- Ethers Ethereum has recorded $ 10 million, bringing total outings in the past two days to $ 100 million

- Is the drop in yield CME ETH behind the continuous outings?

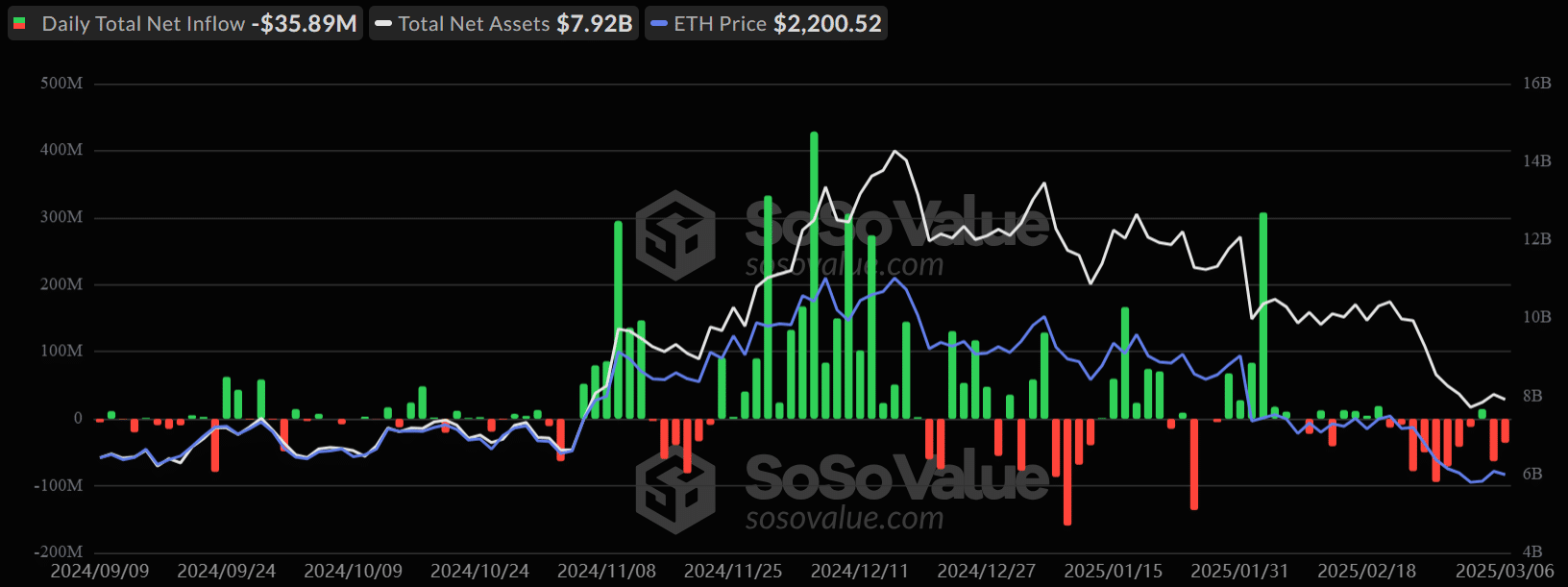

The United States Ethereum (ETH) ETFs recorded $ 35.89 million out of a day on March 6, marking the second day of bleeding. The feeling of renewed risk followed a brief break on Tuesday, after consecutive outings of 8 days.

Source: Soso value

Overall, ETH ETF investors have withdrawn from more than $ 400 million from the product in the past two weeks.

This was clearly different from the stable entries observed in early February. Especially since the rout of the market deepened in the middle of the current Trump wars.

ETH CME yield drops

In February, ETH ETH experienced relatively higher entries than the BTC ETF – an analyst from the Coinbase base related to an irresistible high yield from the basic trade CME ETH.

For strangers, trade implies that institutions buy an ETH spot and opening up a short term corresponding to term contracts on CME to pocket the price difference (yield).

