Este Artículo También is respondable in Español.

Renowned technical analyst Peter Brandt aroused the XRP community on January 30 by publishing a daily prize table (XRP / USDT) suggesting a model of continuation of the “Taurus flag”. Brandt, whose reputation in the decades of cartography of the decades, highlighted $ 4.3,9541 as higher price -based structure of the market.

“Hey xrp_pill_poppers. To be clear: I care what XRP will do. If it goes up, I want to be long. If he goes down, I have never short-circuited it, but I prefer to troll poppers. No other way right now define the graph other than a bull flag. Of course, it could change, ”said Brandt.

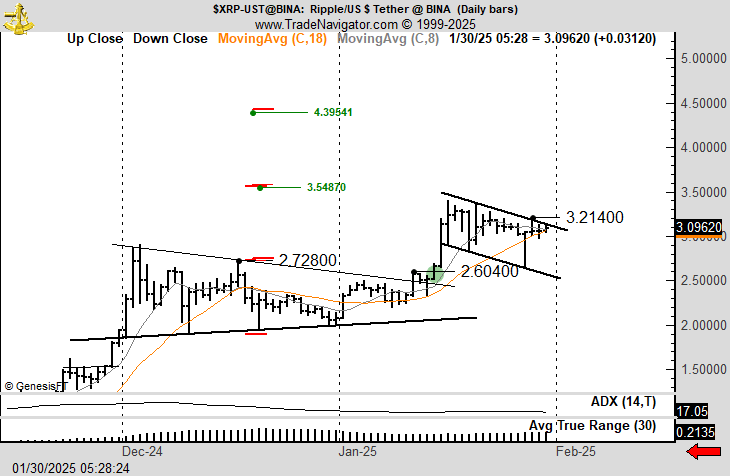

XRP Taurus flag training

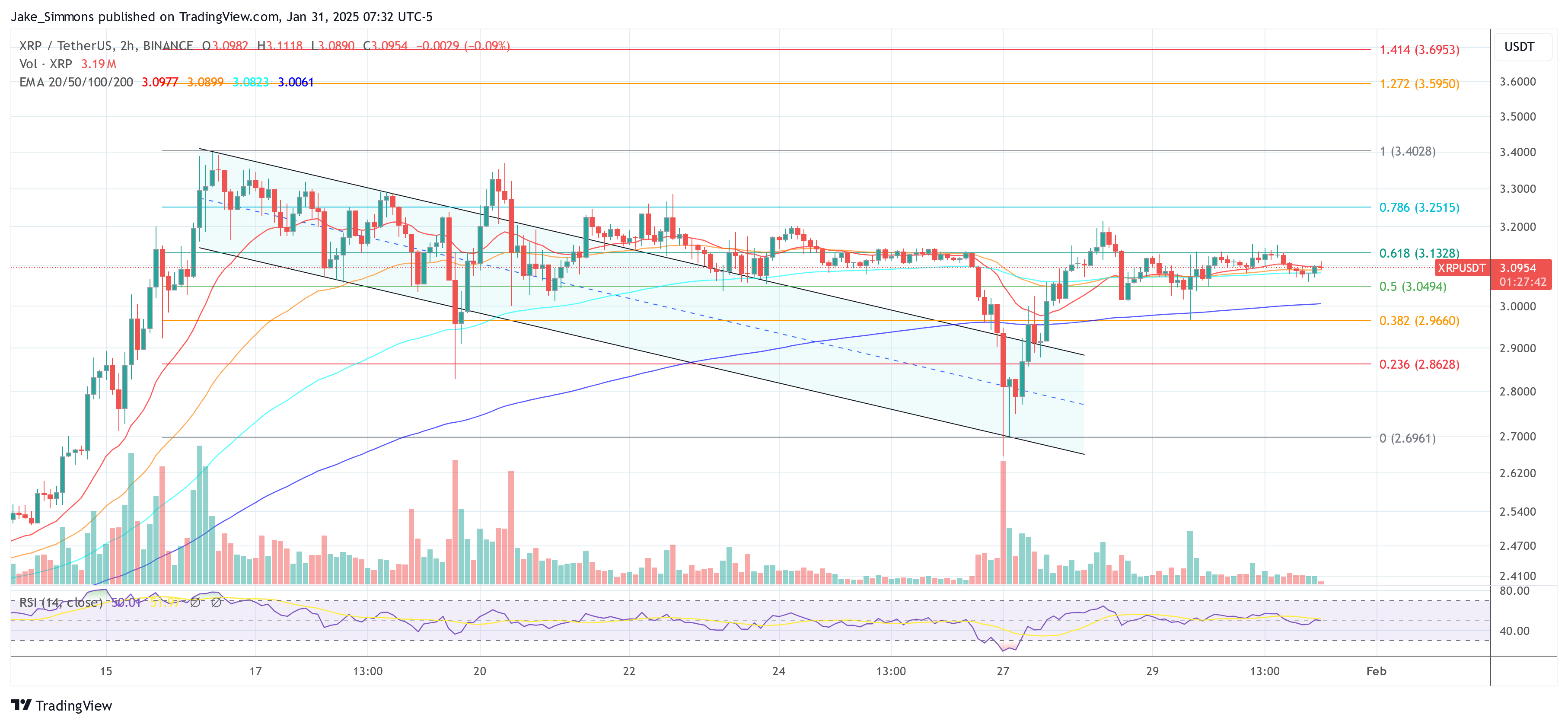

From the analyst’s point of view, XRP rallied strongly earlier in January, pushing above $ 2,6040 before exceeding $ 3,2140. Once this peak has been formed, the market has entered a brief decline, creating a series of lower ups and lower stockings – visualized by descending trend lines on the Brandt graph. This consolidation resembles a manual bull flag, a model generally interpreted as a break in a positive trend in progress.

Brandt’s planned escape could target the next leading aerial region nearly $ 3.5487, with its ultimate bullish target near $ 4.3,9541. These levels – deposited by green lines on the graph – indicate possible areas of resistance if XRP extends its rally by confirming the upper limit of the flag.

Two mobile averages are visible on the Brandt graphic: the 8 -day mobile average (green line) currently oscillates just more than $ 3.00. It helps define short -term support levels. The 18 -day mobile average (orange line) is sloping less than $ 2.70 and strengthens the wider rise in play.

Meanwhile, the ADX reading of 17.05 suggests that the overall trend force is moderate, leaving room for a higher momentum if the price decisively breaks the flag. An average real value of 30 days (ATR) nearly 0.2135 highlights daily volatility, which has increased compared to the previous phases but remains contained compared to certain alternative to high beta parts.

