- A break above the pattern could push XRP towards $3.

- Buying pressure on the token increased, but market sentiment turned bearish.

After a week of rising prices, XRP The bears have stepped up their game over the past 24 hours by pushing the token lower. However, this could well be the start of a new bullish rally.

XRP was on the verge of breaking out of multi-year bullish trends. Let’s evaluate XRP indicators to determine if a breakout is likely to occur.

XRP Multi-Year Model

CoinMarketCap data The token’s price has increased by more than 5% in the last seven days. But the bears have taken control of the market in the last 24 hours, with the price of XRP falling by almost 2%.

At the time of writing, the token was trading at $0.5965 with a market cap of over $33.5 billion, making it the 7th largest crypto.

Meanwhile, World of Charts, a popular crypto analyst, published a tweet highlighting a multi-year bullish triangle pattern on the token’s chart. The pattern appeared in 2020, and since then, the token’s price has been moving within it.

Source: X

According to the tweet, XRP has been showing remarkable strength, consolidating within a multi-year symmetrical triangle formation. This pattern suggested a high-probability breakout, which could trigger a massive bullish wave, potentially propelling the price towards $3 or higher soon.

The tweet also highlighted a number of factors that could trigger a bullish move, such as buying pressure, market sentiment, and more.

The Road Ahead for XRP

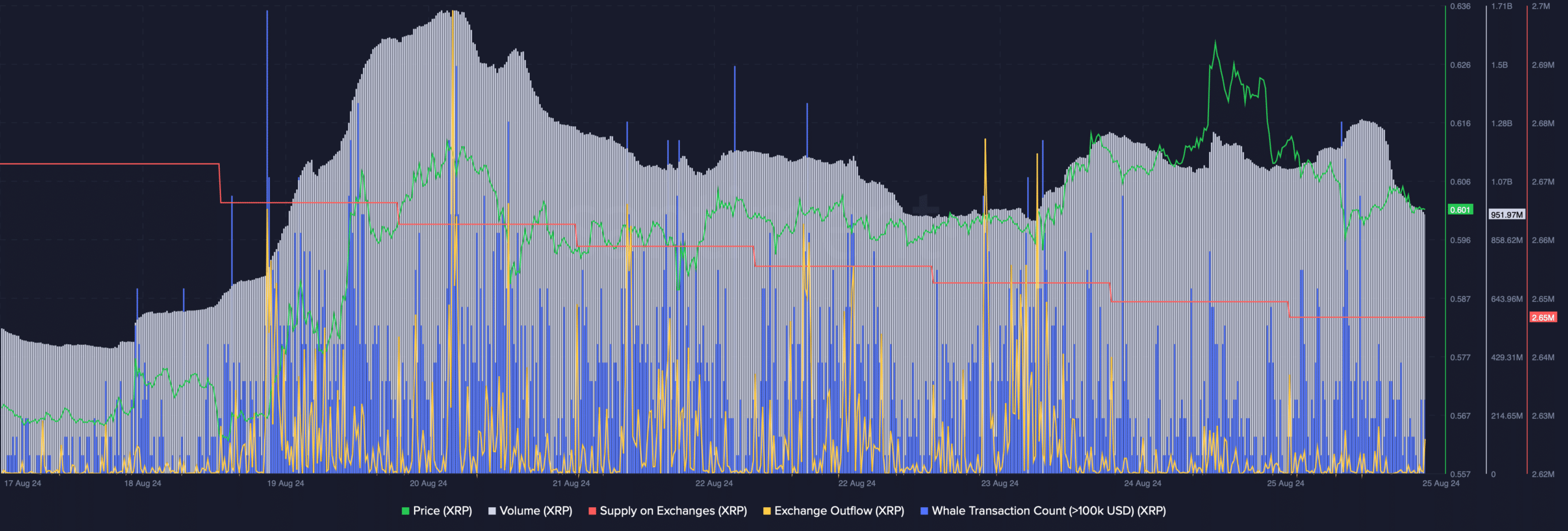

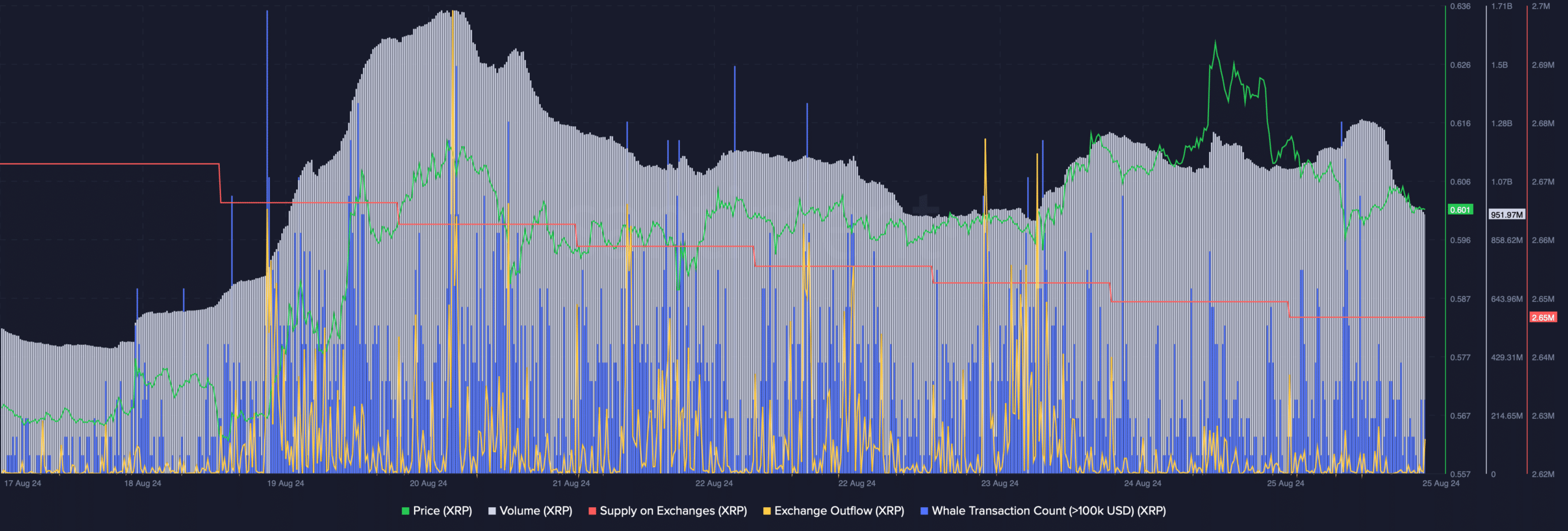

Therefore, AMBCrypto has planned to evaluate these factors to determine if they support the possibility of a bullish breakout. AMBCrypto’s analysis of Santiment data revealed an increase in XRP’s trading volume as well as its price.

Source: Santiment

Buying pressure on the token has increased, as evidenced by the decrease in its supply on the exchange. The fact that investors are buying the token has been further proven by the increase in capital outflows on the exchange.

Apart from this, whales have also been actively trading XRP as the number of whale transactions has increased over the past few days. However, the market sentiment around the token has turned bearish.

