- Trump seemed to test the key support at $ 23.88, the RSI at 32.79 Conditions for putting in signaling album

- The feeling of the market was cautious because the social volume decreased and the open interest fell by 4.54%

Official Trump (Trump) Maybe on the verge of a rebound because the sequential indicator TD has flashed a purchase signal on the daily graphic. After a prolonged downward trend, this could mark the start of a potential recovery phase.

If the purchase increases, the price can try to recover key resistance levels. However, uncertainty remains as market conditions continue to fluctuate. Will this signal trigger a bullish reversal supported in the coming days?

A controversial debate in progress

The Trump token has sparked animated discussions in the cryptography community, some consider it a bull catalyst and others warning potential instability. On the one hand, its launch has shown growing interest in politicians, which could attract new liquidity in space.

However, criticisms argue that it has emptied capital from more deemed assets, leading to volatility on several markets. At the time of the press, Altcoin was negotiated at $ 24.27, down 5.98% – a sign of feeling of mixed investors.

Trump price action – testing the main levels of support

The price of the same has consolidated in a critical support zone at $ 23.88 – a level that could determine its next major movement. If the bulls manage to push over $ 28.13, an increase to $ 40 could follow, offering traders renewed confidence.

In addition, the relative force index (RSI) was 32.79, which indicates that Trump could approach the territory of occurrence. If the RSI amounts above 37.51 in the short term, the purchase of the momentum could be strengthened, improving the chances of rupture.

