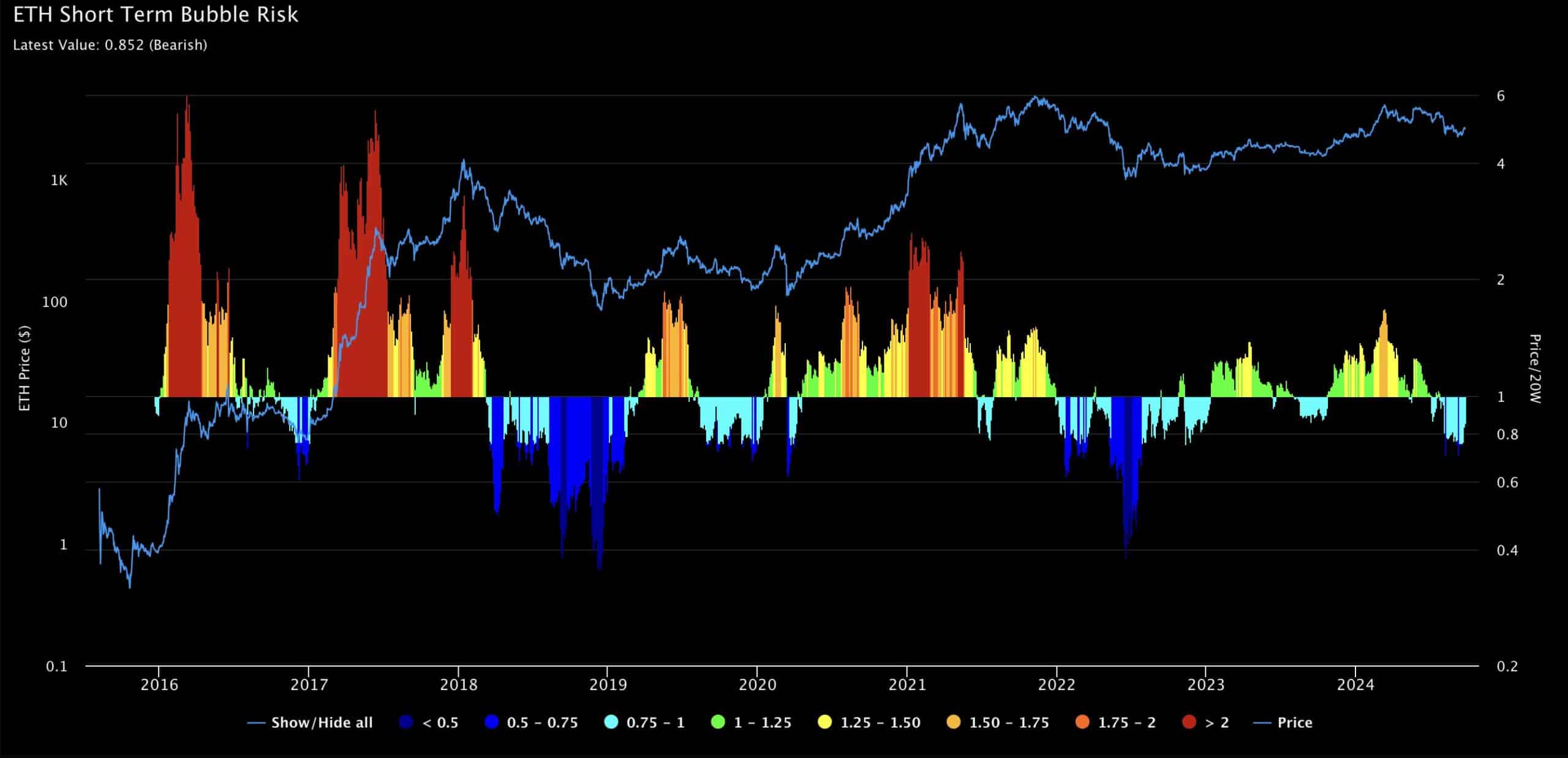

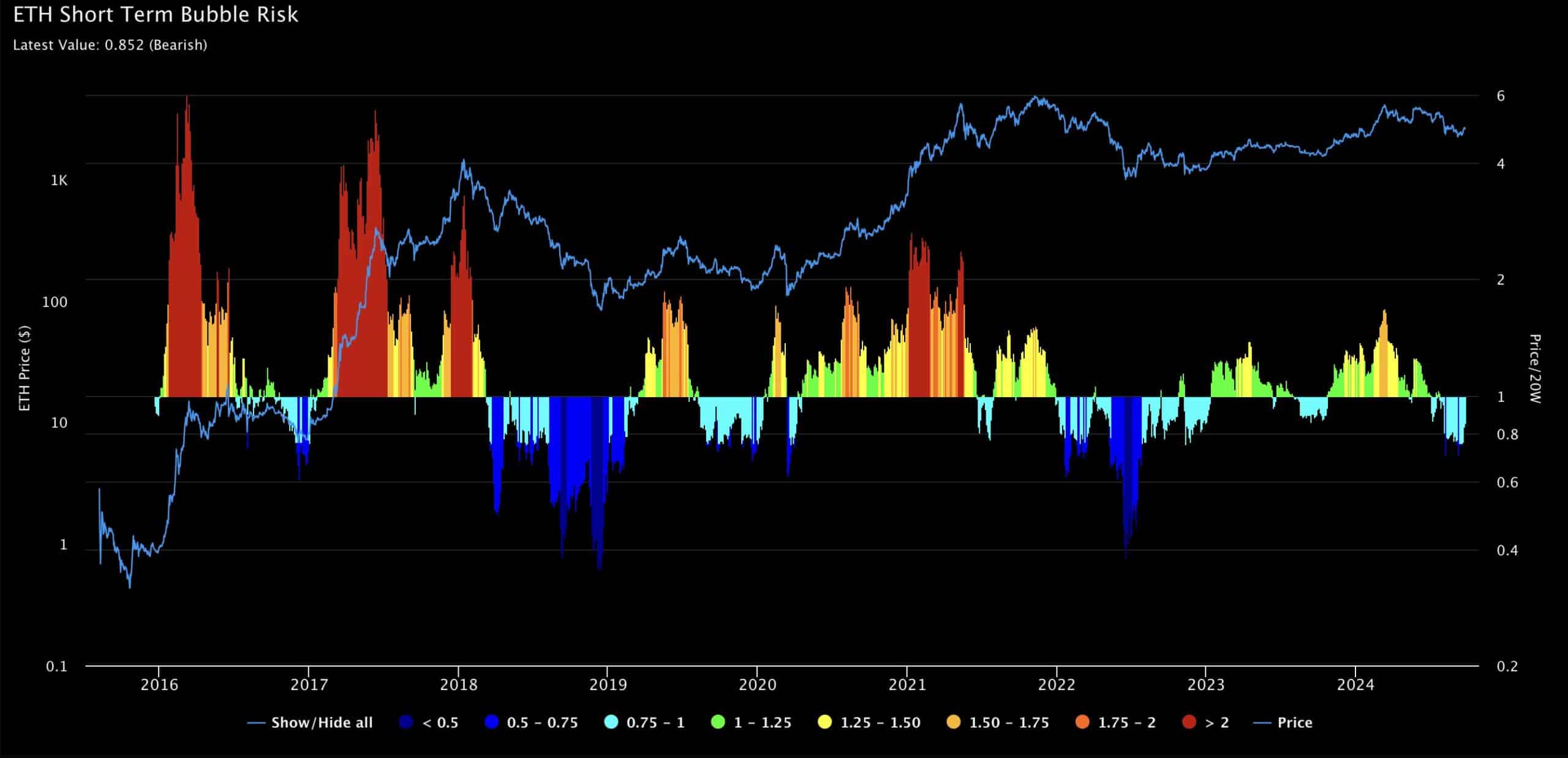

- Ethereum’s short-term bubble risk has signaled bearish sentiment.

