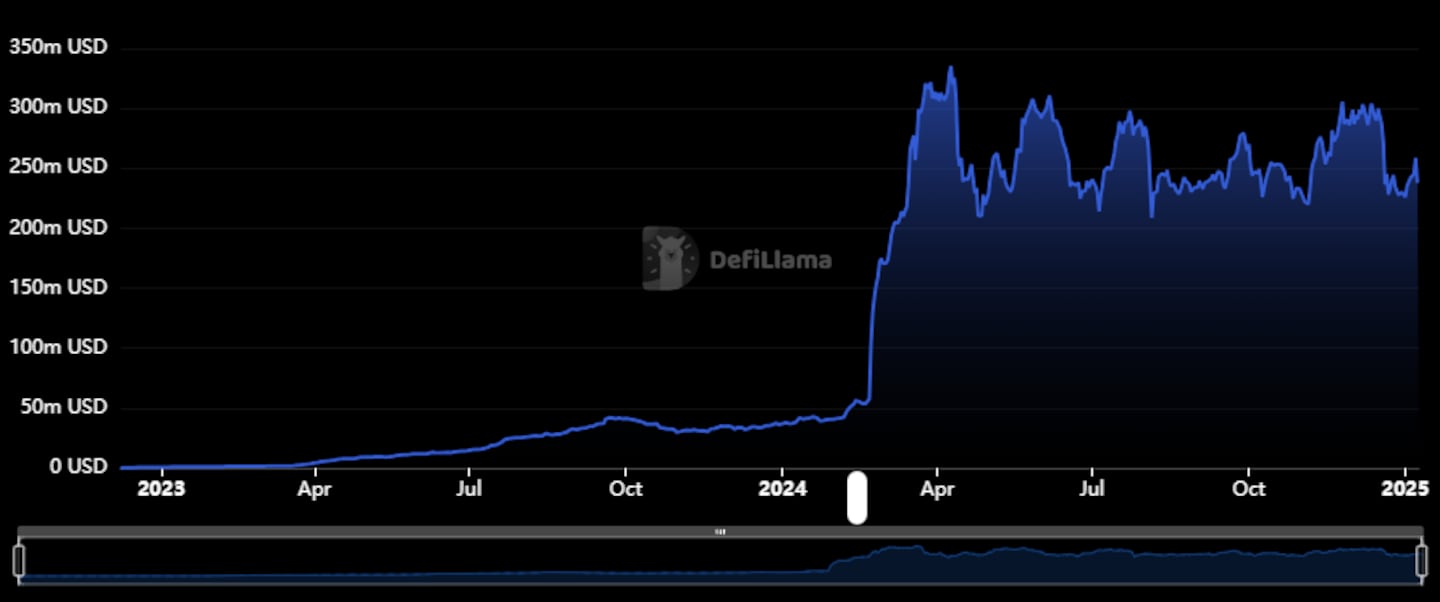

However, even chains that do not explicitly offer or advertise such campaigns, such as Starknet, also maintain higher levels of deposits after the launch of their tokens.