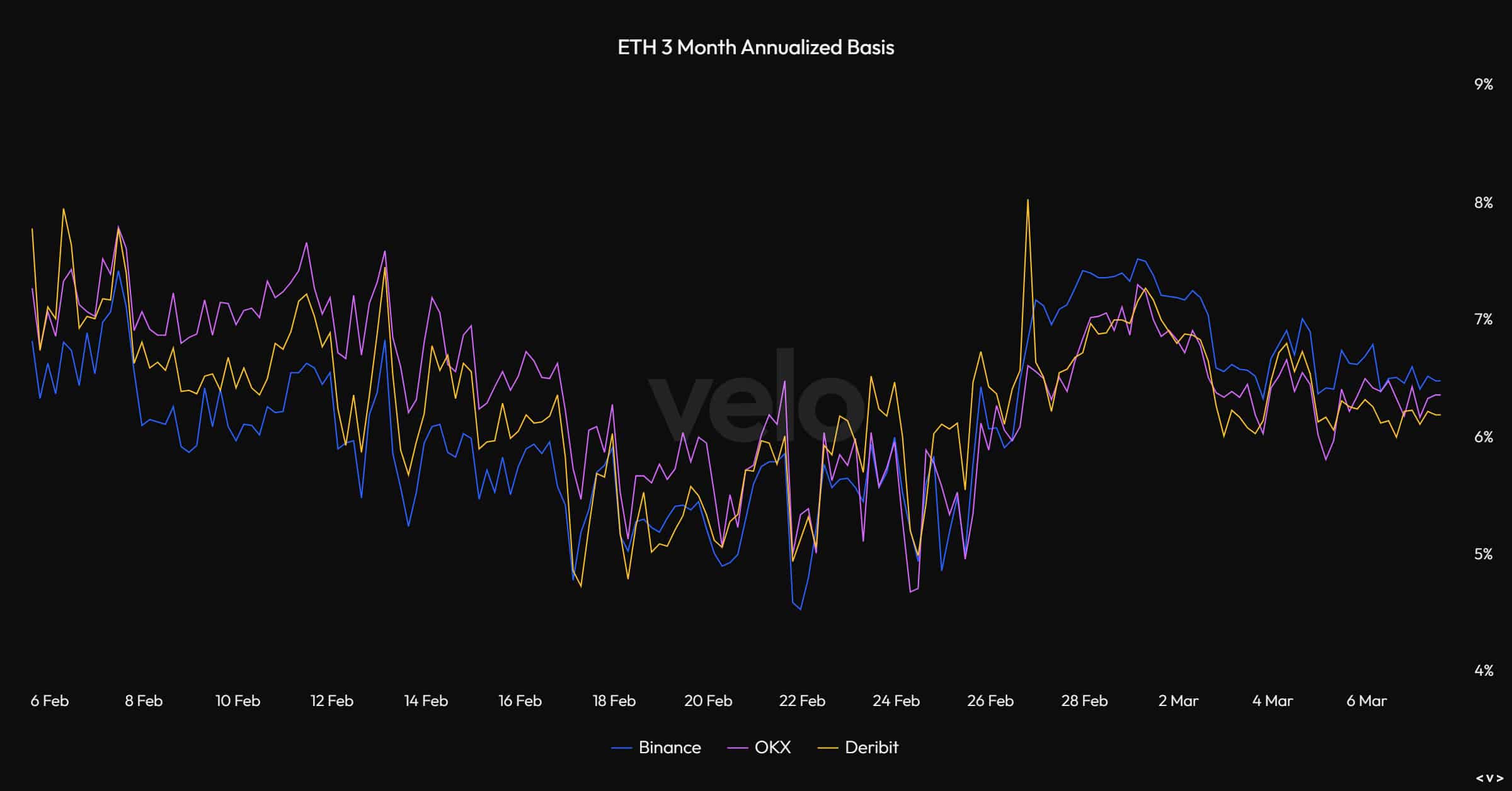

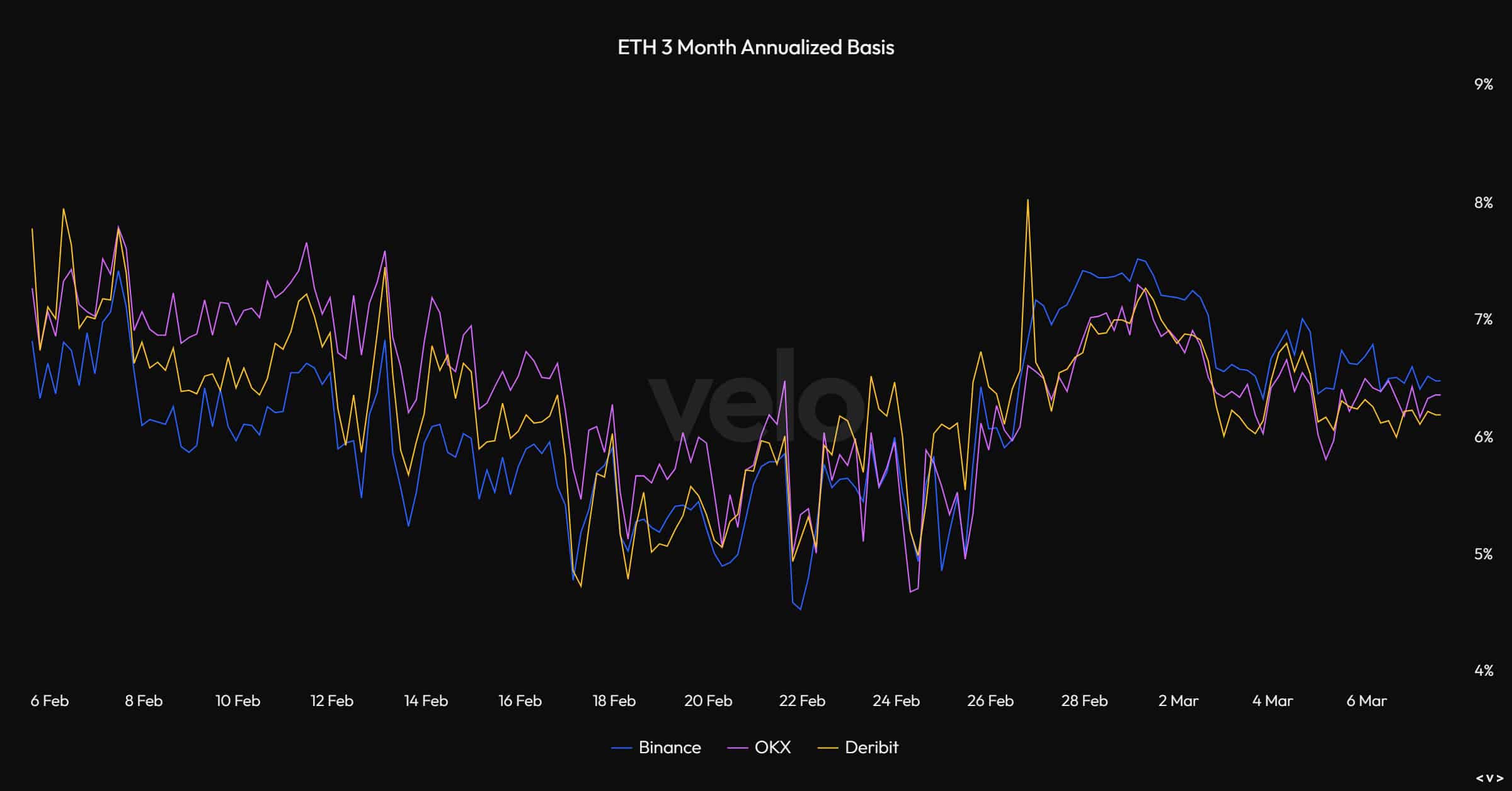

Source: Velo

According to Velo, ETH yield increased to 8% towards the end of February and was marked by strong ETH ETF flows.