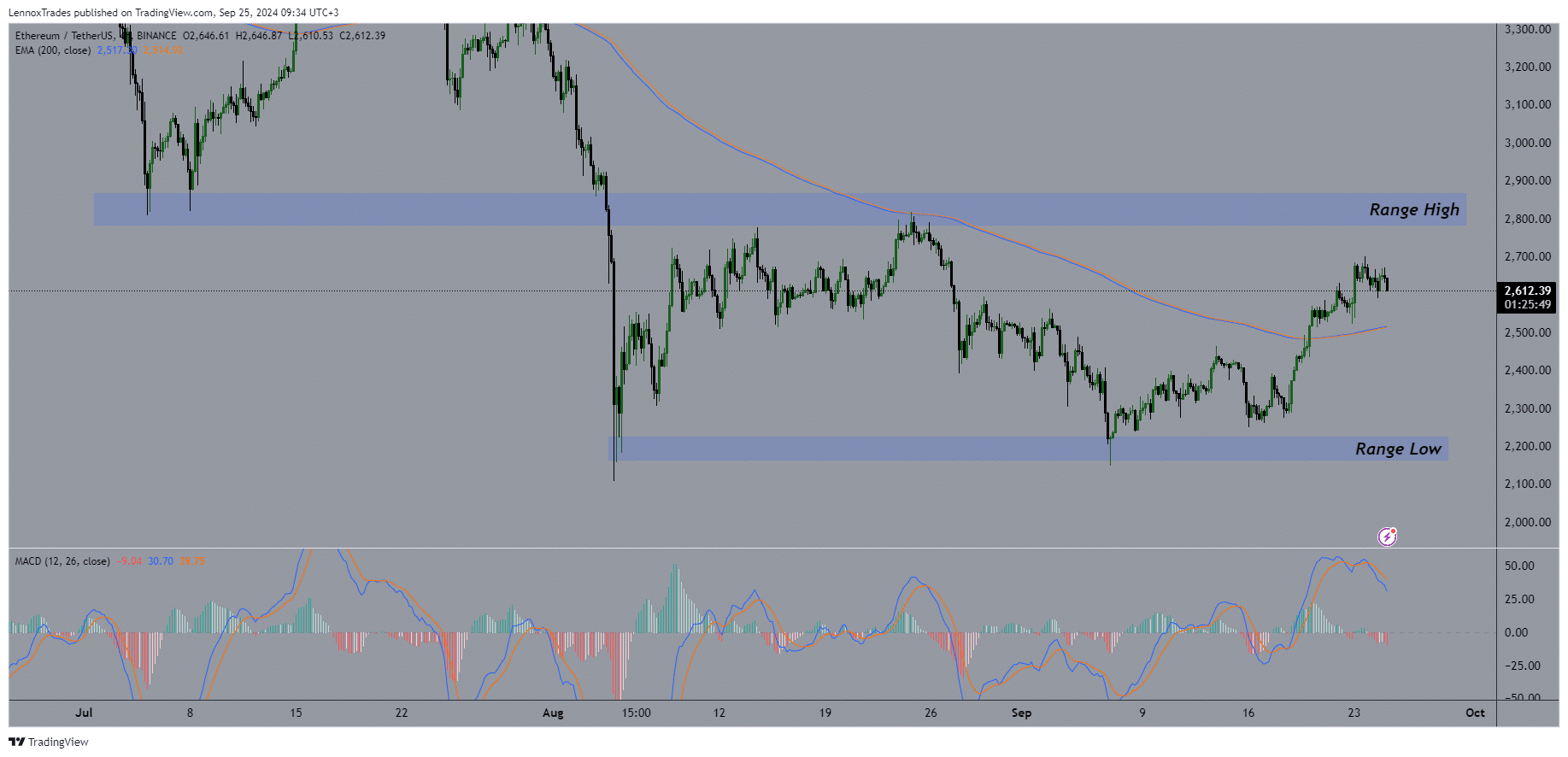

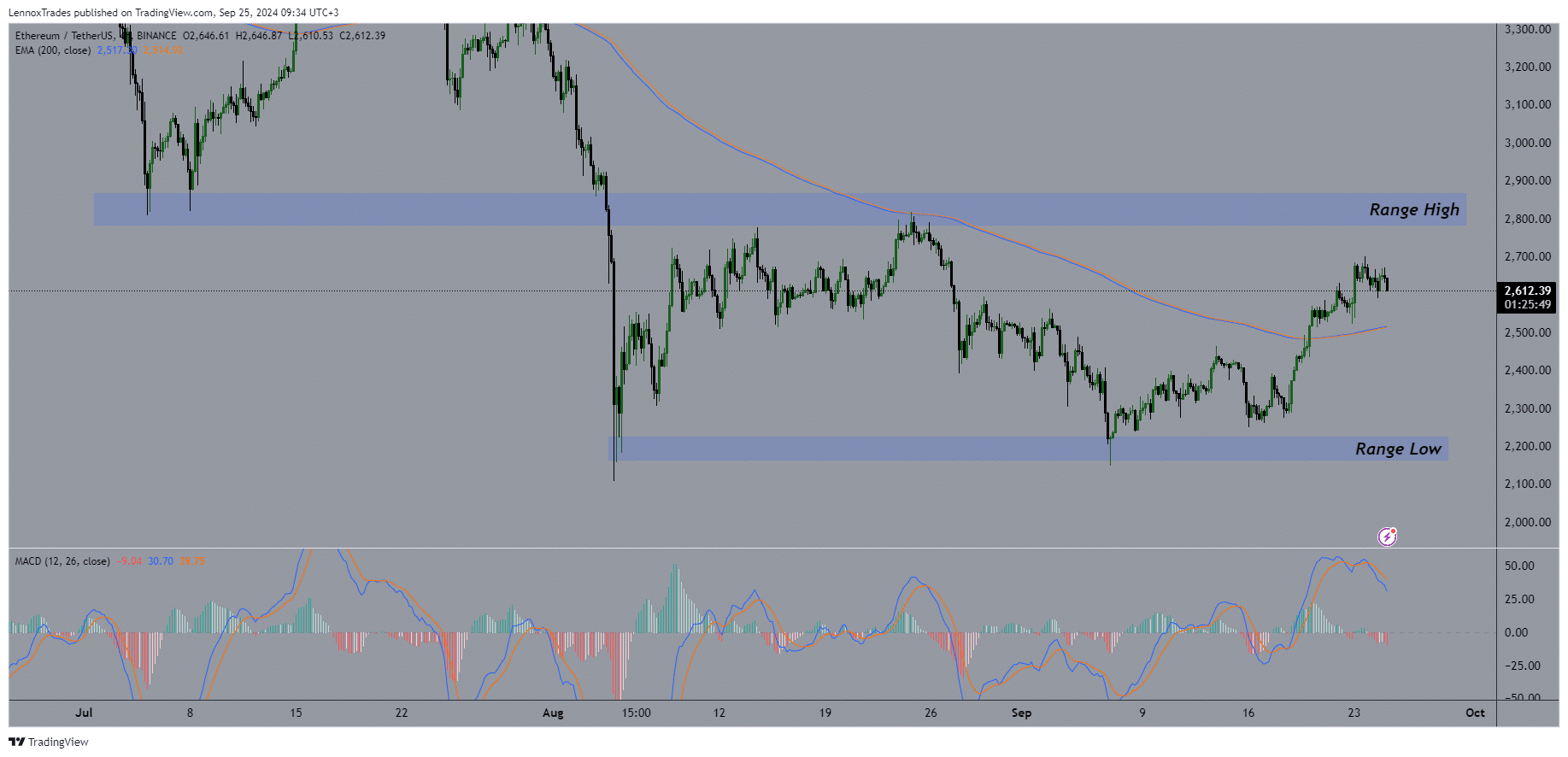

- On the other hand, ETH has reversed the 200 exponential moving average on the 4-hour time frame.

Ethereum (ETH) is hinting at a shift in market sentiment heading into Q4 2024, which is expected to be largely bullish.

Data analyzed by AMBCrypto showed that Ethereum signaled potential short-term fluctuations, with ETH’s short-term bubble risk indicator turning bearish.

This suggests that a brief correction could be on the horizon, despite the overall bullish outlook for the broader cryptocurrency market.

Source: IntoTheCryptoverse

A reversal to bearish sentiment seems unlikely without a significant market event. However, the current bullish trend is leading the debate, leaving the question of what lies ahead for ETH as we prepare for Q4.

Ethereum in correction

Analyzing the ETH/USDT pair, Ethereum recently broke above the 4-hour exponential moving average (EMA) at 200, a critical indicator of short- and medium-term trends.

At press time, the price was targeting the $2,800 high, a key level that ETH must break to break out of the confirmed short-term correction.

If Ethereum manages to break above this level, it could signal a move towards the $3,000 mark.

