- Toncoin sees an average of 500,000 new holders every day.

- Even as holders grew, they struggled to remain profitable.

Toncoin (TON) has demonstrated impressive growth since its launch, with signs suggesting it could eventually overtake Ethereum (ETH) in terms of number of holders.

The latest data reveals a steady increase in the number of Toncoin holders, hinting that they could surpass Ethereum by the end of the year. However, while the number of holders has increased, profitability has shown a downward trend, indicating a mixed outlook for the asset.

Rapid increase in the number of Toncoin holders

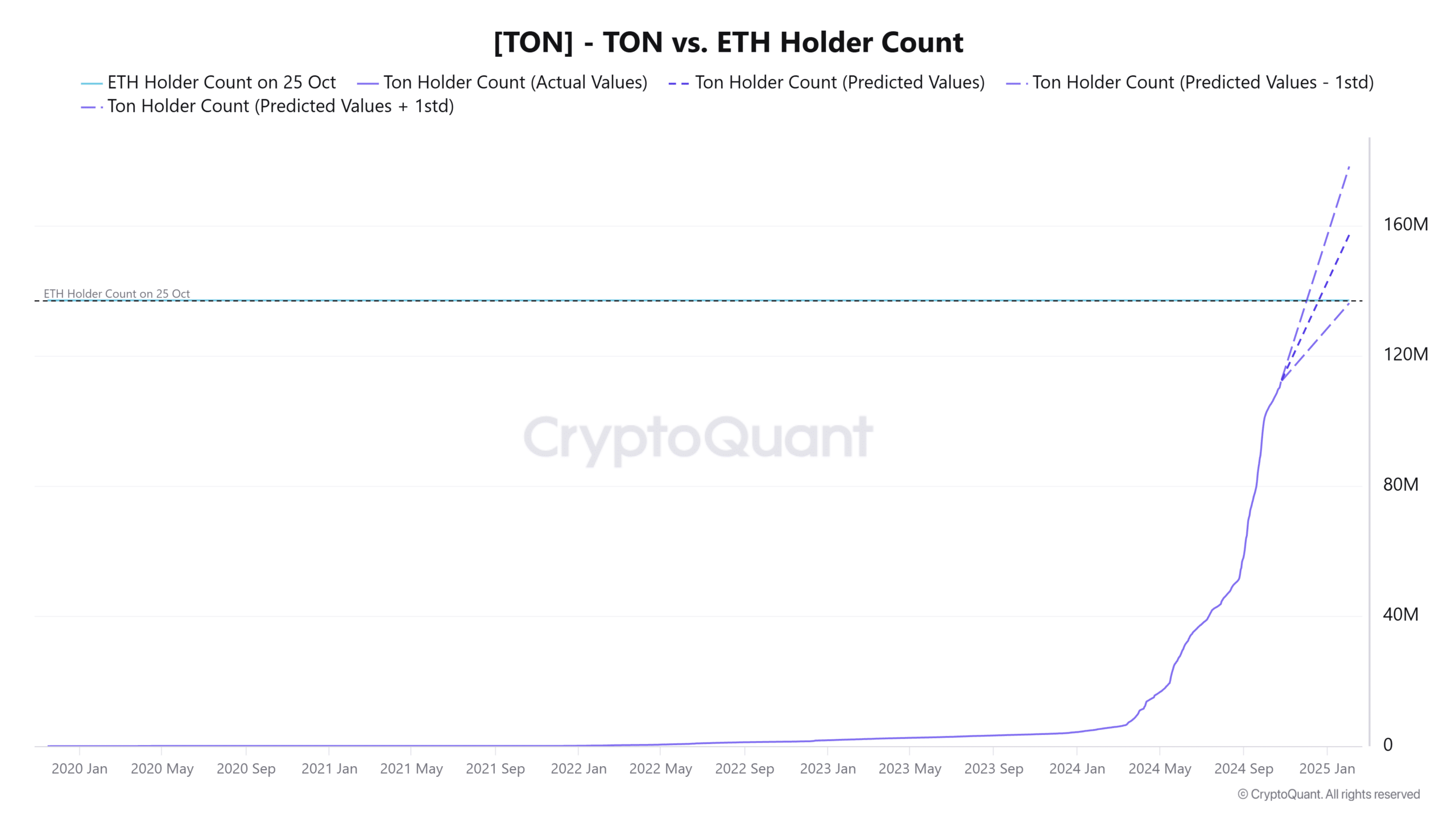

According to CryptoQuant, Toncoin has seen substantial growth in its holder base. Between March 15 and October 17, the number of TON holders increased from around 7.12 million to almost 108 million.

This growth rate far exceeds Ethereum, whose number of holders has remained stable at around 137 million. Analysis suggests that TON is currently adding around 500,000 holders per day.

Source: CryptoQuant

If this continues, Toncoin could surpass the number of Ethereum holders by December. Even if the rate slows, this milestone is expected to be reached within the next year, indicating that TON could soon have more holders than ETH.

Evaluation of profitability among Toncoin holders

Rapidly increasing holders do not necessarily equate to high profitability for all Toncoin investors. Analysis of IntoTheBlock’s Global In/Out of the Money chart indicates that many Toncoin holders are currently experiencing losses.

