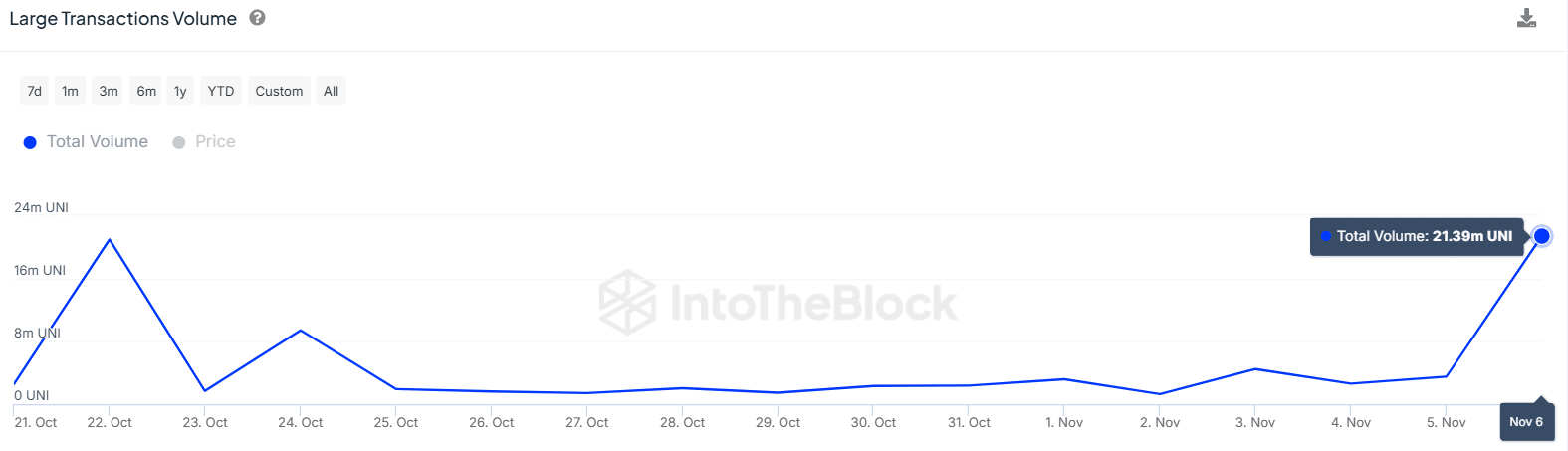

- Uniswap whale activity increased as large transaction volumes increased from 3.05 million to 21.39 million.

