Bitcoin has smashed $90,000 and Donald Trump is fueling the crypto bull run, but when to sell crypto? When to sell altcoins? When to sell Bitcoin?

It’s not a popular topic, but I think it’s time to talk about when to sell your digital assets. Not because they’re not increasing – we mean, hell, Donald Trump isn’t even here yet! – but because everyone should have an exit strategy. Unless you’re one of those r/WSB freaks, of course.

Before you start considering selling your altcoins, you should be familiar with the characteristics of an altcoin cycle. This will put you in a much better position to know when to sell both your Bitcoins and your altcoins.

Warning: This article will get a little cheesy

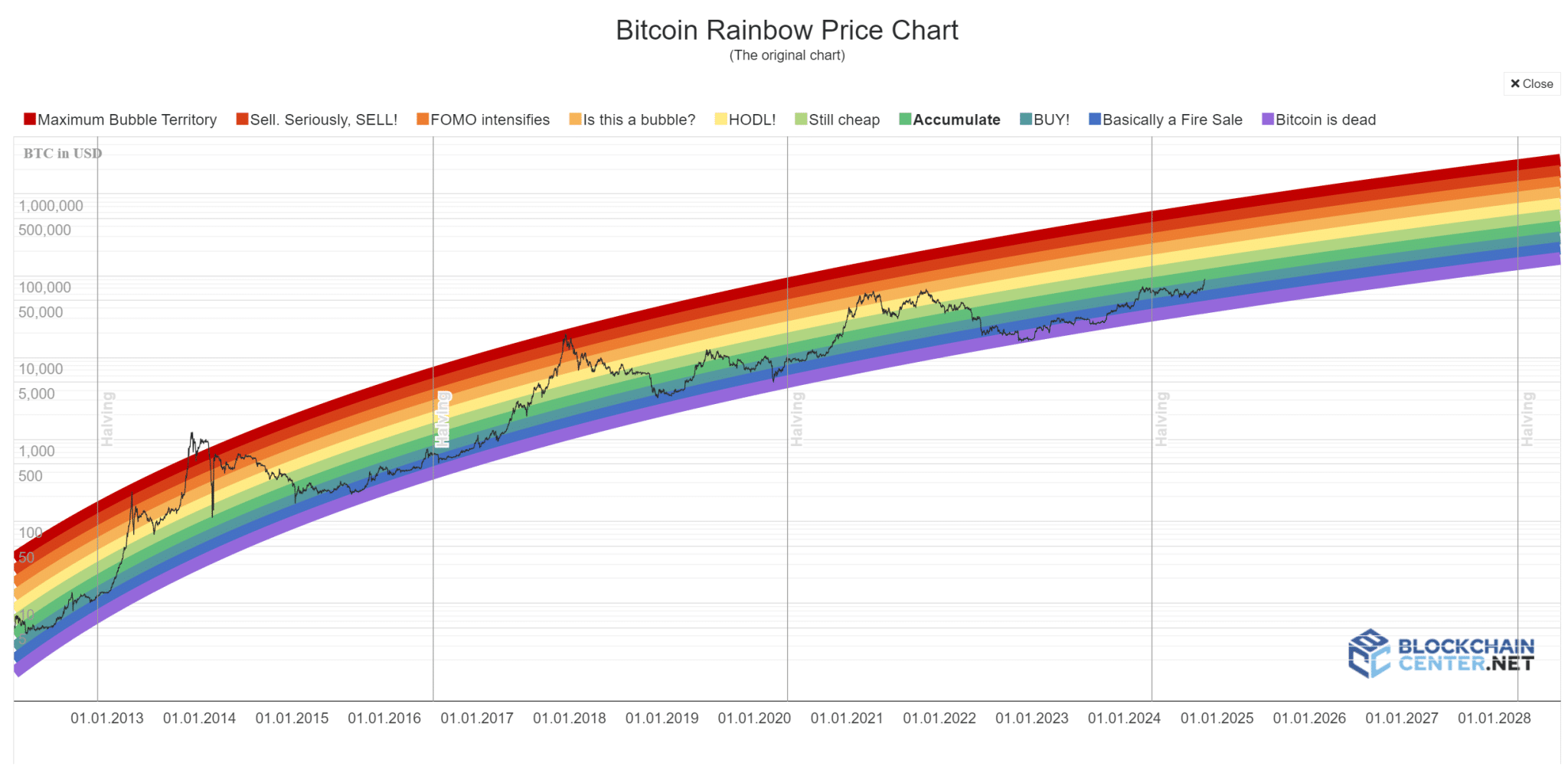

When to sell? Altcoins follow Bitcoin’s four-year cycle

Altcoins tend to follow the four-year bull cycle after a Bitcoin halving event. Bitcoin .cwp-coin-chart path svg { stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

has a fixed supply of 21 million. So during a halving event, the last of which occurred this year in April, slightly less Bitcoin is released into the market until everything is available by 2140.

After the halving, the price of Bitcoin will increase for approximately 16-18 months, and altcoins will follow Bitcoin’s lead.

However, it is important to note: Where altcoins generally perform best is once BTC slows down a bit. Crypto investors are calling this “Altcoin season.”

Although Bitcoin is the initial market mover, you should always wait for BTC to decline a bit in price action before selling your altcoins.

