- XLM was trading at $0.4115 at press time, up 0.77% in 24 hours.

- The altcoin tested the 50% Fibonacci retracement at $0.3685.

Stellar (XLM) was trading at $0.4115 at the time of writing, up 0.77% over the past 24 hours, with a 24-hour low of $0.364 and a high of $0.4384.

Despite its impressive 279% rally over the past 30 days, XLM has lost momentum in recent weeks. THE volume remained strong at $1.37 billion, although the price is still 55.79% below its January 2018 ATH of $0.9381.

The slight decline in Bitcoin (BTC) continues to put pressure on altcoins like Stellar, leading to deeper corrections.

The 50% Fibonacci level is kHey

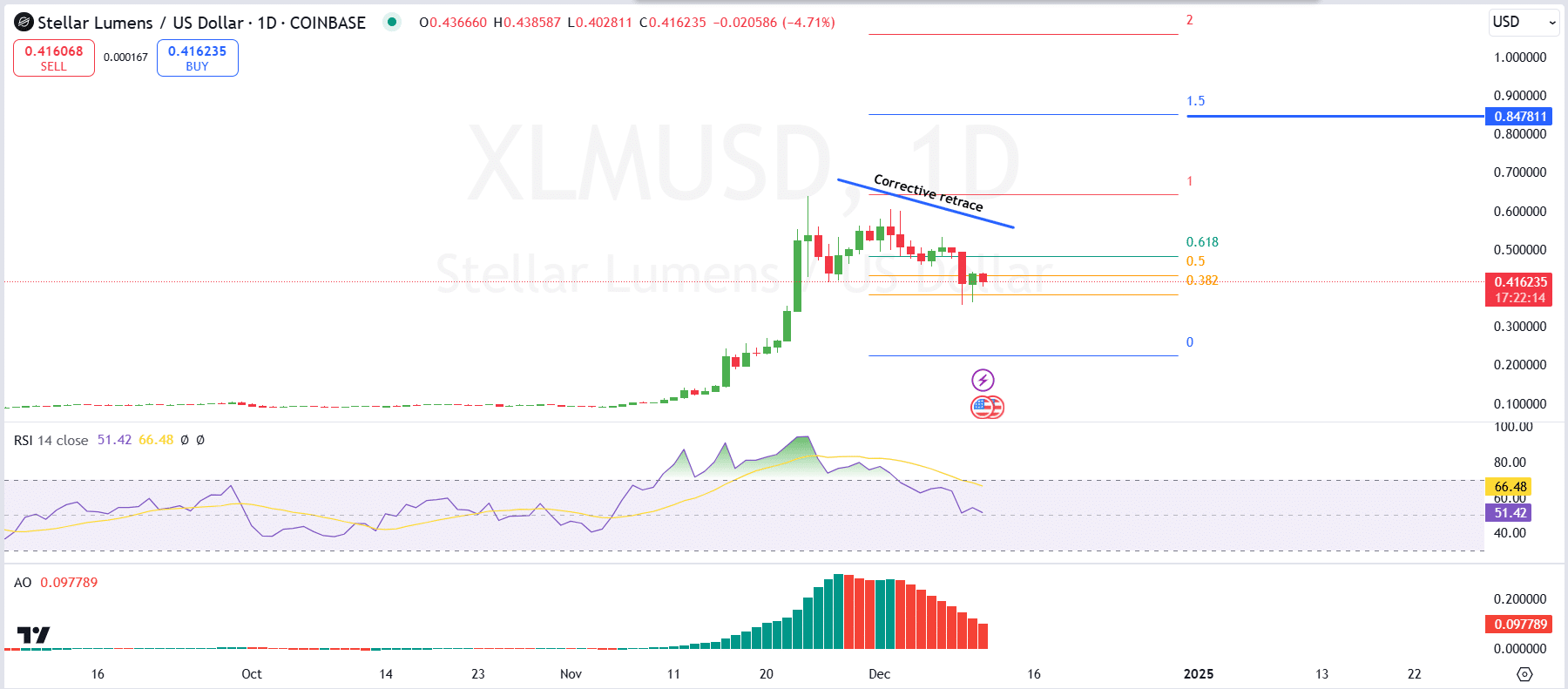

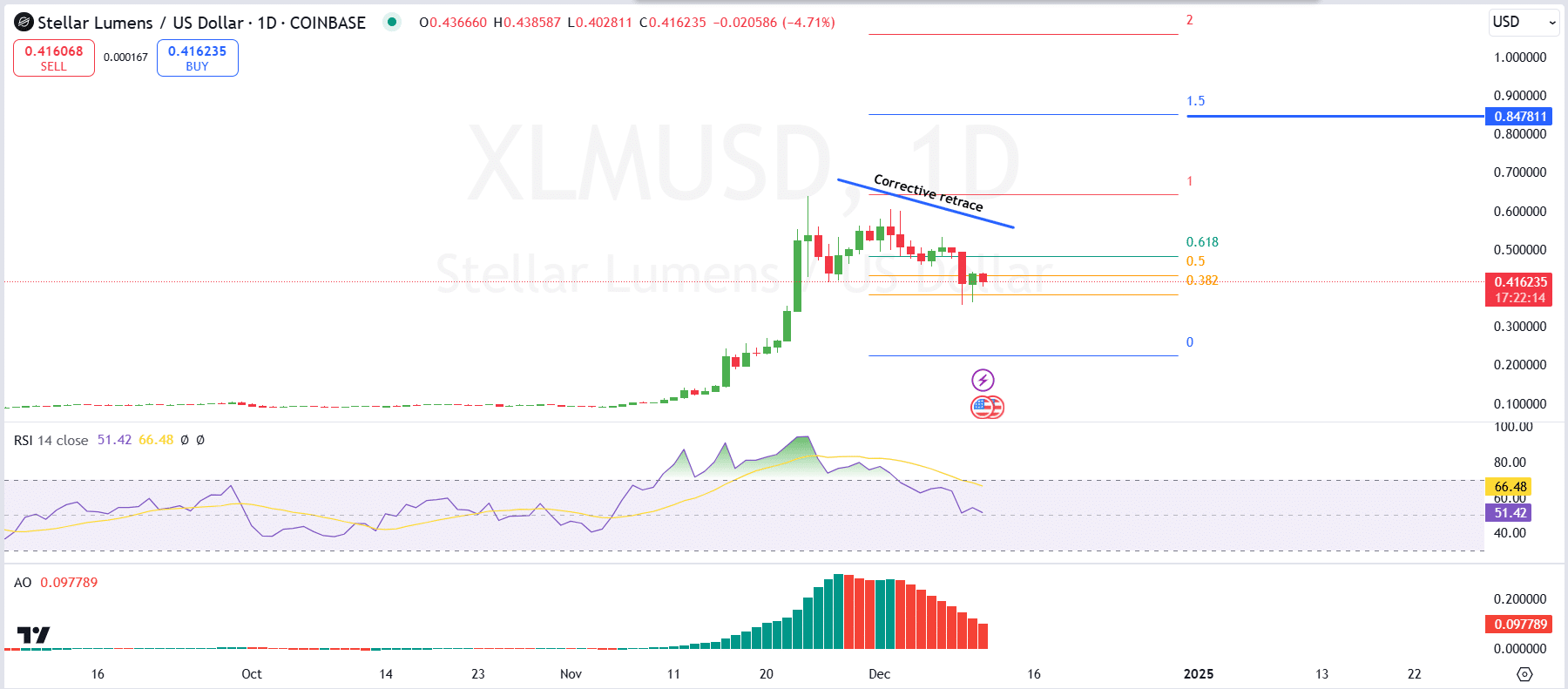

The XLM/USD daily chart indicates a corrective retracement after a strong rally at the time of writing, with the price at $0.4116.

The retracement closely aligned with the 50% Fibonacci level at $0.3685, which was now an important support level.

If the price manages to hold above this level, it could signal a reversal and pave the way for further bullish momentum. Below, the 61.8% Fibonacci level at $0.3030 constitutes a critical support zone for the ongoing retracement.

Upside targets, should price rebound from current levels, include the high at $0.8478 and the 1.0 Fibonacci extension at $1.1687.

A breakout of the $0.5 resistance level would strengthen bullish sentiment, increasing the likelihood of these targets being tested.

Conversely, a break below the 61.8% level at $0.3851 could lead to further declines and shift the market bias towards a downtrend.

Source: Commercial View

Momentum indicators reflect neutral market sentiment. The RSI was positioned at 51.42, signaling neutral momentum without strong overbought or oversold conditions.

The Awesome Oscillator (AO) showed declining bullish momentum, with smaller green bars indicating weakening upside pressure.

