- Virtuals Protocol (VIRTUAL) gained 42% in 24 hours after listing on the Bithumb exchange.

- Open interest also increased by 90% despite an increase in short liquidations.

Virtuals Protocol (VIRTUAL) reached a new all-time high of $1.42 on November 29. At press time, the artificial intelligence (AI) cryptocurrency had retreated slightly to trade at $1.29, with gains of 42% over 24 hours. Its market capitalization also jumped to $1.28 billion.

Data from CoinMarketCap shows that in 24 hours, VIRTUAL’s trading volumes increased by over 100% to $166 million. These volumes were likely driven by the altcoin registration on the Bithumb exchange, where it will be open for trading with Korean won trading pairs.

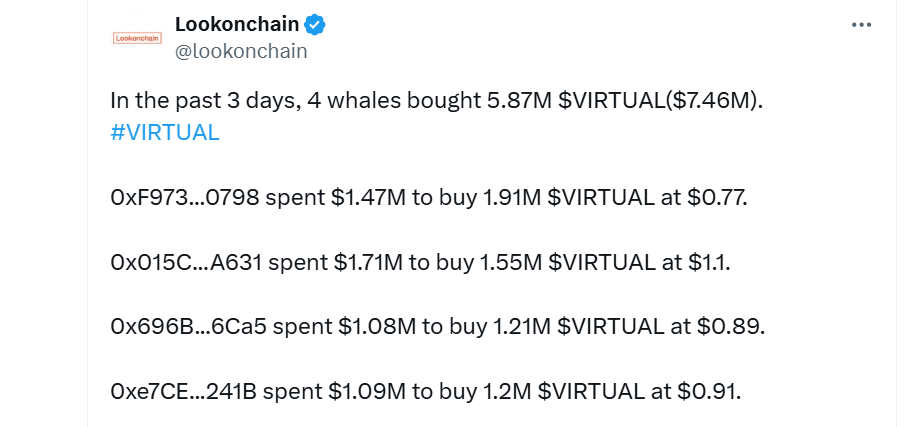

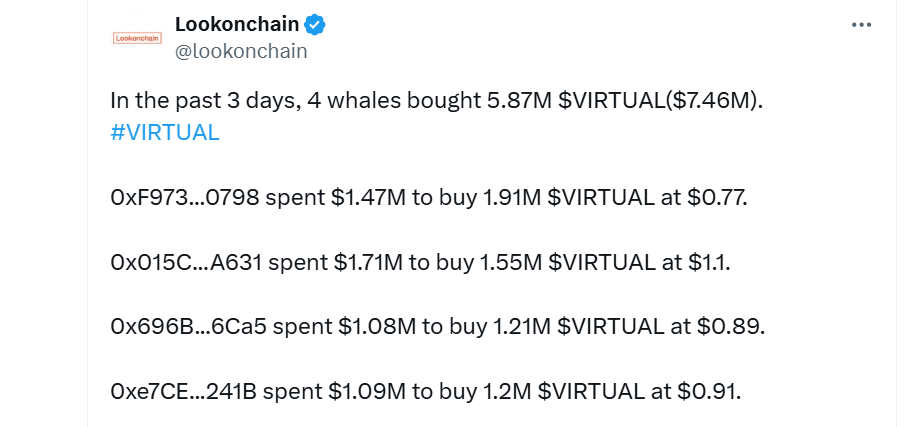

Whale interest in VIRTUAL has also increased over the past four days. According to Lookonchain, four whale addresses purchased 5.87 million tokens over the past three days.

Source:

As VIRTUAL outperforms the broader cryptocurrency market amid increasing whale activity and trading volumes, will the altcoin maintain the bullish momentum or will the trend reverse?

Technical indicators show strong bullish signs

The four-hour chart of VIRTUAL crypto shows the bullish trends strengthening with the positive Directional Indicator (DI) trending above the negative ID.

The wide gap between the positive ID and negative ID along with the rising Average Directional Index (ADX) further shows that the uptrend is strong.

Source: Tradingview

The Money Flow Index (MFI) at 85 further shows that buying pressure is intense and VIRTUAL may have reached overbought levels. Traders should be wary of a decline in MFI, as this would indicate that sellers are entering the market to take profits.

If buying activity continues, VIRTUAL could likely reverse its previous ATH and reach new highs. Conversely, if the uptrend weakens, a crucial support area lies at $1.04, with a decline below to accelerate the downtrend.

