- TRON gains 7% today, setting a positive tone for the week ahead.

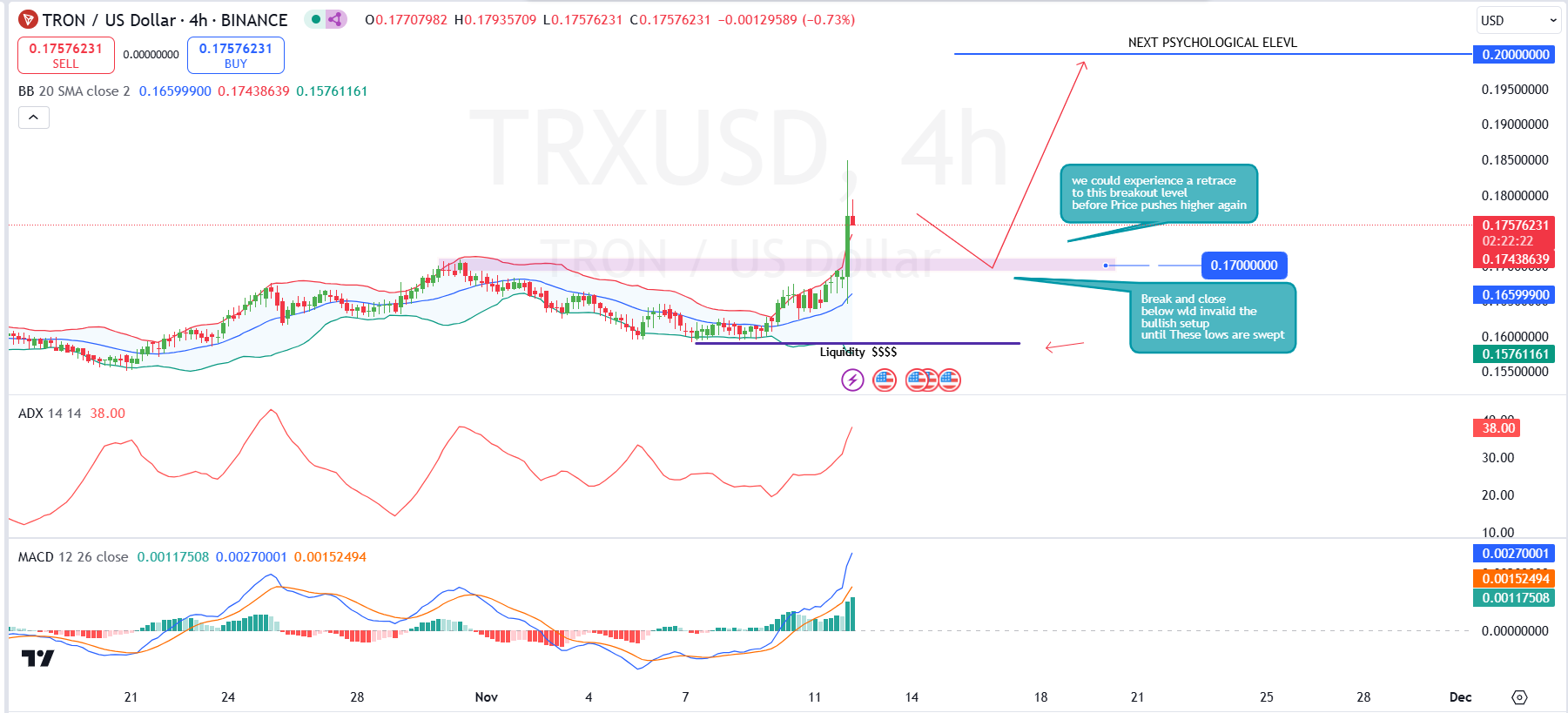

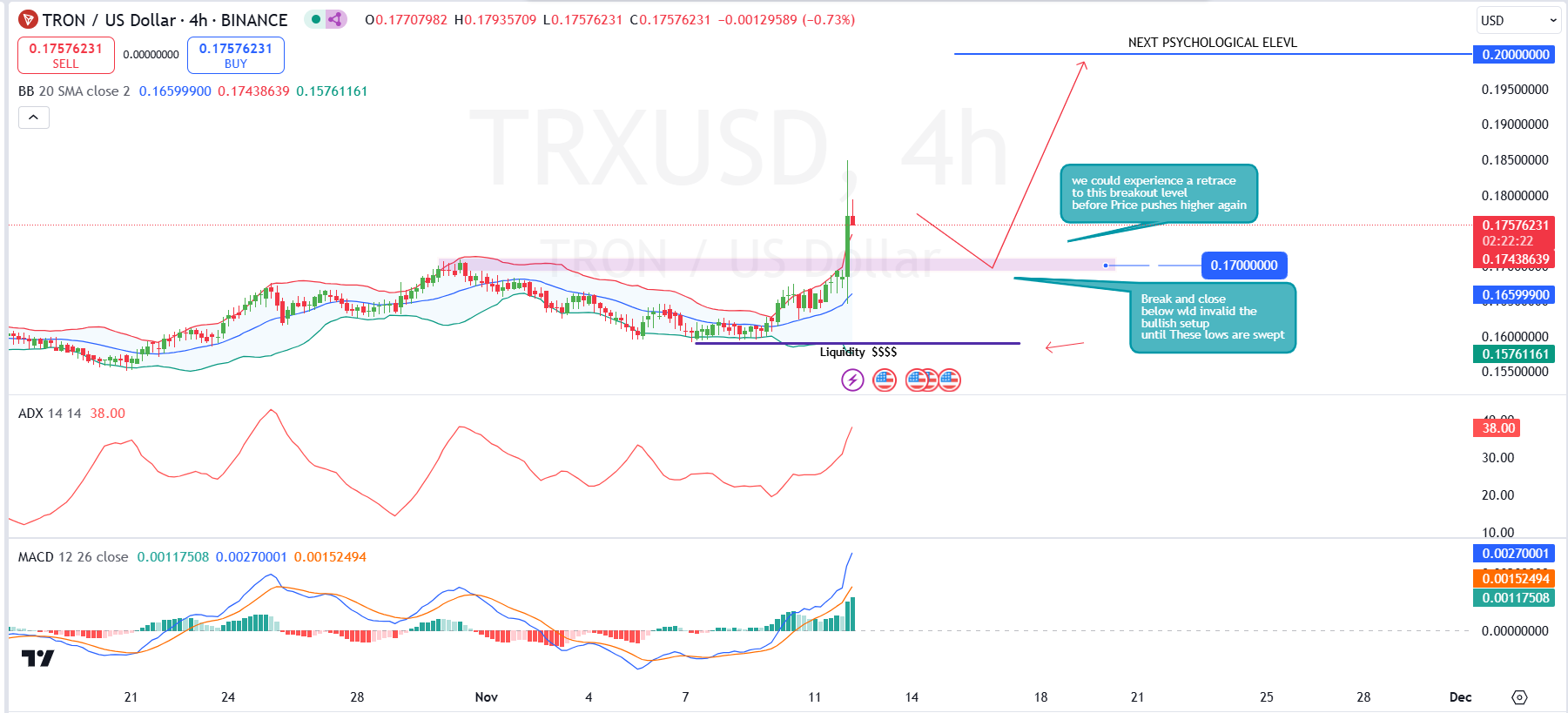

- A break above the Bollinger Bands on the 4-hour chart suggests further gains for the token.

Tron (TRX) reflects gains in the broader cryptocurrency market. At press time, TRON was trading at $0.1778, up more than 7% in the past 24 hours.

During this period, TRON’s 24-hour trading volume jumped 121%, reaching $1.62 billion. Investor interest in the token continues to grow, with its market capitalization increasing by 7.58% to $15.35 billion.

On the monthly chart, Tron has shown strong bullish momentum, reaching highs last seen in April 2021. The move reflects Tron’s potential to revisit its 2018 all-time highs amid the ongoing cryptocurrency bull cycle, which intensified after Trump’s recent election victory.

On the 4-hour chart, the price recently rose above the $0.1700 breakout level, reinforcing an uptrend, with a potential retracement suggested to return to this level. This area could serve as new support, providing buyers with the opportunity to push the price towards $0.20, a key psychological resistance level.

Source: Tradingview

Bollinger bands indicate increased volatility as the price extends towards the upper band, highlighting strong buying pressure. However, a retracement into the bands could occur to consolidate recent gains.

A significant invalidation level lies near $0.1600. A breakout and close below this point would negate the bullish setup, potentially leading to further declines, especially if it attempts to capture liquidity around the $0.1590 low, which could attract more buyers for a while. bounce.

Supporting this bullish outlook, the ADX indicator, currently at 36.44, shows strong trend strength, validating the momentum of this recent move. This ADX level suggests that the trend is robust but overextended, and that a pullback could still occur.

The MACD line crossing above the signal line with expanding histogram bars further indicates bullish momentum, suggesting that buying pressure remains strong.

