After a price crash at less than $ 80,000 last week, Bitcoin has experienced a certain market resumption in the last 48 hours, increasing by more than 7.5% to negotiate over $ 86,000. In the middle of this rebound in the market, the cryptographic market expert Ali Martinez spotted the most critical level of support for the first cryptocurrency for the moment.

Bitcoin faces an “ airspace ” below $ 83,000 – a breakdown could be brutal

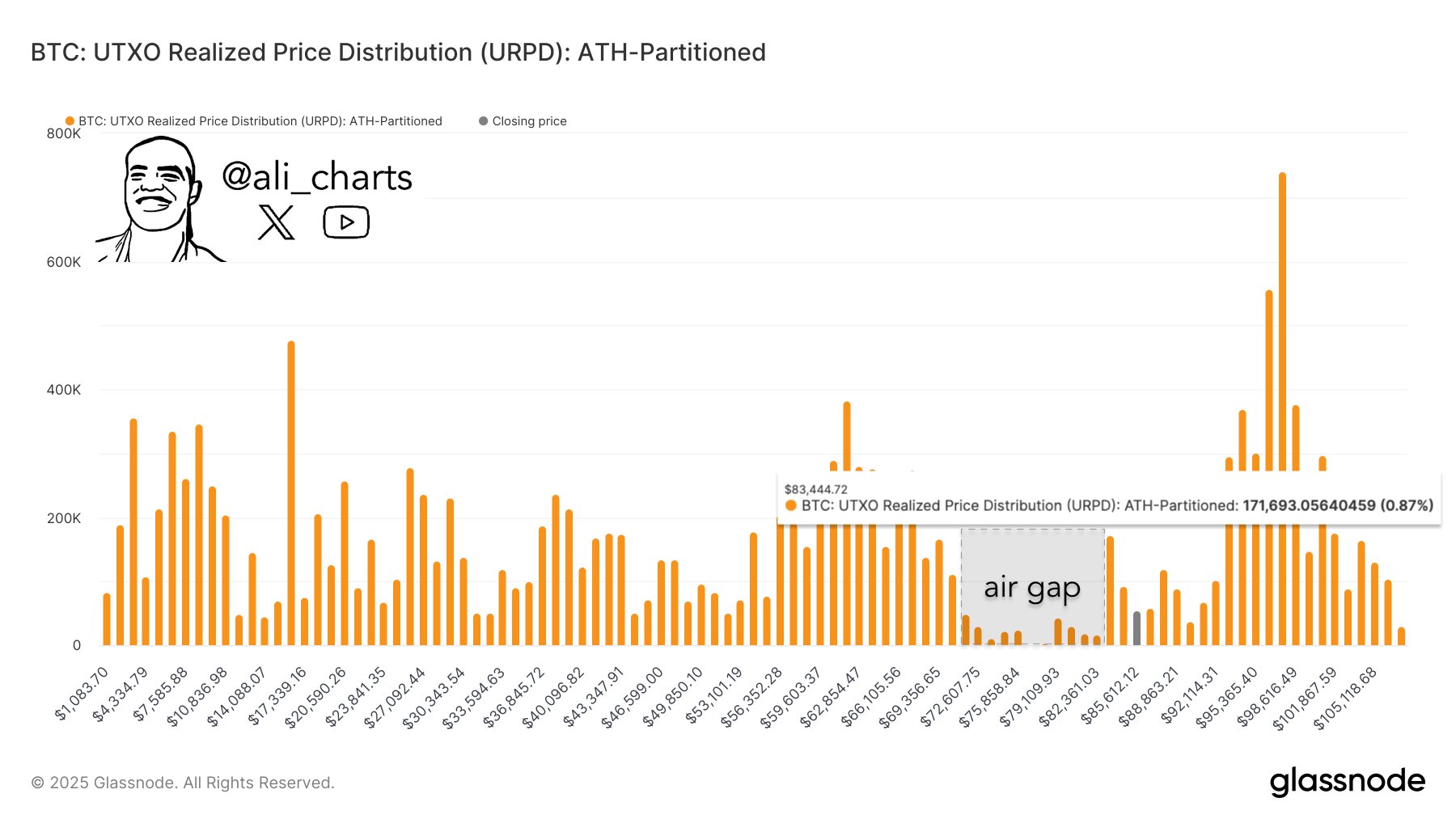

In a post X on Saturday, Martinez shared a confusing overview on the Bitcoin market. By using the price distribution metric (URPD) made UTXO partitioned at the heights of all time, the analyst identified $ 83,440 as the most vital Bitcoin support area.

Generally, the URPD is a metric on a chain which shows the price levels to which the unounded transaction outputs (UTXO) have moved for the last time, thus measuring the amount of bitcoin transgrated at different price levels. Each bar on the URPD graph represents a price range, and the height of the bar indicates the number of BTCs treated at this level.

Consequently, the URPD can be used to identify potential support and resistance levels, as it would show whether a large amount of BTC has been acquired or sold at a specific price level.