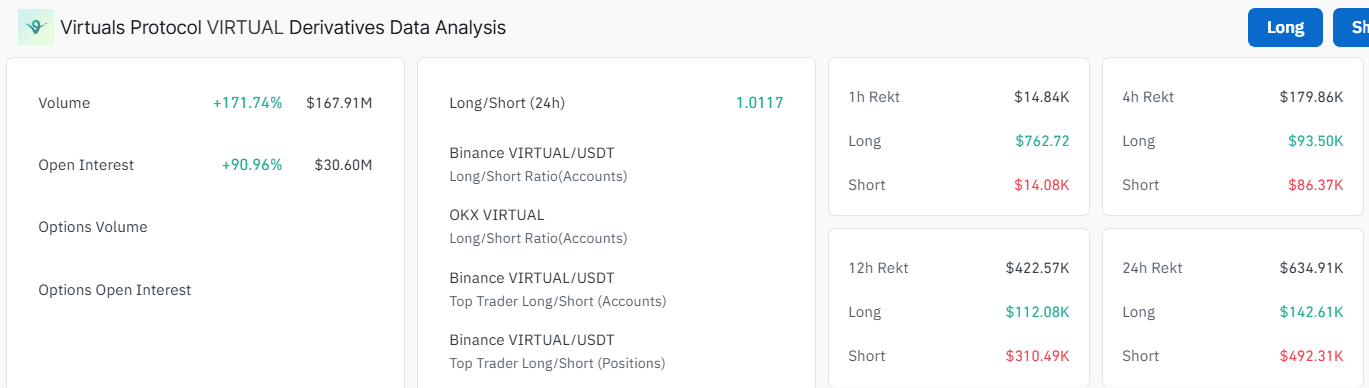

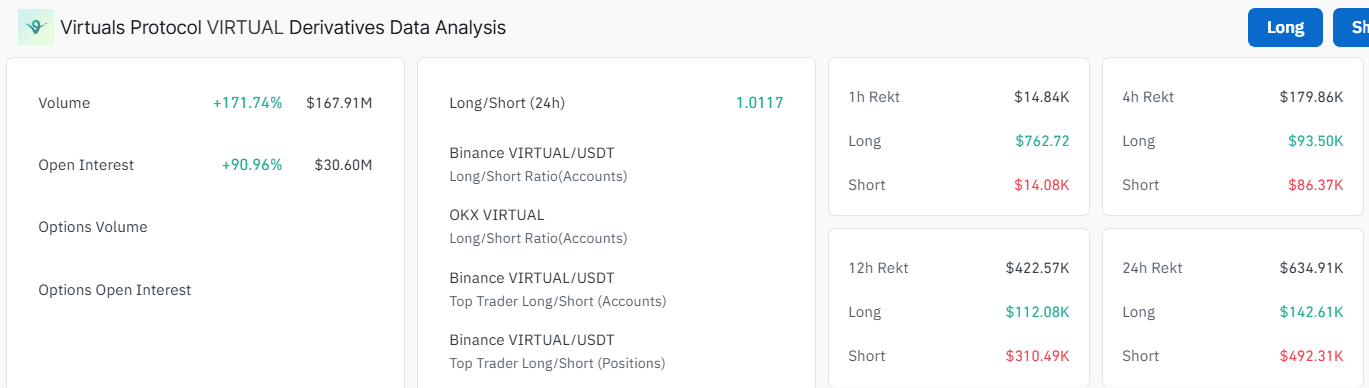

VIRTUAL crypto open interest soars 90%

The derivatives market is also fueling VIRTUAL’s gains. At press time, VIRTUAL’s open interest (OI) had jumped 90% to $30 million. Additionally, derivatives trading volumes increased 171% to $167 million.

Source: Coinglass

The increase in OI amid price increases is a bullish sign suggesting that derivatives traders are opening new positions on VIRTUAL. However, this could also lead to increased volatility.

Liquidations around VIRTUAL have also increased over the past 24 hours to $634,000 at press time. Leveraged short positions resulted in liquidations of $492,000, which could have generated additional gains for VIRTUAL crypto due to forced buying.

AI cryptos lead market gains

At press time, the AI crypto sector had outperformed the rest of the market as a whole after the total market cap of AI Agents cryptos jumped 18% in 24 hours to $7 billion annually. CoinMarketCap.

VIRTUAL now ranks second among AI agents after Artificial Superintelligence Alliance (FET). Its growing dominance in this sector could bode well for the token’s future gains.