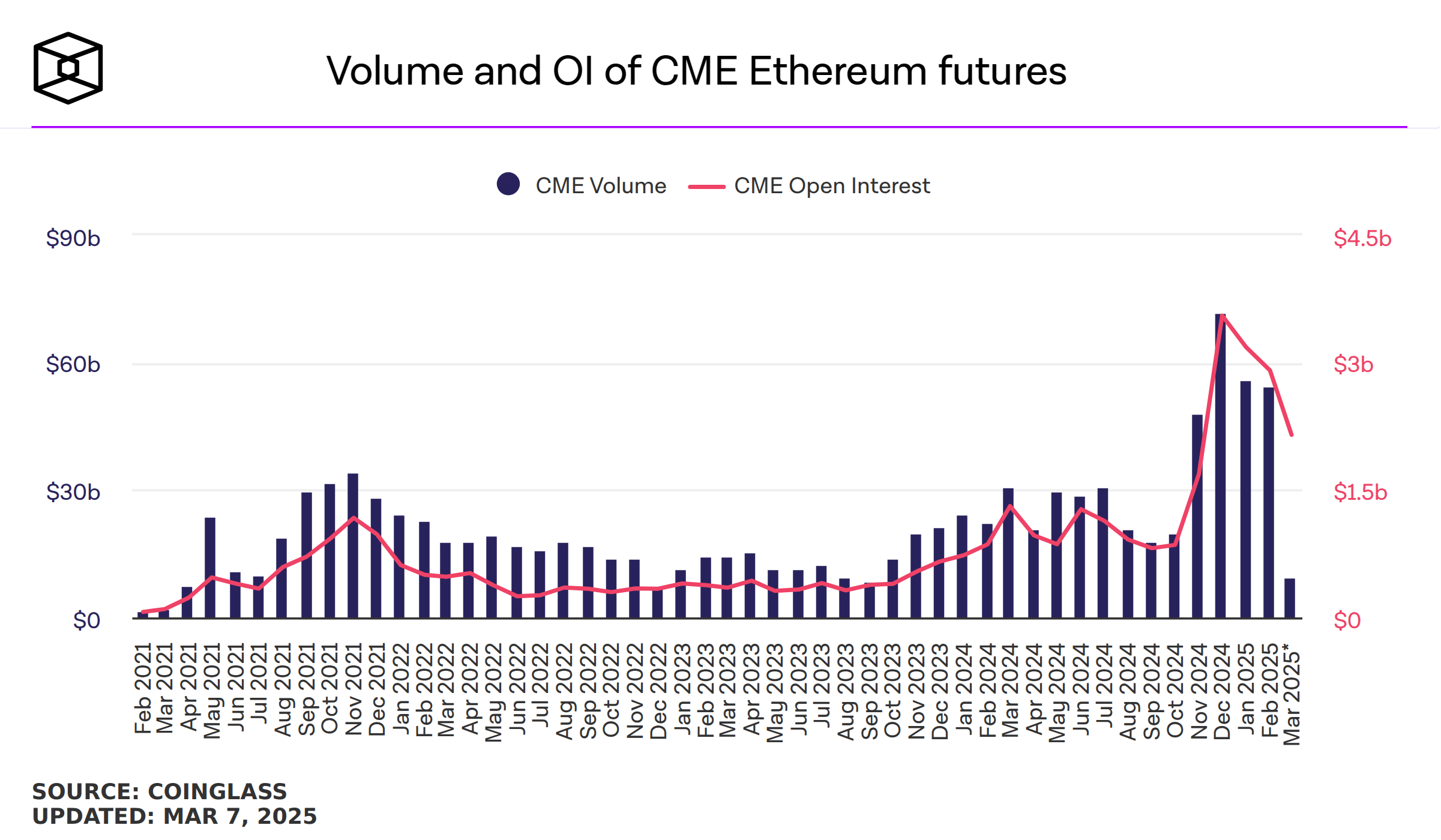

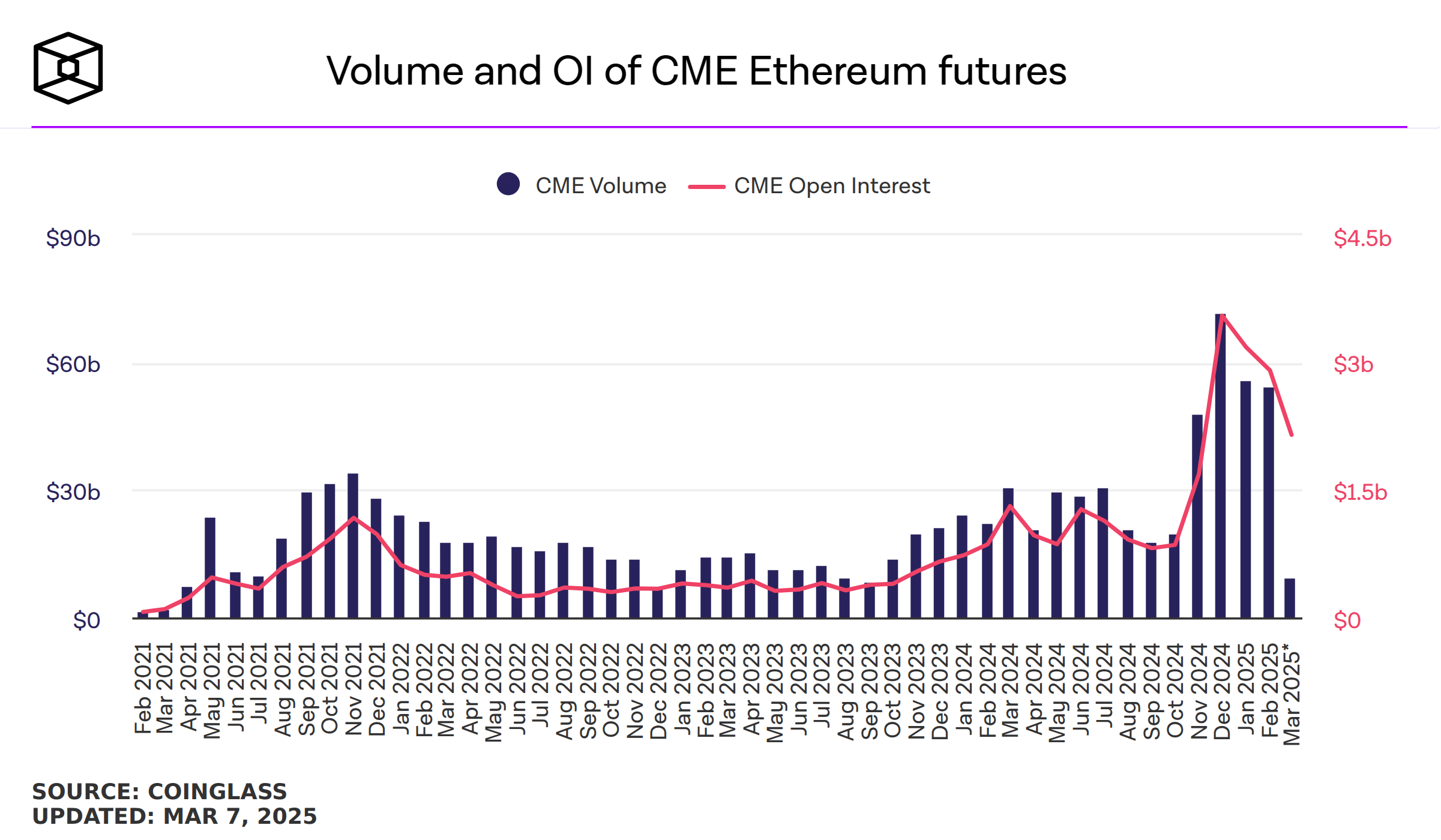

In March, however, the yield fell to 6%. This could work on appetite for transport trade and ETH FNB. In fact, the idea was also reinforced by the interest rate open to the term CME (OI).

The ON decreased regularly in 2025, going from $ 3.18 billion in January to $ 2.15 billion in March, suggesting slight fence positions for relaxing or transportation players.

Source: the block

However, the broader feeling of the market has not improved things for King Altcoin. As such, the downward risk of Altcoin could remain in freedom.