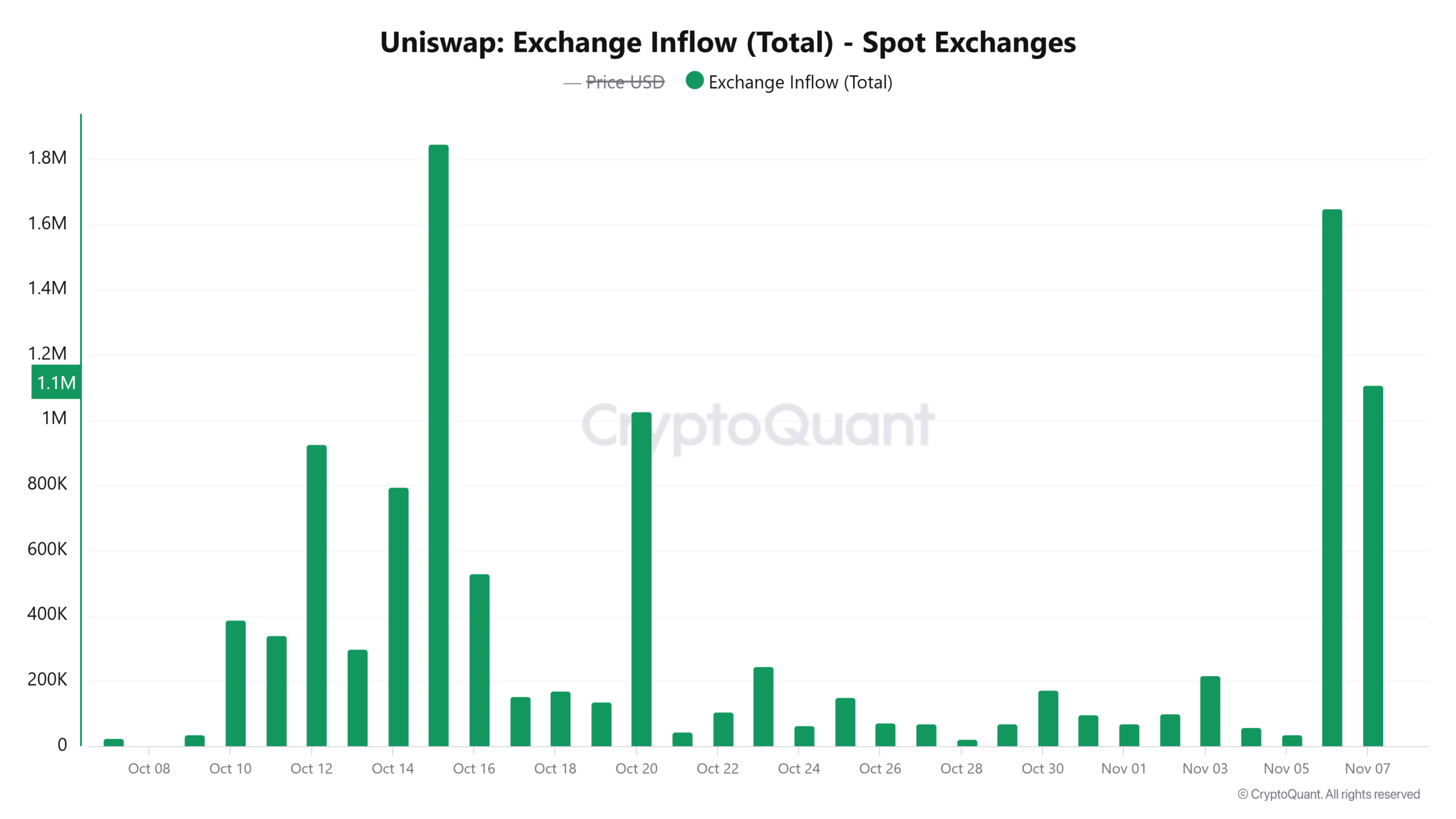

- UNI’s rally to a 4-month high came to a halt after more than 9 million UNI were deposited on exchanges, increasing selling pressure.

Uniswap (UNI) has seen a massive spike in volatility over the past 24 hours, with the price hovering between $8.83 and $9.63. This volatility has occurred against a backdrop of increased whale activity.

Data from IntoTheBlock showed that in 24 hours, large trading volumes exceeding $100,000 increased from 3.05 million to 21.39 million. This represents an increase of more than 500%.

Source: In the block

If these large traders were buying, it likely would have been the cause of the recent rise. For the uninitiated, whales make up 51% of UNI’s circulating supply, while retail only makes up 16%.

Therefore, when whale trading increases, it is bound to have an impact on volatility.

Is Uniswap Ready for a 30% Rally?