According to Martinez’s analysis, Glassnode URPD data show that investors have acquired 171,693 BTC (0.87% of the total offer) to $ 83,440.72, converting this price level into a solid support area. Indeed, Bitcoin bulls are likely to intervene and acquire more BTC at this level in any case of retest.

However, there is a notable air difference between $ 72,000 and $ 82,000 with low UTXO levels recorded in this price range. Thus, a decisive decline below $ 83,440 will result in an additional drop in prices due to the lack of demand in the immediate drop in price ranges.

Bitcoin RSI supports the quest for rebound – more earnings to come?

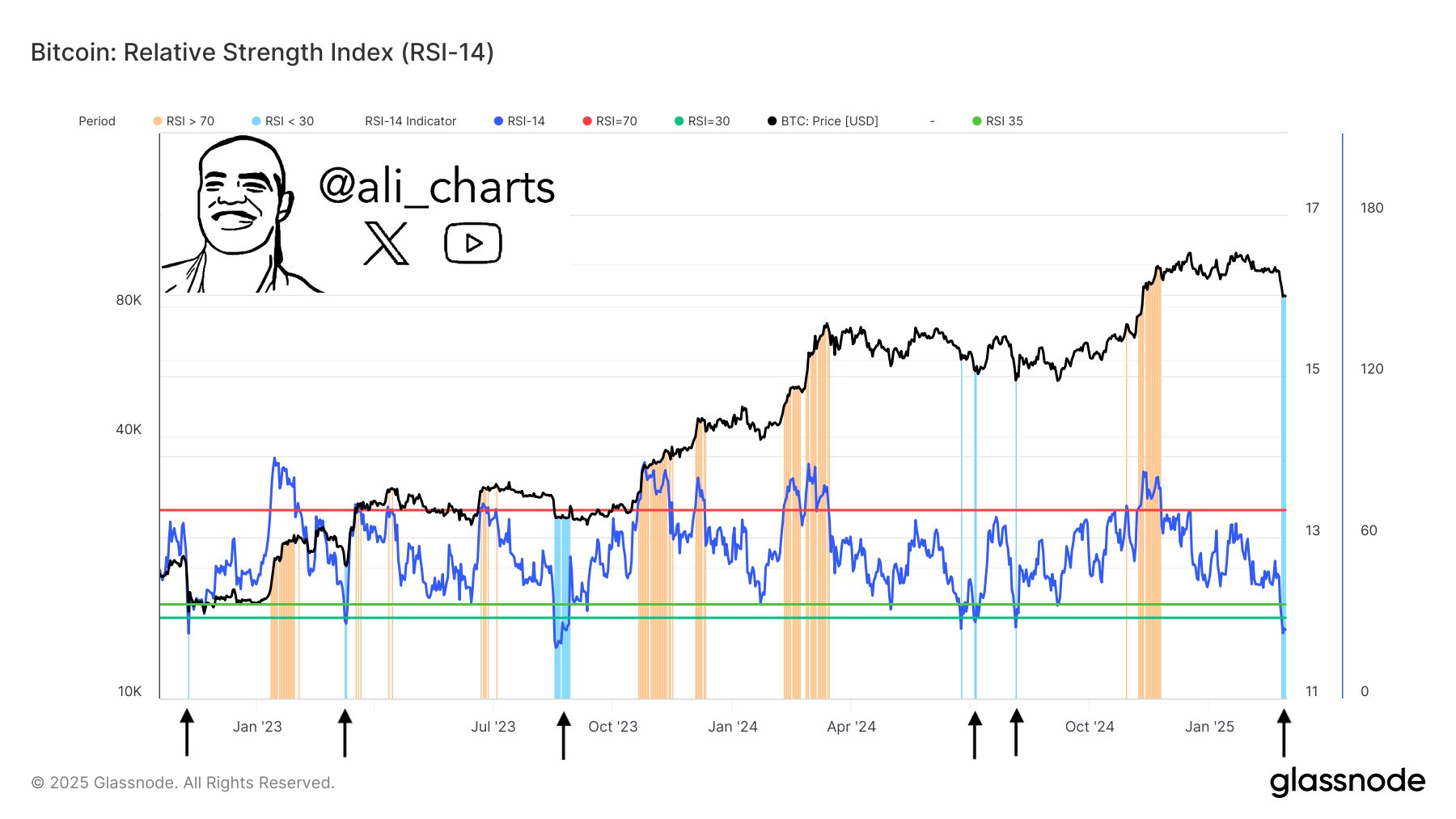

In another article of analysis on the BTC market, Martinez hinted at the potential of new price gains in the middle of the current prices. According to the Crypto expert, Bitcoin historically recorded a price rebound after his relative force index (RSI) went below 30.

The RSI measures the impulse of price movements and determines whether an asset is exaggerated (greater than 70) or occurring (below 30). Martinez states that the Bitcoin RSI recently touched 24 in the surveillance area suggesting that a rebound to recover previous high price levels can occur according to historical data.

At the time of the press, Bitcoin is negotiated at $ 86,383 after increasing by 2.32% in the last 24 hours. Following prices correction during last week, BTC remains at 21.02% compared to its time of all time at $ 109,114.

Istock star image, tradingview graphic