- Trump’s World Liberty Financial sold only 3.4% of its token $300 million allocation.

- Skepticism surrounds WLF, with concerns over its centralized control and website issues.

Donald Trump’s cryptocurrency business, World Liberty Financial (WLF), has stumbled at the starting line.

Despite high expectations following the token sale announcement on October 15, the project only managed to sell 3.4% of the $300 million in tokens intended to go public.

With its website facing technical difficulties, the WLF token sale, priced at 1.5 cents per token and offering a total of 20 billion tokens, attracted only $10.3 million in sales on the first day.

This lukewarm response has raised questions about the viability of Trump’s crypto initiative and its potential impact on the broader market.

Is Trump’s crypto project an election gimmick?

In fact, just a day before its highly anticipated launch, the World Liberty Financial (WLF) project claimed to have attracted the interest of 100,000 potential users.

However, reality painted a very different picture: Etherscan data revealed that only 6,832 unique wallet addresses actually held WLFI tokens.

The situation worsened when the project’s website crashed shortly after the start of the token sale, rendering it inaccessible for several hours due to too much traffic.

Visitors received a “website under maintenance” message, raising further concerns about the project’s readiness.

Underscoring its ambition, the project’s “gold paper,” released the same day, identified Donald Trump as the “Chief Crypto Advocate,” with his sons – Eric, Barron and Donald Jr. – designated as “Web3 Ambassadors.” .

However, Trump did not take this as a sign of defeat and used X to further promote the token sale.

He said,

“Crypto is the future, let’s embrace this incredible technology and lead the world in the digital economy.”

Crypto community criticizes WLF

However, the crypto community received Trump’s tweet with skepticism, as noted by user X Human, who pointed out several reasons why Trump’s crypto project raises “a number of red flags.”

He said,

“@realDonaldTrump ATTENTION World Liberty Financial smells like a Trump University scam.”

The user then expanded on their concerns, pointing out that WLF presents centralized control while claiming to be decentralized.

He noted that the website is registered anonymously, drawing parallels with Dough Finance, a platform that suffered a $2.1 million hack, among other things.

As expected, the user finally concluded by saying:

“In short, World Liberty Financial is a dubious, high-risk project that presents more danger than promise. Its mix of security risks, hidden agendas, and questionable marketing makes it seem far more like a scam than a credible financial company.

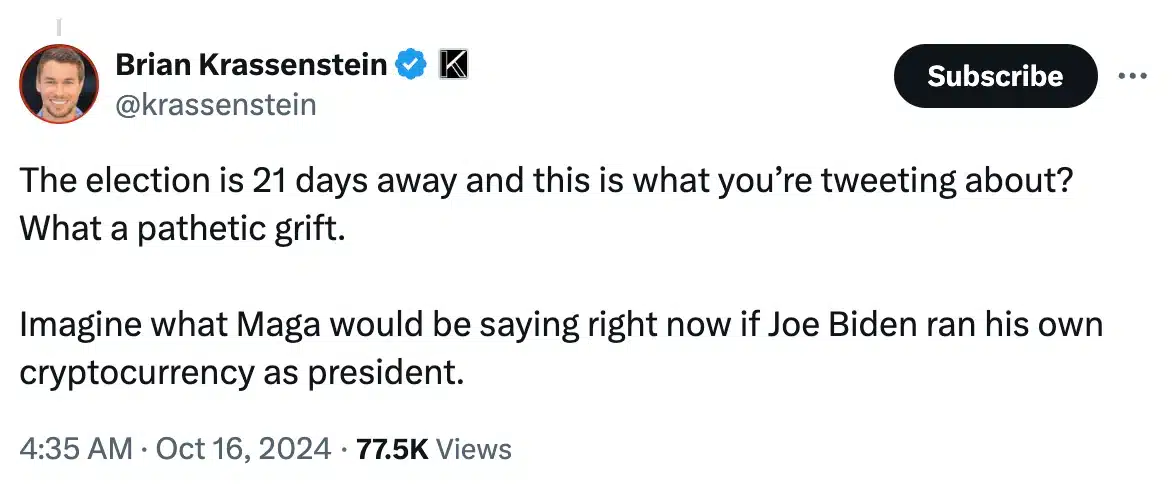

Brian Krassenstein added to the fray:

Source: Brian Krassenstein/X

What’s next for Trump?

