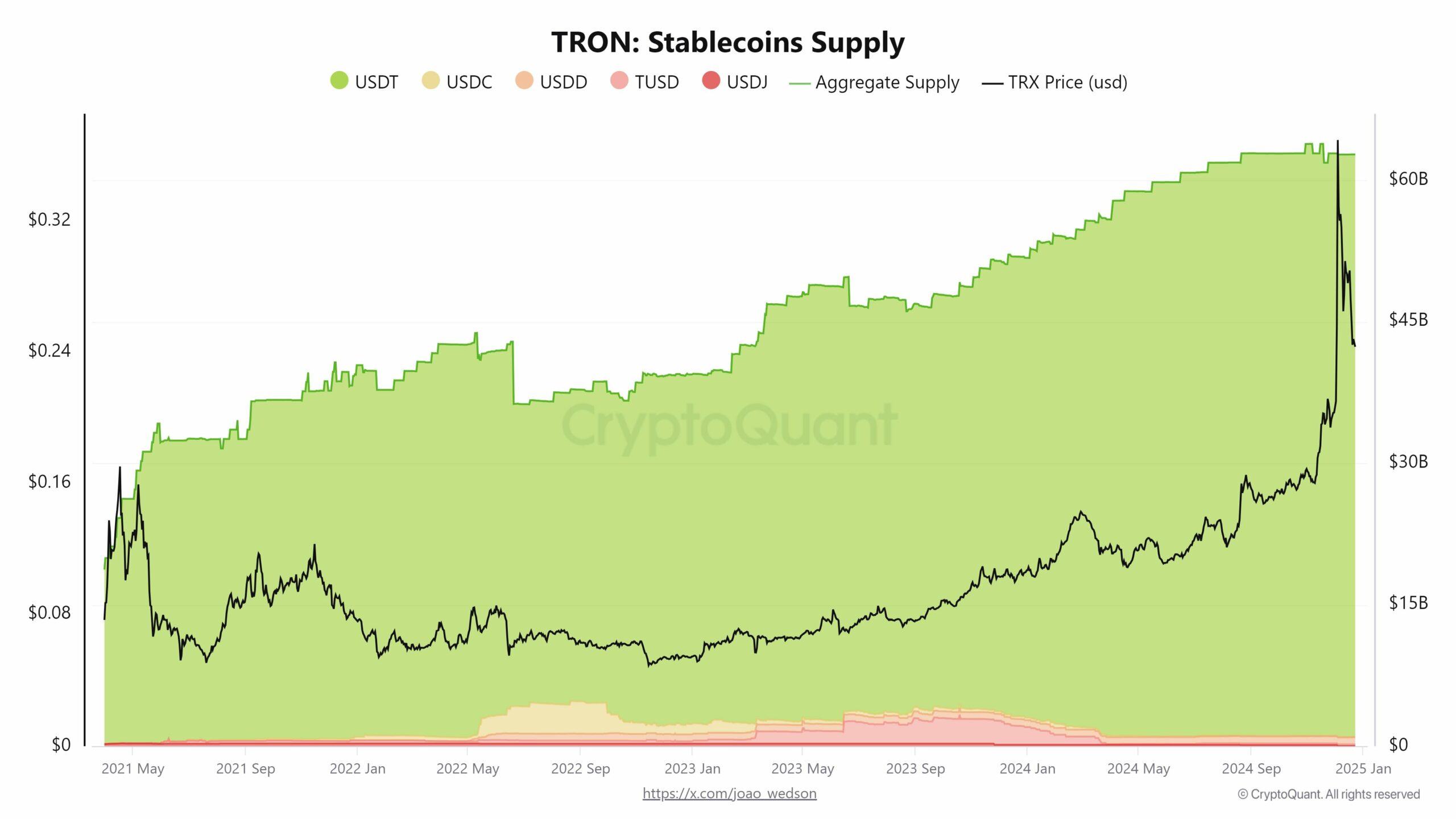

- Stablecoins on the TRON network stabilize at $62 billion

- Network loans represented 55% of TVL

The supply of stablecoins on TRON, particularly USDT, reached a stable level of $62 billion, indicating a pause in minting activities. This stabilization of stablecoin minting and supply suggests a balanced market, where demand effectively meets supply – a sign of ecosystem maturity.

Including USDT, a consistent overall supply level with minor fluctuations corresponded to changes in market dynamics.

Source: CryptoQuant

Excluding USDT, the smaller but steady rise of other stablecoins like USDC, USDD, TUSD, and USDJ has supported the growing diversity and stability of the ecosystem. The scenario pointed to a mature market on the grid, where significant disruptions were less likely and investor confidence could be strengthened.

Further analysis of the dynamics of Ethereum (ETH) and TRON stablecoin transfers showed the market dominance of ETH in stablecoin transactions, challenged by the growing share of TRON.

While Ethereum maintained significant activity in USDT transfers, TRON captured 64% of the market – up 57% from the previous month.

Source: CryptoQuant

This move highlighted TRON’s growing appeal in the stablecoin sector, likely attributed to its lower transaction fees and faster processing times via the TRC20 protocol. It also hinted at a competitive landscape, while highlighting its own potential to significantly reshape stablecoin transactions.