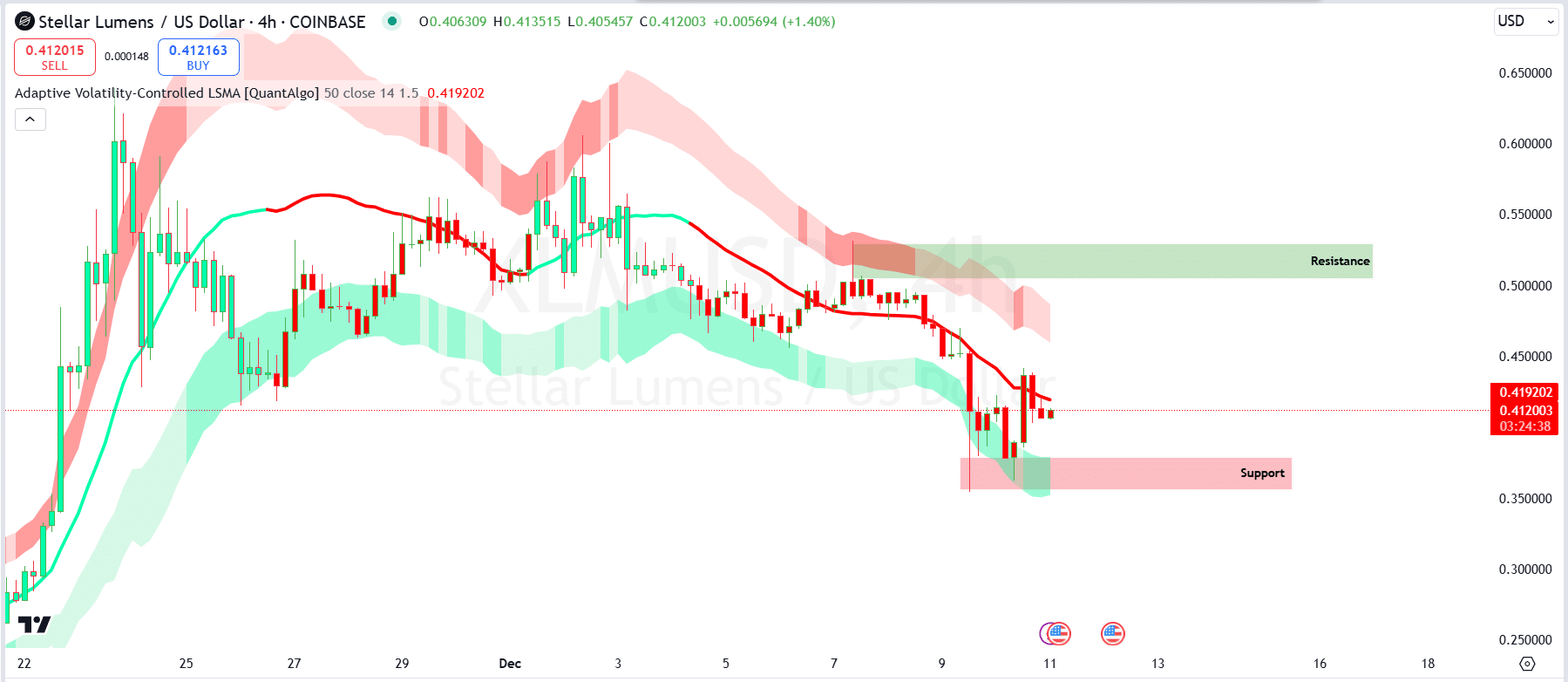

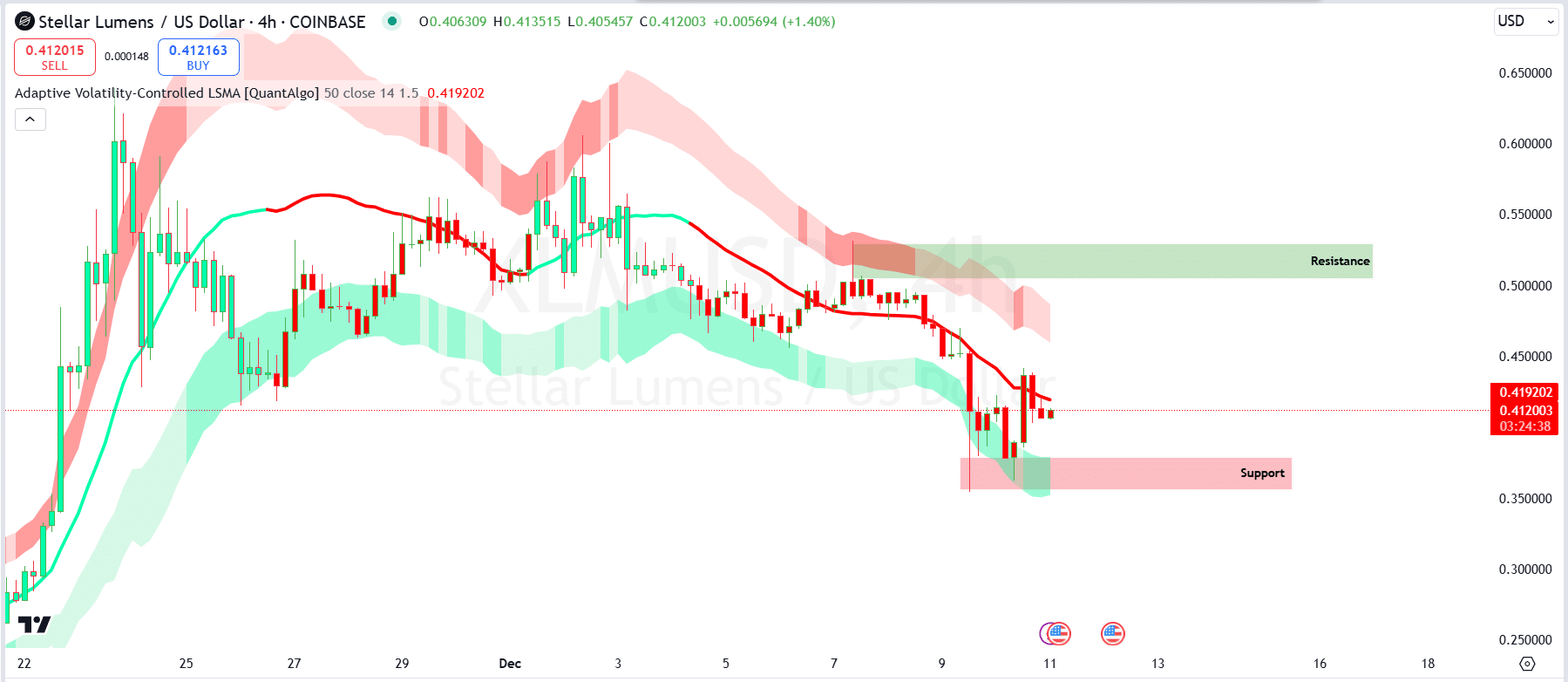

On the 4-hour chart, there was resistance near $0.4191 on the Volatility-Controlled Adaptive LSMA.

Although price appears to have formed a double bottom around $0.3500, a bullish reversal trend indicates potential upside momentum if buyers regain control.

The lower band of the volatility channel provides additional support, suggesting possible stabilization within this range.

Source: Commercial View

If the bullish momentum strengthens, the price could rise to $0.5000, a key resistance level.

