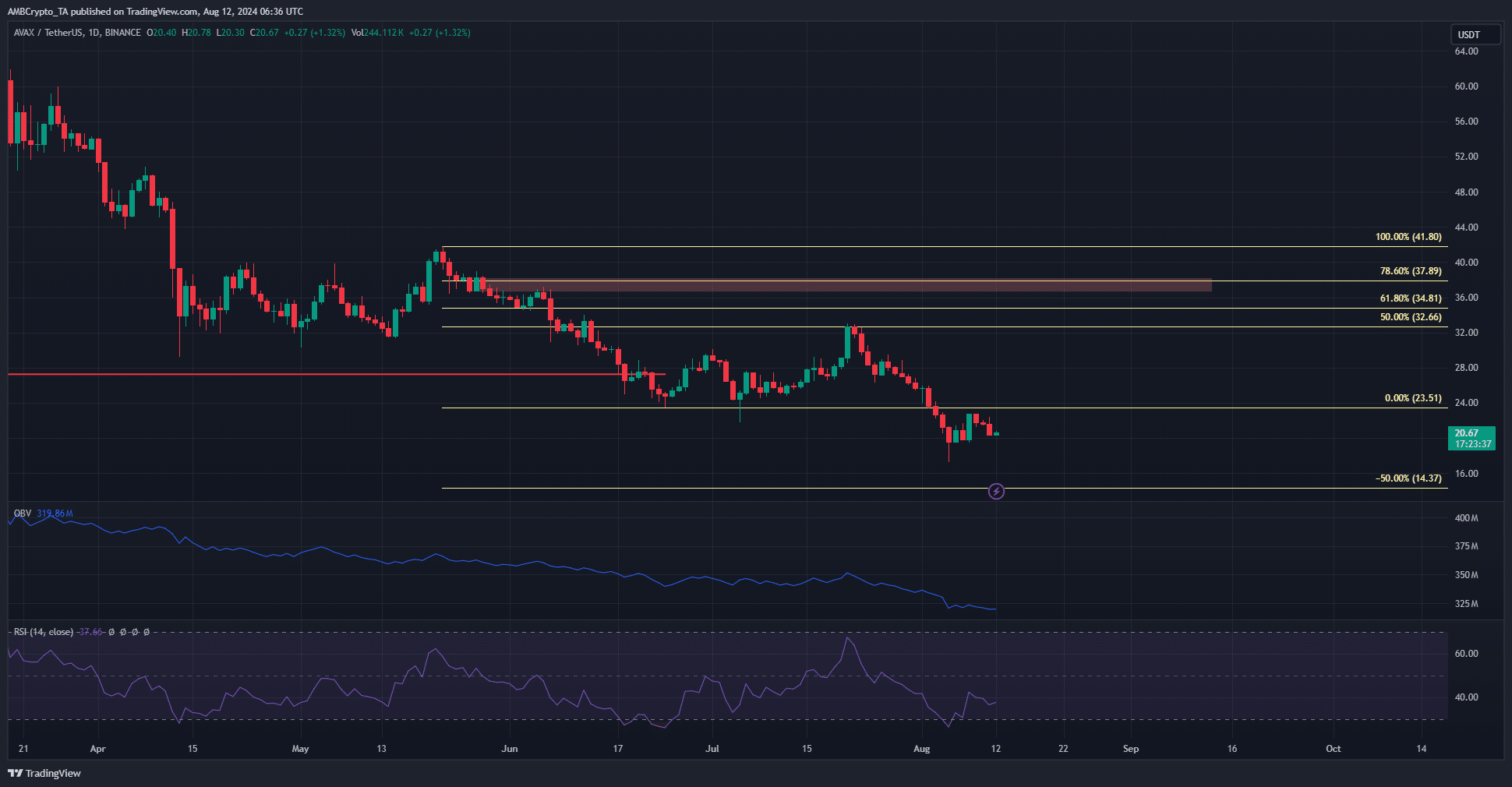

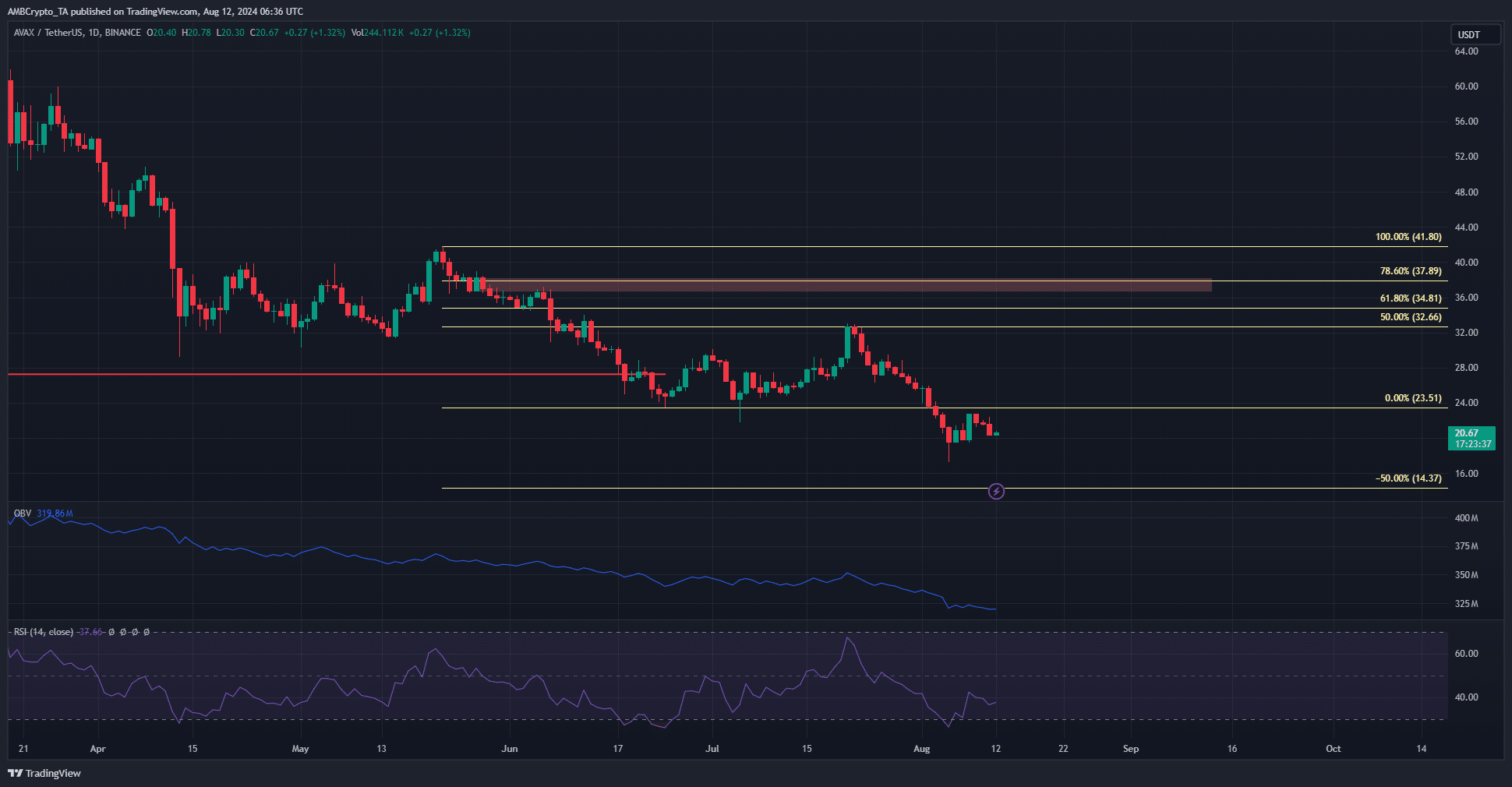

- The former support zone at $23.5 served as resistance during the recent bounce.

- Sellers’ strength was too high and the downtrend is expected to continue this week.

Avalanche (AVAX) was approaching the short-term support level at $19.6. Its trend remained bearish on the daily chart. With Bitcoin (BTC) below $60,000, sentiment in the cryptocurrency market seemed weak.

This could lead to a further decline in Avalanche stock. AVAX futures were also not bullish. What are the price targets in case of a decline?

Avalanche retests former support zone as resistance

Source: AVAX/USDT on TradingView

From mid-June to early August, the $23.5 level was a support. It was broken during the strong selling pressure and was retested in the last few days as resistance. A bounce of AVAX to the $22.8 level was met with rejection.

