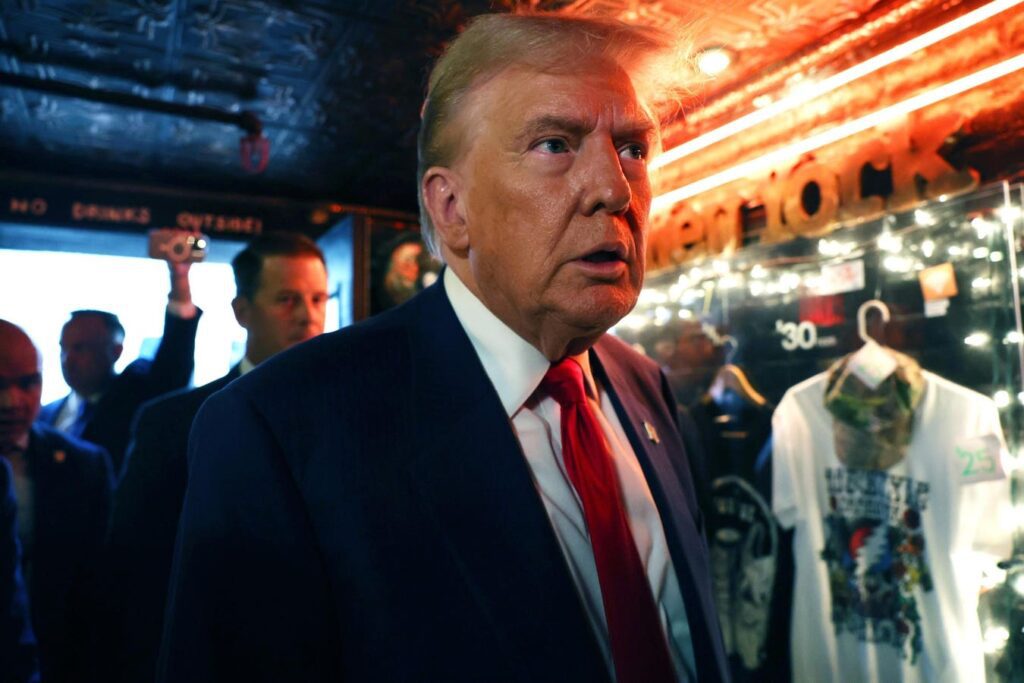

President Trump could make crypto a national priority via executive order.

President Trump is expected to sign executive orders to elevate crypto as a national policy priority and form a Presidential Council of Advisors for Digital Assets, or Crypto Council. Meanwhile, Trump’s designation of acting chairs of US regulatory agencies already shows positive progress for the crypto industry.

Although the crypto executive orders were not included in the initial batch that was very visibly signed on the first day by the new president yesterday, both in the Capital One Arena and in the Oval Office, the crypto industry crypto hopes to see Trump roll out a more positive framework for digital assets than the previous Biden administration.

The future Crypto Council is expected to consist of 24 people, including founders and CEOs from the private sector. Additionally, an executive order may contain a directive requiring all government agencies to review digital asset policies and possibly suspend litigation involving crypto companies.

“President Trump’s creation of a crypto council could serve as a critical public-private partnership to facilitate coordination across agencies, inform consistent regulatory frameworks, and promote global alignment, not just for today’s markets , but also from the perspective of future-proof policies. to drive innovation and ensure America’s position at the forefront of digital assets and emerging technologies,” said Stacey Rolland, founder and CEO of Zero One Strategies, a government relations and consulting firm focused on emerging technology policy.

Other possibilities that may appear in one or more EOs include potential tax relief and capital gains clarification for crypto owners, acceptance of crypto payments, and tax breaks for U.S.-based crypto companies . Additionally, an executive order explicitly prohibiting the formation of a “digital dollar” or central bank digital currency can be signed.

The Crypto Council’s 24 crypto insiders are widely expected to help formulate policies for the crypto space and advise the president on digital assets. Industry executives expected to serve on the Crypto Council reportedly recently visited and met with Trump in Florida at Mar-a-Lago.

The formation of the Crypto Council within the White House would likely reinforce the notion that the Trump administration is elevating crypto as a national priority. Meanwhile, the US electorate’s decision to put Trump in power has led to a changing of the guard from US regulators that directly affect crypto. Some of these changes are already leading to positive developments for the industry ahead of the confirmation of nominees who will take over certain crucial agencies with a direct impact on the space.

With the resignation of former SEC Chairman Gary Gensler on Monday, Trump named SEC Commissioner Mark Uyeda as acting chairman of the SEC. Uyeda has been positive in the past when it comes to digital assets, and an announcement today shows that SEC Commissioner Hester Peirce will lead a new crypto task force that will be dedicated to developing a framework Comprehensive and clear regulatory framework for crypto assets.

After what the crypto industry has seen over the past four years in terms of enforcement actions against major US exchanges and failure to get the agency to issue rules for digital asset tokens, this group SEC work on crypto would be a huge initial victory. of the Trump administration. Uyeda and Peirce likely won’t make any major decisions until Trump’s nominee for SEC chairman, Paul Atkins, is confirmed by the U.S. Senate.

The Federal Deposit Insurance Corporation (FDIC) yesterday saw the departure of Chairman Martin Gruenberg, who was seen as largely negative towards crypto by that industry. The FDIC has been criticized for putting “pauses” on banks’ implementation of crypto lines of business, as well as potentially targeting individuals and companies in the crypto sector for “debanking”, which some call Crypto Chokepoint 2.0.

Trump also named the FDIC’s new acting chairman, Travis Hill, who issued a statement outlining a “more open approach to innovation and technology adoption, including (1) a more transparent approach to fintech partnerships and digital assets and tokenization”. , and (2) a commitment to address increasing technology costs for community banks. Before becoming interim president, Hill previously flagged positive policy moves towards digital assets and tokenization, as well as concerns over debanking.