Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

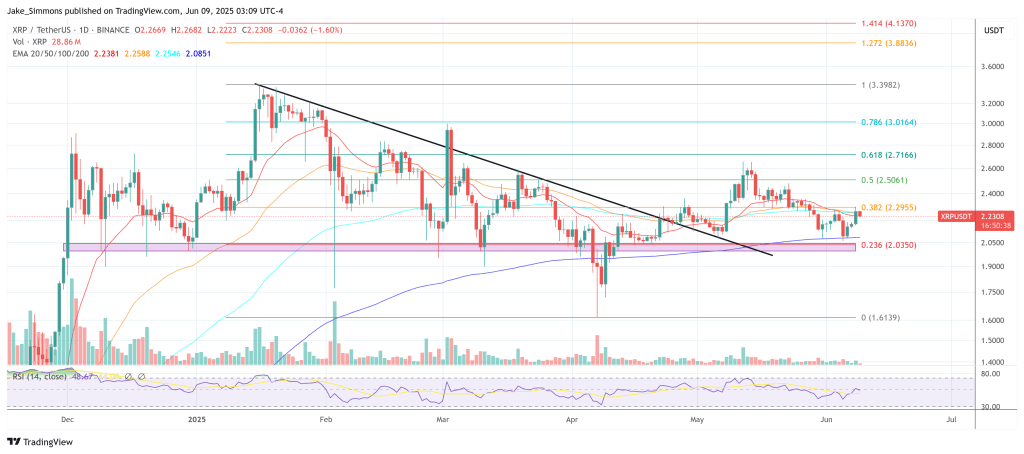

The pseudonym Cryptoinsightuk analyst warned that the next major movement for XRP could be a trap. In a video published on June 8, the analyst described a scenario where XRP turns to $ 2.30 to $ 2.40 in the short term – only to reversed violently into a strong outcrop of liquidity before any sustainable escape occurs.

XRP Imminent Bull Trap?

“I think XRP goes at less than $ 2.0.

The configuration it describes is based on market structure and liquidity dynamics, in particular the accumulation of rest orders under the current XRP beach. “This is a concern here, a real concern for me,” he said, referring to the growing liquidity basin below current prices. According to its internal models, these liquidity areas are statistically affected “80% of time”.

Related reading

“Someone is trying to deceive someone here,” he warned. “I am prudent.” Despite his almost total XRP allowance – he declares that he is “95% +, probably more like 98%” positioned in XRP – Cryptocurnsightuk stressed that he was not a correction. “I don’t want it to fall,” he said. “I’m just showing you what I see.”

The analyst proposed several structural paths: one in which XRP bursts immediately, and another where he briefly gathers to sweep the local summits before rinsing down to form an increased divergence. “We are in a range right now,” he said. “We come, sweep the tops, then take the stockings and leave us?”

He developed the bullish divergence model he looks at, where the price forms a lower hollow while the RSI (relative force index) prints a higher configuration – a configuration that he uses to identify the background structures. “That’s what I would like to see,” he said.

Larger macro-waonditions are always favorable

Despite the downward tactical configuration, the video hit an optimistic macro tone. Will cited four short-term catalysts: the Act on the Surveillance of Stablescoin, the imminent deadline for the SEC remedies phase against Ripple, the JULY decision window for an ETF Spot-XRP proposal, and a renewed expectation of the accommodative budgetary policy triggered by the TRUMP-MUSK televised dialogue last week.

“What it really tells us is that there will be money printing,” he said. “Assets will explode upwards and, for other specific reasons, XRP is probably doing even better.”

By turning to Bitcoin, the analyst observed a continuous drop in the volume of negotiation, suggesting indecision or exhaustion. “There was no volume. There was nothing,” he said about the recent BTC price action.

Related reading

He highlighted a CME’s long -term difference between $ 92,000 and $ 93,000 and added that the fixed beach volume analyzes point to a possible $ 96,000 withdrawal zone at $ 97,000. “It is probably imminent, perhaps this week,” he said about a potential correction, projecting a scenario where BTC plunges into this range before resuming its ascending trajectory.

“Does this mean that we are trying to rise or that we descend and take this bottom and that we put this structure of divergence raised?” He asked, noting a configuration of divergence similar to $ 75,000 earlier this year.

The activity of the XRP point increases the red flags

In the last hour before the video, XRP had “tightened with a certain volume”, but the analyst urged prudence. While open interest had increased sharply, funding remained green – by granting a long position of net positioning – and the overall premium had become red. “It tells me that even if there are still short films, more long than shorts have entered,” he said.

He warned that this imbalance could lead to a net movement lower if the market does not hold the current levels. “If we descend now and lose this bottom, expect a more aggressive and faster movement downwards,” he said, stressing the risk of liquidating leverage.

The relative performance of XRP against ETH and BTC have also been revised. Although he started testing the resistance areas, nor the XRP / ETH cards or the XRP / BTC graphics had decisively erupted. “We could always be breathtaking in this range,” he warned. “Could lose strength until we started to see some confirmations up.”

At the time of the press, XRP exchanged $ 2.23.

Star image created with dall.e, tradingView.com graphic