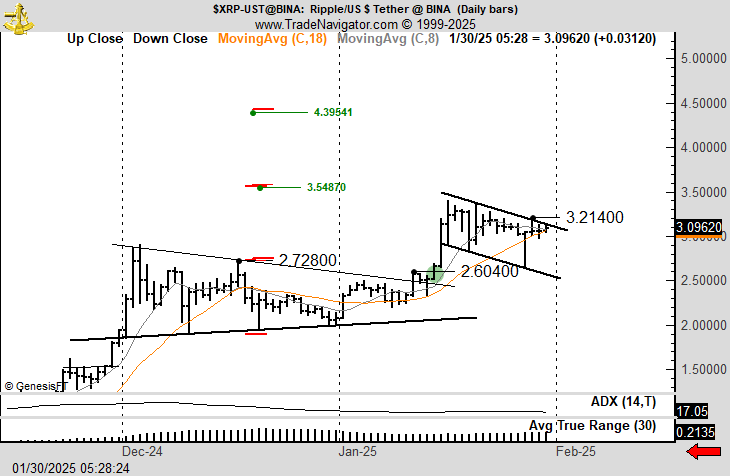

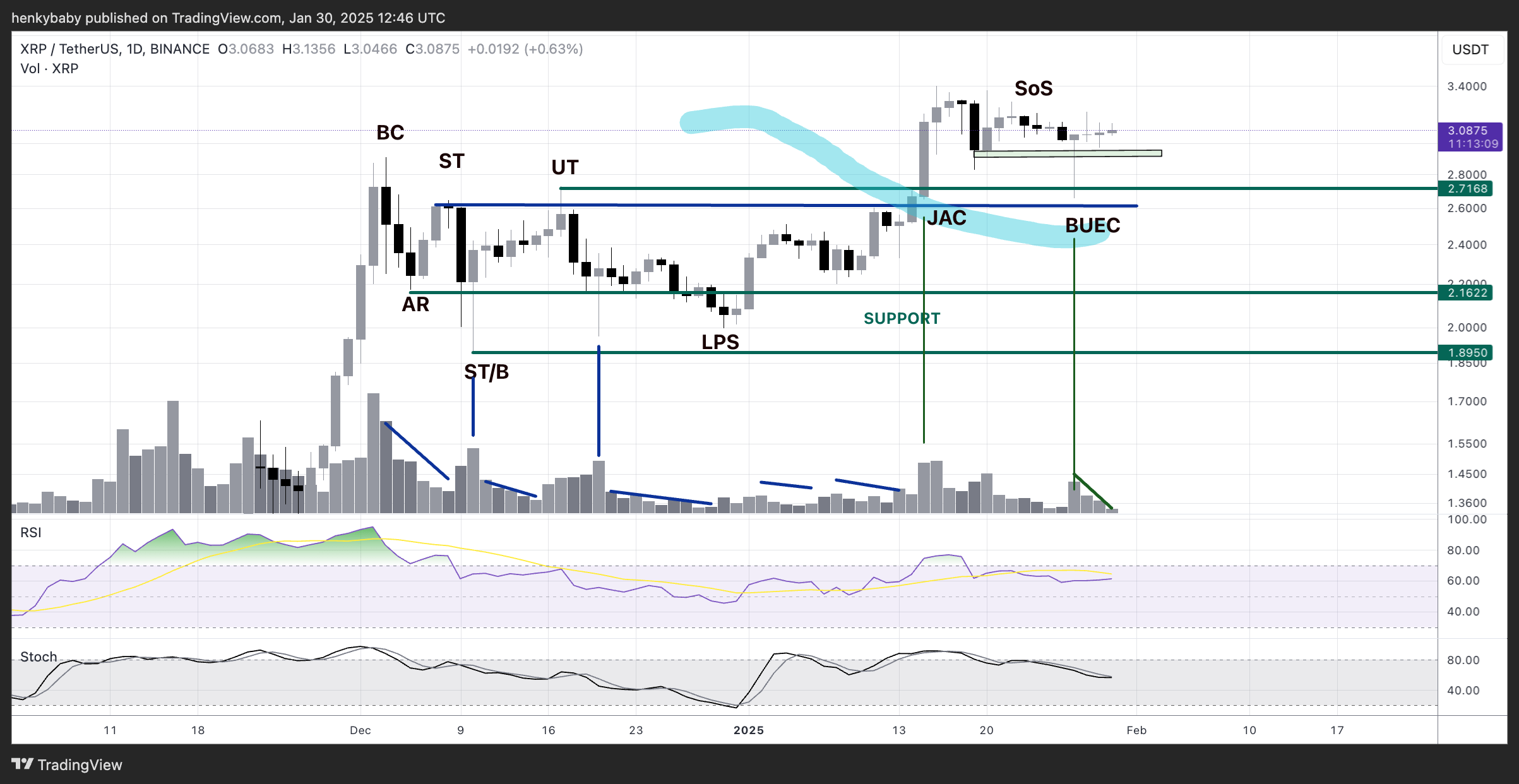

The Brandt post launched a discussion between merchants, including HTL-NL (@htltimor), which noted upward confirmations using Wyckoff analysis. “Using Wyckoff, it looks good too. Of course, if $ TC takes a dive, everything is suffering, but it is one of the ATMs of the Alt Bids Bely cards, “he said. Brandt responded with approval, indicating “a good confirmation of a good source”.

According to the graph based in Wyckoff shared by HTL -NL, XRP has retraced a series of conventional phases – with regard to the automatic rally (AR) after a culminating point of sale (SC), followed by several secondary tests (ST), And culminating in what seems to be a sign of strength (SOS). The SOS label often marks the point to which the request decisively surmounts the supply, the price pushing above a level of key resistance and the maintenance of the above-tested areas above. This behavior is also supported by volume signatures which show that the interest released during gatherings and reducing withdrawals.

In terms of Wyckoff, a successful SOS in a reactive structure generally opens the way to the continuation of the increase. The blue line entitled “Buec” (rear to the edge of the stream) suggests that XRP has already retested its last major resistance as a support. If he holds these levels and confirms the SOS, Wyckoff analysts would anticipate driving to higher targets, aligning with the projection of the Haussier flag of Brandt.

At the time of the press, XRP exchanged $ 3.09.

Star image created with dall.e, tradingView.com graphic