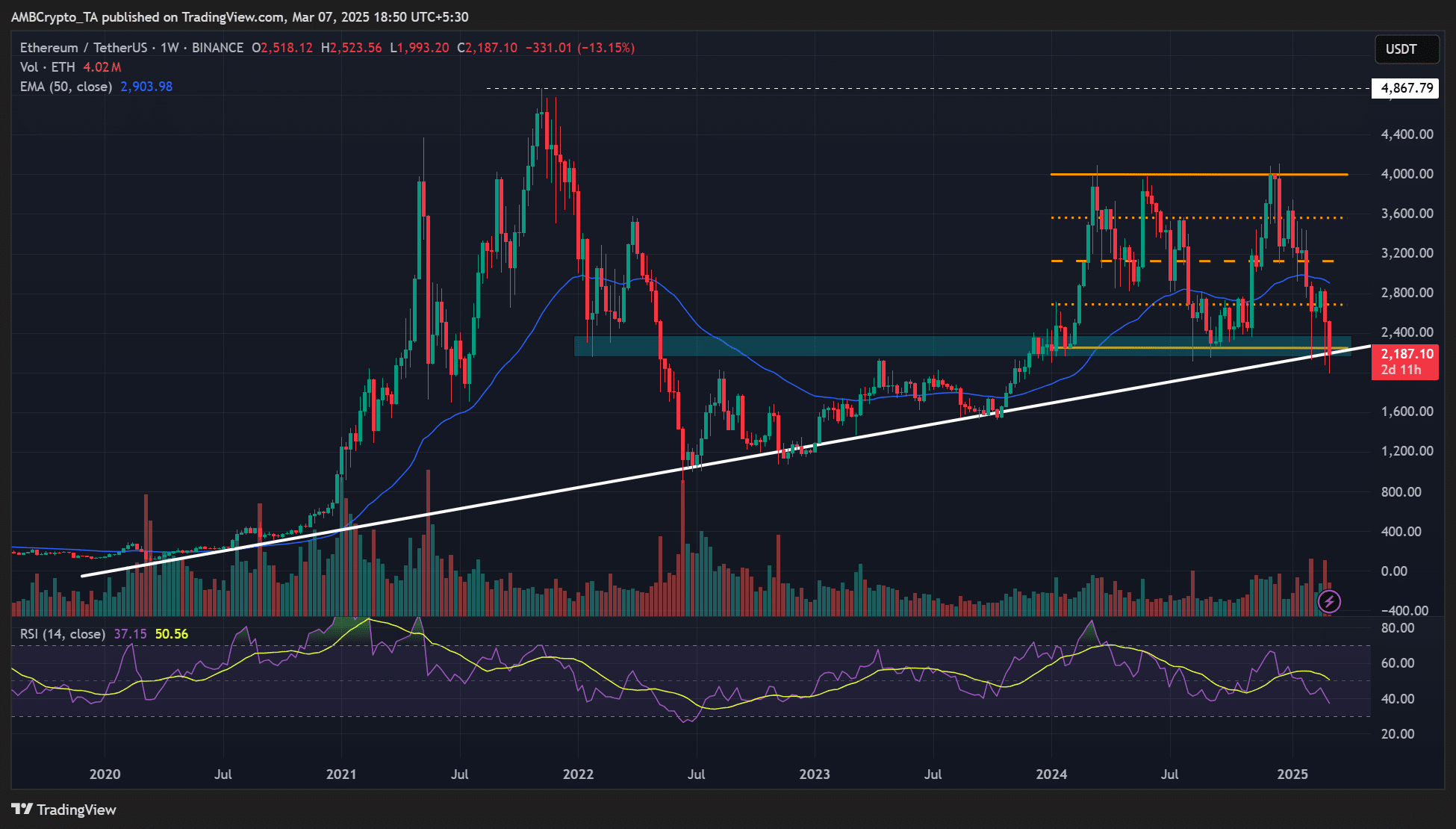

From a technical point of view, the ETH seemed to be at a pivot intersection of the management of the trend lines in the range and in the long term greater than $ 2,000. A violation below the level could modify the structure of the higher calendar market and the interest of merchants for Altcoin.

Source: ETH / USDT, tradingView