Solana ETF Hopes Rise as Donald Trump Is Elected 47th President of the United States, But Are Donald Trump Solana Hopes Real Fuel for SOL Price?

Following the victory of newly elected 47th President Donald Trump, Solana ($SOL) is ready for a breakout.

Solana rose to $185.84, following Trump’s victory over Kamala Harris, but the next step for SOL is the filing of a Solana ETF; here’s why it could be closer than ever.

Solana’s ETF Journey: A New Dawn for Institutional Investing

The concept of a dedicated Solana ETF is not just a strategic decision; this is a potential revolution for Layer One cryptocurrency chains. After Bitcoin and Ethereum managed to obtain institutional funds, Solana appears next.

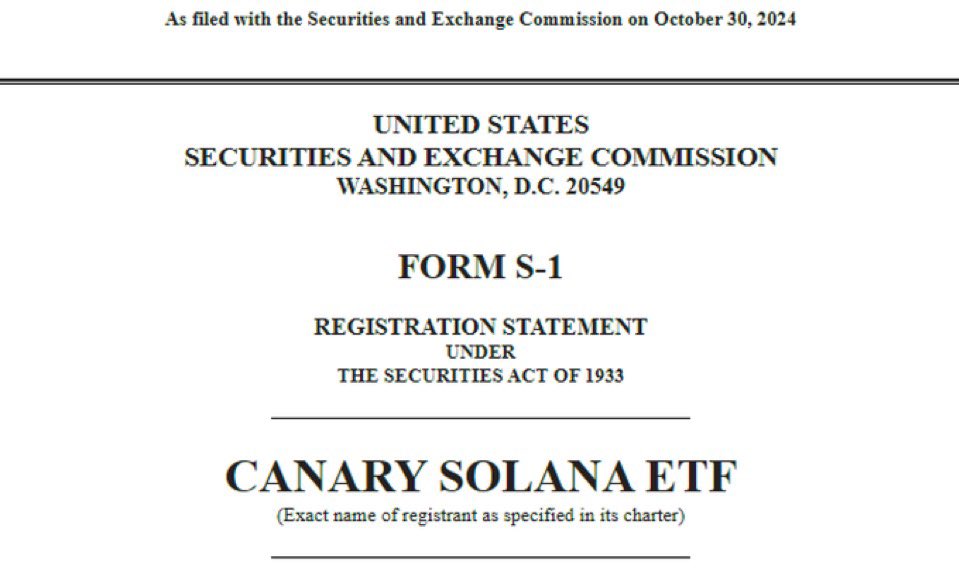

Canary Capital, alongside VanEck and 21 Shares, filed for Solana spot ETFs this year, while Franklin Templeton is reportedly exploring options. Despite this enthusiasm, regulatory challenges loom, particularly regarding the classification of cryptocurrencies and ongoing legal issues with major exchanges.

If approved, a Solana ETF could lead to unprecedented institutional inflows, with price predictions climbing north of $400; the ETF could herald a new era of growth and stability for Solana.

The impact of Memecoin and NFT activities on a SOL ETF

Solana’s reputation as a high-throughput, low-cost blockchain has made it a hotbed for coins and NFTs, raking in 34.3% of its revenue in these trendy sectors. Compare that to Ethereum’s only 6.6% from similar companies, and Solana’s advantage in this niche becomes clear.

Yet betting on such speculative assets is risky for traditional investors who prefer ETFs. The big question remains: will this chaotic meme ecosystem hurt the prospects of Solana’s ETFs? The jury is out.

Another issue Solana faces is wash trading, where SOL traders increase trading volumes by buying and selling simultaneously. With 41.4% of its coin and NFT traffic captured on this web, Solana’s numbers surpass Ethereum’s 28.9% in 2024.

VanEck’s Matthew Sigel notes that SOL’s very cheap transaction fees make it fertile ground for such antics, and that platforms like Pump.fun only add fuel to the fire by making memecoin trading a game of gambling. child. While this frenzy is spurring activity, it casts a long shadow over SOL’s authenticity as an ETF.

DISCOVER: Best New Cryptocurrencies to Invest in in 2024 – Best New Crypto Coins

The path to a SOL ETF

The prospect of a Solana ETF is a double-edged sword. On the one hand, this promises to attract institutional investment and elevate Solana’s position in the market. On the other hand, SEC scrutiny of wash trades and market manipulation poses significant hurdles.

Due to these concerns, the SOL spot ETF offered by VanEck includes risk disclosures, highlighting the need for transparency and regulation.

Challenges aside, 99Bitcoins analysts and experts like Sigel are bullish on SOL for its top-notch user experience and potential to scale beyond speculative trading gambling dens.

While meme coins currently dominate, the future could see Solana move into more stable territories like decentralized infrastructure and social media platforms, redefining its role in the digital landscape.

Discuss trading Memecoin Wash on the Solana blockchain

Solana’s continued success in attracting users and financial activities has angered some in the crypto community. Some claim that Solana’s most documented monthly active wallets are 111 million, compared to those of Ethereum… pic.twitter.com/vch95wuEhT

– Matthew Sigel, recovering the DWI (@matthew_sigel) November 4, 2024

Whether the ETF sees the light of day soon or not, SOL is expected to outperform Ethereum this cycle, both in terms of price and user base. With its fast latency and robust throughput, SOL is transforming from a speculative bubble into the most widely used layer 1 cryptocurrency.

EXPLORE: 20 new crypto coins to invest in 2024

Join the 99Bitcoins News Discord here for the latest market updates

The post Will Solana Get a Spot ETF if Trump Fires Gary Gensler? appeared first on .