Source: TradingView

However, the MACD indicator is currently showing a bearish outlook, with momentum favoring sellers, signaling that ETH may need more time to gain strength for a bullish reversal.

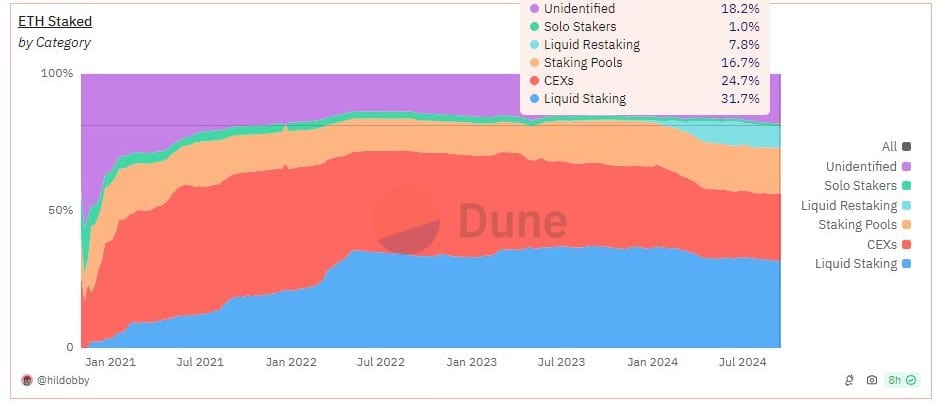

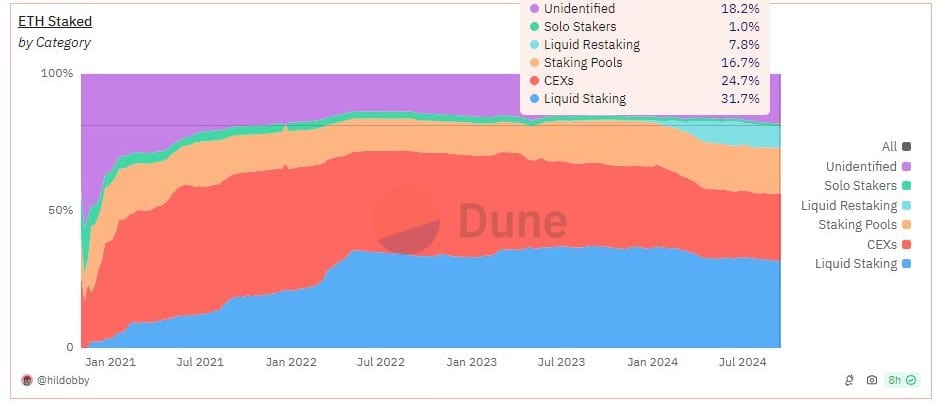

Buterin on Solo Staking in ETH

To strengthen security, Ethereum co-founder Vitalik Buterin has proposed strategies to reduce potential vulnerabilities, such as mitigating the risks of corruption from large node operators and increasing the number of solo stakers.

Buterin’s post on X, formerly Twitter, read:

“Some thoughts on solo staking, what realistic value solo stakers (+ small businesses and communities) could bring to the network, and what changes L1 can make to better support solo stakers.”

Solo stakers are essential to maintaining Ethereum’s decentralization and censorship resistance.

Being independent of large organizations, solo stakers are less susceptible to regulatory pressure, which helps prevent transaction censorship.

Source: Dune

They also play a critical role in blocking finalization at 67%, a critical defense that ensures malicious chains cannot take control of the network without facing significant penalties.

This move in ETH staking means that mitigating risk from staking would be bullish for ETH.

Social domination and commercial activity

Additionally, data from Santiment indicates that Ethereum’s market cap has rebounded to $2,700, fueling growing interest in ETH on social media and trading platforms.

Margin and leverage activity in ETH wallets also increased, reaching 7-week highs. These factors suggest that ETH could see its price rise once the short-term bearish correction is over.

Source: Santiment

Read Ethereum (ETH) Price Prediction 2024-2025

Ethereum remains positioned for potential growth after going through its current short-term correction phase.

As market activity increases, especially with bullish momentum on social media and exchanges, ETH is likely to see further upward price movement in the coming months.