However, the distance between the MACD and the signal line could imply that the trend may need to calm down slightly or consolidate before attempting another rally.

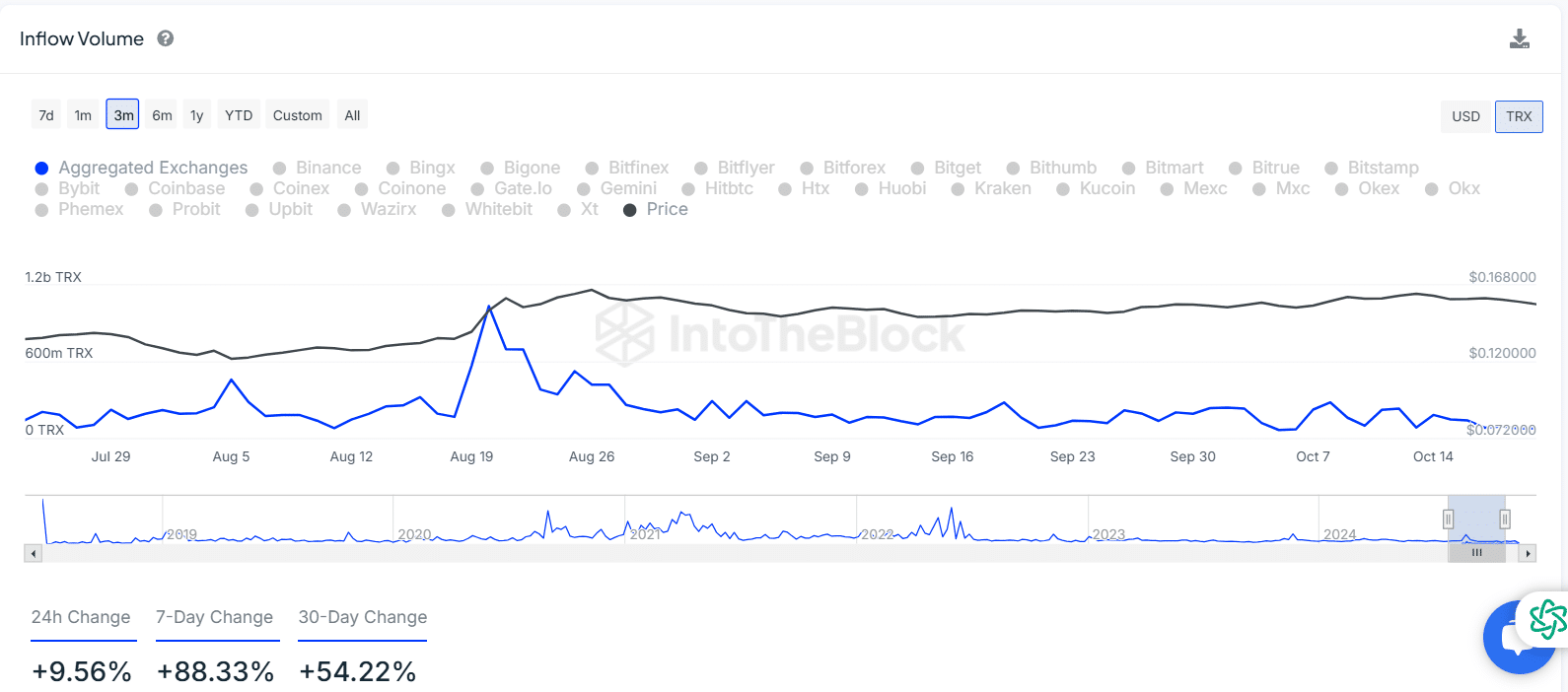

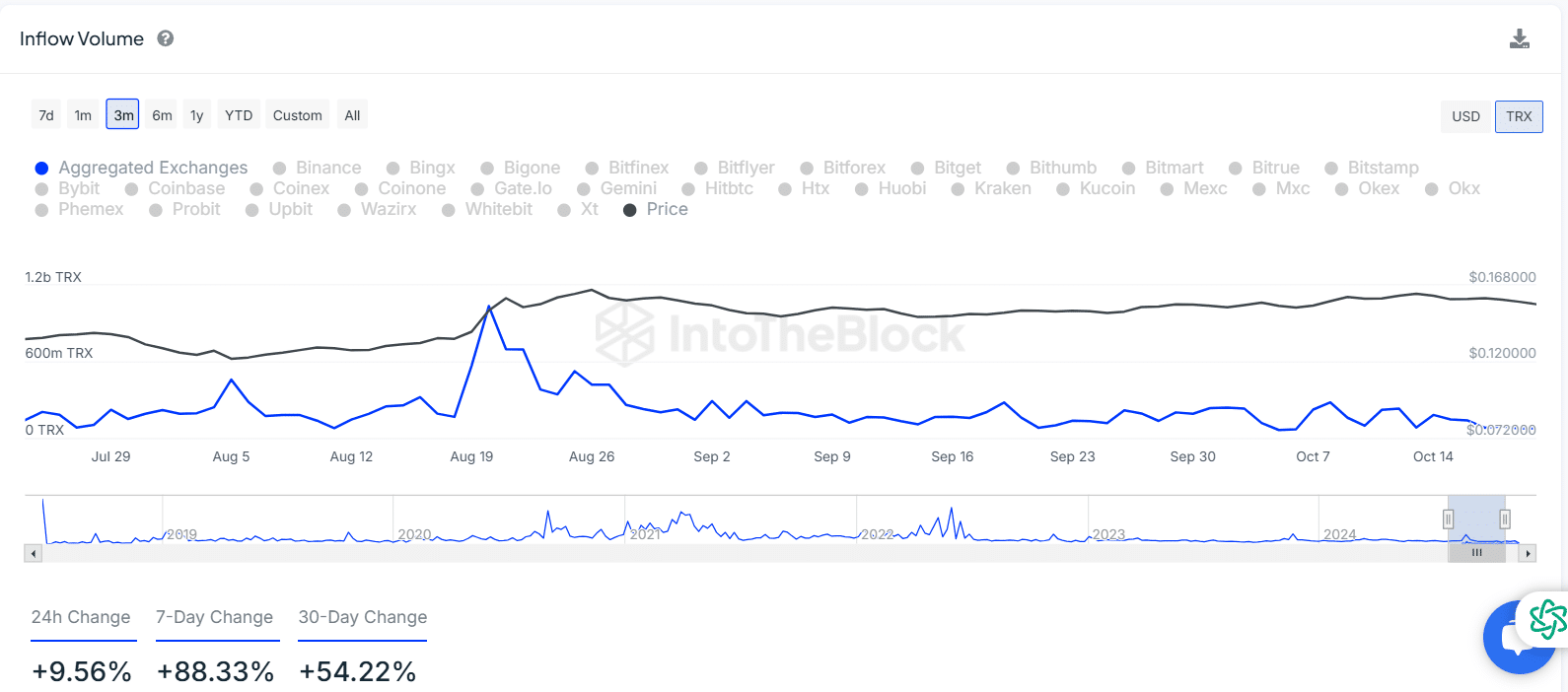

TRX’s Steady Volume Growth Since August Signals Renewed Market Interest

Since August, TRX The volume of capital inflows increased steadily, with notable spikes around mid-August where volume and prices climbed simultaneously, suggesting strong buying interest and increased trading activity.

After the August peak, inbound volumes gradually declined, but remained stable until September and October, during which time prices also stabilized.

This period of lower capital inflows and lower price volatility likely reflects a phase of consolidation or reduced speculative activity in the TRX market.

Source: In the block

Recent data shows a slight increase in entry volume, with an increase of 9.56% over the last 24 hours, an increase of 88.33% over the last 7 days, and an increase of 54.22% over 30 days.

This upward trend in entry volume indicates renewed interest in TRX, which could lead to further price movements if the trend persists, potentially breaking the current range and aiming for 2018 all-time highs.