Source: tradingView

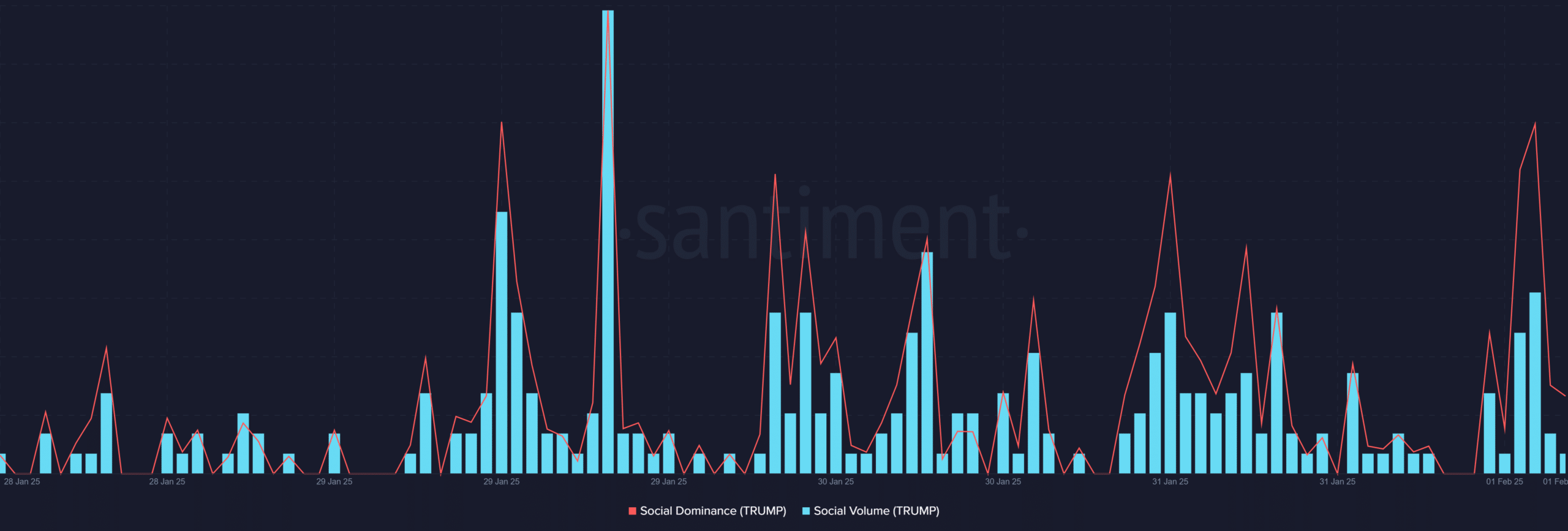

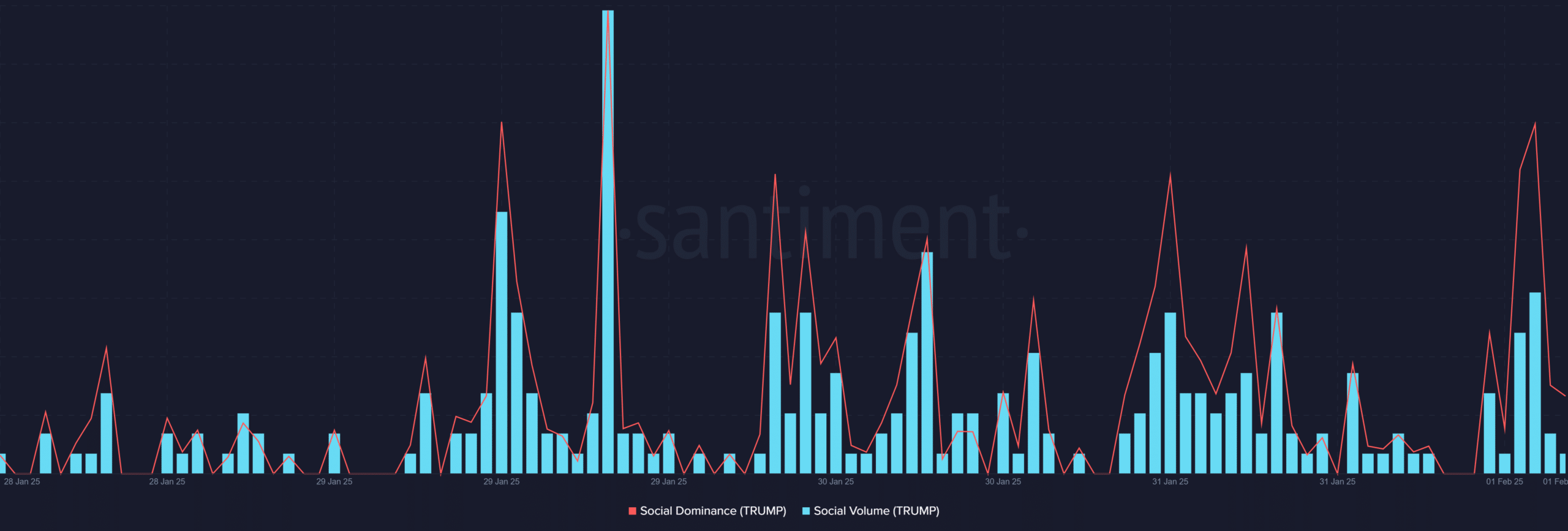

Social volume and dominance of Trump – a discolored media threshing?

While Trump initially gained massive traction, recent data referred to a drop in his social volume and domination. In fact, Santly Analytics revealed that social volume culminated at 2.0 mentions per hour on January 29. However, he has since dropped significantly.

In addition, corporate domination fell to 0.33% – a sign of a drop in traffic discussions surrounding the token. This reduction in media threshing could signify a lower purchase pressure, which makes more difficult for bulls to maintain an upward trend in graphics.

