Key notes

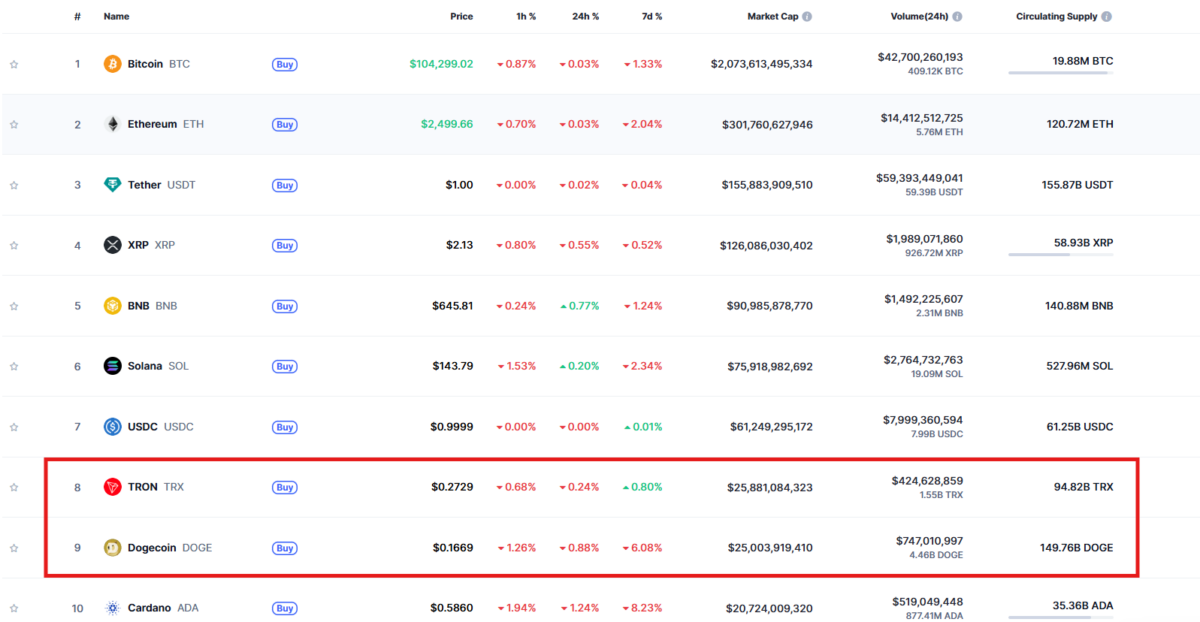

- TRX’s market capitalization reached $ 25.9 billion, positioning it at $ 500 million above the current Dogecoin assessment.

- Tron deals with more than 65% of USDT world transactions with daily volumes reaching $ 3 billion on major discussions.

- Technical analysis shows the consolidation of TRX in a descending triangle model with a potential rupture greater than $ 0,2760.

According to Coingecko, the TRX of Tron has exceeded the eighth digital active in market capitalization.

Trx

$ 0.27

24h volatility:

0.2%

COURTIC CAPESSION:

$ 25.92 B

Flight. 24 hours:

$ 610.84 M

Negotiate at around $ 0.2731 with a market capitalization of $ 25.9 billion, now more than $ 500 million above $ 25.03 billion in Dogecoin.

TRX exceeds DOGE in rank 8 by market capitalization | Source: CoinmarketCap

The rally arrives in the middle of the increase

USDT

$ 1.00

24h volatility:

0.0%

COURTIC CAPESSION:

$ 155.94 B

Flight. 24 hours:

$ 25.16 B

Activity on the network and growing excitation on the next TRON public list via an inverted merger of $ 210 million with SRM Entertainment.

USDT volume and duzz Drive Tron market capitalization gains

TRX has won more than 130% in the past year, while

DOGE

$ 0.16

24h volatility:

5.4%

COURTIC CAPESSION:

$ 24.22 B

Flight. 24 hours:

$ 1.25 B

has dropped by more than 25% in the last month while the interest of the meme continues to fade. The increasing real use cases of Tron, in particular in emerging and developing markets through USDT transfers, strengthen its momentum. According to Cryptochant, Tron deals with more than 65% of the total USDT activity on the channel, Binance with $ 2 billion at $ 3 billion per day.

The DAO Tron stressed that USDT activity is now global, not just focused on the emerging market. Analysts suggest that Tron’s infrastructure could compete with traditional payment networks in regions like Latin America. Meanwhile, DOGE is faced with a drop of more than 80% of the weekly trading volume, reporting that investors are moving to projects based on public services such as TRON.

USDT on #Tron is at the level of both ends of the global financial spectrum. 🌐

Over 662,000 daily transactions of less than $ 100 and 25,000 more than $ 100,000.

A network designed for daily users and institutions.

Learn more about @coinmetrics ⤵️

– Dao tron (@trondao) June 17, 2025

Will Tron maintain rank No. 8 when the Doge outings continue?

As indicated in our previous coverage, Dogecoin experienced a sharp increase in exchange outings this week, suggesting that investors are making profits or run in other assets.

This change of feeling can be fueled by TRX, but the question remains whether tron can hold its position in n ° 8 in the midst of the volatility phases of the market and potential reactors.

The TRX triangle structure approaches resolution

Tron price forecast | Source: tradingView

On the 4 -hour graphic, TRX is consolidated inside a descending triangle with a support at $ 0.2670 and a resistance pressure from above. The price share compressed almost $ 0.2732, and the traders ensure a break greater than $ 0.2760 or a failure of $ 0.2650 for directional confirmation.

Momentum indicators suggest increasing upward pressure. The RSI is around 48.10 and displays an early upward divergence, while MacD is flat but leaning positive. These signals reflect a progressive accumulation as the bears weaken.

TRX continues to maintain higher stockings on the daily graphic, now a long -term diagonal rise trend. The key support is between $ 0.2535 and $ 0.2620. A successful decision above $ 0.2,950 could be upwards to $ 0.3,250 and $ 0.3,545 on the basis of the weekly Fibonacci levels.

The success of Tron highlights the potential for challenge at an early stage of Solaxy

The momentum reflects a wider change towards assets with real utility. For those who explore the potential at an early stage, Solaxy attracts great attention.

Positioned as Solana’s first layer-2 chain, Solaxy mixes a high scalability breeding with web3 innovation, offering an environmentally friendly infrastructure and an enriching tokenomic designed for the next generation of decentralized finances.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Parshwa Turakkhiya is a qualified financial writer with solid experience in the coverage of crypto, forex, stock markets and global finances. By emphasizing the translation of complex financial subjects with clear and usable information, it creates content adapted to professional and retail investors.

Parshwa Turakkhiya on Linkedin