Two crypto companies, dYdX and ConsenSys, have announced a new round of layoffs. What is happening and why are US regulators being blamed?

Antonio Juliano, CEO of decentralized derivatives exchange dYdX, announced a 35% layoff. He thanked former employees for their work and explained the layoffs as the need to “revitalize” the exchange since, in its current form, it is “different from the company dYdX needs to be.”

“I have seen this time and time again and it will continue. What we’re building is bigger than just a company, and you’ll always be a part of it.

Notably, the layoffs at dYdX came shortly after ConsenSys reduced its workforce by 20%. Joseph Lubin, CEO of ConsenSys, cited unfavorable macroeconomic conditions, uncertainty regarding crypto regulation in the United States, and the cost of a legal battle with the Securities and Exchange Commission (SEC).

At the same time, Lubin described the company’s financial situation as stable.

According to him, ConsenSys will focus on its core revenue drivers, which is in line with its previously adopted strategy. The company’s flagship products MetaMask and Linea, the second layer Ethereum network, will serve as the basis for further development.

Additionally, the ConsenSys CEO said laid-off employees will receive support after leaving the company, including severance pay based on seniority, assistance with future employment and expanded health benefits. .

Lubin also told Fortune that the layoffs would affect approximately 162 of the 828 employees working across all of Consensys’ divisions. Now, ConsenSys has now become the leader in layoffs in 2024, according to layoffs.fyi.

Why is the SEC guilty of all the worst again?

In the termination statement, Lubin cited the SEC as one of the reasons he would downsize. In June, the regulator sued the developer of the MetaMask wallet, pointing out that the company had violated the law through the MetaMask Staking service.

The lawsuit comes shortly after ConsenSys filed a lawsuit against the SEC and five of its unnamed employees over its “ETH oversight,” asking the court to formally approve language that would not classify the asset like a title.

As a result, the SEC’s Division of Enforcement has closed its investigation into Ethereum 2.0. The agency took this action after the organization sent a letter requesting clarification on the asset class when approving the Ethereum spot ETF. However, the lawsuit over the SEC’s allegations is ongoing, leaving ConsenSys facing legal costs.

