- FLOKI faces strong resistance at $0.00017480, despite rising volume and bullish momentum.

- An uptick in daily active addresses and a possible short squeeze could fuel a breakout.

Floki Inu (FLOKI) has attracted a lot of attention due to its recent uptrend, attracting interest from retail and institutional investors as its price has steadily climbed. At press time, the altcoin was trading at $0.0001504, up 6.62% over the past 24 hours.

Additionally, its 24-hour volume also jumped 19.81% – a sign of increased activity among traders.

However, despite this positive momentum, FLOKI faces a crucial challenge at the $0.00017480 resistance level. Can she finally get past this level and continue to progress, or will she fall back like she did in her previous attempts?

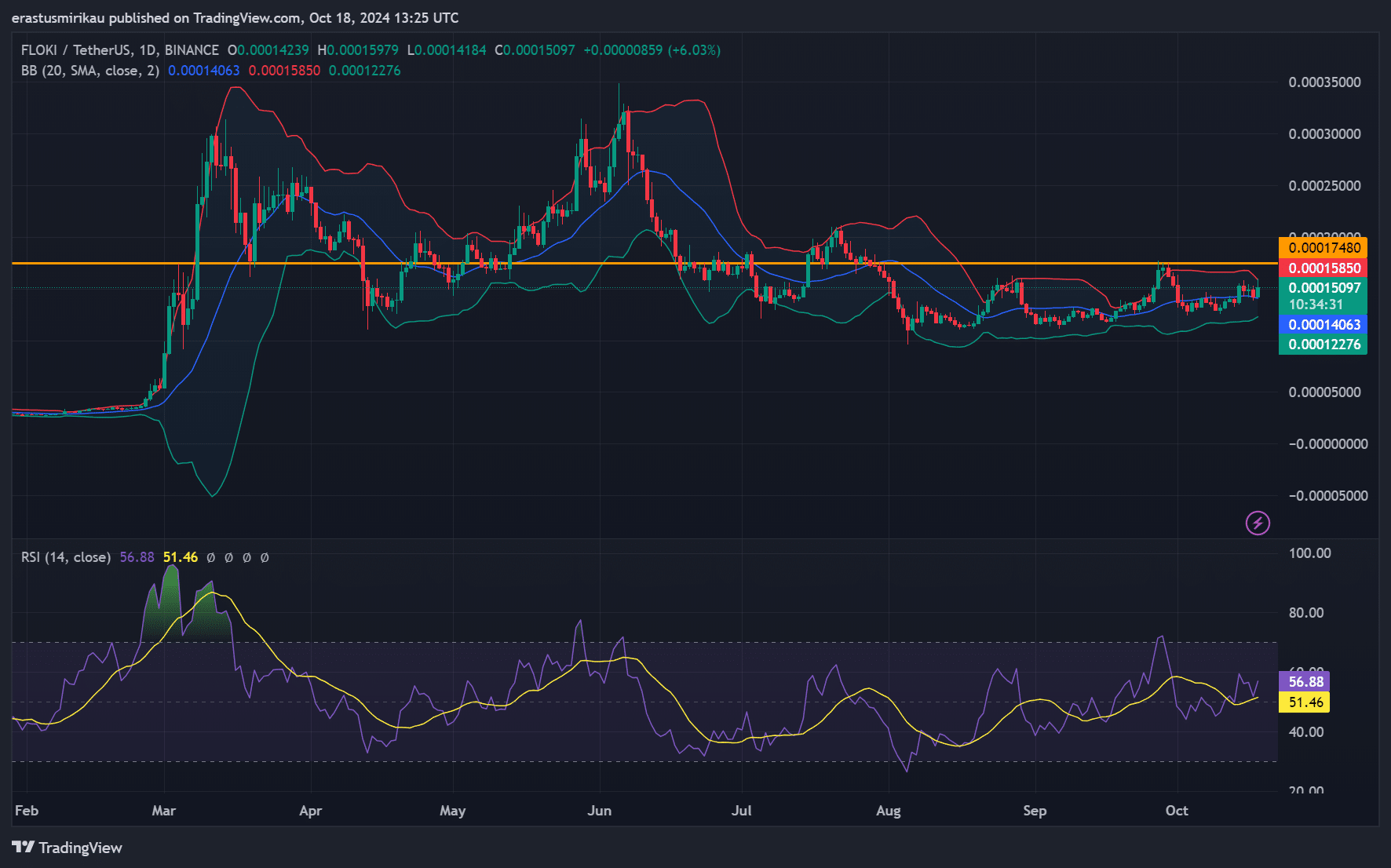

FLOKI Chart Overview – Pressure rises at resistance level

The daily chart shows memecoin testing the $0.00017480 resistance level, a key hurdle it failed to overcome in previous rallies. Bollinger bands tightened around the price, indicating reduced volatility, while the relative strength index (RSI) stood at 56.88.

