- Ton liquidation reaches $7.2 million after Telegram founder’s arrest.

- Fear, uncertainty and lack of investor confidence have led to strong selling pressure.

The Toncoin (TON) community has been under extreme pressure following the arrest of Telegram founder Pavel Durov. According to the report, Durov was arrested in France and faces a possible 20-year prison sentence. This news has had a significant impact on the Telegram-based altcoin.

Tons of liquidation peaks

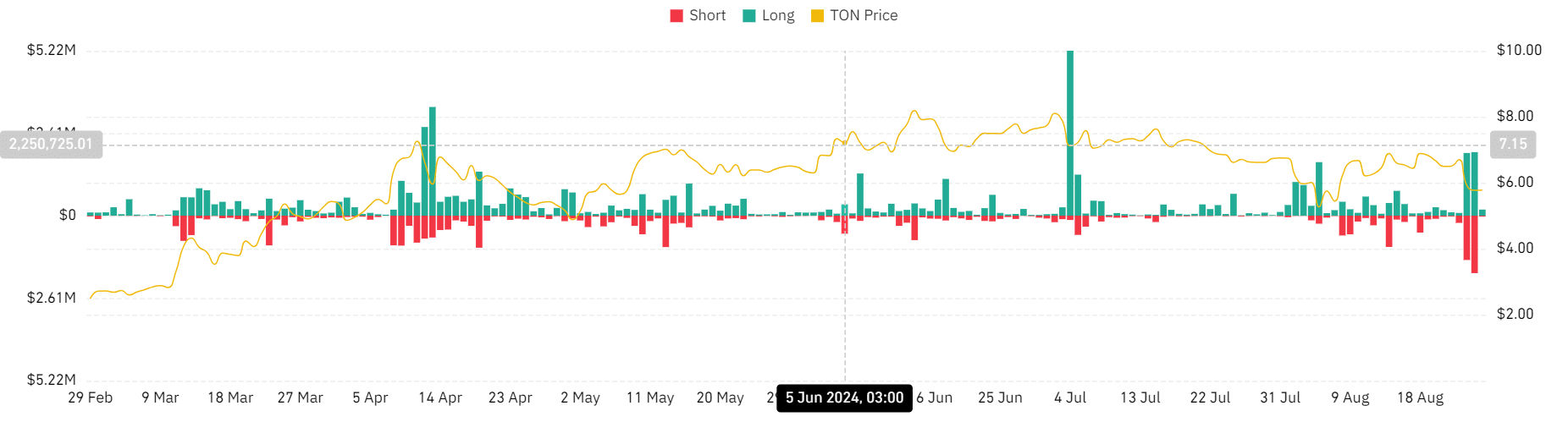

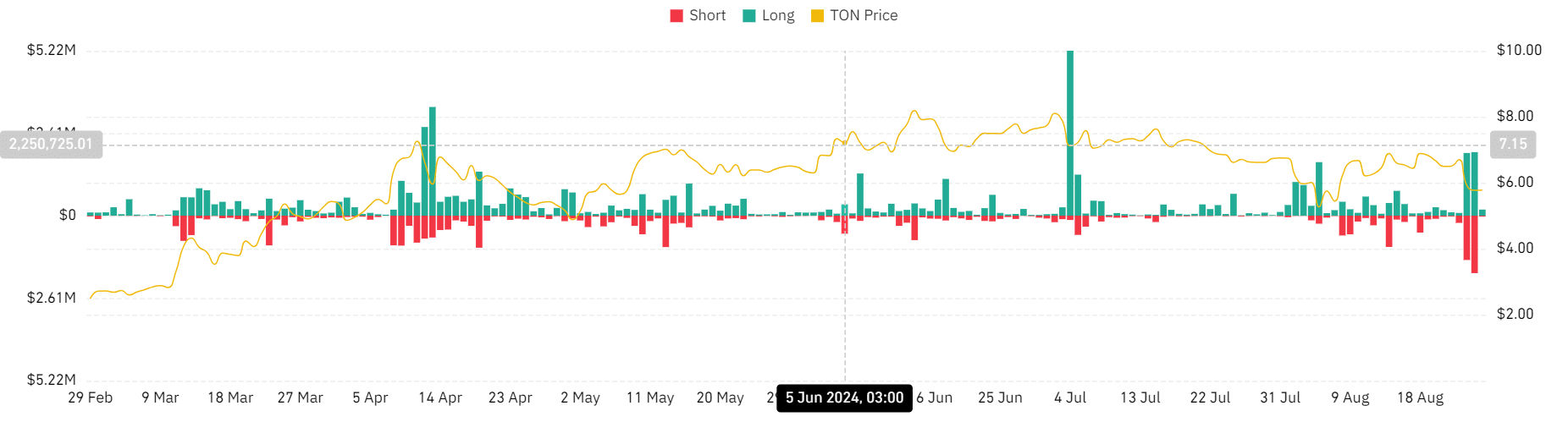

According to Coinglass data, Toncoin liquidation has reached an all-time high. Ton reported $7.21 million in liquidated positions. This exceeds the liquidation reported during the market crash earlier this month.

Data shows that in the 24 hours following the August 5 stock market crash, Ton liquidations hit a record $6.5 million, mostly from long positions. Recent liquidations are different because they show an increase in liquidations for both short and long positions.

Source: Coinglass

It is worth noting that this liquidation shows that the market is experiencing high volatility and rapid price fluctuations. Most of the time, high volatility results in stop losses and margin calls leading to forced liquidations.

Impacts on ton price charts

Since the news of the Telegram founder’s legal troubles, Toncoin’s market cap has decreased by $2.9 billion, from $17.1 billion to $14.2 billion. This decline is due to low trading volume after a 27.3% drop.

Therefore, AMBCrypto’s analysis shows that the increase in liquidation has led to a downward trajectory for Ton. Toncoin has dropped drastically by 18.77% on the weekly charts.

This phenomenon is also evidenced by the decline in the relative strength index (RSI), which went from 52 to 36 at the time of going to press.

Source: Tradingview

A falling RSI shows that the altcoin is experiencing massive selling pressure that is pushing the crypto into oversold territory. This suggests increased uncertainty and a lack of investor confidence in the altcoin’s outlook.

Similarly, the Directional Movement Index (DMI) has dropped from 23 to 16 at the time of writing. This shows that the sell-off has pushed altcoins into a downtrend.

The positive index crossing the negative from above suggests that Ton’s downward move has been strong over the past day.