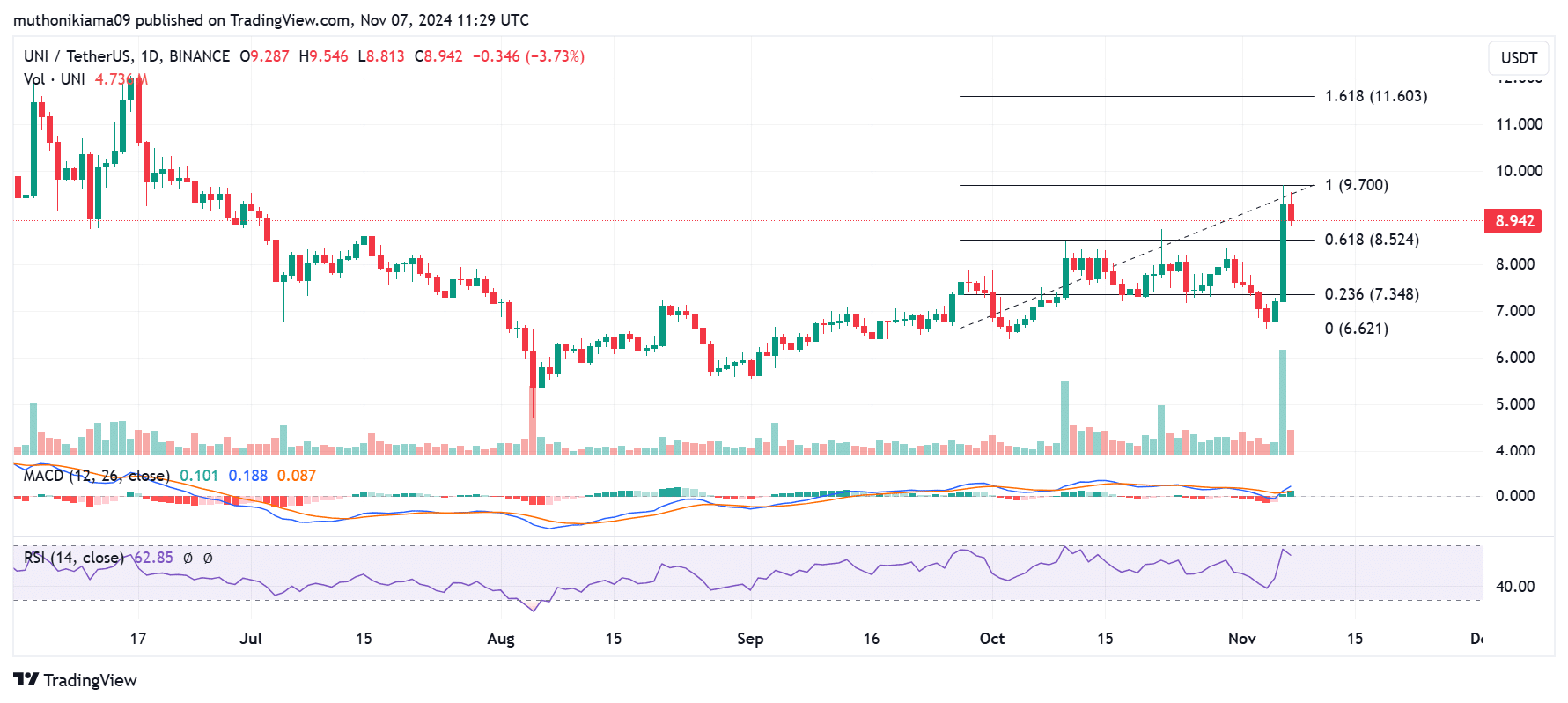

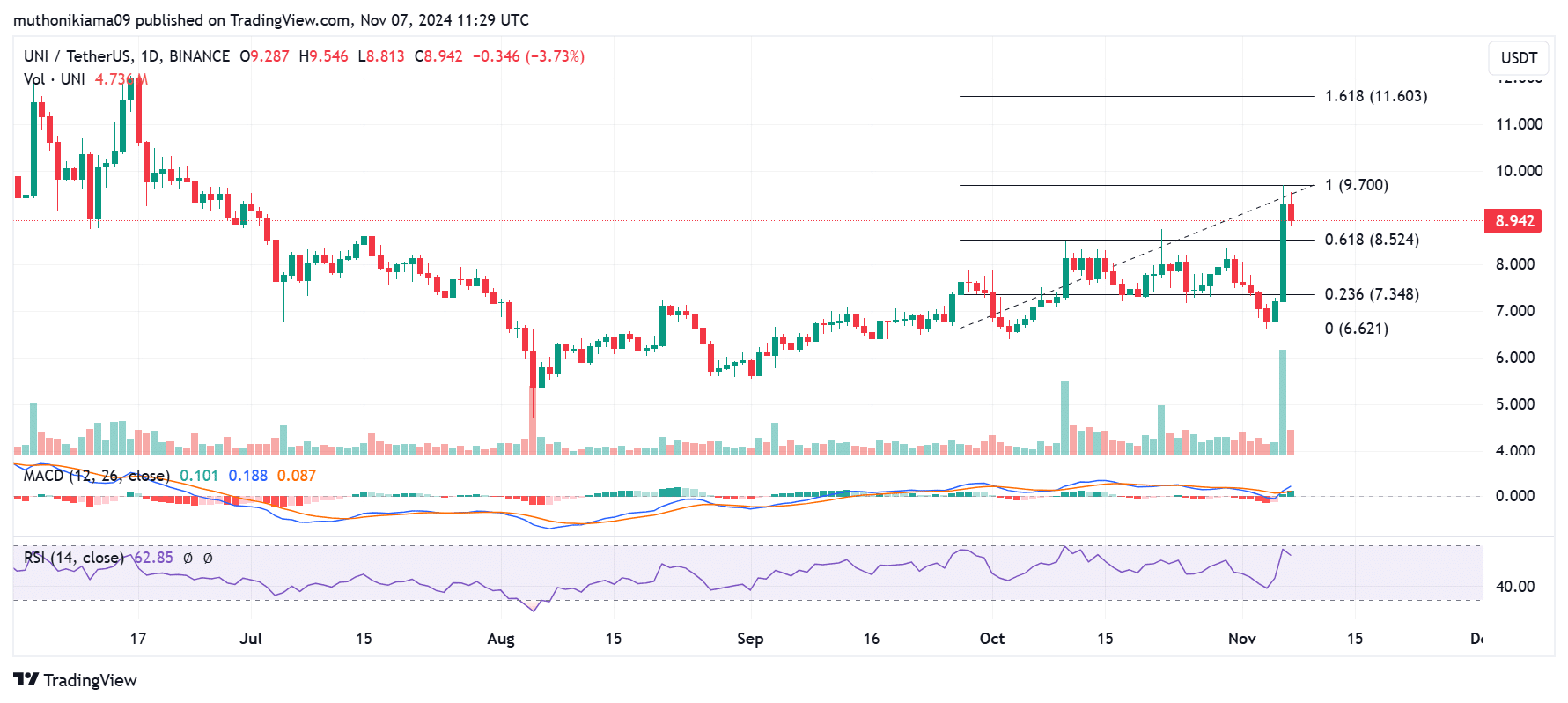

UNI was trading at $8.93 at press time. The recent rally stalled due to buyer exhaustion after the price hit a 4-month high of $9.63.

The volume histogram bars on the daily chart showed that buying pressure was significantly high. The Relative Strength Index (RSI) also rose to 62, suggesting that buyers were behind the bullish momentum.

Source: TradingView

Despite the price retracement, the Moving Average Convergence Divergence (MACD) showed that the bulls remained in control. The MACD line has turned positive next to the histogram bars.

For Uniswap’s uptrend to continue, it needs more buyer support. This could trigger a 30% rally towards the next resistance at the 1.618 Fibonacci level ($11.60).

However, if there is no further increase in buying activity, the uptrend will weaken. Traders should pay attention to support at $7.34, as a decline below could fuel the downtrend.

