The price of XRP has surged 41.5% since the start of the year, now regaining its place as the third largest cryptocurrency. With multiple tailwinds behind US crypto companies like Ripple, the price of XRP is poised to soar.

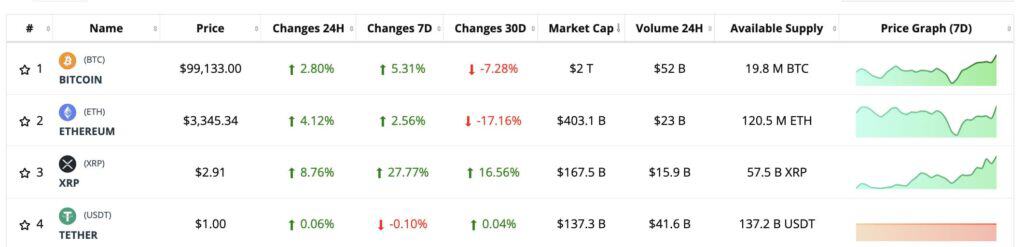

XRP price reached $2.96 on January 15, 2025, marking its highest level since December 2024. XRP price surged 441% in 90 days. With a market capitalization now exceeding $167 billion, XRP now trails only Bitcoin and ETH in the market. BNC Market Cap Table.

XRP has climbed the market cap chart, overtaking Tether. Source: BNC

XRP overtook Tether USDt, which fell to fourth place with a market cap of $137 billion. The sudden rise of XRP is attributed to Ripple Labs’ key partnerships, new product launches like its stablecoin RLUSD, Ripple’s tokenization initiativesthe probable approval of a XRP Spot ETFand the much-anticipated resignation of SEC Chairman Gary Gensler.

All of these factors are important, but the most important factor is the new Trump administration, which has promised to be as effective as possible. crypto-friendly administration in history.

XRP price hit $2.96, up 10% in 24 hours and closing in on an all-time high, source XRPLX

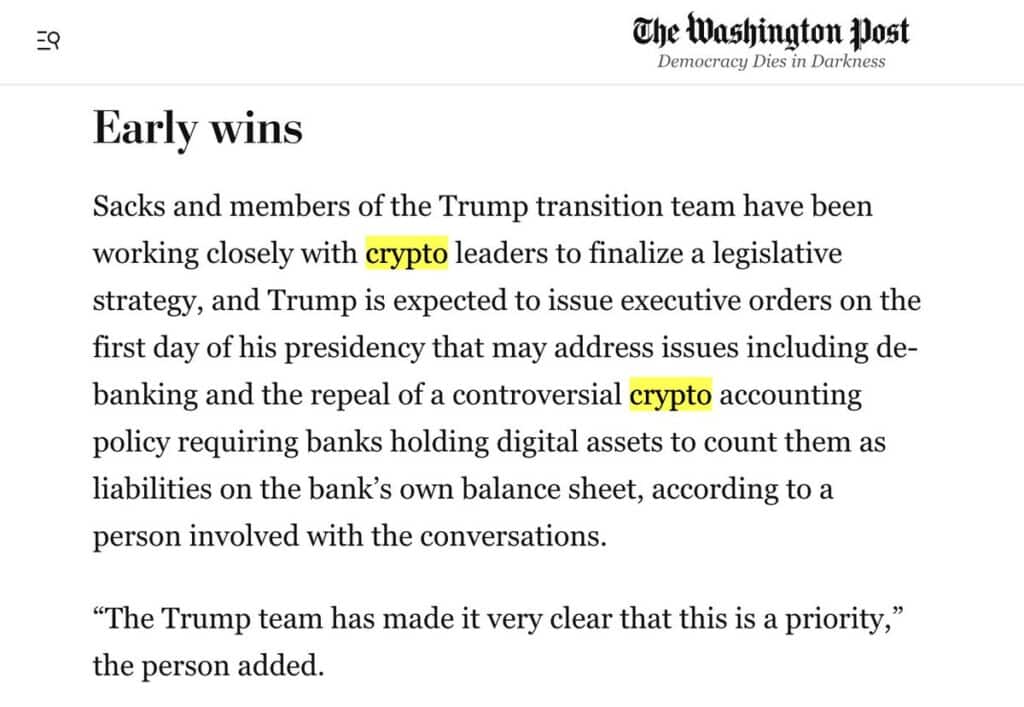

Trump will issue pro-crypto executive orders on day one

In addition to ordering the SEC to suspend all crypto prosecutions while the SEC’s crypto policy is revised, Trump should act quickly on the following points:

- First day crypto movements: Executive orders removing or relaxing crypto regulations could come immediately.

- Reversing Biden-era policies: Controversial accounting rule forcing banks to treat digital assets as liabilities could be scrapped.

- Driving AI innovation: Biden AI executive order, criticized for stifling innovation, could be revoked.