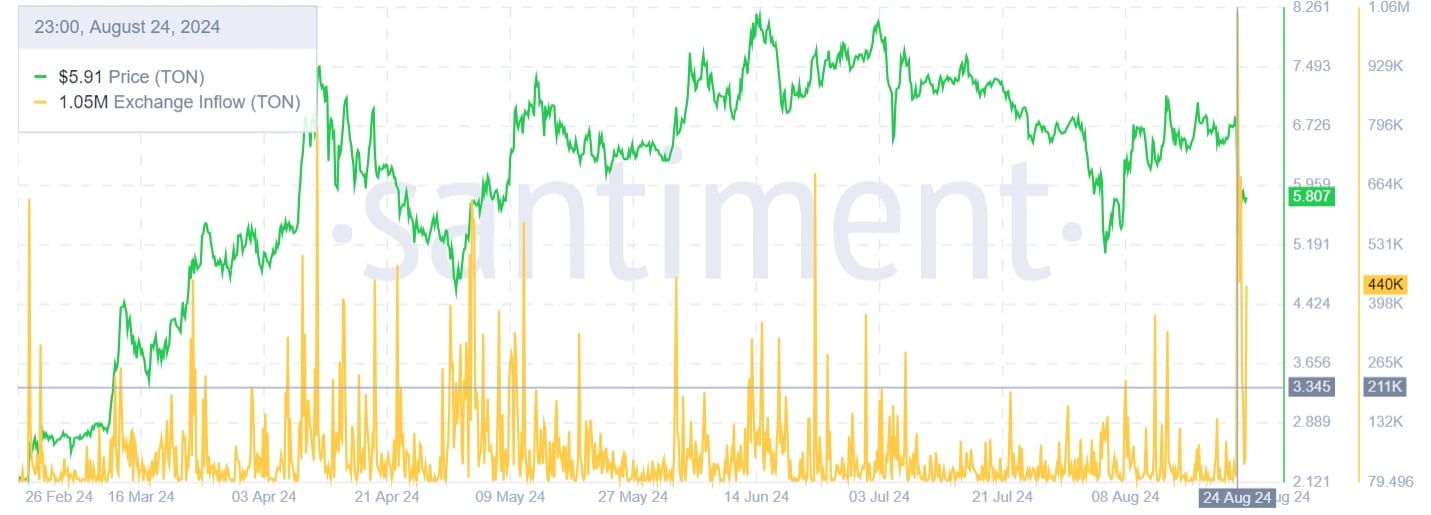

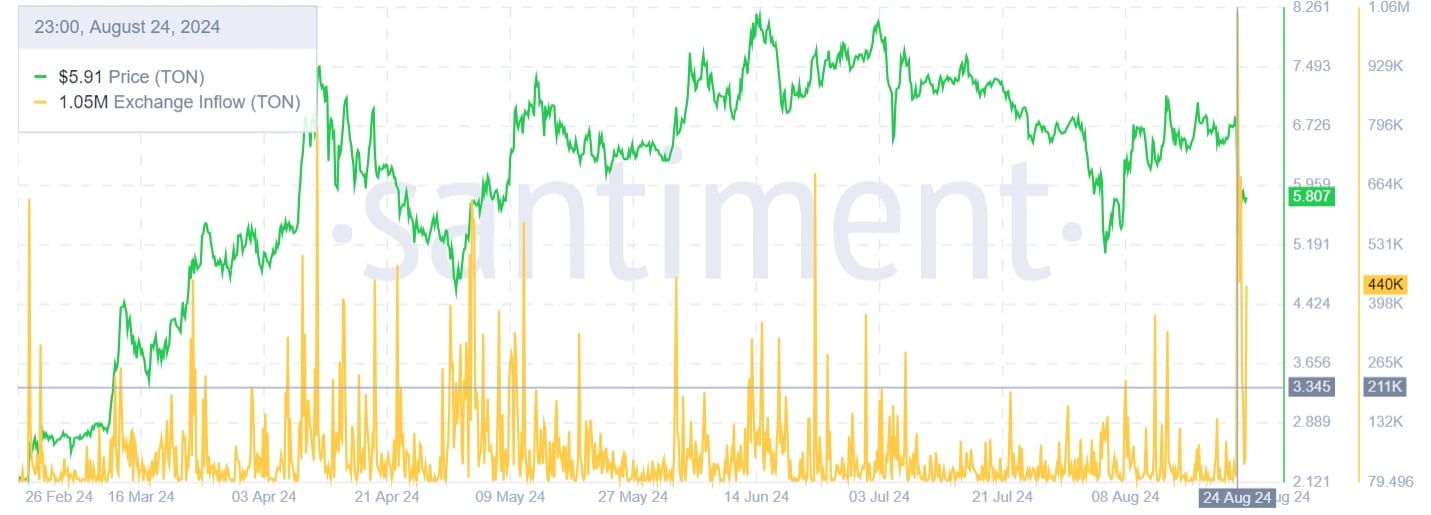

Source: Santiment

Looking further, the increase in capital flows into the stock markets indicates that Ton holders are expecting a decline in prices and are therefore preparing to sell. Thus, due to the negative news, investors had to move their assets to the stock markets to sell them.

Therefore, as the data shows, the negative news impacted market sentiment. The sharp sell-off led to stronger selling pressure, which led to a decline in market capitalization, trading volume, and prices.

Therefore, if the current market sentiment is positive, the altcoin is likely to continue falling to the local support level of $4.77.