Profit-taking presents headwinds

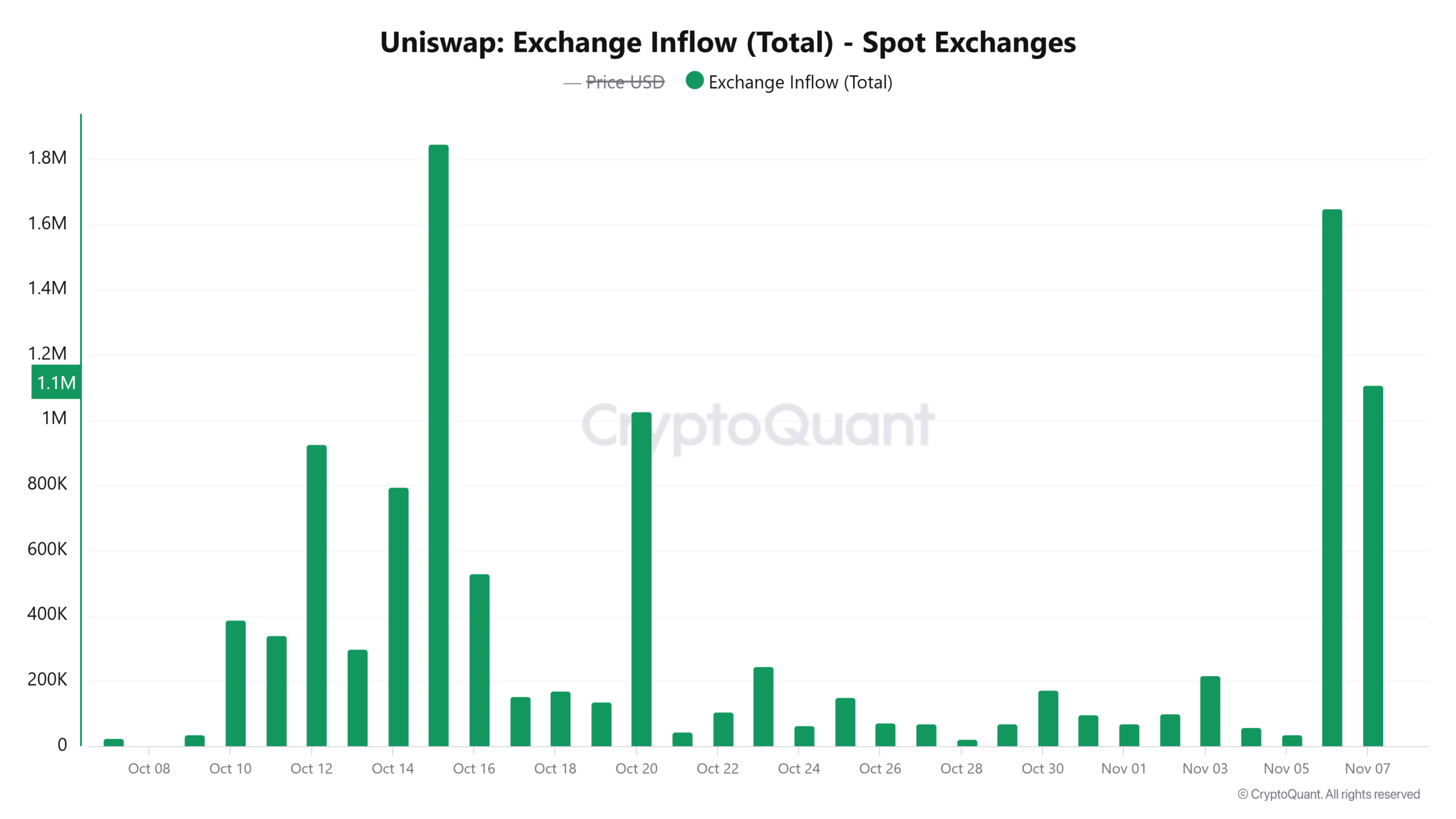

Sellers were currently in a position to trigger a resumption of downtrends. Exchange inflow data from CryptoQuant showed that over the past two days, traders sent over 9 million UNI tokens to exchanges.

Source: CryptoQuant

When traders deposit their tokens on spot exchanges, it shows that they are preparing to sell, which could prevent further gains.

However, deposits on derivatives exchanges have also increased. This could cause a spike in volatility if traders increase their open positions on UNI.