However, a prolonged rejection at $0.4191 or a decline below $0.4000 could trigger a retest of the $0.3500 support zone.

Rises and falls are balanced

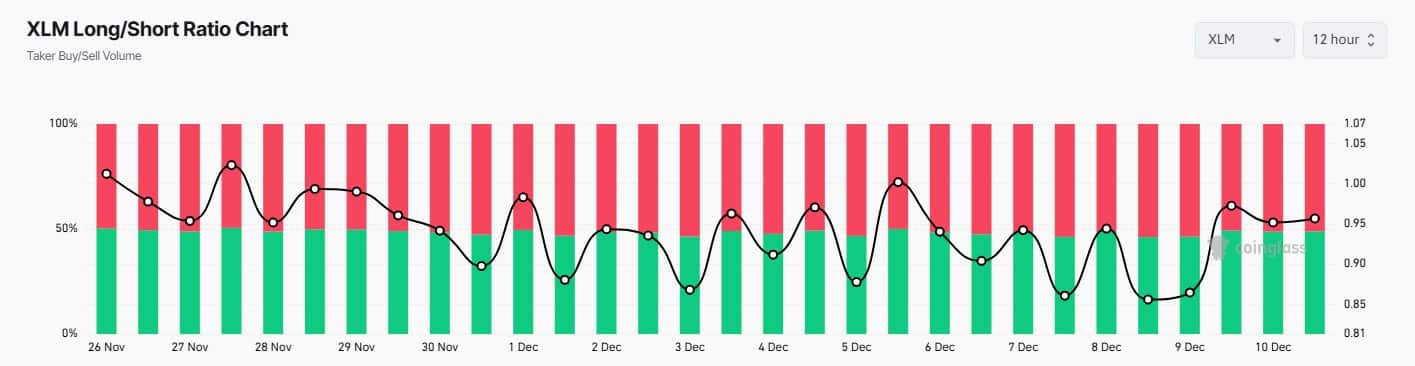

AMBCrypto analyzed XLM’s Long/Short ratio, measured every 12 hours, to gauge market sentiment. A ratio above 1 reflects bullish sentiment, indicating that more traders are opening long positions, expecting price increases.

Conversely, a ratio below 1 signals bearish sentiment, where short positions dominate, indicating the expectation of a price decline.

