Data shows that Bitcoin open interest on exchanges is increasing while the funding rate has turned negative recently.

Bitcoin Open Interest Trend Suggests Speculators Are Back

As CryptoQuant community manager Maartunn pointed out in a new post on X, things seem to be heating up on the derivatives side of the market. Two indicators are relevant here: open interest and funding rate.

Related Readings

The first of these, Open Interest, keeps track of the total amount of Bitcoin-related derivative contracts, whether short or long positions, that are currently open on all exchanges.

When the value of this metric increases, it means that investors are opening new positions in the market at that moment. Since new positions are usually accompanied by an increase in the overall leverage present in the sector, this type of trend can lead to higher volatility in the asset.

On the other hand, the decline in the indicator value implies that investors are closing their positions of their own accord or getting liquidated by their platform. The price of the cryptocurrency could become more stable following this trend.

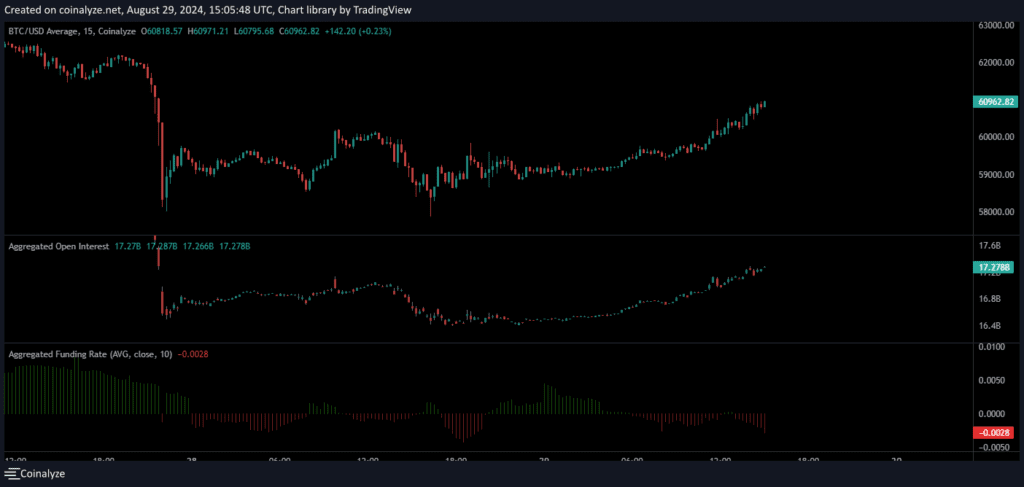

Now here is a chart that shows the trend of Bitcoin open interest over the past few days:

As seen in the chart above, Bitcoin open interest had plunged earlier due to the cryptocurrency’s decline towards the $58,000 level, which led to the liquidation of a significant number of long positions.

After observing some sideways movements, the indicator started to rise again, suggesting that investors have opened new positions. This speculative activity can naturally lead to greater volatility in the asset.

In theory, such volatility could push the asset in either direction, but depending on the composition of positions in the derivatives market, one direction may be more likely than the other.

The indicator that sheds light on the structure of the sector is the second indicator that interests us here: the financing rate. This indicator essentially tracks the amount of periodic fees that traders in the derivatives market exchange with each other.

The chart shows that Bitcoin’s funding rate has been negative during this recent surge in open interest. When the metric has a negative value, it means that short position holders are paying a premium to long position holders to hold their positions, so any new positions that have recently appeared in the sector would be short positions.

Related Readings

Due to the high presence of shorts in the market, it is more likely that these investors betting on a bearish outcome will get caught in a massive liquidation event, making Bitcoin a more bullish direction. It only remains to be seen how the BTC price will evolve in the coming days.

BTC Price

Bitcoin saw a brief rebound above $61,000 yesterday, but the coin appears to have pulled back below $60,000 today.

Featured image by Dall-E, Coinalyze.net, chart by TradingView.com