- Solana, XRP, Dogecoin and BNB erase between 3% and 6% of their value on Tuesday.

- The market capitalization of cryptography is down 3% while Bitcoin vanishes above the level of $ 95,000.

- The same money scandals and JP Morgan’s comments on Tether’s probability of emptying BTC tokens are the main market movers in crypto.

Solana (soil), XRP, Dogecoin (Doge) and Binance Coin (BNB) decreases on Tuesday. The best altcoins classified by market capitalization are in a downward trend, even if Bitcoin (BTC) continues to consolidate around the level of $ 95,000.

Recent events, such as MEMBRA and Melania tokest scandals and the alleged ties with portfolio addresses that have drawn more than $ 100 million from the latter, had a negative impact on the feeling of trader.

Solana, XRP, Dogecoin, BNB Price Departe

At the time of writing the Tuesday writing moment, Solana, XRP, Dogecon and BNB correct 5.31%, 2.97%, 2.59% and 2.59% on the day, respectively. The four pieces even ranked among the 10 best cryptocurrencies by market capitalization.

Nick Forster, founder of Derive.xyz, told FxStreet that Token Unlock is a key market influencing Solana Price. Forster said,

“On the other hand, Solana faces a unlocking of $ 2 billion in 12 days, representing almost 2% of the fully diluted value of the token (FDV), which should exert downward pressure on its price. In addition to an in progress negative feeling surrounding the pieces even, Solana could face a few difficult weeks to come. We see a chance of 10% of solue above $ 280 at the end of the quarter, and a chance of 20% that it will reach less than $ 170 on the same date. »»

In the case of Dogecoin and XRP, the chain data indicate an additional correction in the ALTCOIN prices.

The market value ratio / value made (MVRV) of Dogecoin within 30 days shows that each time the MVRV drops by less than 7%, there is a significant price correction of price. At the time of the editorial staff of Tuesday, MVRV is 15%, which suggests that the price of Dogecoin could decrease more if the model is repeated.

%20(16.48.44,%2018%20Feb,%202025)-638754796514304657.png)

Chain dogecoin analysis | Source: Santiment

The XRP analysis on chain shows that the addresses active within 24 hours are in a downward trend. The financing rate approved by XRP, as we can see on Santiment, was negative over several days between January 27 and February 17.

Negative peaks mean that derivative traders are lowering on the XRP price and expect an additional drop.

%20(16.52.26,%2018%20Feb,%202025)-638754796821588191.png)

XRP chain analysis | Source: Santiment

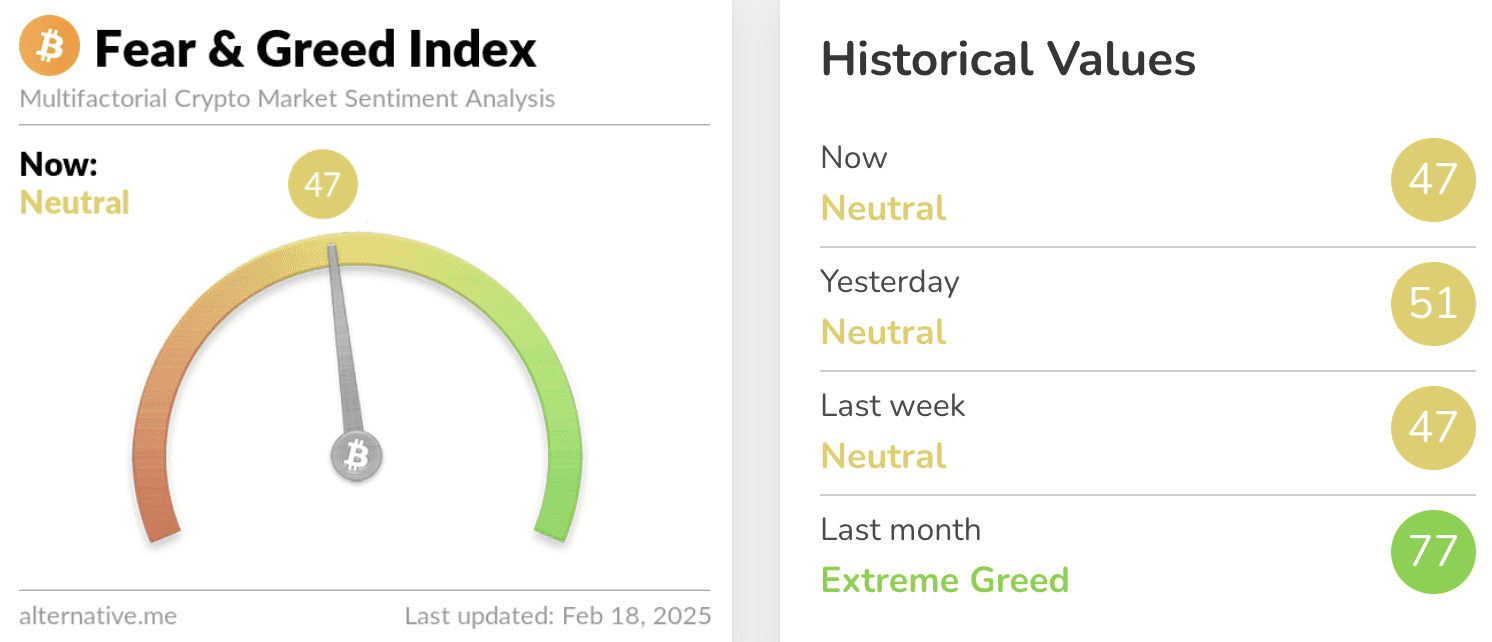

The developments surrounding the entities behind the balance, promoted by the Argentinian president Javier Milei, and the Melania token enveloped the controversial Solana blockchain. This also negatively influenced the feeling among traders, as evidenced by the Crypto Fear & Greed index, which is now at a neutral level after “extreme greed” last month.

Index of cryptocurrency and greed | Source: alternativem