Layoffs come at a time when the market is bucking trends

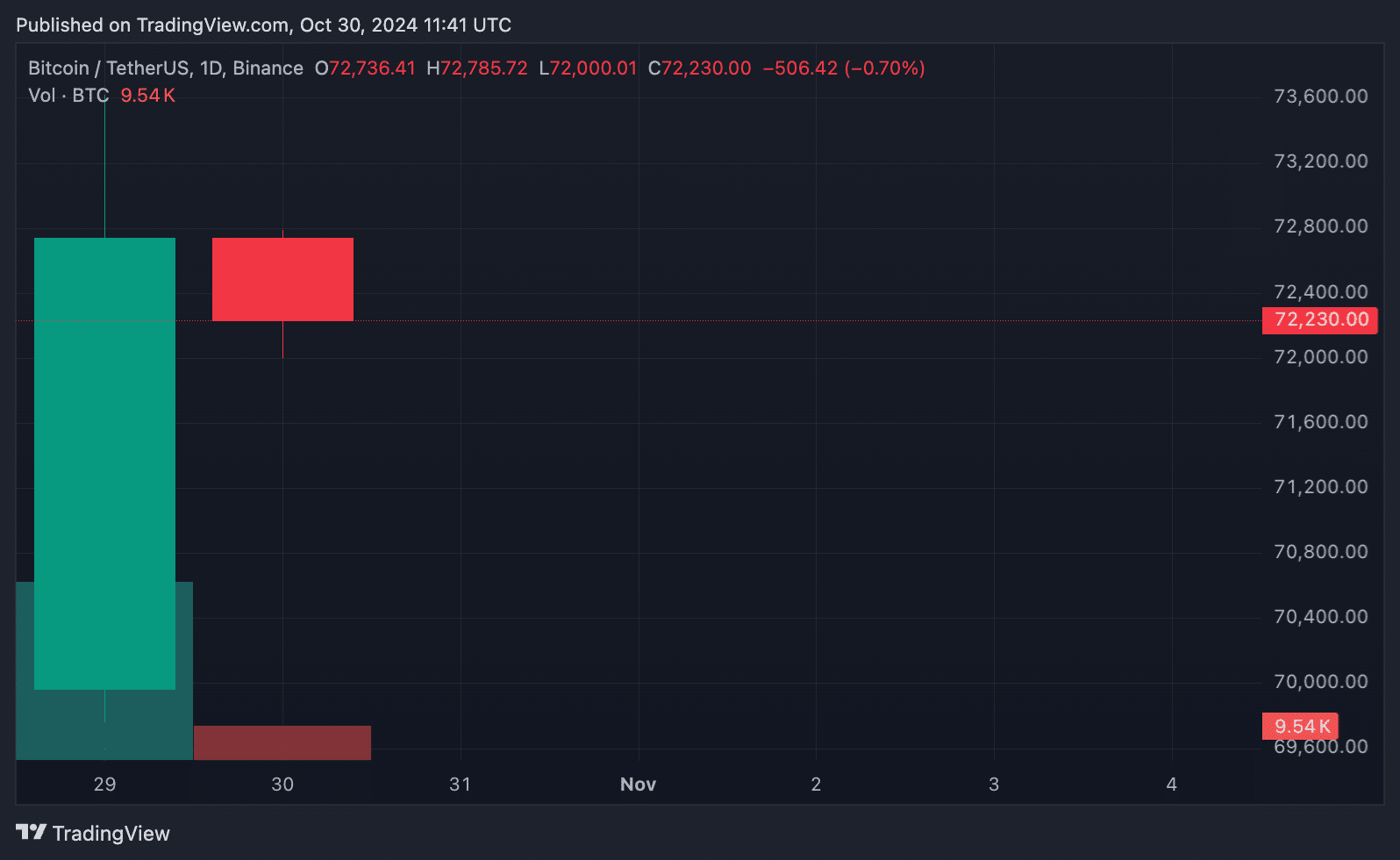

Notably, the crypto market was booming at the time of the layoff announcement, which is generally considered good timing for crypto companies. Thus, on October 29, the price of Bitcoin (BTC) rose from $70,000 to just over $73,600, approaching the historic maximum of $73,777. Since the start of the month, the value of the cryptocurrency has increased by 12%. Analysts link this trend to predictions for the US presidential election.

Interestingly, the growth of Bitcoin is also explained by the situation in the United States, which the CEO of ConsenSys had already complained about, explaining the layoffs.

The growth in the price of Bitcoin is due to several factors. In particular, interest in Bitcoin ETFs from large firms such as BlackRock is increasing, attracting significant investments. Recently, the United States saw an influx of $2.7 billion into Bitcoin ETFs, which helped attract new investors and increase the price.

Additionally, the desire to protect against inflation has a significant impact on the market. Faced with a weakening dollar and rising inflation, many investors are turning to limited assets such as Bitcoin to preserve their savings.

dYdX reduces its workforce while its competitors gain momentum

Since the start of the year, the crypto market has been recovering from a long crypto winter, with many exchanges accelerating their growth. According to Bloomberg, Crypto.com, Binance, Coinbase, Gemini and Kraken are hiring as cryptocurrencies like Bitcoin rise, but not dYdX.

In announcing the staff reduction, Juliano mentioned that in its current form the exchange is different from what it should be, without specifying what exactly he meant. However, continued development will require human capital capable of relaunching the platform. Therefore, announcing a 35% staff reduction against a backdrop of crypto exchanges trying to make the most of the current rally seems illogical to say the least, but Juliano is hardly worried about FOMO.

How have the dynamics of layoffs in the crypto industry changed?