Therefore, FLOKI still has some room to maneuver before reaching overbought conditions.

However, to break through this resistance level, memecoin will need to see a sharp increase in buying pressure. Therefore, the dominant technical indicators pointed to a potential breakout, but only if volume also continues to increase.

Source: TradingView

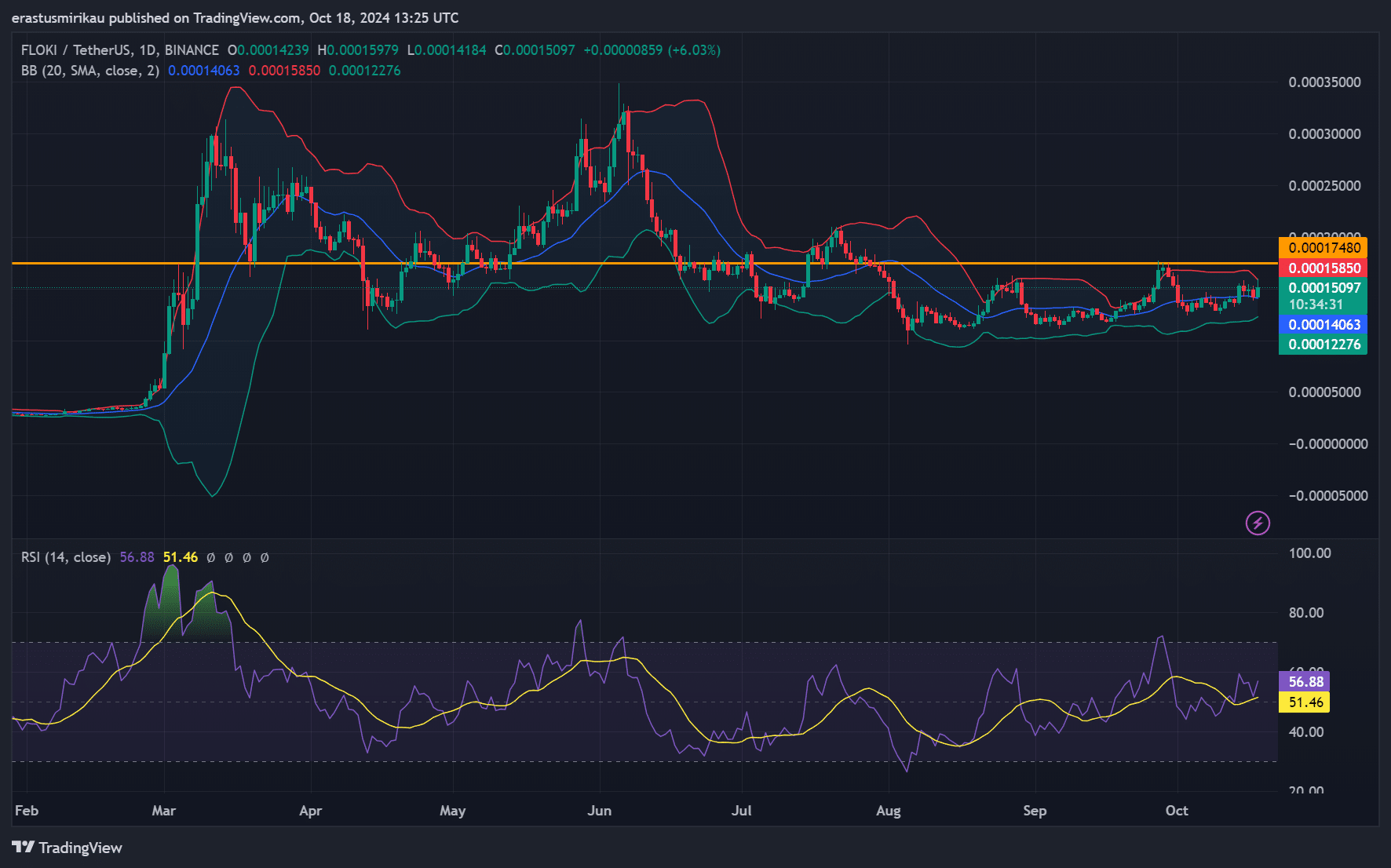

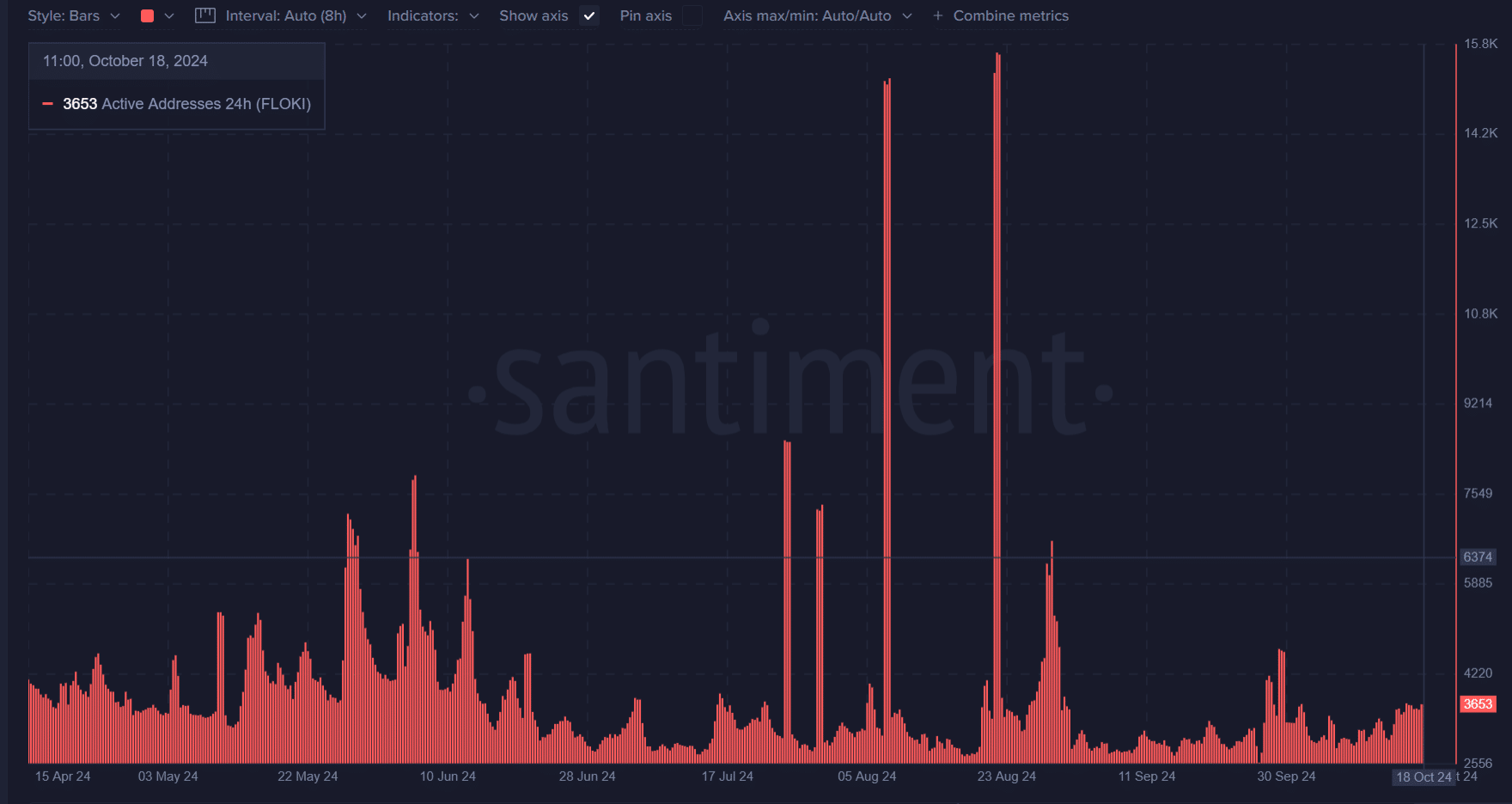

FLOKI Daily Active Addresses – Is Interest Coming Back?

Interestingly, FLOKI’s daily active addresses increased slightly to 3,653 from the previous day’s figures of 3,560. This highlighted a marginal increase in user engagement. However, this figure still pales in comparison to increases seen earlier in the year, when active addresses reached over 10,000.

Therefore, while the resumption of activity is a positive sign, it is clear that FLOKI needs stronger retail participation to support any significant price movement.

Additionally, continued engagement might not be enough to break the resistance level.