Currently, approximately 75.43 million addresses, or 80.70% of total holders, are classified as “out of the money” (unprofitable).

Conversely, only about 13.16 million addresses, or 14% of holders, are “In the Money,” while the remaining 5.22% break even.

In comparison, Ethereum metrics show a more favorable profitability outlook. Currently, over 67% of Ethereum holders are “In the Money,” while 29% are “Out of the Money,” making ETH a more profitable asset for its holders, based on recent data.

Current market position of Toncoin

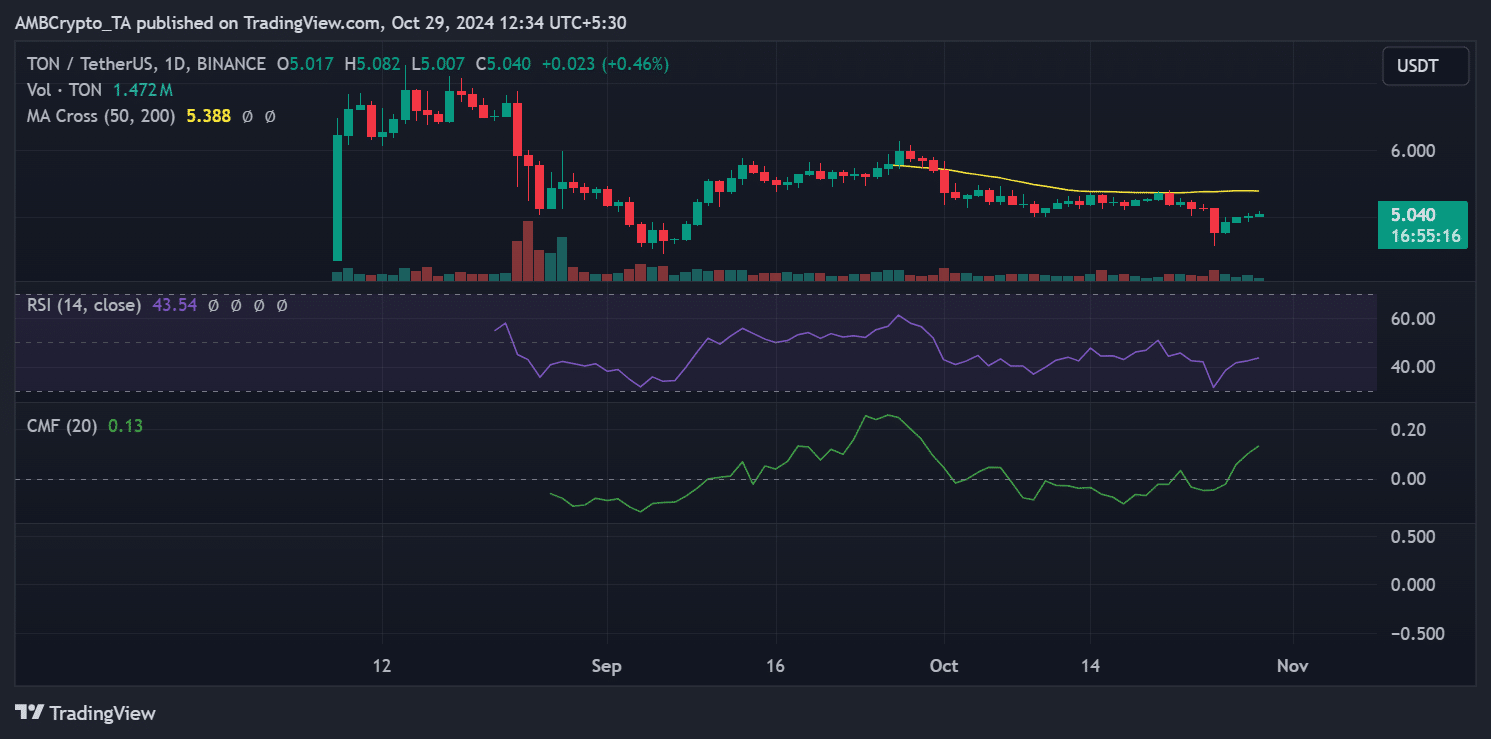

Toncoin is trading around $5.04, posting a slight gain for the day but remaining below its 50-day moving average of $5.388. This positions TON in a medium-term downtrend.

The Relative Strength Index (RSI) sits at 43.54, suggesting neutral to slightly oversold conditions, which could indicate room for a potential move higher if buying interest increases.

Source: TradingView

The Chaikin Money Flow (CMF) indicator, at 0.13, reflects positive money flow, indicating some accumulation within the market. TON must rise above the 50-day moving average to move into an uptrend.

If it fails to maintain its bullish momentum, TON could continue to consolidate around its current price or potentially test lower support levels near $4.90.

Is your wallet green? Check out the Toncoin Profit Calculator

Overall, while the growth in Toncoin holders is notable, profitability remains a concern. Its stock performance in the coming weeks will largely depend on its ability to overcome these technical resistance levels and generate continued investor interest.