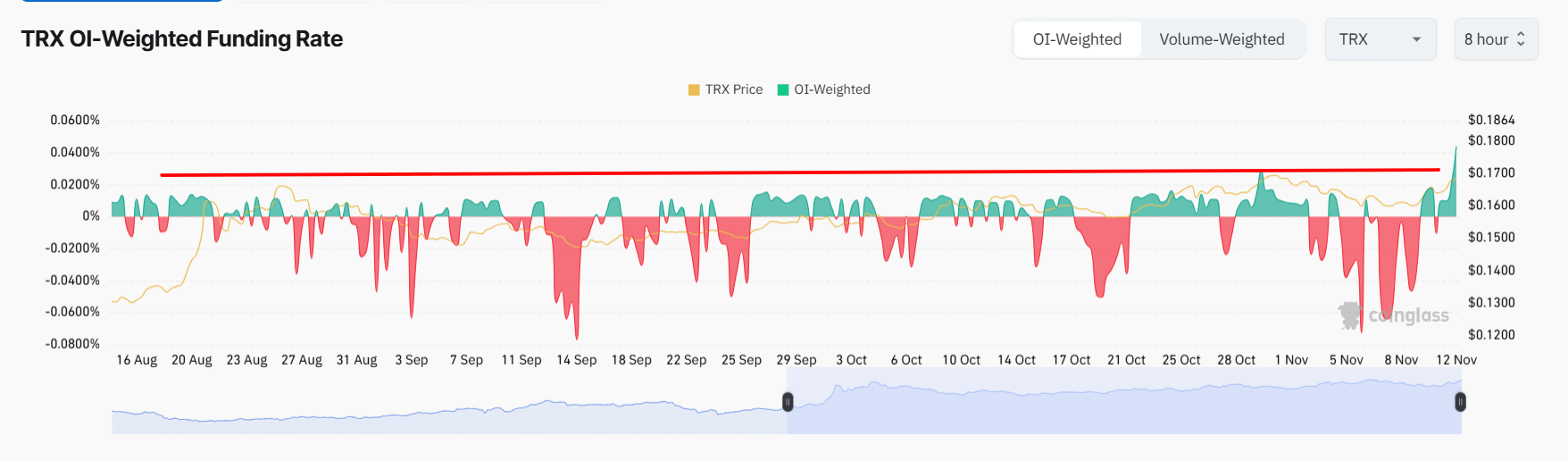

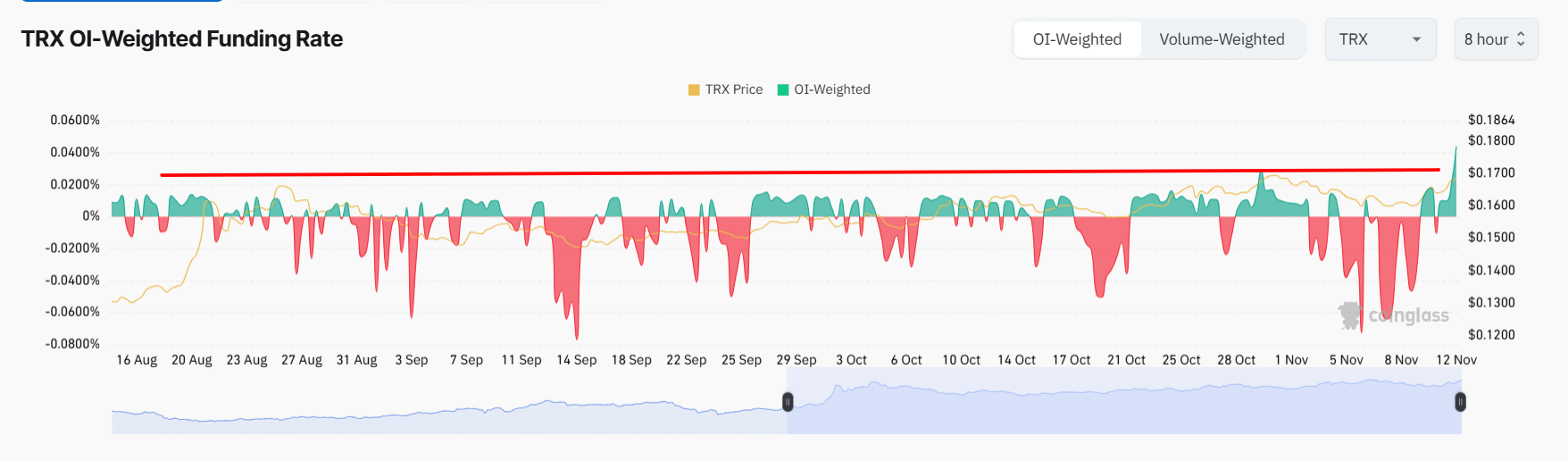

Positive and sustainable funding rate in TRX portends higher prices

THE TRON The funding rate reflects a strong shift toward bullish sentiment, with the funding rate recently hitting 0.04%, the highest level since August.

Throughout August and September, the funding rate hovered around neutral, hovering between -0.02% and 0.02%, indicating mixed trader sentiment.

Source: Coinglass

Read TRON (TRX) Price Prediction 2024-25

However, recent data from early November shows a steady increase, with the funding rate consistently holding above 0% and now reaching 0.04% as Tron prices approach $0.2.

This positive and sustainable funding rate suggests that traders are increasingly paying premiums to hold long positions, indicating strong confidence in further price increases.