Join the community to receive our latest stories and updates

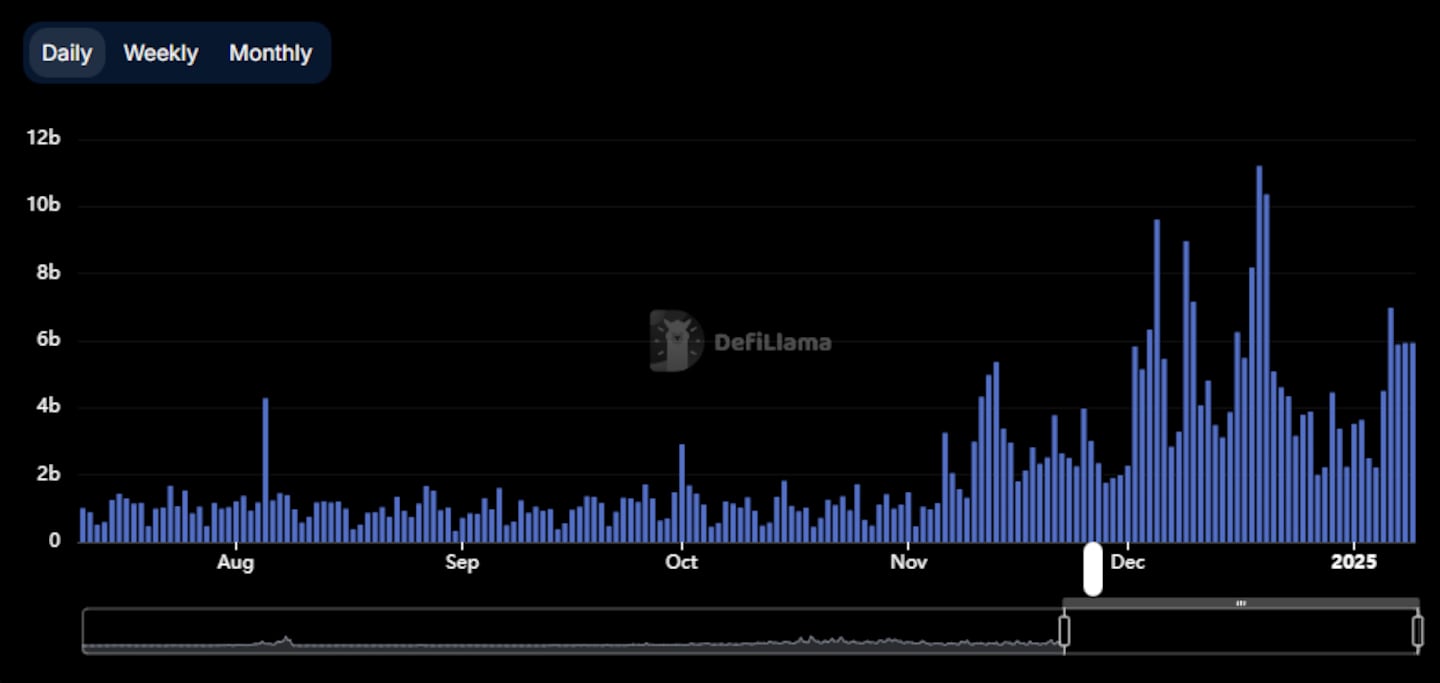

Another example is the perpetual futures trading platform Hyperliquide.