Source: Santiment

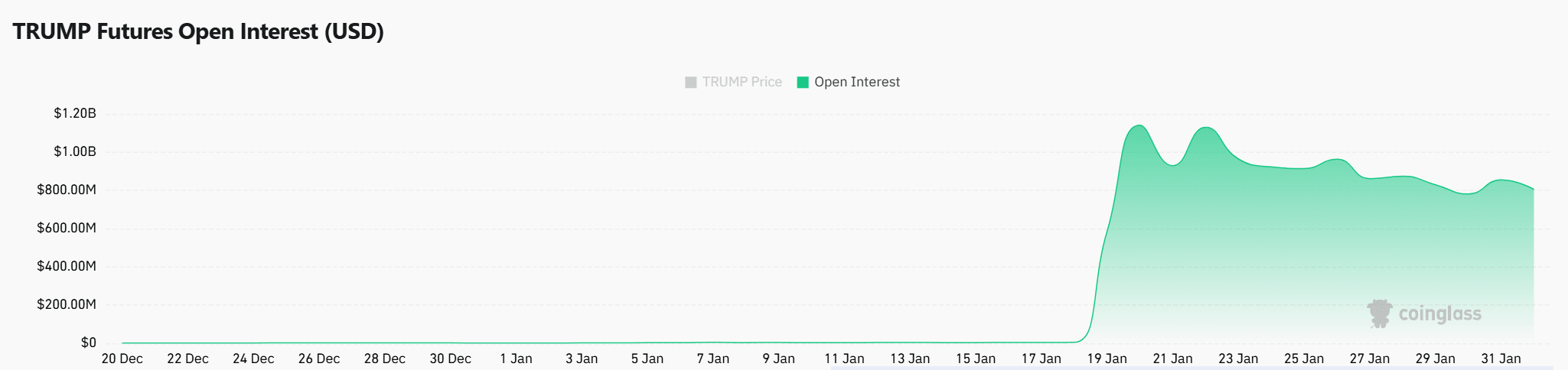

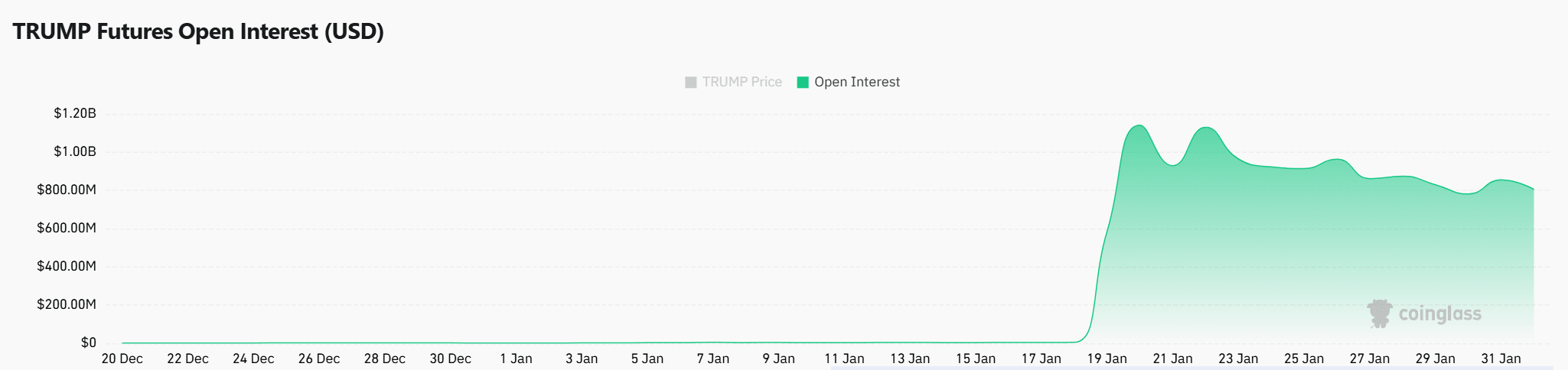

Open interest – Do traders lose confidence?

Open interest dropped by 4.54% to 833.39 million dollars, indicating a traditional reduced activity. As a rule, the increase in open interest means confidence in a potential decision, but the last decline seemed to refer to hesitation.

In addition, this drop could mean that traders close positions, rather than betting on a major price swing. If an open interest continues to drop, it can refer to a risk of decline.