Source: Santiment

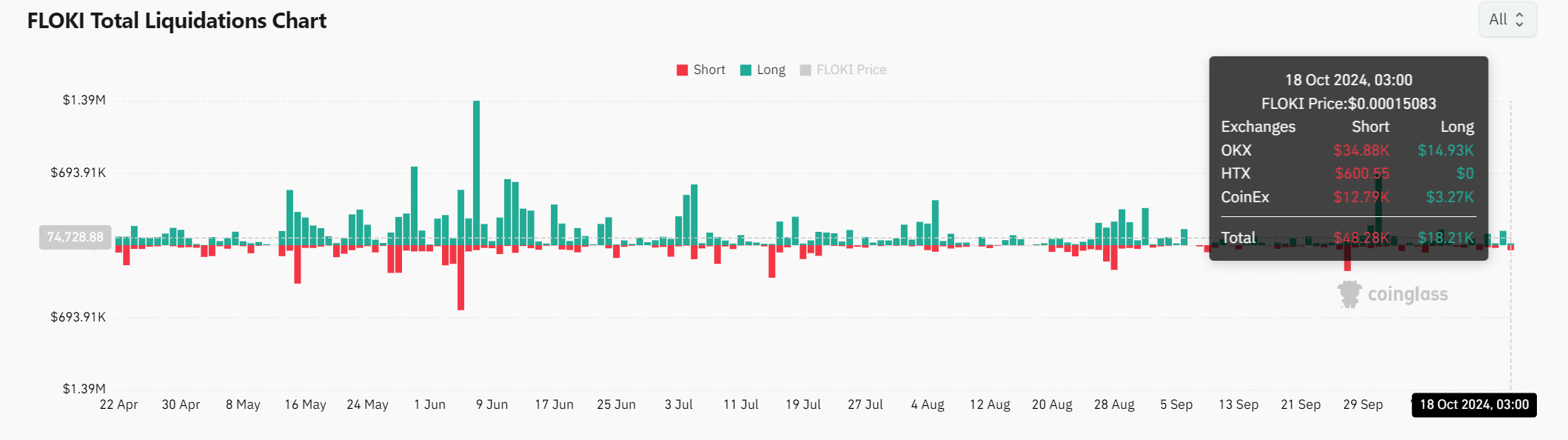

FLOKI Liquidations – Short squeeze on the horizon?

Over the past 24 hours, memecoin saw $48.28K in short liquidations compared to $18.21K in long liquidations. Therefore, this is a sign that bearish traders may soon be forced to exit their positions, which could add significant upward pressure on FLOKI price.

Additionally, if FLOKI manages to break resistance, a possible short squeeze could further fuel its rally.

Source: Coinglass

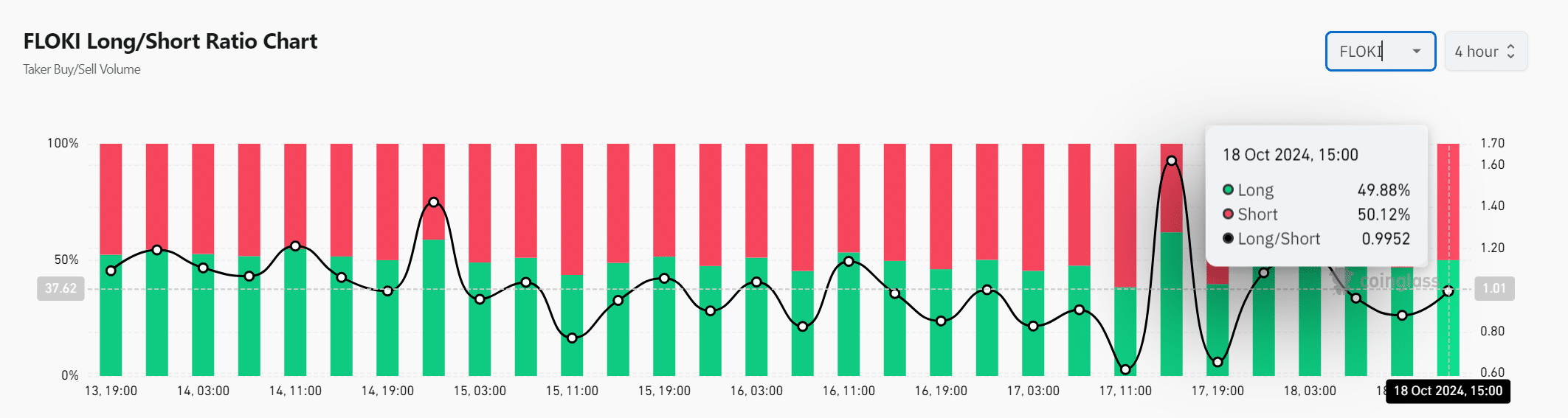

Long/Short Ratio – Are the Bears in Control?

At press time, the long/short ratio stood at 0.9952, indicating an almost even battle between the bulls and bears. However, shorts appeared slightly ahead at 50.12%, reflecting some caution among traders.

Therefore, if memecoin fails to break the resistance, the bears could quickly regain control. On the other hand, a successful breakout could force the bears to cover their positions.

Source: Coinglass

Realistic or not, here is the market capitalization of FLOKI in terms of BTC

Ultimately, FLOKI’s future depends on its ability to break through the $0.00017480 resistance.

While rising volumes and increased short liquidations provide cause for optimism, the lack of meaningful daily engagement raises some concerns. If traders manage to maintain the buying pressure, FLOKI could move higher.