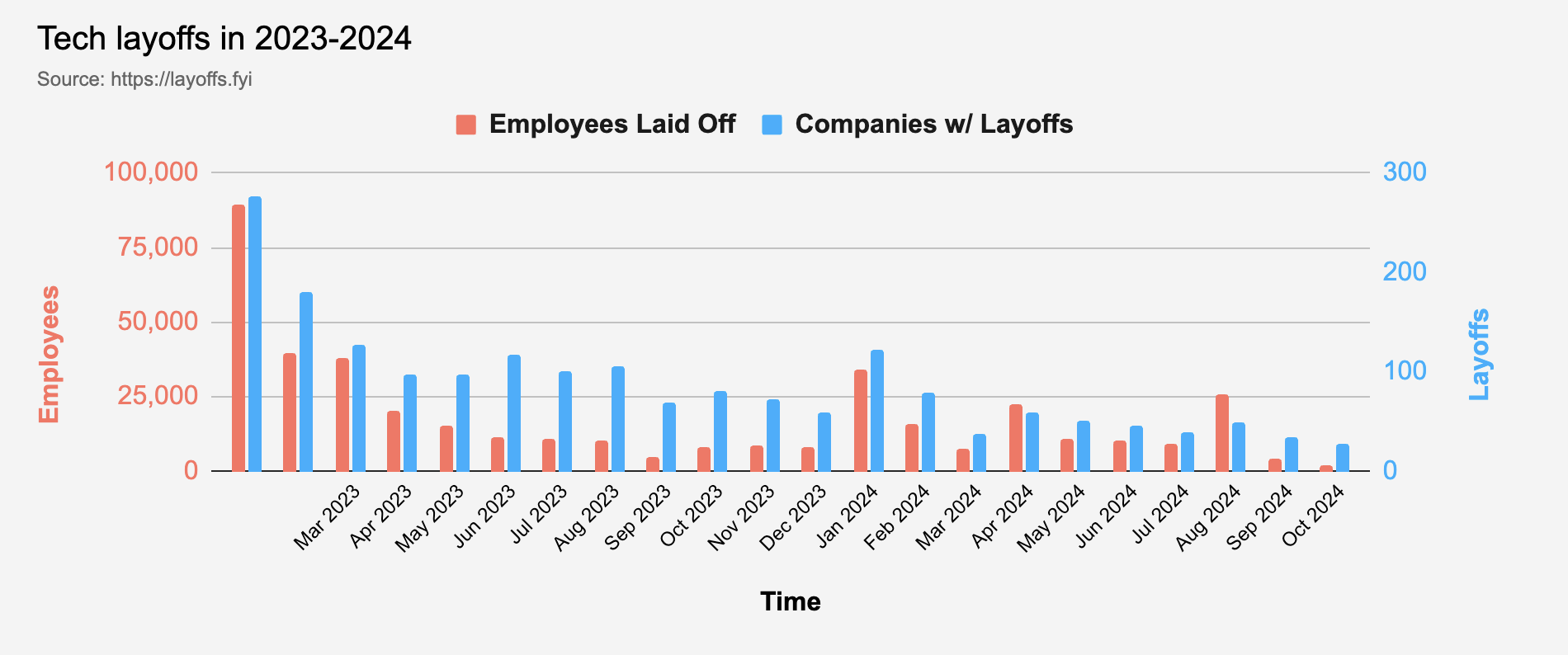

According to layoffs.fyi, the first quarter of 2023 was the peak of layoffs since 2020, when more than 167,000 employees lost their jobs. However, in 2024, the situation looks much better: the peak of layoffs took place in the first quarter, with 57,000 employees losing their jobs. There were even fewer layoffs in the second and third quarters – 43,000 and 38,000, respectively.

Thus, the story of dYdX and ConsenSys has become more of an exception to the rule than a typical trend for 2024. After massive layoffs in 2022 and 2023, the blockchain job market appears to be recovering.