Source: Coringlass

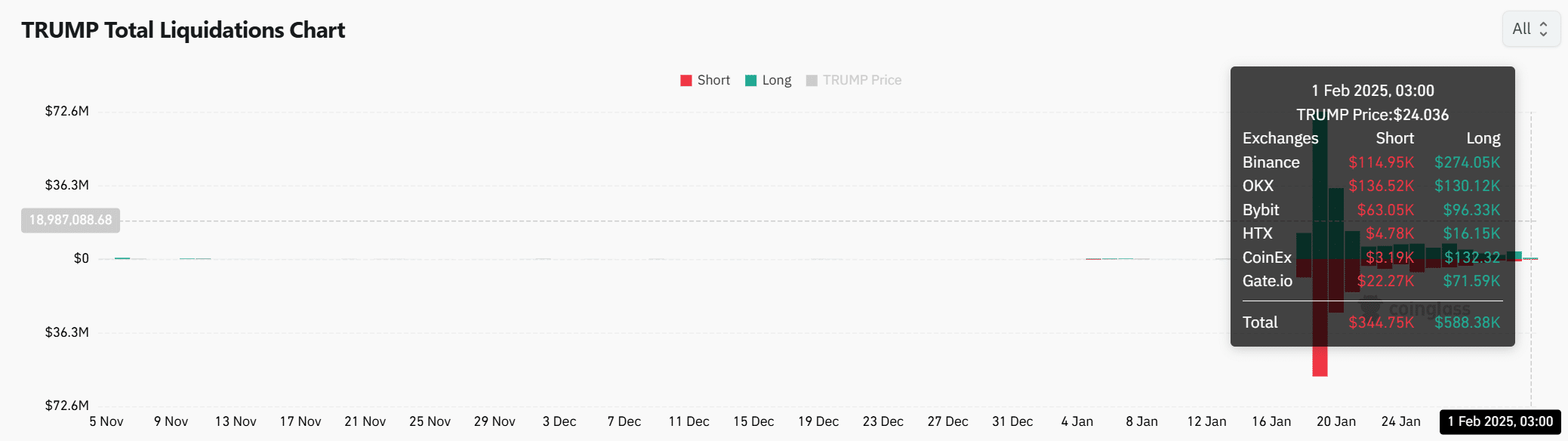

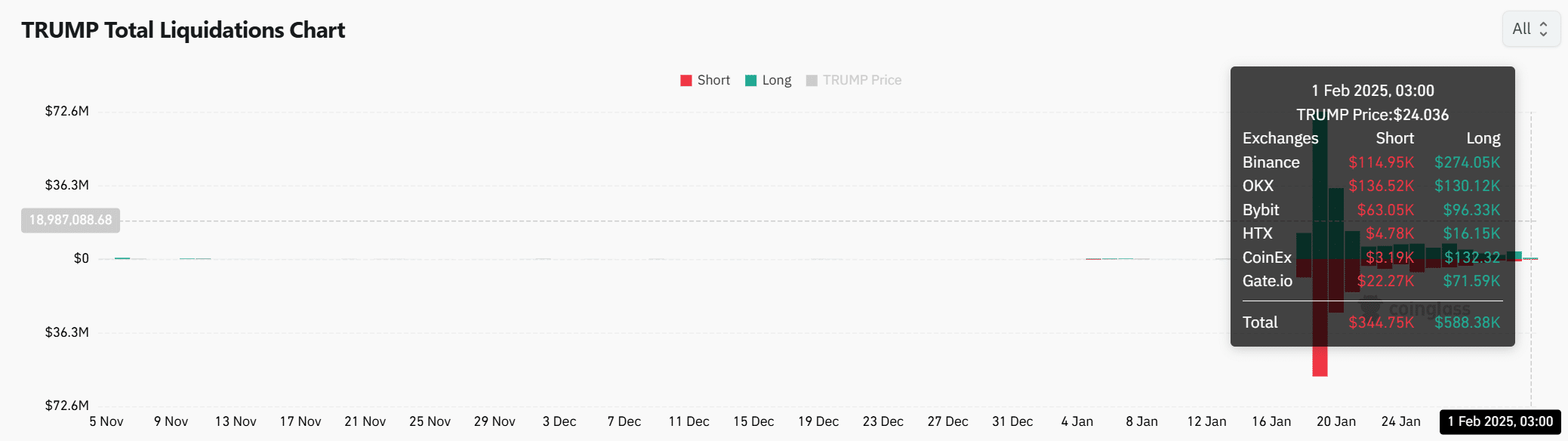

Total liquidations – What do they reveal?

Liquidation data revealed that $ 344.75,000 in short positions and $ 588.38,000 in long positions were wiped out. In simple terms, bulls and bears were faced with challenges as price volatility increased at all levels.

However, if short liquidations intensified, a short pressure could increase the price of Trump on the graphics. Consequently, traders should closely monitor the liquidation trends for the signs of an upcoming escape.

Source: Coringlass

Trump’s price remains at a critical time, where to exceed $ 28.13 could trigger a bullish reversal. On the contrary, non-compliance with support could cause more losses.

Read the prices forecast of Trump (Trump) 2025-26

With a drop in social volume and an open interest, the feeling of the market may seem somewhat cautious. However, if the bullish momentum is built, Trump could recover lost land in the coming days.

For the moment, traders should monitor key levels before confirming a clear trend change.