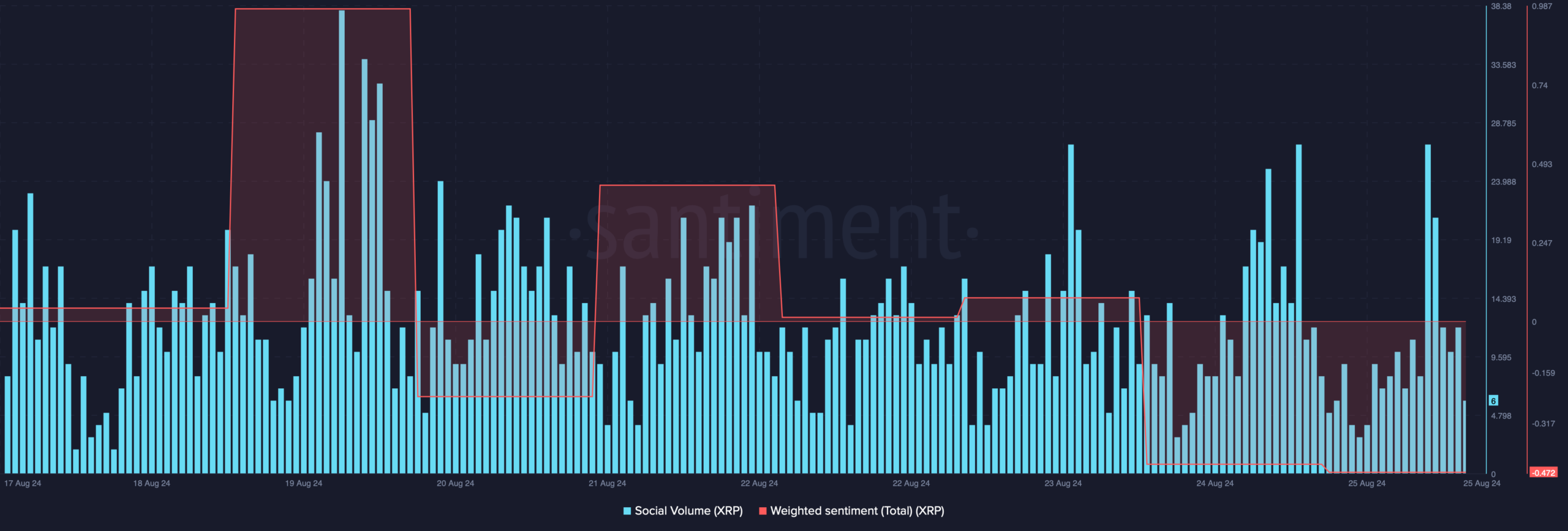

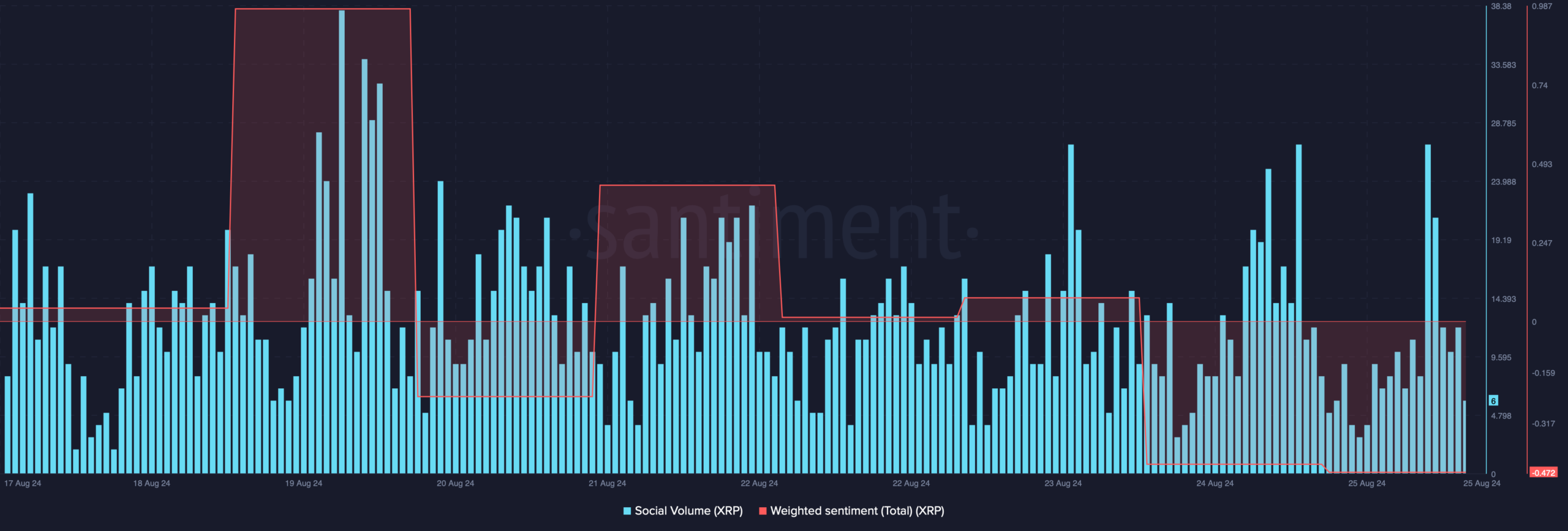

This seems to have been the case as the token’s weighted sentiment fell into the negative zone. The token’s social volume also decreased, reflecting a decline in its popularity.