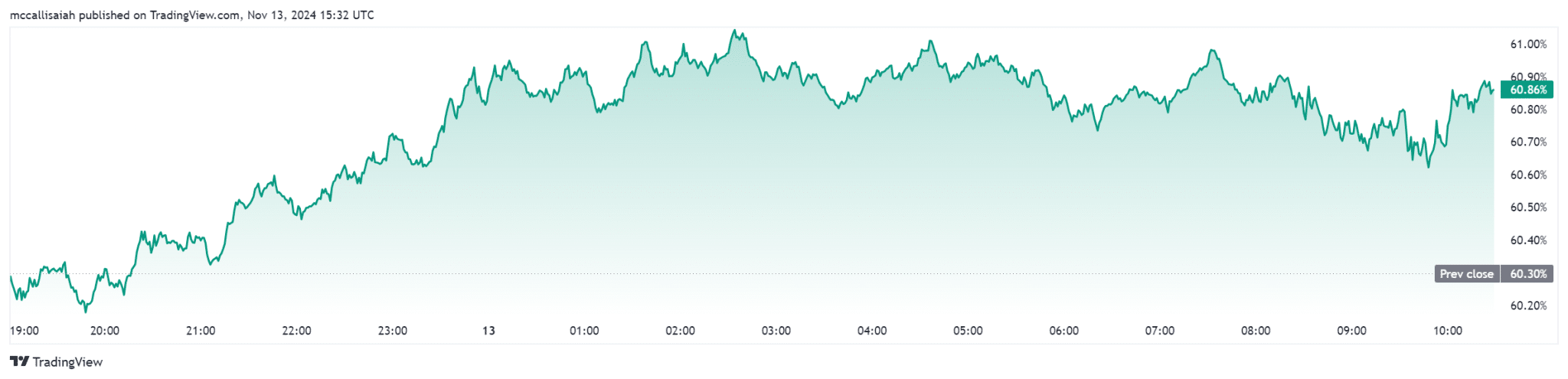

The dominance of Bitcoin also plays an important role. BTC dominance refers to Bitcoin’s share of the total cryptocurrency market capitalization. Simply put, the Bitcoin Dominance Chart is an indicator that demonstrates the percentage of Bitcoin market capitalization in relation to the entire crypto market capitalization.

When Bitcoin’s dominance declines, more money is invested in altcoins. To see where altcoins are heading, check the Bitcoin dominance chart to see if it is trending up or down.

DISCOVER: How to buy Bitcoin with Apple Pay before it hits 100,000

How to Exit an Altcoin Trade

Now that you know how the altcoin market is moving, let’s take a look at the different ways to exit an altcoin trade. You will want to integrate one or more of these approaches into your trading:

1). Profit target

One of the most common ways to exit an altcoin trade is to have a profit target.

For example, if you buy Sui at $3, you can decide to make profits at $10. You can place a sell order at $10 and wait for the price to reach your sell order target.

2). Sales Signals

You can also use so-called “sell signals”.

There are a number of websites offering buy and sell signals on various assets, including altcoins.

3). Technical indicators

You can also use technical indicators such as the 200-day moving average to determine when to sell your altcoins.

For example, if an altcoin falls below the 200-day moving average of crypto market leaders (e.g. Bitcoin and Ethereum), it might be time to sell it. This is especially true if we are in a bear market.

But Bitcoin LOVES macro summer and fall even more.

The crypto summer has started and is fully developing after the halving… it’s still the Everything Code cycle… pic.twitter.com/9ZDQH5jOdG– Raoul Pal (@RaoulGMI) March 24, 2024

Cryptocurrencies die during prolonged bear markets because investors are more likely to invest in reliable and more secure projects. If you hold on for the long term, you will have to endure the crash.

4). Portfolio rebalancing

My favorite way to sell an altcoin is to rebalance my portfolio at the same time.

Let’s say you buy five altcoins for $5,000 each. Three of the altcoins increased in value a month later, while two fell.

You can sell part of the positions in the three winning altcoins and increase your positioning in the falling altcoins – buy the damn dip – until all five altcoins are equal in value. This allows you to lock in profits on winning altcoins while buying the dip on falling altcoins.

5). Consider the tax implications

Death and taxes. Altcoins are no exception either.

Altcoins held for less than 12 months are taxed at your regular tax rate. Altcoins held for more than 12 months are taxed at 0%, 15%, or 20% depending on your deposit status and income.

8). Average dollar cost to exit your position

Another smart way to sell your altcoins is to use dollar cost averaging of a position. This method allows you to avoid panic sales.

Just like you can invest $500 in a trade over a period of time, you can also slowly withdraw that money when you reach your price target.

As Benjamin Graham, Warren Buffet’s mentor, once said: “(DCS) is a policy that will ultimately pay off, no matter when it is initiated, provided it is followed conscientiously and courageously under all conditions. »

One more thing to remember about taking profit

Don’t fall into the cryptocurrency fervor trap of holding onto them until the end of the day and never selling a cent. Develop an exit strategy and lock in your gains.

With the right strategy, you can make incredible profits from your altcoins and maybe even change your life.

EXPLORE: Former FTX Digital Markets Co-CEO Ryan Salame Sentenced to 7.5 Years in Prison

Join the 99Bitcoins News Discord here for the latest market updates

The post When to sell cryptos? Here’s When You Should Sell Your Altcoins appeared first on .