Read Uniswap (UNI) Price Forecast 2024-2025

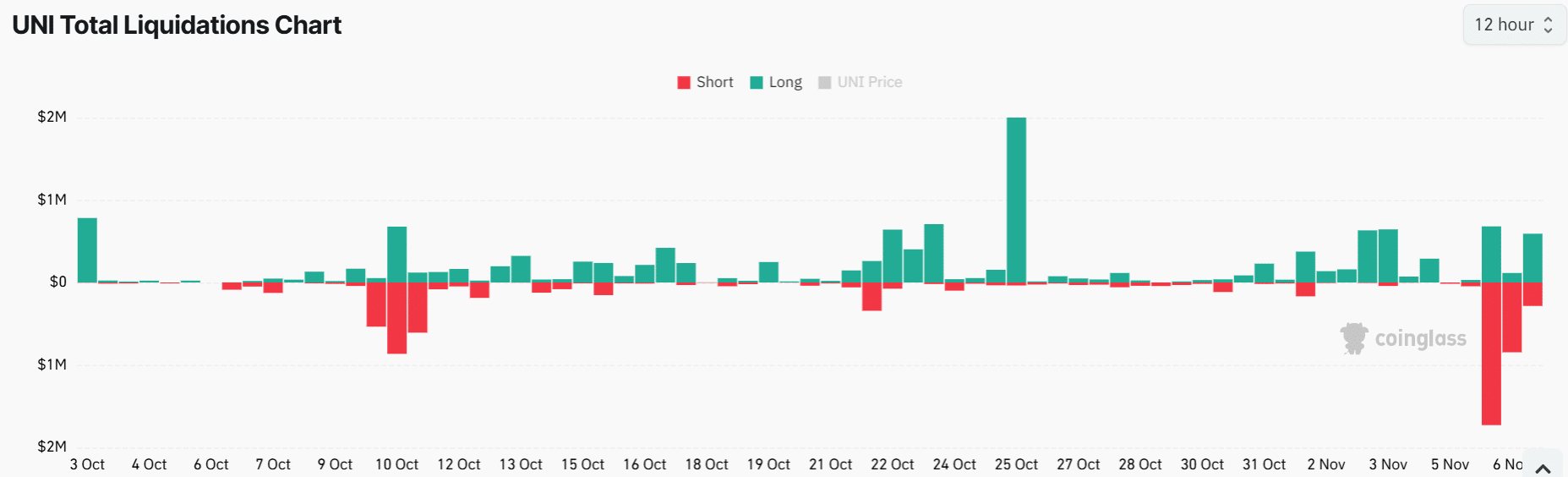

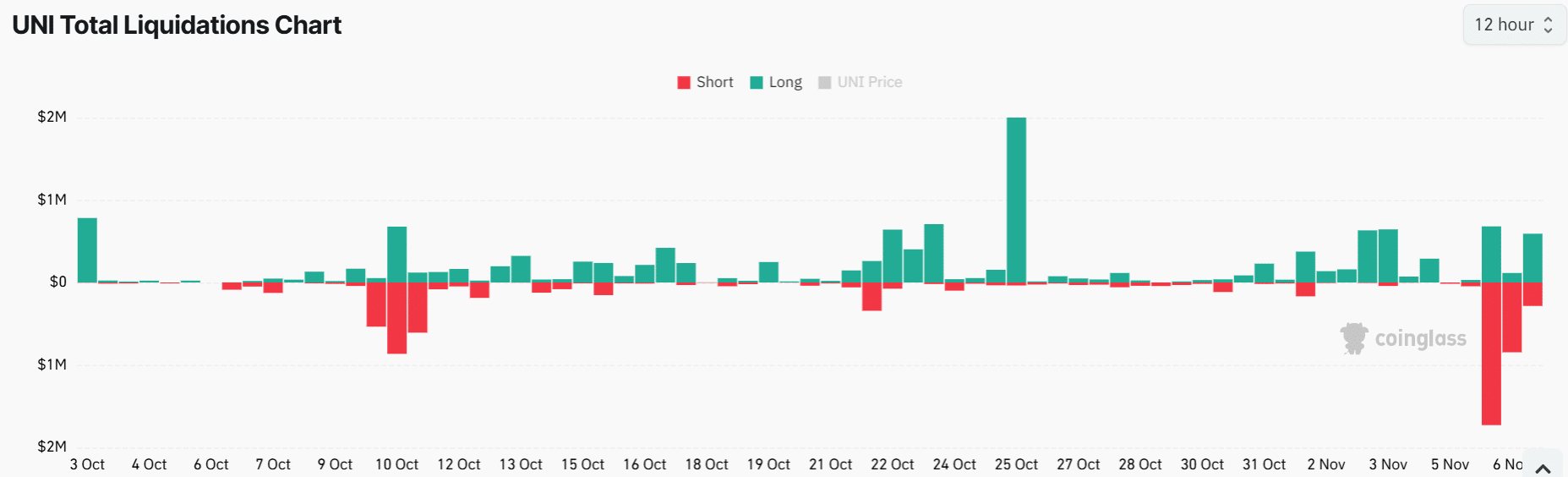

In the derivatives market, there has been an increase in forced liquidations of open short positions. Data from coin mechanism shows that in less than 48 hours, more than $2.8 million in UNI short positions were liquidated.

Source: Coinglass

Short liquidations tend to stimulate buying activity, as short sellers are forced by buyers to close their positions. If the renewed bullish sentiment around UNI causes more forced liquidations, the altcoin could trend higher.