The daily RSI was still below the neutral level of 50 and the OBV continued its downward trend. Together, they were a sign of strong bearish momentum and a lack of demand.

The $19.2 and $14.37 levels are the next targets, based on recent price action and Fibonacci extension levels. Bitcoin’s trajectory could heavily influence AVAX, and sentiment was turning bearish as BTC was back below $60,000.

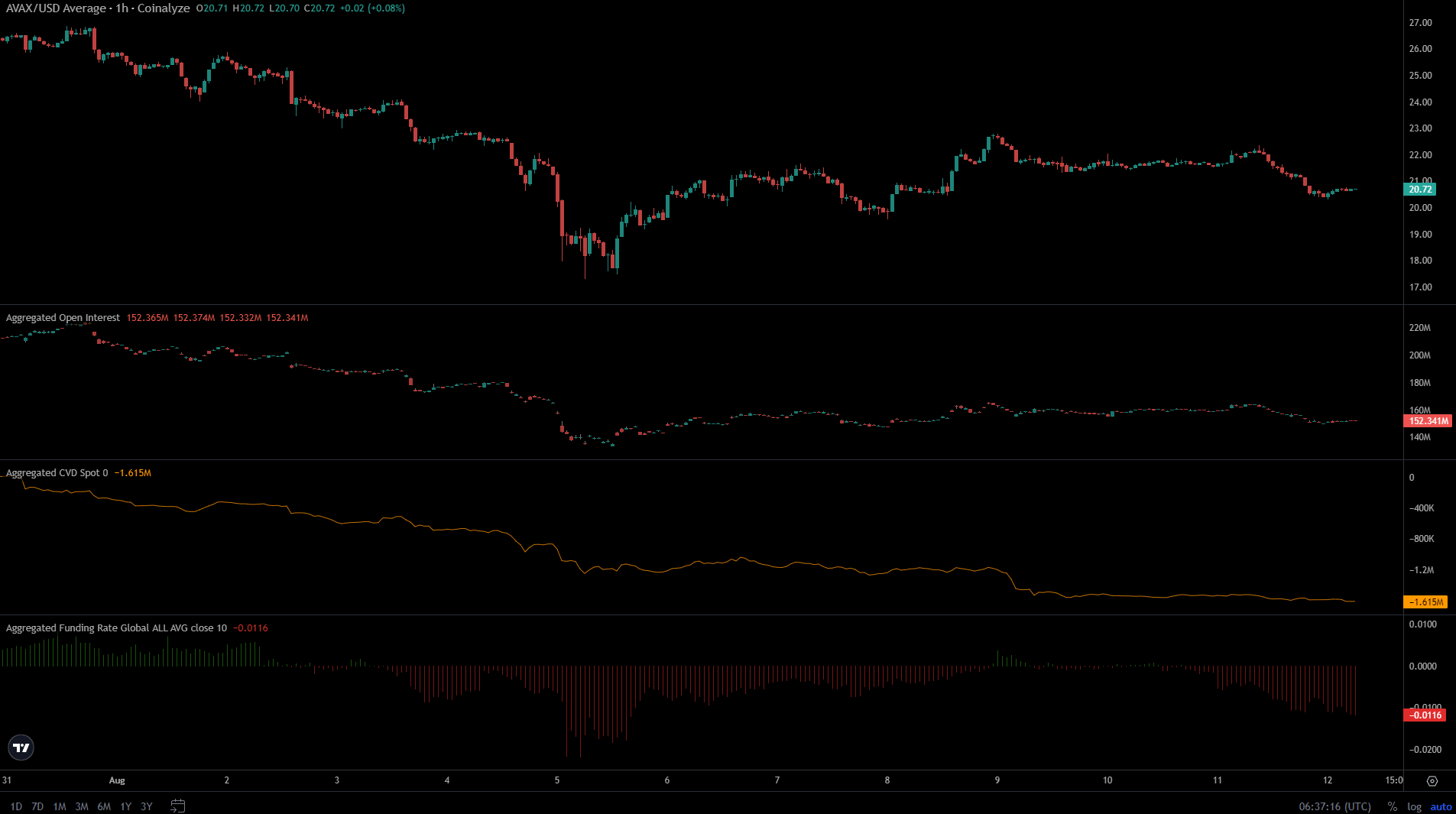

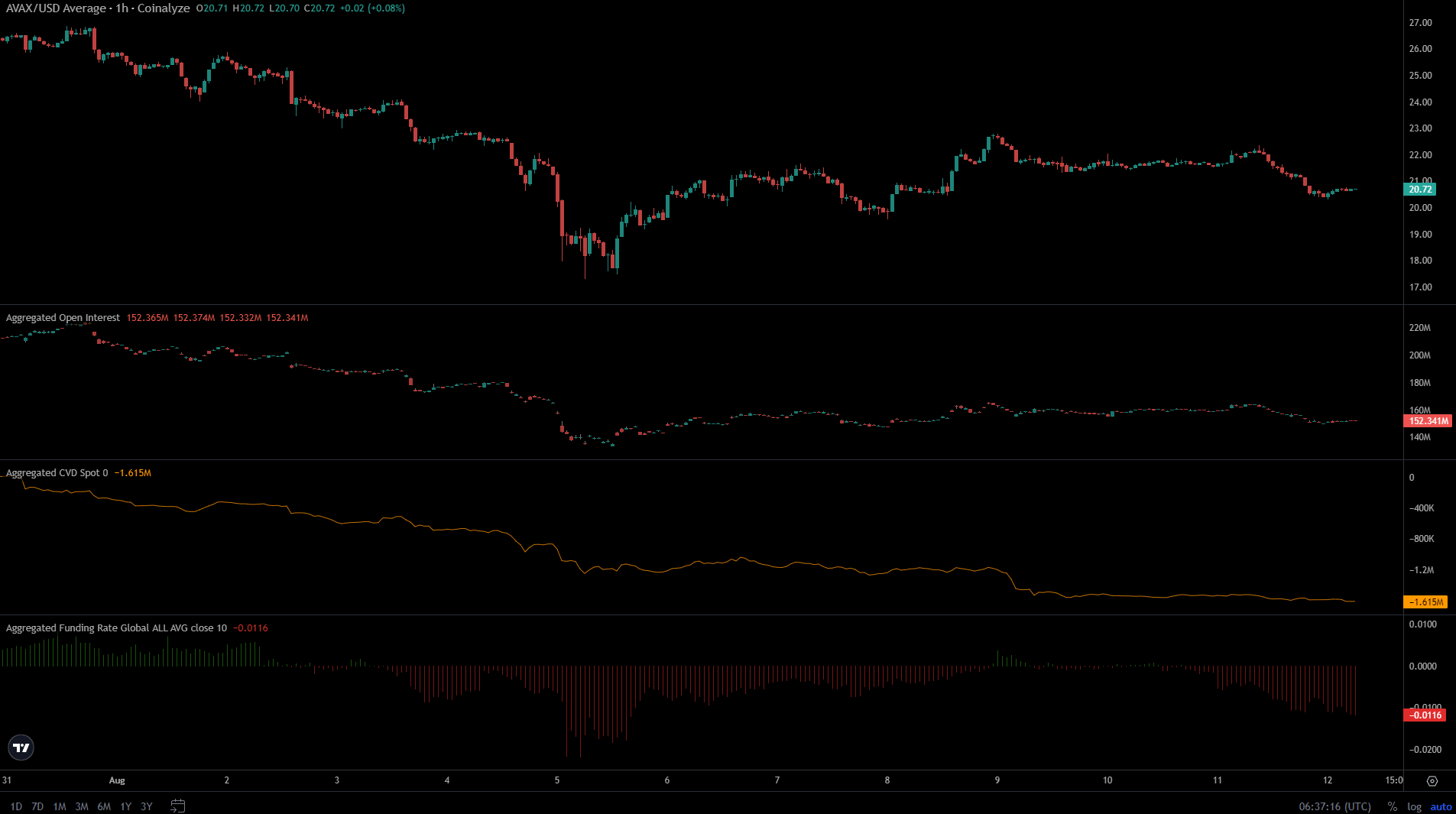

Speculative interest was low during the price rally

Source: Coinalyze

The futures market had no hope of seeing Avalanche rally. When the price hit $22.8 on August 8, the funding rate was barely positive.

Open interest rose from $152 million to $165 million, highlighting the market’s lack of bullish conviction despite the price rally.

Read Avalanche (AVAX) Price Prediction for 2024-25

Since then, both the interest rate and the financing rate have fallen in line with the price. The spot CVD has been slowly declining.

Overall, short-term market sentiment was bearish and further losses are expected.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.