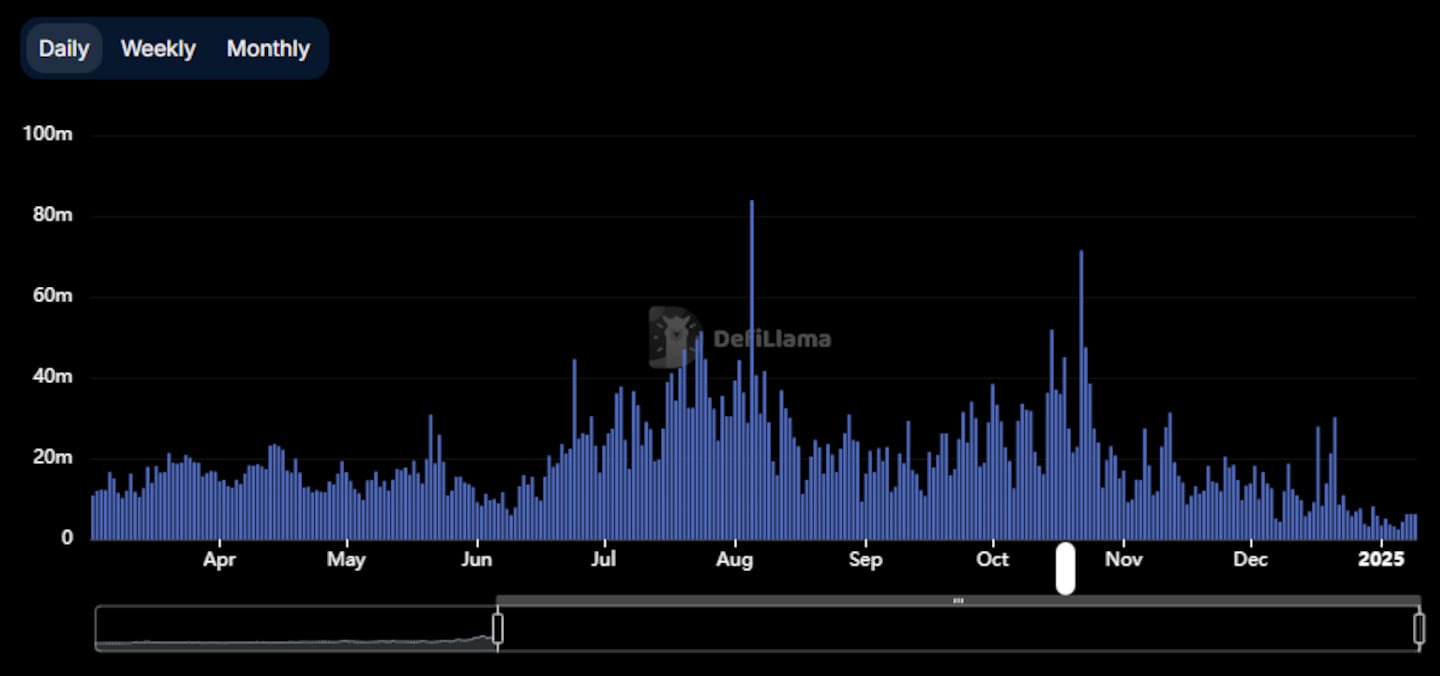

The following is a graph of just perpetual futures volume before and after the launch and airdrop of its HYPE token. The chart excludes the spot volume of the platform’s HYPE token.

HYPE perpetual futures volume is almost negligible on the chart, accounting for about 5% of daily volume, so all volume is the main volume of their perps product, not volume determined by users trading their own token.

The HYPE airdrop led to a huge increase in non-HYPE trading on Hyperliquide.