Source: Coinglass

The data revealed a fluctuating trend, with sentiment oscillating between bullish and bearish positions.

On December 9 and 10, the ratio briefly climbed above 1, reflecting traders’ optimism.

However, the latest reading places the ratio slightly below 1, indicating near-balanced sentiment but a bearish trend.

This change highlights traders’ cautious approach to XLM’s short-term price movements.

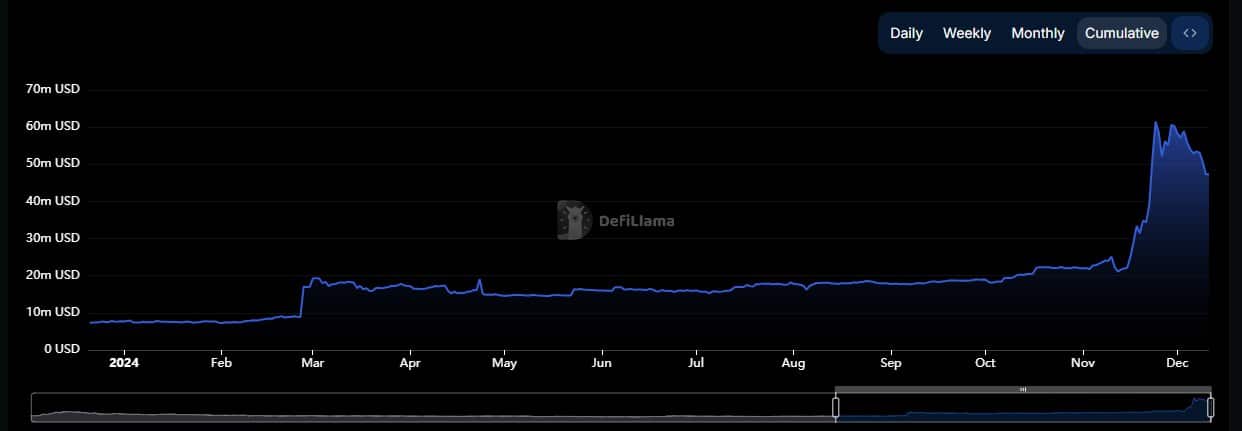

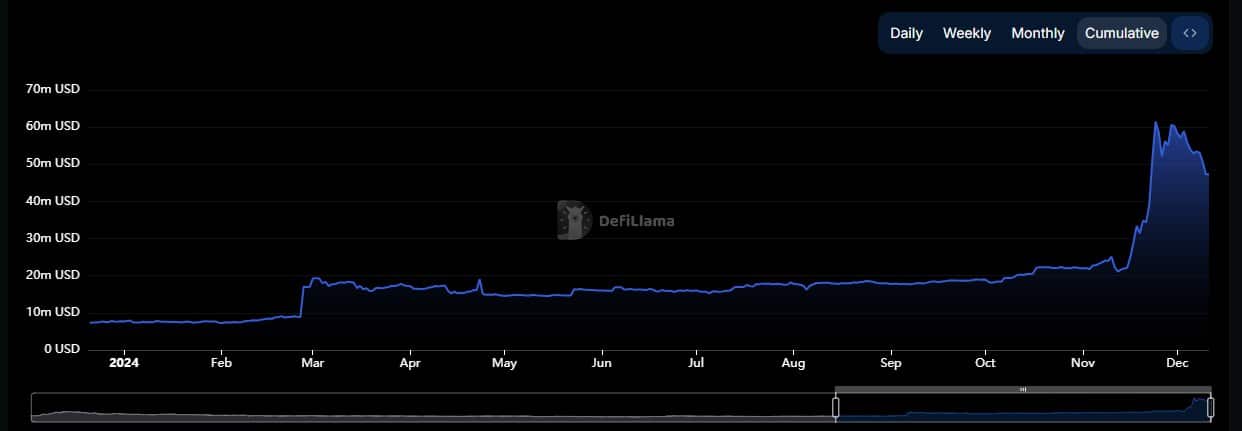

XLM TVL increases in 2024

The total USD locked value of XLM showed steady growth in early 2024 before skyrocketing in late October.

TVL remained steady around $10-20 million for most of the year, but in November it climbed dramatically to nearly $70 million, reflecting increased network activity and a large influx of liquidity.

Source: DéfiLlama

After November 25, the TVL saw a notable decline, returning to around $55 million in December.

Read Stellar (XLM) Price Prediction 2024-2025

This decline is likely due to profit-taking and broader market corrections.

Despite this decline, TVL levels remained significantly higher than earlier in the year, demonstrating continued investor interest and confidence in the XLM network.