- Crypto Freedom Push: Expect efforts to reduce compliance constraints that hinder startups and innovation.

- Federal Oversight Reform: The administration aims to introduce a single and clear regulatory framework for crypto.

- Regulatory clarity: Uncertainty around the application of rules has caused volatility in cryptocurrencies: clarity could stabilize the market.

- XRP ETF Approval: With Bitwise Request for spot XRP ETF underway, approval is likely by early 2025.

- Bitcoin Strategic Reserve: A bold proposal to establish a national Bitcoin reserve could emerge quickly, positioning the United States as a leader in the digital economy. Using Bitcoin as a hedge against fiat instability, the move could significantly boost The price of Bitcoin and influence market forecasts for 2025.

Collectively, these developments provide strong bullish momentum to the entire crypto market, with Ripple and the XRP Price among the main beneficiaries.

Trump will make pro-crypto announcements on day one, source Washington Post

American crypto first

Given Trump’s strength America First PolicyUS-based crypto companies are best positioned for success over the next four years. As a proud American company with a significant presence in the United States, Ripple Labs is poised to be at the forefront of the crypto revolution in the United States under the pro-crypto Trump administration.

Brad Garlinghouse, CEP of Ripple Labs, was private meeting with Trump at Mar-a-Lago to discuss US crypto policy. Under Garlinghouse’s leadership, Ripple is taking significant steps to solidify its position in the United States. The company recently received final approval from the New York Department of Financial Services (NYDFS) for its stablecoin, RLUSDwhich is pegged to the US dollar. This step is expected to improve Ripple’s digital payments platform, broadening its appeal and strengthening the utility of XRP as part of its ecosystem.

Additionally, Ripple executives have directly engaged with the new US administration. CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty recently met with President-elect Trump, signaling a potential collaboration to shape a favorable regulatory environment for digital assets. Garlinghouse announced a strategic change in Ripple’s operationsinfluenced by what he calls the “Trump effect.” It revealed that 75% of Ripple’s current job openings are now based in the United States – a marked turnaround from previous years, when most hires were international. This pivot reflects anticipation of pro-crypto policies under the new administration, which Garlinghouse believes will spur innovation and job creation in the United States.

Brad Garlinghouse and Trump meet at Mar-a-Lago, Source:

Ripple’s renewed national focus is evident in its dealmaking activity. In the last six weeks of 2024, Ripple signed more US-based deals than in the previous six months combined.

This marks a drastic change from years past, when Ripple considered relocating its global headquarters due to regulatory challenges. At its peak, 95% of Ripple’s customers were based overseas, underscoring the impact of the regulatory stance of the U.S. Securities and Exchange Commission (SEC) under former Chairman Gary Gensler. Garlinghouse criticized the SEC for stifling Ripple’s domestic growth, but expressed optimism that the new administration will foster a more favorable environment for blockchain and cryptocurrency companies.

Ripple’s strategic pivot is part of its broader plan to reinvest in the US market, particularly in engineering and product development roles. Analysts view the shift as a reflection of renewed optimism among blockchain companies about the future of cryptocurrency innovation in the United States.

The market is already taking note of these bullish developments and continues to evaluate XRP growing higher and higher. XRP has overtaken Tether in terms of market capitalization, and XRP has also exceeds the market capitalization of BlackRock, the world’s largest asset manager, valued at $149 billion.

XRP Price Technical Analysis 2025

XRP made a remarkable comeback in early 2025, rebounding more than 30% from its monthly low to reach $2.89 on January 15, the highest price in six years. An all-time high for XRP is now in sight. This momentum has been fueled by expectations of pro-crypto policies from President-elect Trump, who takes office on January 20, and predictions that a spot XRP ETF could attract $4 billion to $8 billion in new assets.

The current surge in XRP price corresponds to a significant accumulation of whales holding between 1 and 10 million tokens. Analysts suggest that XRP could climb to between $4 and $5 in the near term, with some optimistic targets reaching $27 by the end of 2025.

Technically, which could lead to short-term corrections. or consolidations.

Chartist Dark Defender highlights a “confirmed uptrend breakout” on XRP’s monthly chart, drawing parallels to its 2017 bull run, when it gained 1,022%. The analyst predicts that XRP prices could reach $10.23 and even $18.23 in the near term, based on the Fibonacci retracement levels of the 2017 rally. Whether XRP goes to the Moon, or else “ on Mars”, both options are on the table in 2025.

Source: Dark Defender via

Although the price outlook for Ripple’s XRP token in 2025 is very optimistic, with the alignment of fundamental and technical factors, the cryptocurrency remains subject to market volatility. Investors are encouraged to conduct thorough research before making any trading decisions. However, it is clear that the current bullish setup for XRP price is the strongest since the crypto bull market of 2017. XRP rise is expected throughout 2025. New XRP incoming unprecedented. Act accordingly.