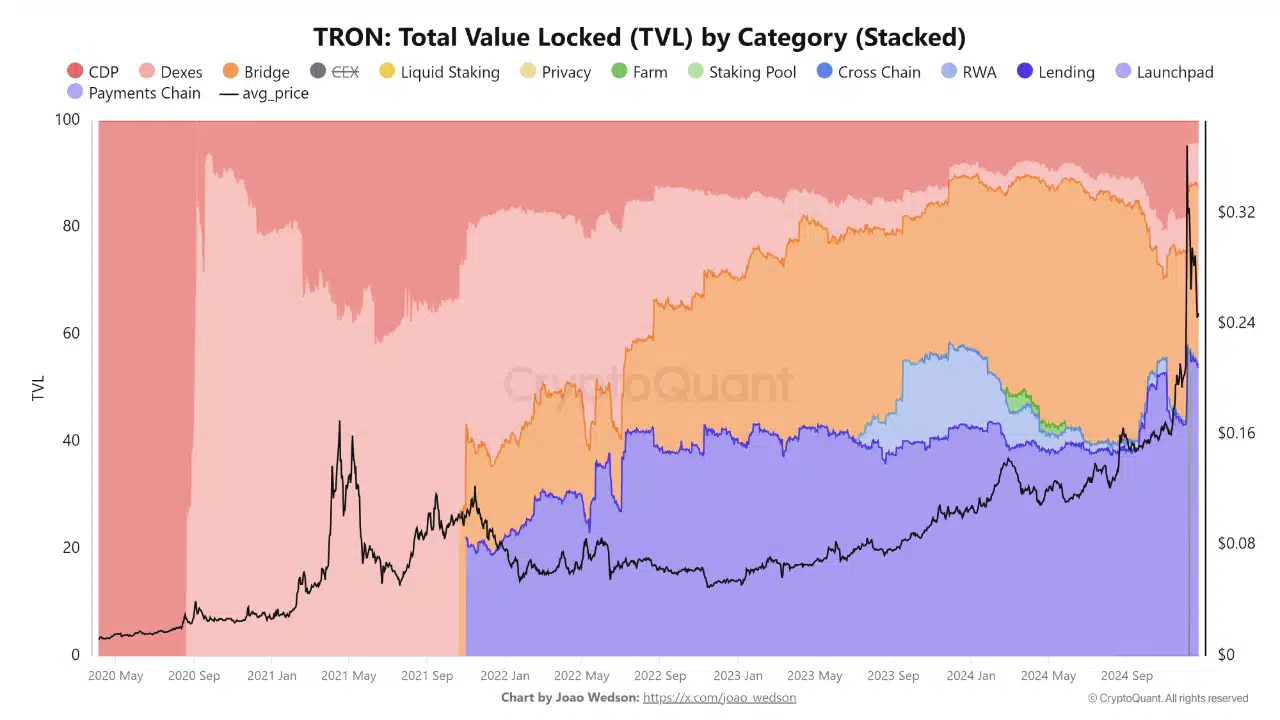

Lending on the TRON network

Lending activities have also shaped the network’s financial landscape, contributing more than half of the network’s total value locked (TVL) since 2022. JustLend has spearheaded this trend, providing users with the ability to s engage in decentralized finance (DeFi) by granting and earning loans without intermediaries.

This increase in lending not only increased user participation, but also improved the overall liquidity and financial stability of TRON.

Source: CryptoQuant

By facilitating loans secured with collateral, these platforms have provided security for lenders and mitigated default risks. JustLendDAO has strengthened TRON’s DeFi ecosystem by offering accessible financial services.

This development has cemented it as a serious competitor in the DeFi space. This has been demonstrated by its continued growth in TVL and various financial businesses such as payments and cross-chain operations.

This growth trajectory has highlighted TRON’s ability to maintain its role in the rapidly evolving DeFi sector. It promises a future for its ecosystem and lending service participants.

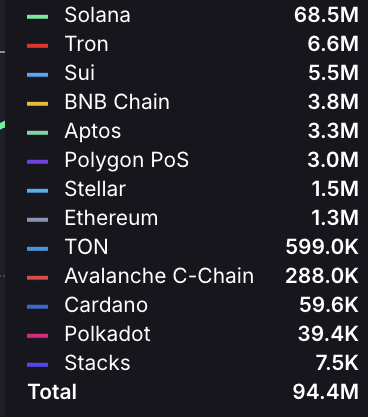

Daily network transactions

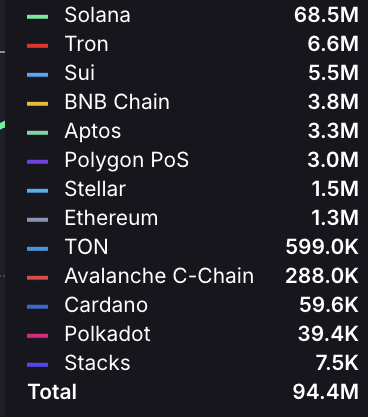

TRON also held second place behind Solana (SOL) on the daily network transactions front. Overtaking other major chains like ETH has illustrated its ability to efficiently handle large transaction volumes.

This was further quantified by TRON’s monthly transaction figures, which consistently outperformed others. Indeed, in recent months, 182 million, 167 million and 135 million have been recorded.

Source:

Collectively, these highlighted TRON’s strong position in the blockchain space. By often outperforming its peers in monthly transactions, it has now solidified its DeFi status.