Source: Santiment

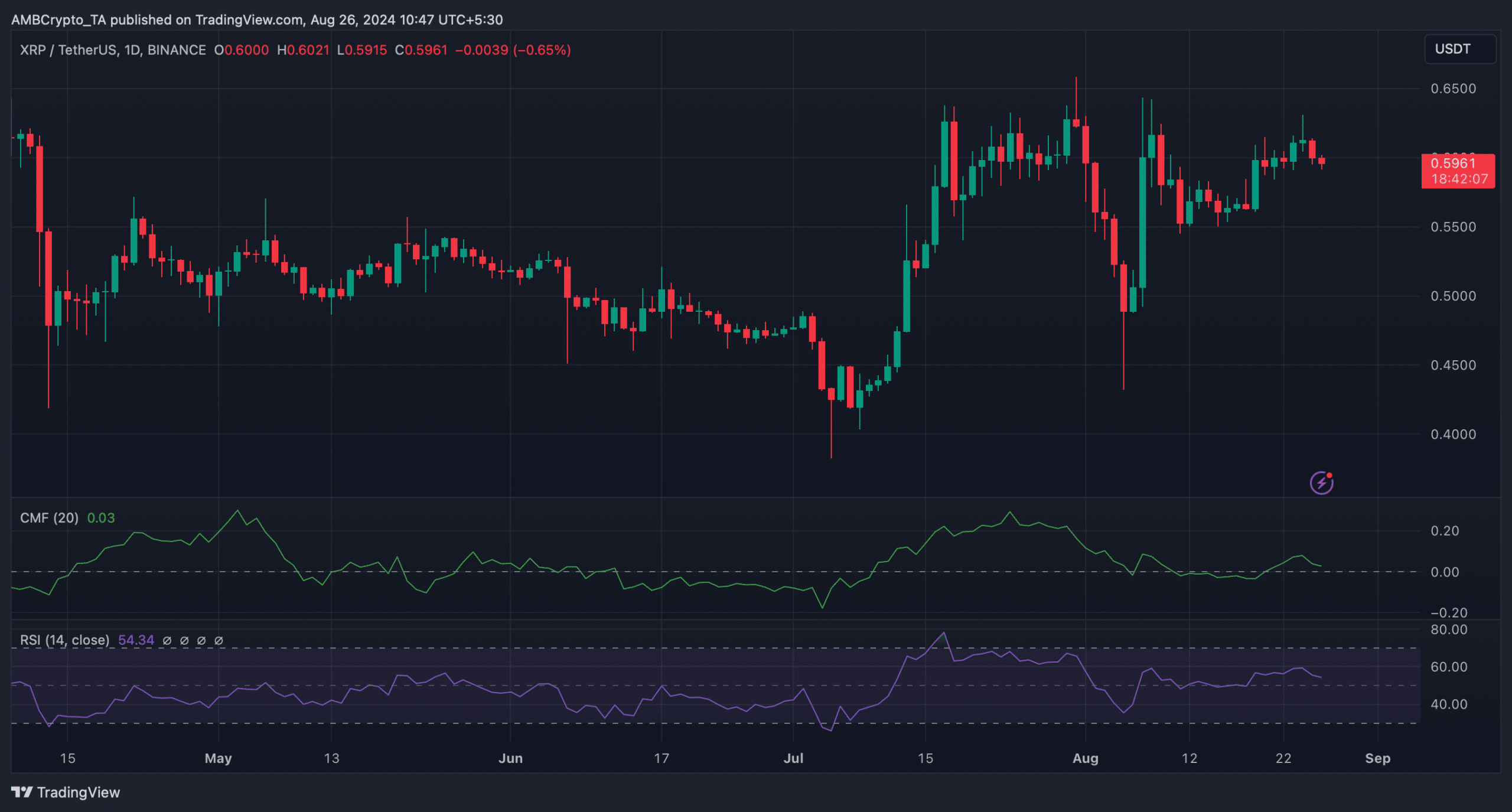

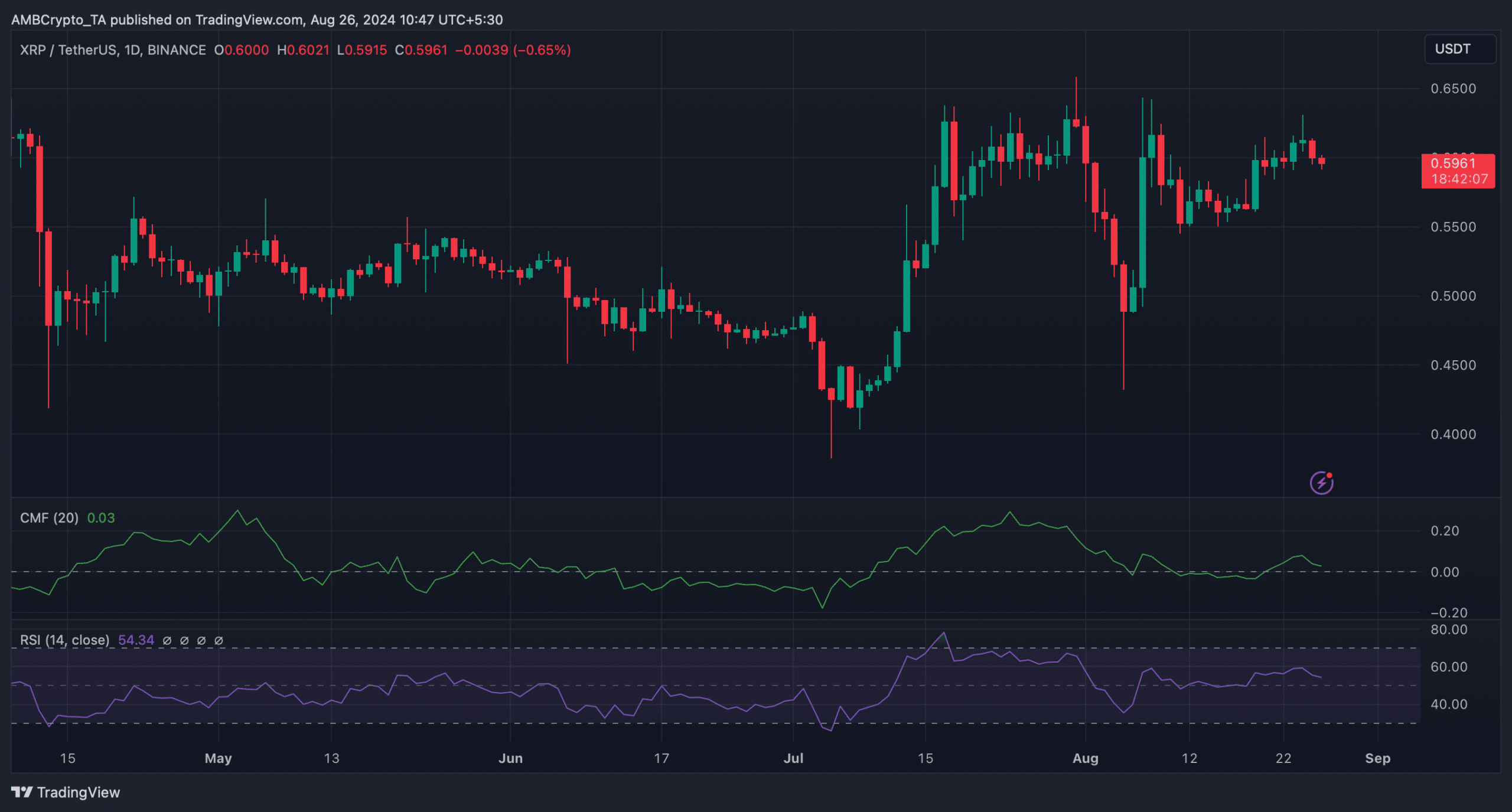

AMBCrypto then checked XRP’s daily chart to find out what market indicators were suggesting.

Read Ripple (XRP) Price Prediction 2024 – 2025

We observed that the token’s Chaikin Money Flow (CMF) has registered a decline and is heading towards the neutral mark.

The Relative Strength Index (RSI) also followed a similar trend, suggesting that XRP may take more time to break out of the multi-year bullish pattern.

Source: TradingView