Interestingly, this news coincided with Bitcoin trading above $67,000 and Vice President Kamala Harris’ recent launch of her “Opportunity Economy” campaign, which focuses on investor protection black Americans.

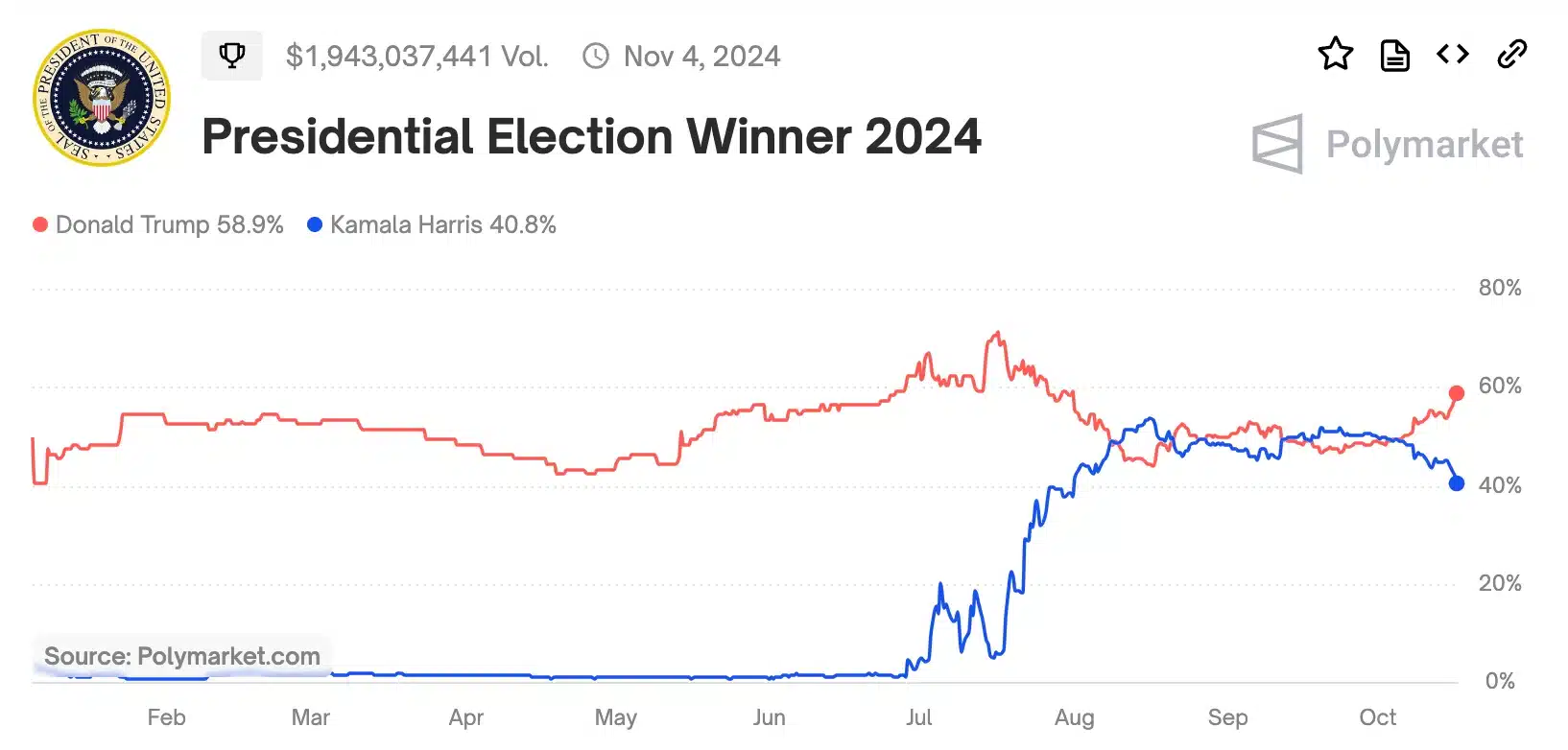

Despite his fall, Trump continues to dominate Polymarket polls, garnering 58.9% of the vote to Harris’ 40.8%.

Source: Polymarché

While Trump-affiliated memecoins are showing positive trends, those inspired by Harris are struggling, reflecting a stark contrast in market performance, as indicated by the top Politifi coins listed on CoinGecko.