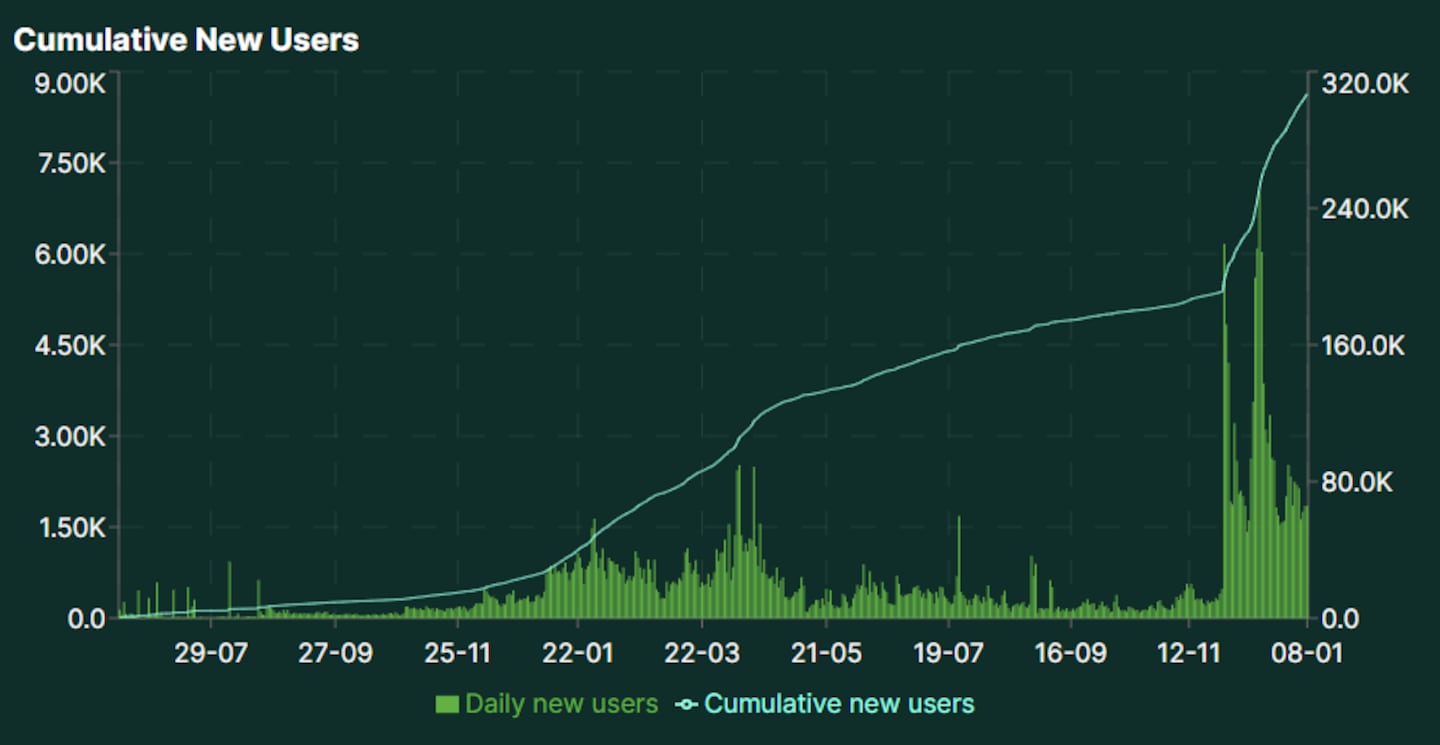

We can find this effect in a graph showing the growth of new Hyperliquide users.

Looking at other chains, this pattern repeats itself frequently: the native token airdrop is an important growth catalyst that leads to new users and increased growth that, in many cases, is sustained over time.

Overcoming inertia

So why does this happen?

Part of this is likely due to the surge in attention the channel is receiving, as everyone in crypto pays attention to it for a few days, and some of that attention converts into new users like any other product .

But I suppose the main reason we are seeing this trend is that participating in the token launch – investing in or trading the newly launched token – is an activity that can often only be done on that token’s chain.

In today’s crypto environment, chains have become a commodity.

They all have decentralized exchanges, or DEXs, where users can trade bridged versions of major crypto assets like Bitcoin and Ethereum, lending protocols where they can borrow funds, perpetual futures protocols for FX trading. lever, etc.

Basically, you can do just about every major crypto activity on any chain.

So if all the major needs are met, why link to other channels? It’s the same story for all products: when a consumer is already using a product and there is a slightly better competitor, in most cases users will not switch products due to inertia and switching costs.

But when a new chain token is launched, you can only trade it on that chain, so it’s a catalyst that forces everyone who wants to trade it to log onto the chain and try the products there- low, then if they like them, they could keep them. use them or skip them altogether.

I think that’s what happened with Hyperliquid: users came to trade HYPE and ended up moving their perpetual futures there because they liked the product.

Case Study: Scrolling

A great case study that supports my theory is Scroll’s token launch in October. This was a highly anticipated blockchain token launch like the others we’ve covered, but in this case, Scroll chose to launch with a big partnership with Binance.

Scroll’s SCR token was tradable on Binance upon launch, and the chain gave Binance many tokens for liquidity. Additionally, Scroll also gave Binance many tokens that users could earn on the exchange.

Due to these factors, the best place to trade SCR when it launched was not the Scroll Chain itself, but Binance.

When you look at Scroll’s DEX volume after the airdrop, it shows a very different pattern than other cases we’ve looked at, with usage decreasing. Users who wanted to trade the token were not required to use the chain, so many were not onboarded like in other cases.

Similar catalysts

When we look at other recent growth catalysts, they are similar: it’s about having something that can only be done on your channel.

A big part of the initial growth story of Coinbase’s core chain was the SocialFi Friend.tech platform. Users moved to Base because it was the only place they could exchange X profiles and they wanted to do it.

Arbinyan, a protocol in which users deposited Ether to earn the protocol’s NYAN token, created a similar effect. It launched shortly after the Arbitrum channel went live and generated huge buzz as users rushed to exploit it.

However, these growth catalysts are not easily replicable.

No one predicted that Friend.tech would be a success before its launch. Its founder’s previous SocialFi experiments had largely failed, and Arbinyan’s attempts to replicate led to DeFi users farming and abandoning their projects en masse, as everyone already knew how the game would play out.

The chips then fell to zero.

In comparison, the launch of a native token is one of the few catalysts that a chain’s team can completely control.

What’s interesting is that we’ve recently seen two major blockchains, Move and Abstract, throw this away by launching their tokens on another chain before their own chain is active.

When channels finally launch, these teams will have a major missing tool in their arsenal, and while it’s entirely possible to grow without the token launch, as Base has proven, it will likely make them the more difficult task.

Tim Craig edited this article.